Crypto Report Card 🗂️

Look at crypto’s performance halfway through 2024. Drunken sailor spending to fuel Bitcoin? US, German governments competing in selling Bitcoin? Ethereum ETFs in window dressing stage. $3.2B VC fund.

Hello, y'all. Is it we you looking for? ♪

Do try the Music Quiz Game 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

How is 2024 treating crypto so far?

Bitcoin soared.

Bitcoin took a breather.

Memecoins had the time of their lives.

Ethereum survived SEC.

A very happening H1

Bitcoin

Reached a new peak of $73,768 in March.

Pulling back around 15% from that high.

Bitcoin's dominance: Over half (55%) of the entire crypto market value.

Ethereum

Ethereum's price surged 51% in the first half of 2024.

Posted an impressive performance in Q1 2024, with revenue soaring to $1.2 billion, a 155% year-over-year increase.

US crypto ETFs attract investors

Spot Bitcoin ETFs launched in January and have seen $14.5 billion inflows.

Ethereum ETFs in US, approved, still waiting to be listed.

Applications for spot Solana ETFs were filed by VanEck and 21Shares.

Memecoins

Meme coins stole the show, Dogwifhat skyrocketed 1,300% in the first half of the year.

Pepe, the meme frog token, wasn't far behind with a near 800% surge.

Even established meme coins like Floki Inu and Shiba Inu outperformed Bitcoin with gains of 418% and 67% respectively.

Celebrity memes coins and political meme coins made big waves.

Read: Celebrity Memecoin Chaos 🙆♀️

Traditional finance embraces crypto

Growing interest from TradFi service providers like VanEck who are betting on a Trump win (potentially pro-crypto) for increased adoption.

M&A activity expected as TradFi seeks entry points into the crypto market (e.g., Robinhood-Bitstamp acquisition).

But, what happened on July 4?

Bitcoin took a detour.

Pulled the rest of the market with it too.

Look at the mess

Both Bitcoin and Ethereum are down 12% over the past month.

Liquidations? $300 million.

ETFs? Outflowing again.

Now, why the mess?

Three reasons why

1/Mt. Gox Ghost Returns: Remember the Mt. Gox exchange that went belly-up after a hack years ago? Yeah, they're planning to return $9 billion worth of Bitcoin to creditors. Everyone's worried this flood of crypto might sink the price.

We know this already: Manic Monday 🫨

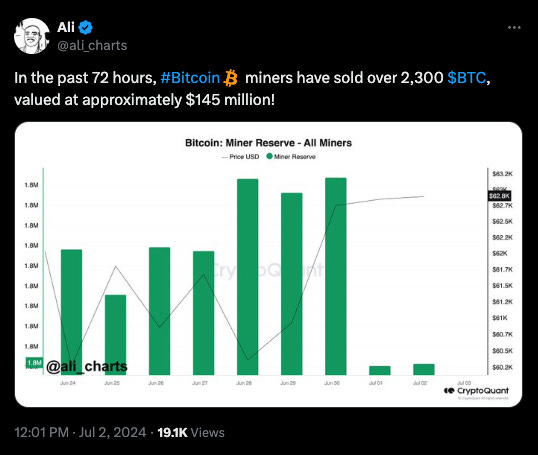

2/Miner Blues: Bitcoin miners, the folks who power the network, have been in less profit ever since the halving happened (cuts their rewards in half).

They've been selling off their Bitcoin reserves, which isn't exactly a vote of confidence.

3/Fed Put on Hold: The party pooper of the financial world, Jerome Powell, isn't budging on interest rates. This lack of free money is making investors a little grumpy.

Why are we still seeing bulls?

Historically, July has been a good month for Bitcoin, especially after a rough June. This suggests a potential price surge in the coming weeks.

Analyst predictions

Twitter co-founder Jack Dorsey believes Bitcoin will eventually replace the US dollar.

Standard Chartered predicts Bitcoin‘s price could hit a new all-time high in August

TradingShot believes Bitcoin will bounce back and reach $100,000.

Block That Quote 🎙️

Co-founder of BitMEX, Arthur Hayes.

“The only way to escape, assuming no capital controls are erected, is to buy a store of value outside of the system like Bitcoin”

Hayes points at the potential rise in US military spending due to conflicts in Ukraine and Israel.

He believes this will force citizens to finance war efforts, potentially through measures like directed bank lending or government bond purchases at below-market rates.

Read: Zoom Out

The US budget deficit is expected to increase 27% to $1.9 trillion next year.

"Drunken Sailor" spending to fuel Bitcoin?

Mike Novogratz, CEO of Galaxy Digital, argues that regardless of who wins the US election, government spending is unlikely to slow down. He believes this, coupled with rising war expenses, could propel Bitcoin's value.

The idea is that as the dollar weakens, Bitcoin strengthens as a store of value (there’s only 21 million in existence)

Read: What's Bitcoin Inflation? 🔑

Government Fire Sale

The US and Germany seem to be engaged in a bizarre competition.

Who can scare the Bitcoin market the most?

Over the past two weeks, government addresses linked to the US and Germany funnelled huge amounts in Bitcoin to exchanges.

We are talking $738 million.

Coinbase, Bitstamp, Kraken and even Flow Traders, the trader whisperer, got a piece of the action.

Germany takes the lead (and most of the blame)

Total: $496.4 million worth of Bitcoin in 30 transactions.

Average price: $63,400 per Bitcoin.

Currently holds 43,549 BTC (around $2.6 billion).

The US joins

Recent sale: 3,940 BTC ($241.2 million) to Coinbase Prime.

Now sells seized Bitcoin directly on Coinbase, unlike past auctions.

While Germany's fire sale is a new development, the US seems to be a seasoned pro at this game. They've likely been offloading seized crypto (not just Bitcoin, but Ethereum too) since November 2020.

Big Loss.

Sold ~15,903 BTC since 2020 (average price: $37,000).

Could be worth $958.7 million today, a potential loss of $370 million.

US government sells other seized crypto:

Sold $49.1 million in ETH since 2020 (average price: $452).

Could be worth $358 million today, a potential loss of $310 million.

But, US still holds crypto:

Approximately $13.3 billion worth of Bitcoin (mostly).

$300 million combined in Ether and Tether.

Did the government tank the market? It's hard to say for sure if these government fire sales are to blame for the recent Bitcoin blues.

But guess what? There is a knight to save the day 👇

In The Numbers 🔢

$3.2 billion

Q2 Venture capital investment in crypto companies - Galaxy report.

A 28% increase from Q1.

Median pre-money valuation jumped 94% to $37 million, near an all-time high.

Web3 projects captured the most investment ($758 million) followed by infrastructure and trading/exchanges.

Farcaster secured the largest funding round ($150 million) in this category.

Bitcoin Layer 2 networks saw a 174% increase in investment to $94.6 million.

US companies received 53% of capital and 40% of deals.

A total of 577 crypto deals were recorded in Q2, with early-stage ventures receiving almost 80% of the funding.

Why the increase?

More competition is driving up valuations and potentially creating "fear of missing out" (FOMO) among investors.

Crypto price increases (Bitcoin & Ethereum up nearly 50% YTD) are also fuelling the interest.

Despite Bitcoin's rise, VC activity remains lower than 2021-2022 bull market highs.

Ethereum ETFs Are Coming Soon?

Three things to know today.

1/Bitwise Amends S-1 Registration

Asset manager Bitwise has updated its SEC filing to launch a spot Ether ETF.

The amended filing suggests a launch "as soon as practicable" after registration becomes effective.

A June 15 approval?

2/‘Window dressing’ phase

Galaxy Digital's Steve Kurz expects Ether ETFs to be approved in weeks, not days.

He believes the SEC is in the final stages of review ("window dressing").

“We’ve been doing this for months now, we did it with the Bitcoin ETF, the products are substantially similar — we know the plumbing, we know the process.”

3/Big Billions comin’

Up to $5 billion could flow into new Ethereum ETFs within the first six months, according to Gemini, a cryptocurrency exchange.

“Net inflows below 20% or $3 billion would be a disappointment, given spot BTC ETFs had $15 billion net inflows in approximately the first six months. Net inflows exceeding $5 billion, or one-third of those into spot BTC ETFs, would be a strong showing, while anything close to 50% or $7.5 billion would be a significant upside surprise.”

Meanwhile K33 Research predicts ETH’s price could even outperform Bitcoin.

The Surfer 🏄

Mt Gox wallets associated with the collapsed exchange made small bitcoin transactions. One of the transactions sent a small amount of funds to Bitbank, an exchange designated for making repayments to creditors.

Dormant Bitcoin address containing $6.8 million in BTC wakes up after 12 years. Last transaction from the address was in 2012, when the balance was worth $600.

South Korean crypto exchanges have set guidelines to prevent mass delistings ahead of upcoming legislation. Guidelines aim to standardise criteria for supporting and terminating digital asset trading on exchange platforms.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋