Hello!

Circle went public at $31 per share. Opened 2x above on its debut. Then, it jumped 2x more to touch a high of $133.

It’s now inspired a crop of crypto firms to dream of a successful Wall Street entry.

Check out Wednesday’s edition to know more.

In 2023, JPMorgan Chase, Wells Fargo, and U.S. Bank launched a pilot programme that challenged decades of credit card underwriting process. These lenders began approving credit cards for consumers by analysing their account activity: checking and savings balances, overdraft history, and spending patterns, instead of requiring traditional credit scores.

The programme targeted the 55 million Americans with "thin files or no files" at credit bureaus and extended unsecured credit to them based on their demonstrated financial behaviour.

Early participants were selected from existing bank customers who had maintained their accounts responsibly, avoiding overdrafts and demonstrating consistent cash flow management. This approach revealed that traditional credit scoring was systematically excluding creditworthy individuals who simply lacked formal credit histories. Think immigrants, young adults, and cash-preferring consumers who had never needed traditional credit products.

Financial institutions find alternative data more indicative of real-world risks and repayment abilities, especially for individuals with limited credit history.

Lenders are missing out on ~20% growth in credit-seeking consumers in the US by not opting to add alternative data along with traditional scoring models, said Tom O’Neill, Senior Advisor at Equifax, a consumer credit reporting agency.

The decentralised finance (DeFi) ecosystem is yet to evolve beyond crude over-collateralisation. Most of the DeFi lending protocols still require borrowers to deposit a security whose value exceeds what they seek to borrow.

Under-collateralised lending works in the traditional world because defaulting on a loan may benefit the borrower short-term but damages their reputation and future credit access long-term.

Blockchain's pseudonymous architecture makes this enforcement mechanism ineffective and impossible. A borrower could default with one wallet address and simply create another for future activities. This makes it impossible to enforce a “reputational collateral”.

This has forced DeFi into only supporting speculative rather than productive use cases, which is an inefficient use of capital especially in bear markets.

Why?

When prices fall, the demand for borrowing also comes down and so do the yields on these loans. This preference for serving speculative borrowers excludes builders who can generate returns by building a crypto project but lacks access to cheap credit.

This is where a case for under-collateralised loans can be made.

The Opportunity

The global lending market represents one of the largest financial sectors worldwide, valued at $10.4 trillion in 2023 and projected to reach $21 trillion by 2033.

Out of this, on-chain lending accounts for a mere fraction (0.56%) of the opportunity, with total value locked in DeFi lending protocols at ~$58 billion across lending protocols.

Aave, the dominant lending protocol, commands roughly 47% of the on-chain lending market but less than 0.3% of global lending volume.

These figures reveal both the enormous growth potential and current limitations of DeFi lending.

Global private credit markets, which involve lending by non-bank players, have exploded to over $3 trillion in 2024, growing at double-digit rates annually, yet on-chain lending remains constrained by over-collateralisation requirements that artificially limit its addressable market.

These growth rates demonstrate massive institutional appetite for innovative, under-collateralised lending approaches that bridge DeFi liquidity with real-world enterprises facing unmet credit demand.

The appetite for under-collateralised lending becomes stronger when you stack the challenges the traditional world faces.

Building something for the global audience from a remote African town where the borrowing costs are in the high teens? Need credit at cheaper, single-digit rates from across the border? Try doing that in the physical world. We are talking cross-border currency conversions, regulatory compliances across jurisdictions, lengthy settlement times and lenders demanding over-collateralised securities.

Bring in on-chain lending and it solves for most of these bottlenecks.

What you now have is a global credit market operating 24/7, denominated in stable digital currencies, accessible to anyone with an internet connection and sufficient creditworthiness.

A developer in Lagos can now access USDC credit from liquidity providers in London within minutes, not weeks.

What’s more? DeFi lending protocols verify transaction history, token holdings, and smart contract interactions along with the traditional checks. This allows them to achieve comprehensive creditworthiness assessments that neither system could achieve alone.

The Path

The challenge with under-collateralised lending is that everyone wants to perfect credit assessment and risk management without having to ask the borrower for more money as collateral.

Traditional world solved this through reputation and legal consequences: mess up your credit and you’ll spend years rebuilding the trust; all this while still clearing the dues at higher interest rates.

How to replicate this model amid pseudonymous identities? Some DeFi lenders tracked spending behaviour: how the borrowers spend and pay bills, what they buy and assets they own on-chain. This gives them a clearer view of borrowers’ financial discipline than most traditional credit metrics.

On-chain tools such as Arkham and 0xPPL help in linking wallet addresses by tracking transactions between them.

Some others asked for revenue evidence.

Predicting cash flows and projected income streams by looking at borrowers’ historical income levels can be more reliable than static asset holdings.

Borrow against Future

3Jane.xyz introduces a "credit-based money market" to address the over-collateralisation problem. Its approach expands beyond asset-backed loans to include future-backed loans.

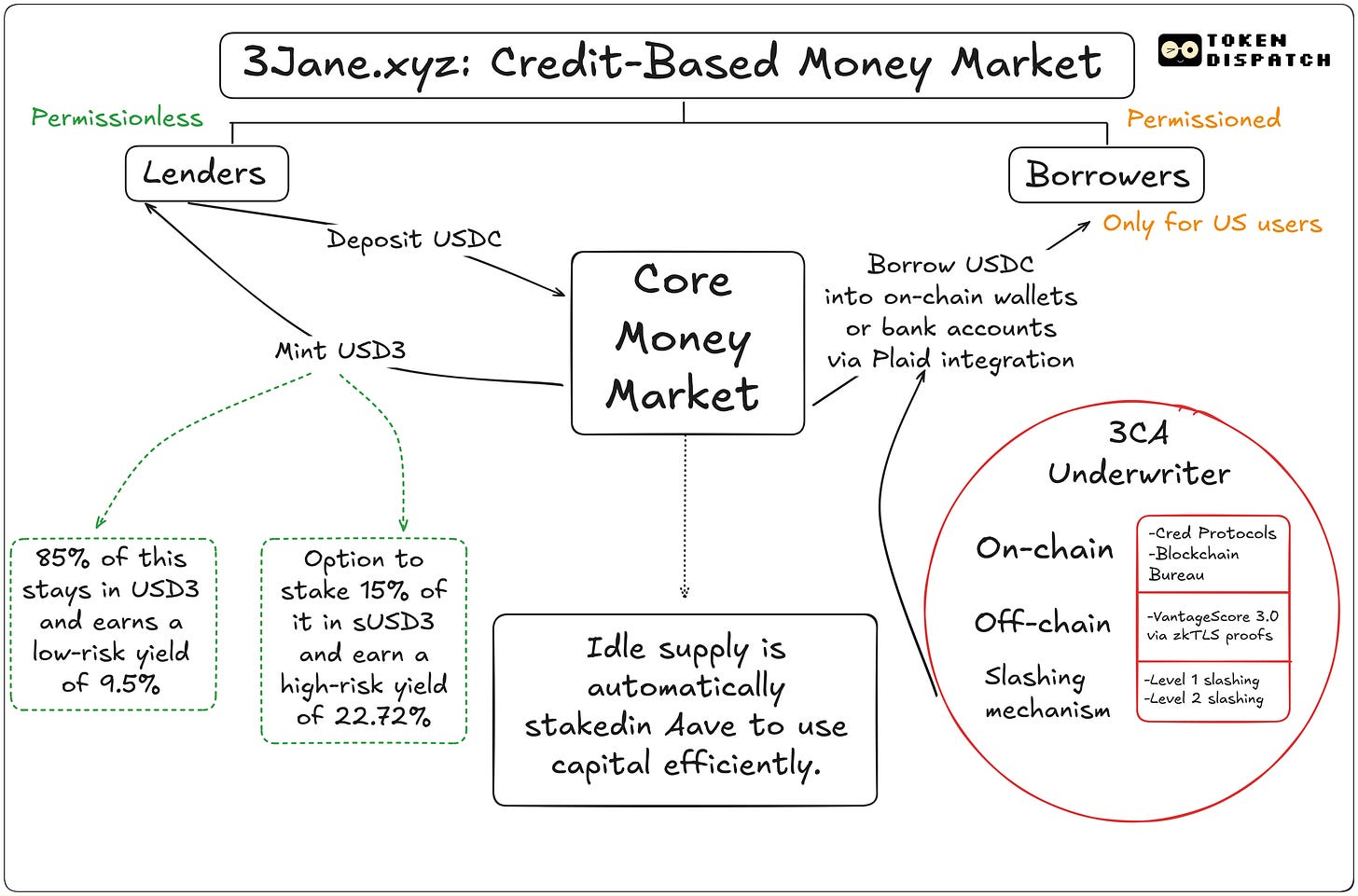

The protocol operates a two-sided market.

For lenders, 3Jane offers a permissionless system where suppliers can deposit USDC to mint USD3 tokens, earning competitive yields while maintaining liquidity.

The protocol splits deposits into two tranches: 85% goes to USD3 (senior tranche) earning base interest rates (read ‘low risk, low return’), whilst 15% goes to sUSD3 (junior tranche) offering higher yields but absorbing first losses from repayment defaults.

Currently, USD3 yields 9.5% while sUSD3 offers 22.72%, with idle supplies automatically staked in Aave to maximise capital efficiency.

For borrowers, 3Jane provides a permissioned system serving US users who can connect both on-chain wallets and traditional bank accounts via Plaid integration.

The protocol's proprietary 3Jane Credit Algorithm (3CA) analyses this comprehensive financial profile to generate personalised credit lines with risk-adjusted rates.

Current borrowing rates average 11.2% (4.5% base rate plus 6.7% risk premium), representing a significant improvement in capital efficiency compared to over-collateralised alternatives.

3Jane's Credit Risk Algorithm (3CA) checks multiple data sources to generate a user’s credit line.

It evaluates on-chain credit scores from Cred Protocol and Blockchain Bureau, off-chain VantageScore 3.0 credit scores accessed through zero-knowledge TLS proofs, comprehensive asset holdings across DeFi protocols and centralised exchanges, traditional bank balances and cash flows, and historical transaction behaviour patterns.

This approach enables the protocol to serve both asset-rich yield farmers seeking greater capital efficiency and asset-light businesses requiring working capital based on productive capacity.

It also addresses the challenges in under-collateralised lending through a tiered "credit slashing" system.

The slashing mechanism is the DeFi equivalent of credit score destruction in the traditional world. When a borrower defaults on repayment to a physical bank, the penalty will follow them into the future when they seek new loans.

How do you make a pseudonymous borrower worry about reputation in case of defaults? 3Jane’s slashing mechanism creates something similar.

Level 1 slashing includes reducing future credit line sizes for delinquent borrowers and implementing a shared responsibility mechanism where late interest payments from defaulters are distributed pro-rata amongst all existing borrowers, creating community incentives for responsible borrowing.

Level 2 slashing introduces an on-chain Dutch auction system where licensed US collections agencies bid on non-performing debt on a contingency basis. This mechanism brings traditional debt recovery into the DeFi ecosystem.

These agencies have multiple means of incentivising repayment, including the right to furnish defaults to offchain credit bureaus to slash offchain credit scores and increase future credit exclusion, and get a court injunction to force repayment.

This tackles one of crypto's biggest contradictions. Web3 users prize their pseudonymity: nobody wants their wallet address linked to their real identity. But lenders need some way to chase down defaulters.

3Jane's Level 2 slashing does this precisely: borrow pseudonymously, but default at your own risk. When you take out a loan, your identity stays private. The protocol only knows your wallet address and your credit profile. But if you default? That's when the mask comes off. Collections agencies get the teeth to access your real-world identity and pursue you through traditional channels including credit reporting and legal action.

3Jane's model rethinks how we conceptualise credit, collateral, and economic expansion in decentralised systems.

Just as JPMorgan Chase and other banks demonstrated that traditional credit assessment missed crucial behavioural signals, 3Jane challenges DeFi's loyalty to over-collateralisation by proving that sophisticated credit assessment can enable sustainable under-collateralised lending at scale.

The protocol's competitive moat is in its 3CA algorithm and comprehensive off-chain credit underwriting capabilities.

A privately-held algorithm could be contradictory to DeFi ethos, which expects utmost transparency. It could leave borrowers without any explanation on why their application was approved or rejected. But, a fully transparent algorithm has its own challenges. It could make it manipulatable by the public.

It could address this by publishing statistics without revealing the algorithm and setting up a feedback loop for rejected applicants to appeal and course correct.

The protocol shows the evolution of permissionless lending from theory to real-life application, just as microfinance evolved from a niche academic concept to mainstream financial infrastructure.

3Jane’s approach to capital efficiency brings accessibility for crypto users who have been systematically excluded from optimal capital allocation, yet faces scalability issues. Considering it is open only to US users, those without bank accounts, credit histories, or US residency remain locked out, some of whom form the very populations that DeFi was supposed to liberate. Expanding further could mean tailoring algorithms to match the market needs. Expanding to other geographies also means that slashing ability needs to expand, which depends on working with different agencies. Not necessarily scalable.

Players are taking different routes to uncollateralised lending.

Goldfinch works with real-world lenders in emerging markets to extend crypto liquidity to borrowers who lack traditional credit histories. It relies on local institutions to handle underwriting rather than building proprietary algorithms.

Maple focuses on institutional lending by having "pool delegates”, basically professional fund managers, to conduct due diligence and vouch for borrowers. It outsources credit decisions to traditional finance experts rather than algorithmic scoring.

Affirm, a traditional fintech player, pioneered the use of machine learning to analyse thousands of data points from shopping behaviour to social media activity for instant loan approvals.

3Jane’s hybrid approach could bring in more productive capital allocation in DeFi, where borrowing power aligns with economic productivity rather than existing wealth concentration.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.