Crypto and AI are Electricity Hungry 🔌

International Energy Agency (IEA) issues energy consumption warning. Sell-off pressure on Bitcoin easing up? US government to sell over 2,900 Silk Road Bitcoin. Google's new text-to-video generator.

Hello, y'all. If you think you know your music, then this is for you frens👇

A complete go. Check out 👉 Asset - Music Nerd.

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

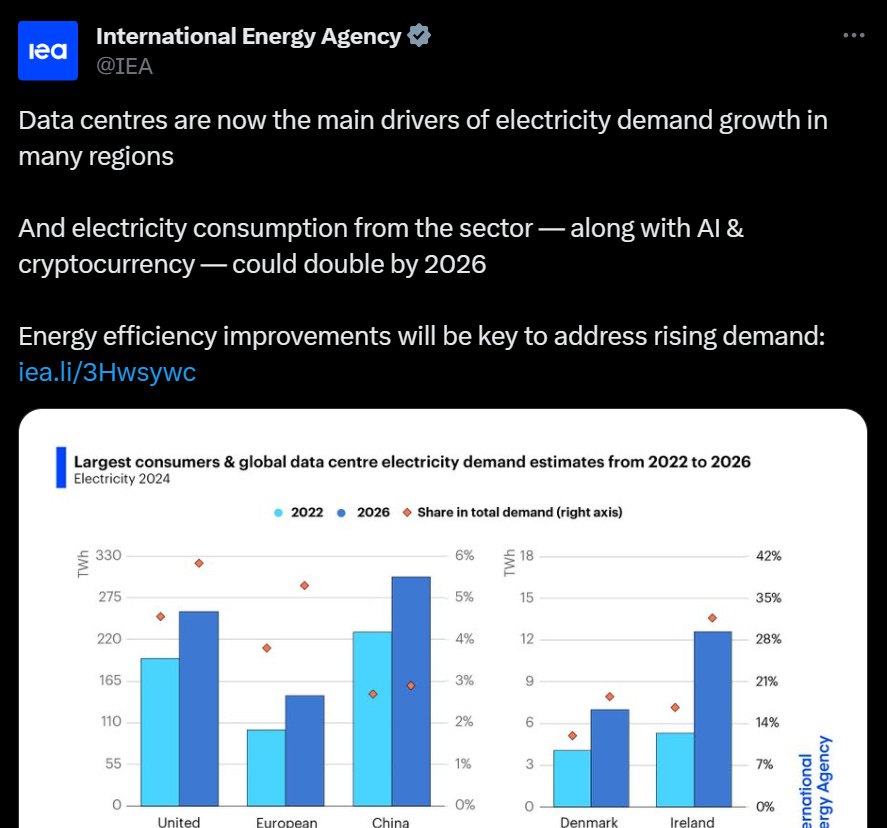

The International Energy Agency (IEA) dropped a big heads-up about our power consumption, especially at crypto and AI.

Right now, they consume almost 2% of global electricity.

But apparently, this could double soon.

First up, here's the Lowdown of the Global Scene

The power generation sector, which is a big emitter of CO2, is also leading the charge towards net-zero emissions.

Renewable energy sources are set to become the main players by 2025.

The electricity consumption growth is expected to jump from 2.2% in 2023 to 3.4% by 2026.

China and India are going to be big contributors to this increase.

Now, for the Crypto and AI Part

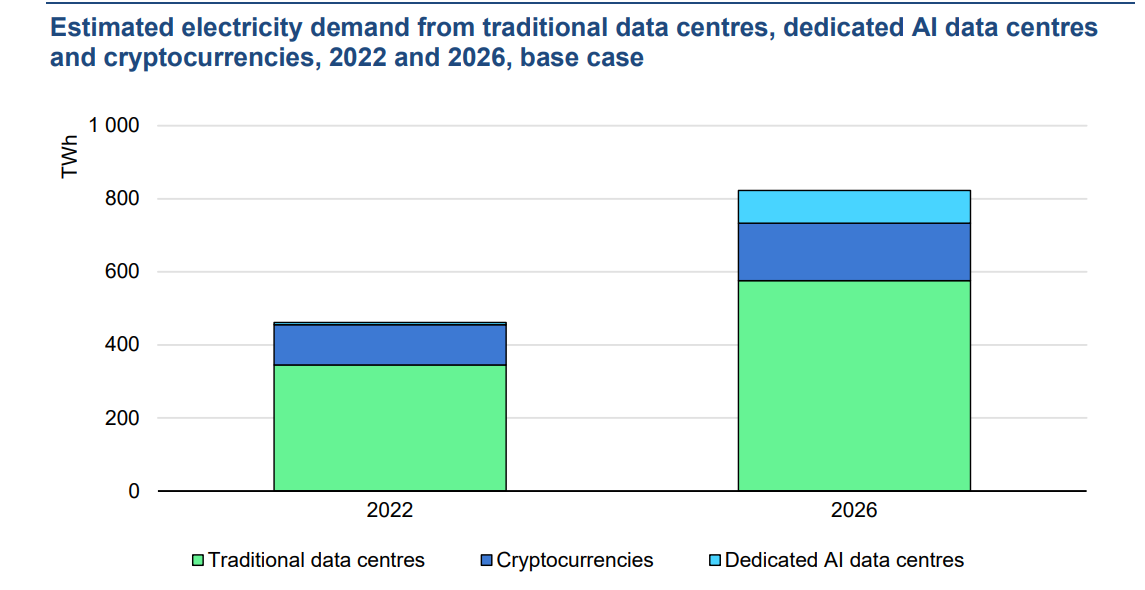

By 2026, the power use from data centres, AI, and crypto could leap up to between 620 and 1050 terawatt-hours (TWh).

In 2022, these sectors already consumed about 460 TWh of electricity, almost 2% of the total global electricity demand.

AI is set to lead this surge, with its power consumption predicted to skyrocket tenfold between 2023 and 2026.

Something like ChatGPT could use up almost 10 TWh per year by then. Each ChatGPT request is nearly ten times more power-hungry than a Google search.

In 2023, Bitcoin alone gobbled up 120 TWh out of the total 130 TWh used for all crypto mining - up from 110 TWh in 2022, which was 0.4% of the world's energy usage.

The IEA thinks crypto mining could use up 160 TWh by 2026.

This isn't a new convo: Back in 2023, there was a spike in electricity theft in the UK, and crypto mining was fingered as one of the top suspects.

Also, let's not forget the West Midlands Police busting a massive Bitcoin mining op that was slyly dodging the electric bill.

TTD GBTC 🔴

GBTC outflows were $429 million on Jan. 24 — the smallest since launch

Is this the end of it?

JPMorgan's analysts, led by Nikolaos Panigirtzoglou, have some good news.

The recent sell-off pressure on Bitcoin is easing up.

Therefore: “most of the downward pressure on Bitcoin,” should be over.

This comes after a significant amount of profit-taking in the Grayscale Bitcoin Trust (GBTC), which has converted into a spot Bitcoin ETF.

Read this: This too shall pass🤞🏿

Read this: Who's selling? 🪝

GBTC has seen outflows of $4.3 billion since turning into an ETF. This figure is even higher than JPMorgan's initial estimate of $3 billion.

This sell-off in GBTC shares is seen as a major factor behind Bitcoin's recent price dip. .

GBTC needs to watch out for new players and maybe fix the fees a bit:

"There appear to be two emerging competitors to Grayscale's bitcoin ETF: BlackRock and Fidelity, which have so far attracted $1.9 billion and $1.8 billion of inflows respectively. They both have much lower fees of only 25 basis points (without waivers) vs 150 basis points for GBTC."

TTD Sell 💰

The US government has filed a notice to sell over 2,900 Bitcoins - $130 million.

This is connected to the Silk Road case.

Seized from individuals including Ryan Farace, a dark web drug dealer.

Details of the Forfeit: Two Lots of Bitcoin:

First Lot: Around 2,800 BTC, approximately $129 million.

Second Lot: 58 BTC, about $3 million.

Farace, sentenced in Maryland last year to 54 months for money laundering conspiracy, and his father were involved in laundering bitcoin initially used for drug trafficking.

Farace and his father tried to transfer over 2,874 Bitcoin to a third party for moving to a foreign bank account.

Connection with Shaun Bridges

Former Secret Service agent tied to the first lot of bitcoin.

Sentenced to six years in prison in 2015 for stealing BTC during the Silk Road investigation.

Legal Actions

Both Faraces ordered to forfeit their bitcoin.

Bridges agreed to surrender the stolen bitcoin to U.S. agents.

TTD ONDO 💸

ONDO, the governance token of Ondo Finance, has seen a remarkable trading volume of over $1 billion in its first week.

What's the Deal with ONDO?

Holding ONDO gives you a say in the Ondo DAO cooperative.

ONDO kicked off with a bang, raking in $150 million on day one. You can find it on big-name exchanges like Coinbase and Kucoin.

Some folks aren't too happy with how ONDO was rolled out. Only 14% of its total supply is floating around right now.

Ondo Finance is making moves in the world of tokenising real-world assets. They're like the third-biggest player - $189 million in crypto.

Ondo Tokenomics in a Nutshell

Critics worry about the disparity between circulating supply and fully-diluted valuation, fearing that the influx of new tokens could erode value.

88% of circulating tokens are earmarked for ecosystem growth, controlled by the Ondo team, suggesting a lower actual market supply.

TTD Google 🔎

Google's latest brainchild, named Lumiere, is a text-to-video generator.

What Makes Lumiere Special?

Space-Time U-Net Architecture: This fancy term means Lumiere can create smooth, realistic videos in one go. It works by processing both spatial and temporal dimensions of a video, all at once.

User-Friendly: Got a text description or a still image? Lumiere can animate it into a video, edit it, or even add some style.

The Tech Behind It:

Training: Lumiere learned its craft from 30 million videos and captions.

Performance: It can generate 80 frames of video at 16 frames per second.

But, There's a Catch: Google's keeping mum about where they got all those videos for training Lumiere. Given the hot debates around AI and copyright laws, this has raised some eyebrows.

TTD Surfer 🏄

Mark Scott, a lawyer involved in money laundering through the OneCoin cryptocurrency scheme, has been sentenced to 10 years in prison by a federal judge.

Hong Kong leaders are trying to balance crypto support with battling scams.

Swan Bitcoin, a BTC-focused investment platform, launched a mining arm last summer, which has already mined over 750 BTC.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋