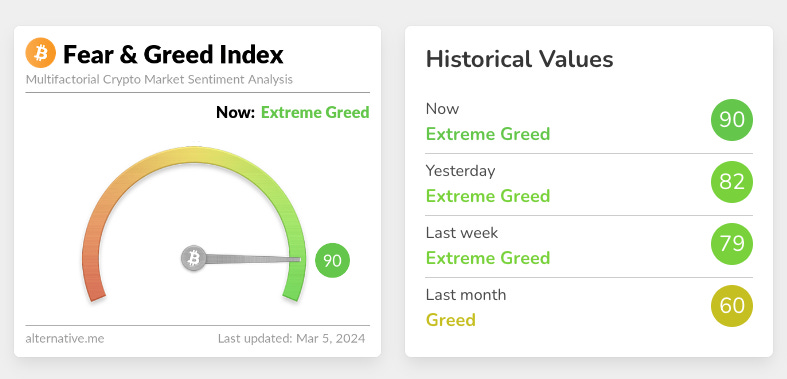

Crypto Fear & Greed Index ATH? 🟢

Extreme greed @ 90. BTC hits $68K. ETH close to $3800. SEC pushes back BlackRock spot Ethereum ETF. Vitalik Buterin on memecoins and Reddit IPO. Tether hits $100B MCAP. Bitcoin Ordinals are a hit.

Hello, y'all. If you think you know your music, then this is for you frens. A complete go. Check out 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Today's big news is not just Bitcoin aiming its ATH.

Ethereum is also on a tear.

Crypto is on a roll.

Fear and Greed index is closing in at ATH.

The scale is: 0 = Extreme Fear | 100 = Extreme Greed

Hold on. We are in territory not seen before?

Fear. Greed. It's all in the human mind … isn't it?

ETH price just surpassed $3,750.

Highest point since early 2022.

All thanks to Dencun upgrade, which promises faster and cheaper transactions.

Dencun upgrade: Launching in 9 days (March 13th) and expected to significantly improve transaction speed and cost.

Read: Ethereum's Dencun Upgrade 🦋

Ether is beating Nvidia stock over the past five years.

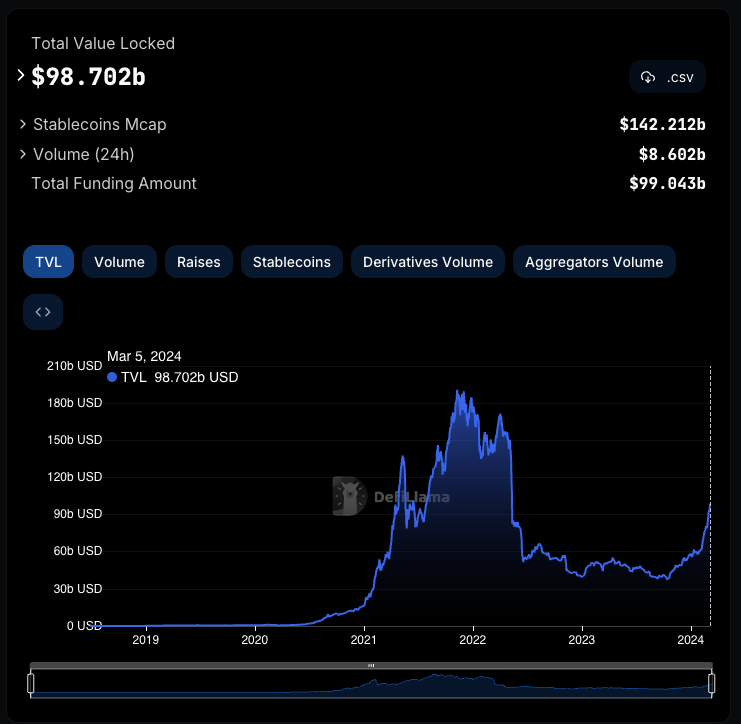

DeFi is so back in action: Total value locked (TVL) in DeFi protocols hits $98 billion, the highest since the TerraUSD crash in 2022. This suggests renewed investor confidence in the DeFi space.

The NFTs are back in vogue: The Punks are selling hot again. So is the EtherRock.

Now back to Bitcoin

Topped $68,000 on Monday.

Inching closer to its all-time high of $69,000.

Bitcoin also hit an all-time high in euros - a record-breaking €61,000.

That's not it, though

ATH are being crushed across the globe.

New target: Silver's $1.4 trillion market cap.

According to data from IntoTheBlock, 97% of Bitcoin addresses are currently "in the money," meaning their average purchase price is lower than the current market value.

Open interest is exploding: This indicates a surge in leveraged bets, often a warning sign.

Similar open interest levels in 2021 preceded price drops for both assets.

Crypto short sellers are getting burned. Liquidations are hitting them hard, with an average of $110,000 lost per minute on short bets.

Crypto stocks take flight

Coinbase (COIN): Gained over 11%, likely fueled by increased trading activity on its platform.

MicroStrategy (MSTR): Soared by 23%, as investors bet on the company's massive Bitcoin holdings appreciating in value.

MicroStrategy raises $600 Million.

Why? To buy even more Bitcoin. Currently owning 193,000 BTC.

Meanwhile, Coinbase glitches again: Users see $0 balances.

Ethereum ETF pushback

The US SEC has delayed a decision on BlackRock and Fidelity’s proposal for a spot ethereum ETF and is seeking public feedback.

The SEC is concerned about whether Ethereum’s proof-of-stake mechanism is vulnerable to fraud and manipulation.

SEC delays decision on BlackRock and Fidelity's Ethereum ETF proposals.

This is the second time the SEC has pushed back a decision on these applications.

May 23rd, the final deadline for another Ethereum ETF application, is seen as the key date for potential approvals.

Bloomberg also predicts: 70% chance of approval by May 23.

Crypto lawyer Jake Chervinsky believes denying spot Ether ETFs is more likely than expected, citing legal and regulatory concerns.

Block that Quote🎙️

Vitalik Buterin, Ethereum founder, on crypto and community ownership

“Today, it feels like some categories of infrastructure are way over-invested, and others are still very under-loved"

Buterin throws shade at meme coin craze, calling for a more balanced crypto investment approach.

Buterin's concerns

Meme coin mania: He believes the current investment focus on meme coins like Dogecoin might be hindering other vital areas of crypto infrastructure.

Funding imbalance: He argues for a more balanced distribution of resources, stressing the difference between "public goods" and sectors driven by competition.

He also briefly mentions Ethereum Improvement Proposal (EIP) 4844, hinting at its potential to improve network efficiency and reduce costs.

Despite Buterin's subtle critique, meme coins continue to surge, with their total market cap reaching $63 billion.

Read: Memecoin Mania 💫

Crypto Solves Geographical Constraints

Citing Reddit IPO example, Buterin builds on the constraints of the traditional finance systems.

Where’s ETF?🚨

On March 4th, the total net inflow to Bitcoin spot ETFs was $562 million. Grayscale ETF GBTC net outflow of $367 million yesterday.

Highest net inflow was BlackRock ETF IBIT, of $420 million.

The total historical net inflow to IBIT has reached $8.38 billion👇

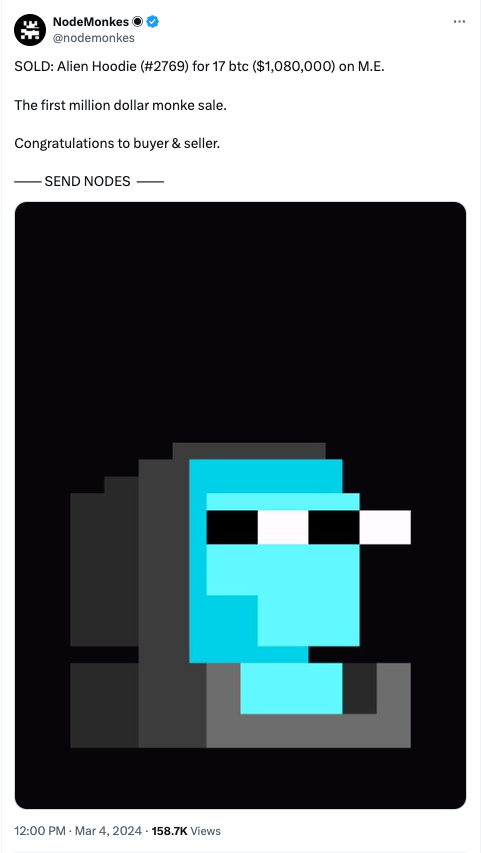

Bitcoin NFT Sells for $1 Million

Move over, CryptoPunks, there's a new contender in the NFT world, and it's built on Bitcoin.

NodeMonkes, the hottest collection of Bitcoin Ordinals, just shattered records with a $1 million sale. This follows a red-hot week for the project, raking in nearly $45 million in secondary market sales.

The surge in Ordinals sales coincides with Bitcoin's own rise, nearing its all-time high.

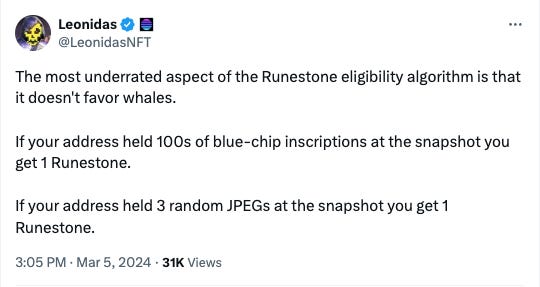

Massive Airdrop Incoming.

Bitcoin NFT airdrop called Runestone is about to hit the scene.

The Bitcoin ordinals project spearheaded by Leonidas will airdrop Runestone inscriptions.

It's a reward for early believers in the Ordinals movement, those who jumped in when the space was still young.

Here's the lowdown

112,383 wallets will receive Runestone inscriptions, a special type of Bitcoin NFT.

You had to be an early Ordinals adopter with at least 3 inscriptions (excluding specific file types) to qualify.

The airdrop celebrates the decentralised spirit of Bitcoin, and the Runestone art is even freely remixable under a Creative Commons license.

Tether joins $100 Billion club

Tether's USDT stablecoin, despite past controversies, has hit $100 billion market cap.

Key Points:

First time ever: USDT reaches a record $100 billion market cap.

Liquidity boost: Increased demand for crypto trading drives USDT growth.

Dominating the market: USDT holds over 70% of the $140 billion stablecoin market share.

Profiting from the boom: Tether reports significant profits from rising interest rates on its U.S. Treasury holdings.

This surge comes despite past criticism of Tether's reserve management practices and lack of independent audits.

Tether has also launched a recovery tool to migrate its USDT stablecoin between different blockchains.

The Surfer 🏄

Taiwan's financial regulator is exploring the possibility of a special act to regulate the cryptocurrency industry.

Deutsche Börse Group has launched a crypto trading platform for institutional clients.

Virginia Senate passes bill to create a workgroup dedicated to studying cryptocurrencies and blockchain technology.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋