Crenshaw Slams Ripple-SEC Deal

The SEC Commissioner argued that the manner of handling the case has created a regulatory vacuum at the agency under Trump's administration.

The blockchain payments company settled with the Securities and Exchange Commission (SEC) yesterday for $50 million, a 60% discount from the $125 million penalty Judge Analisa Torres ordered last August.

The settlement slashes Ripple's penalty, dissolves a court-ordered injunction against the company, and returns $75 million held in escrow.

This agreement has split opinions inside the SEC.

"If Ripple decides tomorrow to sell unregistered XRP tokens to institutional investors—in plain defiance of the court's order — this Commission will do absolutely nothing about it," said SEC Commissioner Caroline Crenshaw.

Crenshaw issued a public statement, calling the deal "not in the best interests of the investors and markets that our agency is tasked with serving and protecting."

The Commissioner, who’s been sceptical of crypto for long, said the agency’s manner of handling this case creates a “regulatory vacuum with no end in sight”.

"[The settlement] subverts the clear and honest application of the facts to the law, a cornerstone of any effective law enforcement program," she said.

Crenshaw raised concerns that deserve serious consideration.

This deal creates an unusual precedent: a company found in violation of securities laws getting a reduced penalty and permission to continue the very activities a court deemed illegal.

The $4.9-Million Question

Ripple donated $4.9 million to Trump's January inauguration, making it the second-largest donor after Pilgrim's Pride ($5 million). CEO Brad Garlinghouse has made no secret of his White House connections, posting photos of meetings with Trump in January.

"We thank the new leadership in the executive and legislative branches for supporting a rational and constructive way forward on crypto," Garlinghouse said after the settlement announcement.

The Ripple settlement is part of a systematic dismantling of crypto regulations established under the previous administration.

The SEC has dropped cases against Coinbase, Kraken, and Richard Heart without penalties

US President Donald Trump's "Strategic Bitcoin Reserve" is moving forward (initially proposed to include XRP)

SEC Chair Paul Atkins, confirmed just last month, has replaced Gensler's enforcement-focused approach with an industry-collaborative stance

Ripple’s case, initially filed in 2020 under former Chair Jay Clayton during Trump’s first term, has now concluded in his second term, delivering a result that’s a complete 180 from where it began.

XRP jumped 6.5% to $2.37 yesterday according to CoinGecko. This pushes its market cap to over $138 billion.

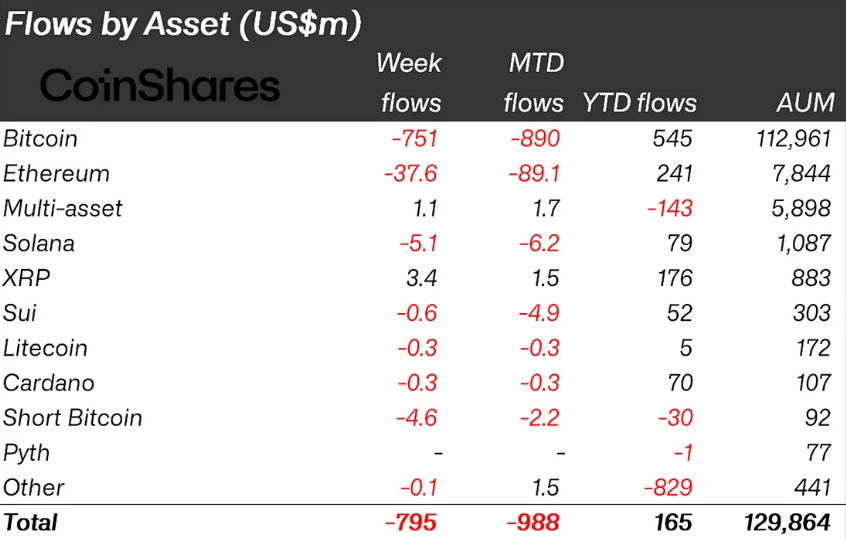

Institutional flows tell more.

CoinShares data showed XRP investment products attracted $3.4 million in inflows in April, even as Bitcoin products bled $751 million. This suggests some institutional investors anticipated this regulatory pivot.

The Ripple settlement reveals how quickly the regulatory landscape can shift when money and politics align.