Crypto Correction Underway? 🙇♀️

How this bull run compares with previous ones, what are the market indicators saying? Wood declares support for Trump. $58B token unlocks behind altcoin market turmoil?Jump Crypto president departs.

Hello, y'all. Hang in there?

Do try the Music Quiz Game 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

June 24 saw a bloodbath.

Possible catalysts?

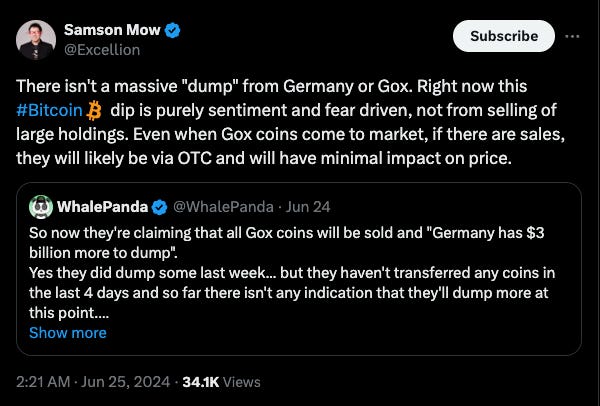

Potential $8.5 billion market dump by Mt. Gox

Outflows from US spot Bitcoin ETFs

Germany selling its Bitcoin reserves

Bitcoin miners selling off more Bitcoin than usual

Read: Manic Monday 🫨

But, is the Bitcoin bull market over?

Was March ($73k) the top of this cycle?

It's hard to say for sure until hindsight provides clarity.

Unpacking the bull market comparison

Historically, bull markets hit their peaks after ~840 and 1,060 days.

At 585 days (roughly 20 months), we're in the second half of this potential cycle.

Bitcoin has grown 4x since its November 2022 bottom, which falls between the gains of the previous two bull runs (6x and 3x).

If March was the top, this would be the shortest bull cycle ever (excluding the first year of price discovery).

Or is this a different kind of bull run altogether?

Past bull runs saw significant gains in the following 200 days. This time, returns might be more modest.

Unlike previous cycles, there hasn't been a significant altcoin season.

This bull market has deviated from past trends in terms of altcoin performance.

Read: How this bitcoin bull market stacks up against the others

Profit taking by early investors

Mark Wong, head of trading at HashKey OTC, observes early Bitcoin adopters cashing in on their holdings.

Which could be contributing to the current price dip.

“All around, I believe that the volatility may not have begun yet ... We haven’t quite seen the 2021 levels of excitement.

I think bitcoin does show better performance within the fourth quarter, so the market may be looking forward to that.”

Outflows from US Bitcoin ETFs - a broader market correction.

“There are a number of ETF flows that are related throughout arbitrage so there’s a trade ongoing that people buy for ETFs and sell sort of CME futures, where that volume may be a lot bigger than just pure buy volume. This is a hedge trade so within the Hong Kong side, we have, in total, [flows coming in around] $10 or $15 million US. We feel like it’s very positive, and everything that we are confident and continues to grow in the space.”

The recent mess? “Cyclical” event.

Are we overreacting?

Let’s look at 4 indicators

1/Fear and Greed Index

Crypto Fear and Greed Index plunges to its lowest level in 18 months.

Fell 21 points on June 24.

This "Fear" score reflects a significant shift from the "Greed" that dominated just a week ago.

It hasn’t hit a score below 30 since Jan. 11, 2023.

2/Whale Games

Whales are strategically placing and removing buy and sell orders to create the illusion of low liquidity.

What is that? Spoofing.

It can push prices up or down depending on the whales' goals.

The lack of real buying pressure behind these orders makes it difficult for the price to recover quickly.

3/Relative Strength Index

The silver lining? Bitcoin's RSI reached oversold territory for the first time since August 2023.

This historically indicates a potential buying opportunity as the price may have bottomed out.

Overall, this correction could be a temporary cooling-off period before a price rally.

4/Bitcoin and Ethereum transaction fees at to lowest level in 7 months

The low fees come as the crypto market experiences one of its worst weeks of 2024.

On June 23, the average Bitcoin transaction fee reached $1.93, its lowest since October 2023.

Ether gas fees have reached a new low, with prices as low as 1 gwei, the lowest in years. Current ETH gas fees are around 4.5 gwei

What does it mean?

Low Bitcoin fees indicate lower network activity and less competition for block space.

Bitcoin fees often spike during high volatility and price appreciation, as increased speculation generates competition for block space. Except for the 2021 bull run, every major BTC price rally since 2012 has resulted in higher transaction fees.

Low Ethereum gas fees are attributed to activity moving from the base layer to layer-2 networks after the March Dencun upgrade. Since Dencun, average Ethereum gas prices have decreased by about 92%.

Boomers coming for crypto?

Baby boomers are going to transfer $84 trillion to their heirs in the next decade.

A good chunk, potentially $20 trillion, could land in the crypto market.

Says who? Noelle Acheson, a former market analyst for Genesis Global Trading.

And he predicts Bitcoin's price to hit $600,000, And Ethereum $32,000.

The reason? Younger generations like crypto older folks don’t.

A Bank of America survey found only 4% of wealthy Americans over 44 favour crypto over traditional investments, while 28% of their younger counterparts prefer crypto.

Block That Quote 🎙️

Ark Invest CEO, Cathie Wood.

“As I’ve said to my children... as I've said to them, 'Look, I am going to vote for the person who’s going to do the best for our economy.' I am a voter when it comes to economics ... And on that basis, Trump.”

Wood publicly declared her support for Donald Trump in the upcoming presidential election.

Why? Economic reasons.

She supported her choice by referencing Arthur Laffer, an economic advisor to Trump.

She praised the economic growth during the initial three years of his presidency before the pandemic hit.

What is Trump up to?

In discussions to take the stage at the Bitcoin 2024 conference in Nashville, a major crypto event.

Other politicians at the same event: Presidential candidate Robert F. Kennedy Jr., former candidate for president Vivek Ramaswamy and Republican Sens. Bill Hagerty and Marsha Blackburn.

US Presidency: Popular vs Electoral

Biden is popular.

But Is he gonna win the presidency?

Not an easy question.

Popular vs. Electoral: Prediction markets suggest Joe Biden could win the popular vote in the upcoming election with a 56% chance, but his odds of securing the presidency are lower at 34%.

In contrast, Trump's odds are 36% for the popular vote but 59% for winning the presidency.

Big Bets Placed: $182 million has been bet on who will win the presidency - Polymarket's largest market. $36 million is riding on who will snag the popular vote.

Carole House is back at the White House

Who? House is a key player behind President Biden’s crypto executive order, and has snagged a role back at the White House.

Announced via LinkedIn, House is jumping back into the game as a special adviser for cybersecurity on the National Security Council.

In The Numbers 🔢

$58 billion

The value of tokens unlocked in 2024.

Large amounts of locked tokens, previously held by venture capitalists and project founders, are being released into the market.

What is wrong with that? A surge in available coins, which can drive prices down if there aren't enough people buying them up - downward pressure on altcoin prices.

We're talking about coins like Avalanche (AVAX), DYDX, and Pyth Network (PYTH) – all of which have taken a tumble recently.

Here's the kicker: This week alone, $85.5 million worth of tokens are hitting the market.

The biggest culprit? Optimism (OP), planning to unleash $56.1 million worth of tokens.

Over 20% of top cryptocurrencies have significant locked tokens, hinting at potential future volatility.

The altcoin market has already suffered this year, with prices dropping nearly 25% since Bitcoin's March peak.

Jump Crypto President Departs

Kanav Kariya, the young president of Jump Crypto, has stepped down from his position.

His exit follows a series of challenges for Jump Crypto.

Commodity Futures Trading Commission (CFTC) investigation: The CFTC is reportedly investigating Jump's involvement in crypto.

Wormhole bridge hack: Jump bailed out the Wormhole bridge for $320 million after a hack in 2022 and later spun it off from its business.

Terraform Labs and Luna collapse: Jump was a major investor in Terraform Labs and allegedly helped maintain the peg of its UST stablecoin before its collapse in 2021.

Jump Crypto? A major market maker and investor in crypto assets.

The company is also known for its contributions to:

Pyth network: Provides off-chain data for DeFi protocols.

Wormhole bridge (formerly): Connected Solana and Ethereum blockchains.

Kariya? Joined Jump Crypto as an intern and rose to become its first president at the age of 25. Kariya also played a role in founding Pyth, and contributed to the development of the Wormhole bridge.

The Surfer 🏄

Julian Assange has been freed from jail after reaching a plea deal with the US. He is expected to plead guilty to one count of conspiracy to obtain and disclose US national defense information.

Bitcoin mining firm Hut 8 has secured a $150 million investment from Coatue to expand its AI infrastructure market. The investment will be in the form of a convertible note and aims to meet the growing demand for AI compute capacity.

Alex Lab attributes $4 million exploit to North Korea's Lazarus Group. The attack resulted in about $4.3 million in losses for Alex Lab. The project identified substantial evidence linking the attack to the Lazarus Group.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋