The most expensive mistake I ever made was selling my childhood Pokémon collection for $5 in a garage sale. That holographic Charizard I traded away for a sandwich? Now worth more than my car.

The sad part is even if I'd kept those cards, trading them would still have been a nightmare. List on eBay, pray someone bids, package carefully, ship with insurance, hold your breath until delivery confirmation. One damaged corner during shipping? There goes half the value. International buyer? Good luck with customs and three-week delivery times.

The collectibles market is massive and estimated to grow from $400 billion in 2024 to $600+ billion globally by 2032, a Credence Research report showed. Yet, the experience of trading collectibles feels like that from the Stone Age. Until now.

Last weekend, I discovered something that made me question everything I thought I knew about collecting. A San Francisco-based startup called Courtyard.io is taking on the biggest problem in collectibles: making them actually tradeable.

👉🏼 Try Courtyard.io for yourself

The $50M Problem That Shouldn't Exist

Picture this: You own a $5,000 graded Pokémon card. Someone in Tokyo wants to buy it. You're both willing to make the deal, but now what?

You could ship it internationally (risky, expensive, slow), meet in person (impossible), or use a traditional auction house (30%+ fees, 30+ day settlement). Every option sucks.

Or consider this: You see a card you want on eBay. The seller has 98% positive feedback, the photos look good, but is it authentic? Is it damaged? Will it arrive safely? You're essentially gambling thousands of dollars on a stranger's honesty and shipping skills.

This friction explains why most collectibles sit in storage doing nothing. They're assets without liquidity, like owning stock in a company that never trades.

But what if there's now a way to buy a $10,000 sports card, instantly resell it for 90% of market value with zero questions asked, or trade ownership globally in seconds — all without the physical card ever leaving a secure vault?

Why Previous NFT Collectibles Failed

CryptoKitties and NBA Top Shot tried to create artificial collectibles from scratch. Digital cats and video highlights had no intrinsic value beyond speculation. Once the hype died, they became worthless.

The core problem was to manufacture demand for purely digital assets with artificial scarcity.

Courtyard's approach is different because it tokenises real collectibles people already want. Pokémon cards were valuable before blockchain existed. The NFT represents ownership of something tangible in a Brink's vault, not a speculative digital artifact.

The lesson for founders is to not create new collectible categories, but to bet on making it easier to trade collectibles for which demand already exists.

From Wallet to Pokémon Cards

When I decided to test Courtyard.io, I expected the usual crypto complexity. What I found was one of the smoothest onboardings I've experienced in Web3.

Setting up was surprisingly simple: I could fund my account via Google Pay, credit card, bank transfer, or by connecting a crypto wallet — say a Phantom or a MetaMask. I connected my Phantom wallet but realised the platform uses USDC on Polygon. So I quickly swapped some SOL for USDC (Polygon) directly in Phantom, which took me under a minute.

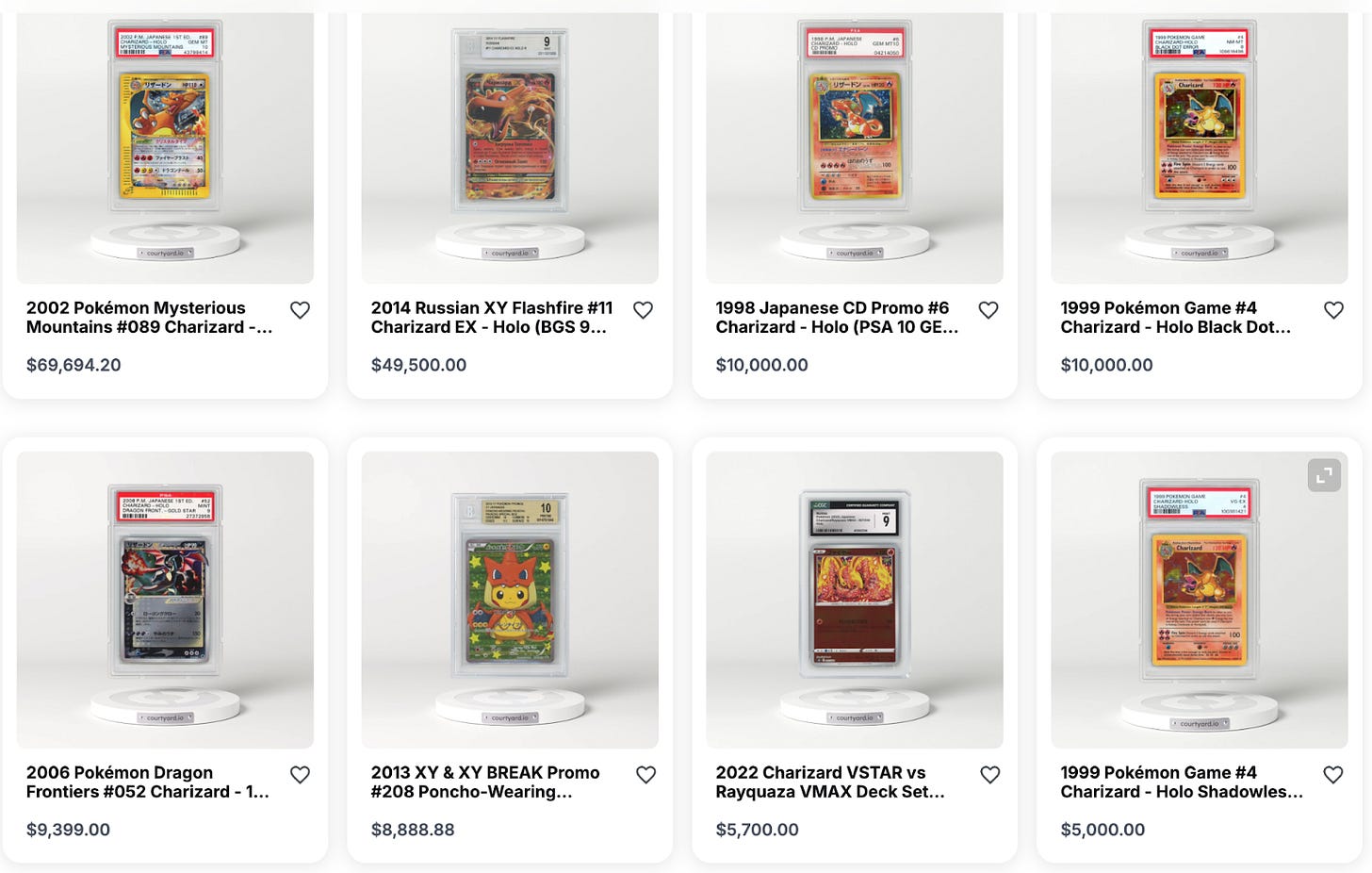

The interface felt like Amazon: Clean product pages, intuitive filters, professional photography. I could browse by category (Pokémon, sports cards, comics), price range ($6 to $250,000!), or rarity. What stood out for me was the pricing transparency. Every item showed current market value, recent sales history, and clear condition details.

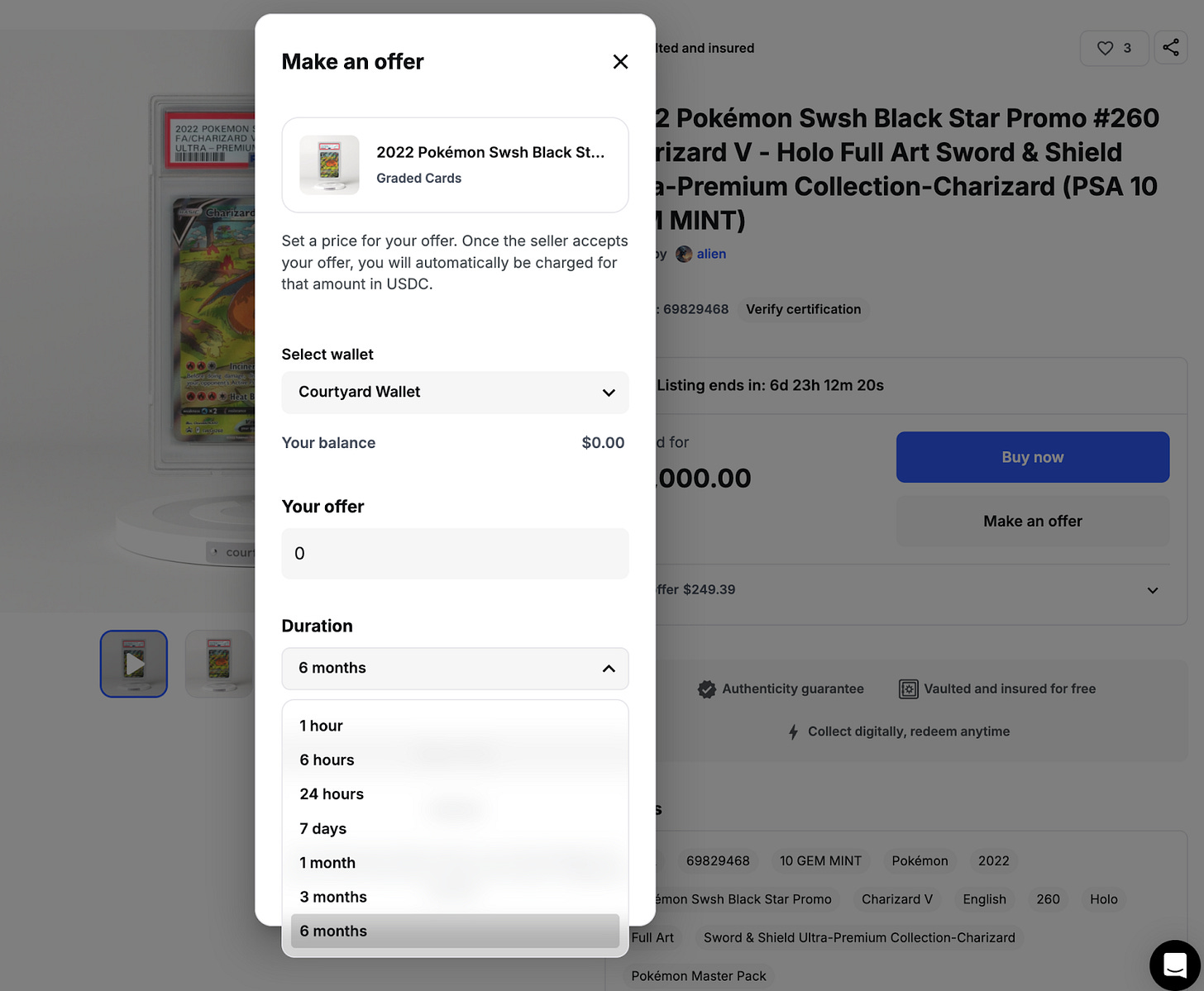

And it only got interesting. Unlike eBay's "Buy It Now or Bid" model, Courtyard lets you negotiate on everything. I could make offers with custom expiration times, effectively saying "I'll pay $X for this card, and this offer stands for Y hours or days or months." It felt like having a personal dealer relationship with every seller.

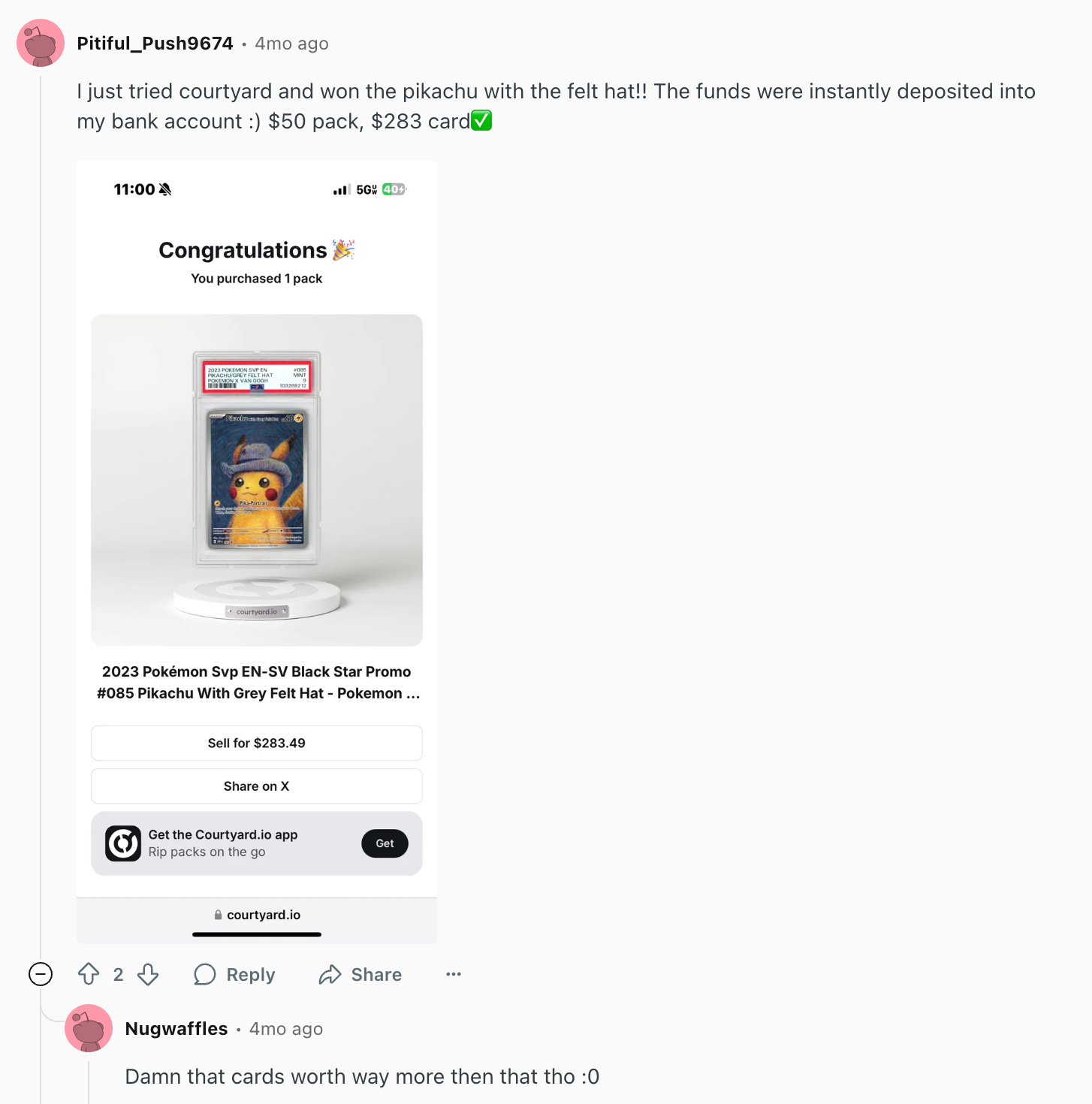

What I found the coolest was the digital pack opening. I bought a $25 mystery pack and watched a slick animation reveal my card, followed by a graded Pokémon piece now sitting in a Brink's vault with my name on it. The gamification was perfect: all the excitement of pack ripping with none of the physical storage headaches.

The 90% Safety Net

Every single item on Courtyard comes with an instant buyback guarantee at 90% of market value.

Think about that. I could buy a $1,000 card, immediately change my mind, and get $900 back instantly. No listing fees, no waiting for buyers, no negotiation. The platform acts as a market maker, always willing to buy at 90% FMV.

This addresses the biggest problem in collectibles trading head-on: providing liquidity. Traditional collectibles markets offer zero liquidity safety nets. Buy a card on eBay and realise you made a mistake? You're stuck listing it yourself, paying fees, and hoping someone wants it.

Courtyard’s Got VC Attention

Courtyard made around $50,000 in monthly sales in January 2024. Today, just over 18 months later, they're hitting $50 million per month.

That's a 1,000x increase.

Their recent $30 million Series A, led by Forerunner Ventures with participation from NEA and Y Combinator, values the company's approach to solving the trillion-dollar collectibles market's biggest problem: liquidity.

The startup makes money when it buys cards back from customers for 90% of its value and resells it to customers in a new mystery pack. The same card is sold an average of eight times a month on the platform, the company said.

Think about that: the average card on Courtyard trades 8 times per month. In traditional collectibles markets, a card might sit on a shelf for years between transactions.

The Brink's Partnership

Courtyard has partnered with Brink's, the global leader in total cash management, route-based secure logistics and payment solutions, to ensure the highest levels of security and accountability for physical assets.

Your $10,000 Pokémon card sits in the same vaults that protect gold for central banks. Every physical card in Courtyard's system gets authenticated, insured and stored in a Brink's-operated vault. The tokenised collectible acts as a digital voucher for proof of ownership and authenticity, and enables the physical asset to be traded without having to be physically moved around or re-authenticated at each sale.

Want the physical card? At any point, the owner of the NFT can choose to redeem it in exchange for the physical asset.

How Courtyard Actually Works

Step 1: Tokenisation - Physical collectibles are authenticated and stored in Brink's vaults. Each item gets minted as an NFT on Polygon, representing legal ownership of the physical asset.

Step 2: Trading - You buy/sell ownership of physical collectibles through NFT transactions. The actual card never moves unless you specifically request delivery.

Step 3: Liquidity - Can't find a buyer? Courtyard instantly purchases at 90% market value. Want to speculate? List at any price on their zero-fee marketplace.

Step 4: Redemption - Want the physical item? Burn the NFT and Courtyard ships the card from the vault to your door.

Why Courtyard Stands Apart

The collectibles storage and trading space has several players:

Traditional Platforms

eBay: Largest marketplace but zero liquidity guarantees, high fees, shipping risks

Heritage Auctions: High-end focus with 20%+ buyer premiums

Emerging Competitors

Alt: Focuses on liquid auctions for high-value cards (they vault Stephen Curry's $5.9M card)

StockX: Vault NFTs for sneakers and cards, though they've faced legal battles with Nike

Rally: Fractional ownership of collectibles, but you own shares, not the actual item

What sets Courtyard apart is their instant liquidity model. While competitors require you to wait for buyers or auctions, Courtyard acts as the market maker—always ready to buy at 90% FMV.

As Nicole Johnson from Forerunner explained to Fortune: "That might sound like a small thing, but it's a big unlock: it lowers the barrier to entry in a category that's historically been tough to navigate."

The User Experience

What surprised me most was how addictive the experience became. Here are some of the takeaways from the product.

The Good

Instant gratification: Buy, sell, trade in seconds

Risk mitigation: 90% buyback removes fear of bad purchases

Discovery: Browse thousands of items across categories and price ranges

Social elements: Show off your digital collection, see what others own

Gamification: Mystery pack opening recreates the thrill of pack ripping

The Concerns

Potentially addictive: Instant trading and pack opening can feel like gambling

Market dependency: 90% buyback only works if Courtyard maintains accurate pricing

Platform risk: You're trusting a startup with high-value assets

Some of the users got lucky with a steal deal.

While others raised some challenges.

Whether you're a serious collector tired of eBay's friction, an investor looking for alternative assets, or just someone curious about Web3's practical applications, Courtyard deserves attention.

They've found the sweet spot: making physical collectibles as liquid as crypto, with none of the volatility and all of the security.

It’d be interesting to see if they can maintain their instant liquidity promise as they scale to billions in volume, and whether other industries will adopt similar tokenisation models.

For now, they've innovated a way to collect, trade, and invest in physical assets with digital efficiency. And after experiencing it firsthand, I'm convinced this is just the beginning.

See you next week with another cool product.

Off to holding on to my favourite collectibles,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.