Crypto ETPs See Largest Exodus Ever 🛫

Billions gone in weeks; why are investors running away from Bitcoin products?

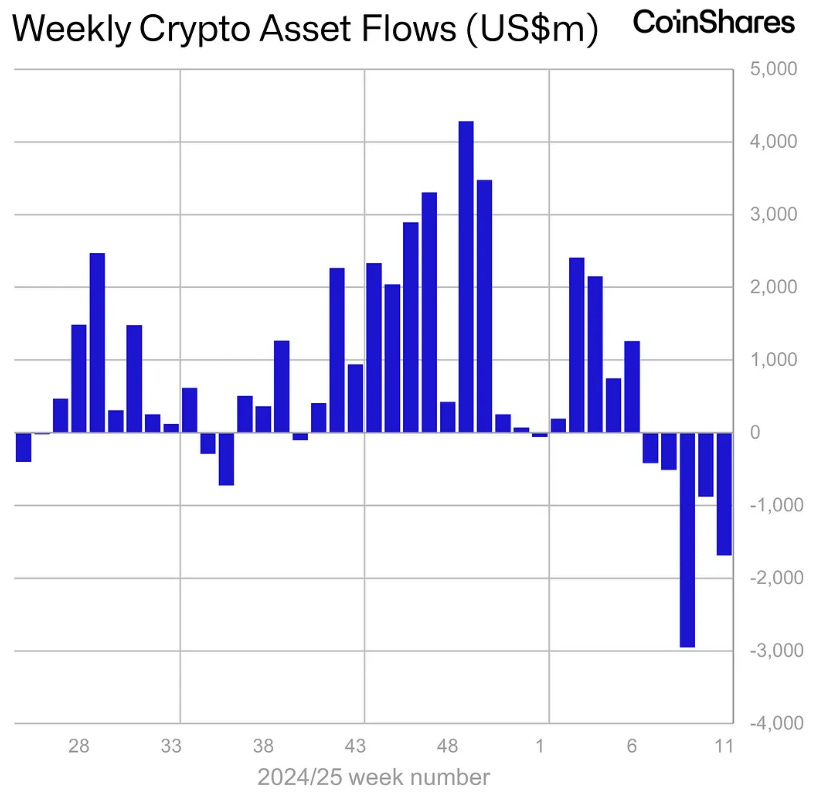

Cryptocurrency exchange-traded products (ETPs) just suffered their largest exodus in history, with $1.7 billion pulled out in last week alone. This marks the fifth consecutive week of retreats and pushes the total outflow to nearly $6.4 billion.

What's happening?

After Bitcoin's record high of $109,000 in January this year, the coin has retreated more than 20% to the range of $82,000-$84,000. That's left many investors booking profits and heading for exits.

Numbers show the severity of this sell-off

17 consecutive days of outflows — the longest negative streak since 2015

Bitcoin ETPs bore the brunt, losing $978 million last week

Total assets under management plummeted by $48 billion to $133.6 billion

XRP and Cardano products managed modest inflows of $1.8 million and $400,000 respectively — small consolations in an otherwise bleak landscape.

A Perfect Storm of Pressure

The sell-off comes amid multiple concerns - President Trump's tariff policies stirring inflation fears, regulatory uncertainty in Europe, and technical resistance levels keeping Bitcoin's price in check.

François Villeroy de Galhau, a European Central Bank official and Bank of France Governor, recently warned that Trump's pro-crypto stance could "sow the seeds" of a financial crisis.

Consumer sentiment has hit its lowest point since November 2022, according to the University of Michigan's index. When people feel economically insecure, speculative assets like cryptocurrencies often take the first hit.

Silver Linings in Technical Signs

For those seeking hope amid the carnage, CoinShares' analysts point to Bitcoin's mercurial RSI, which has printed a bullish cross — a technical pattern that historically preceded average price recoveries of 55% within three to five months.

"We may be approaching peak bearishness," suggests James Butterfill of CoinShares, noting that outflows slowed toward the end of last week.

Meanwhile, institutional crypto hedge funds have quietly increased their Bitcoin exposure to a four-month high — a contrarian move that could signal smart money positioning for a rebound.

What Happens Next?

The market now faces a critical juncture. Bitcoin hovers near crucial support levels between $82,000-$84,000. If these hold, we could see a consolidation phase before another push higher.

However, all eyes are on the upcoming Federal Reserve meeting. Any surprise in monetary policy could either accelerate the sell-off or trigger a relief rally.

Despite the current turmoil, year-to-date inflows remain positive at $912 million—a reminder that longer-term enthusiasm for crypto ETPs hasn't completely evaporated.

For now, though, the party in crypto land has definitely hit a sobering patch. It is not longer if the market will recover — but when, and at what cost to investor confidence.