Crypto on steroids 💉

Bitcoin and Ethereum lead the crypto charge. Meta engineers pocket big bucks. US banks lose money on mortgages they financed. US economy is at risk of shrinking. Americans skeptical of crypto?

Hello, y'all. We like history. You all like Bitcoin. Happy days. We know👇

This is The Token Dispatch; show us some love on telegram 🤟

Bitcoin wants to make everything better for the world.

The largest cryptocurrency blasts off to $30,000, igniting a frenzy in the digital asset market.

Let’s breakdown all the ripple effects.

Bitcoin's Performance

Bitcoin is up over 7% in the last 24 hours, trading for $30,327.

It has seen a 9% increase in the past seven days, reaching levels last seen on June 9 of the previous year, almost 10 months ago.

Effect on other Cryptocurrencies

Ethereum, the second largest digital asset, has also experienced a 4.3% increase in the last 24 hours, trading for $1,933.

Dogecoin, amidst the recent drama on Twitter, has also gained attention.

On crypto firms

Coinbase has reversed some of its recent losses, rising 7.6% in value.

Galaxy Digital saw a nearly 6% increase, recovering from its losses last week.

Cryptocurrency mining companies, including Riot Blockchain and Marathon Digital, have made double-digit gains after a decline in value earlier in April.

MicroStrategy $4.17 billion Bitcoin investment turns profitable as price surpasses $30,000. The hold 140,000 BTC in its reserves (great timing!).

Even Bank of America and Fidelity are showing continued interest in indirect bitcoin exposure, holding significant numbers of MicroStrategy shares on their balance sheets in the first quarter.

The BTC movement

Over 1 out of every 2 bitcoins in circulation hasn't moved in the last 2 years, hitting a new all-time high of 53% as per the data from Glassnode.

And believe it or not

29% of all Bitcoins in circulation haven't moved in the last 5 years

Just under 15% haven't moved in a decade.

More than 50% haven't moved in the last 2 years.

Ethereum's big day

The countdown has begun - Shanghai + Capella = Shapella 👽

The upgrade is causing tension within the community, with some developers and miners opposing the changes. It aims to improve the network's scalability and reduce transaction fees, but it requires a change in the mining algorithm, which could lead to a split in the network.

This split could result in a "war" between the two factions, with each side vying for dominance. The conflict could have significant implications for the future of Ethereum and the wider cryptocurrency industry.

Why not sponsor us, eh?

Meta engineers still pocket big bucks

Meta paid virtual reality (VR) developers salaries of up to $1 Million.

What? Yes.

This hasn't gone down too well. Why?

Cut down around 21,000 workers since November 2022.

Reality Labs division reported $13.7 billion in operating losses in 2022.

Metaverse project questioned over feasibility and impact on the society.

Hit with multiple lawsuits and regulatory scrutiny, leading stock crash.

But then, talent don't come cheap.

The company continues to invest heavily in the development of the metaverse, with engineers playing a crucial role in its success. The high salaries are said to be a result of intense competition for talent in the tech industry, as well as the ambitious nature of the project.

TTD Check it out 🧐

Etherscan has started hiding zero-value token transfers to deter address-poisoning attacks. Address poisoning is used by hackers to trick users into sending funds to a malicious address by making it appear as a legitimate one.

By hiding zero-value transfers, Etherscan hopes to make it harder for hackers to identify which addresses are active and which ones are not. The Ethereum community is all praise for the steps to improve the security on the platform.

TTD Number picker 🔢

46%

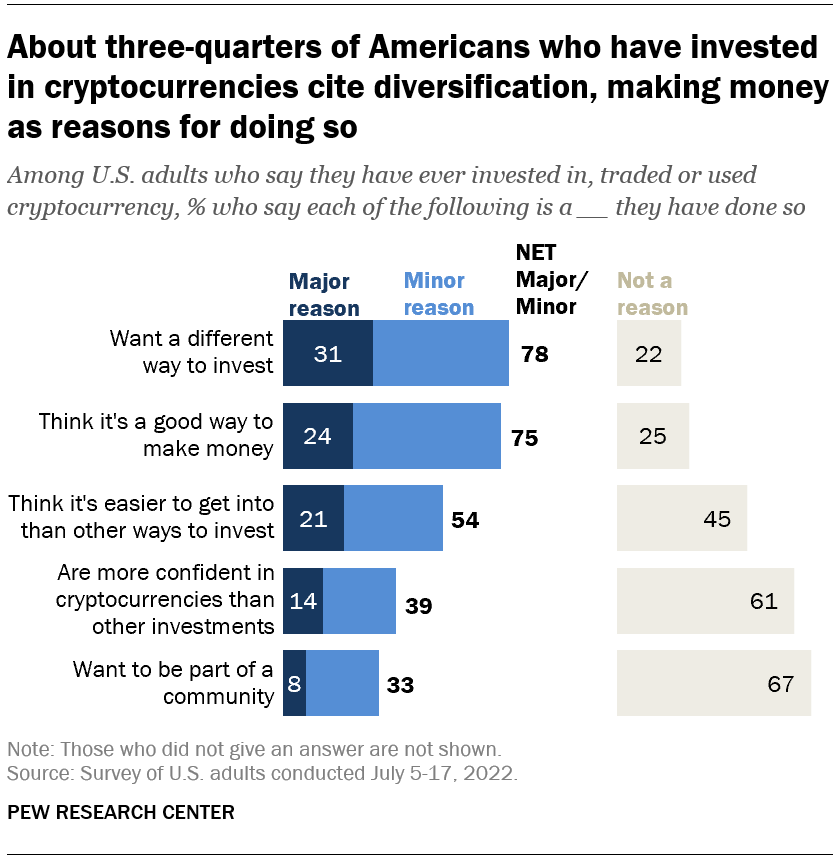

Americans invested in cryptocurrency say it’s done worse than expected.

A Pew Research Center survey finds that despite the growing popularity of cryptocurrencies, Americans remain skeptical of their safety and reliability.

TTD The troubled 😵💫

US banks have lost money on mortgages they financed.

For the first time in the history.

Why? Economic impact of the COVID-19 pandemic.

The financial strain on the economy has caused a surge in mortgage delinquencies and defaults.

Banks have had to set aside billions of dollars to cover potential losses, and some have reported significant declines in profits. The situation has led to increased scrutiny of the banking industry and calls for greater regulation to prevent similar crises in the future.

US economy is at risk of shrinking - Bank of America

12% decline in GDP in Q2.

Why? Economic impact of the COVID-19 pandemic.

The bank's economists predict a 12% decline in GDP in Q2, followed by a rebound in the second half of the year.

The warning comes as the US unemployment rate has surged to 14.7%, the highest level since the Great Depression.

Binance US has been turned down by several banks

Why? Over concerns about regulatory compliance and money laundering.

Without a banking partner they can't accept customers' cash deposits. They have been operating without a banking partner since its launch in September 2019, relying on third-party payment processors to handle deposits and withdrawals.

TTD Cool stuff 😎

A new documentary film called "The Dogumentary" will chronicle the rise of the "Doge" meme, which inspired the creation of the Dogecoin cryptocurrency.

Know more about it

Kabosu, Shiba Inu mascot of Doge meme, a $11.6 Billion cryptocurrency.

It has inspired a life philosophy, a holy pilgrimage and now a documentary.

Funded to date by PleasrDAO and Own the Doge community members.

Produced and directed by Jon Lynn and New Revolution Media.

The film will explore the origins of the meme, its cultural impact, and the community that has formed around it. It will also feature interviews with key figures in the Dogecoin community, including co-founder Billy Markus and Dogecoin Foundation board member Shibetoshi Nakamoto.

The film is being produced by the same team behind the documentary "The Rise and Rise of Bitcoin" and is set to be released in 2022.

The Doge makes it to the big screen. Next stop? Moon?

TTD Surfer 🏄

Cardano whales have accumulated $218 Million ADA tokens in the last couple of weeks. The demand has been attributed to the Alonzo upgrade.

CleanSpark buys $144.9 Million of Bitcoin mining rigs from Bitmain, to double its total operational mining capacity by the end of the year.

A new proposal wants the Arbitrum Foundation to return 700 Million ARB tokens after community backlash. Voting ends on April 14.

Proof launches Moonbirds: Diamond Exhibition. 10,000-piece collection, exclusively to holders with Diamond Nest status for staking NFTs.

Tyler and Cameron Winklevoss lend $100 Million to Gemini crypto exchange to support the business through the market downturn.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us some love on Twitter & Instagram🤞

So long. OKAY? ✋