Crypto - This time for Africa 🌍

The crypto story playing out in Africa. Institutional investors positive about crypto over the next year? $20M crypto donations for Russian military groups. Vitalik Buterin feels 'bad' for Solana.

Hello, y'all. Unveiling tech icons' spirit animals in #nft style👇

🦅 #elonmusk: Eagle

🦉 #billgates: Owl

🦊 #markzuckerberg : Fox

🐆 #jeffbezos : Jaguar

🐺 #samaltman: Wolf

🦁 #stevejobs: Lion

Give your books a »» Muzify «« spin? That's what we do dispatching #fyi

This is The Token Dispatch, you can hit us on telegram 🤟

While crypto may sometimes feel like a wild casino in the West, in Africa, it's a whole different story. Bitcoin can actually save Africa.

How is this happening?

Financial Inclusion: Crypto has the potential to bring financial services to millions of unbanked and underbanked individuals in Africa. With traditional banking systems often inaccessible or unreliable, crypto offers a decentralised and inclusive alternative.

Protection Against Inflation: Africa has faced significant challenges with high inflation rates in many countries. Crypto provides a hedge against inflation by offering a store of value that is not tied to any specific national currency.

Combatting Corruption: Corruption has long been a concern in many African nations, hindering development and eroding trust in traditional financial systems. Crypto, built on transparent blockchain technology, offers a potential solution. It can reduce corruption, increase accountability, and restore trust in financial transactions.

Cross-Border Transactions: Africa has a vibrant network of cross-border trade and remittances. However, traditional methods of transferring money across borders can be costly, slow, and prone to intermediaries taking a cut. Crypto facilitates faster and more cost-effective cross-border transactions, enabling individuals and businesses to engage in international trade and remittances with greater efficiency and reduced fees.

Access to Investment and Capital: Crypto presents Africans with new avenues for accessing investment and capital. Through initial coin offerings (ICOs) and tokenisation, startups and entrepreneurs can raise funds for innovative projects. Additionally, crypto offers opportunities for micro-investments, allowing individuals with limited resources to participate in global markets and investment opportunities. This democratisation of capital can fuel entrepreneurship, job creation, and economic development in Africa.

Numbers don't lie

According to a global survey, 47% of Nigerians own or use digital currencies daily, making Nigeria one of the countries with the highest cryptocurrency adoption.

According to a study by Kasi Insights

66% of surveyed African residents claim to have been exposed to digital assets like Bitcoin, but only 8% admit to being crypto holders.

Crypto adoption is more significant in poorer African countries than wealthier countries like Kenya and South Africa.

Countries like Namibia and Angola have higher adoption, awareness, and usage of crypto than Kenya and South Africa, challenging the perception of leading crypto countries in Africa.

Millennials make up the majority (60%) of African crypto investors, while the baby boomer generation represents just 1%.

Men account for 54% of African crypto investors.

Reasons for investing in digital assets include the desire to make money quickly (33%), portfolio diversification (28%), and not wanting to miss out on the opportunity (17%).

Block, led by Jack Dorsey, teamed up with Yellow Card to make cross-border payments in Africa a breeze. And guess what? The number of crypto users in Africa exploded by a whopping 2,500% in 2021. This massive interest led to an 11-fold increase in venture capital funding in 2022. Investors are seeing the potential, and they want a piece of the action.

What do the execs say?

Now some execs in the crypto world agrees that blockchain technology is solving real-world problems over there.

Chris Maurice, founder and CEO of Yellow Card (African crypto exchange):

"Crypto solves real-world problems with banking and currencies on the continent, and it isn't the casino that it can feel like sometimes in the West."

He says crypto in Africa "is growing at the speed of light" and allows them to escape from the traditional financial system's failures.

Maurice believes that Africa lives closer to the original mission of crypto technology than any other part of the world.

Kevin Imani, the founder and CEO of Sankore 2.0

Kevin is a big believer in the power of blockchain-based payments. He sees it as a game-changer for human rights, especially in underdeveloped nations.

"It's important to recognise the human rights protections that it provides to people in underdeveloped nations. In many developing countries, hyperinflationary pressure and corruption have left citizens with few options."

Brandon Quittem the Head of Marketing for Swan

“Before bitcoin, there was no incentive to provide electricity for rural Africa.”

Okoye Kevin Chibuoyim, the CEO of GIDA (crypto education platform):

"I personally see Crypto as Africa's next shot at life, another opportunity to be part of something great, as opposed to the internet revolution of the 2000s, when most Africans weren't as exposed as today."

Anita Posch, fonder of Bitcoin for Fairness

Legal and Regulatory Landscape

While crypto adoption thrives in many African nations, some countries still struggle with legal and regulatory clarity. Maurice identifies Nigeria as a frontrunner in crypto adoption, with reports suggesting that 47% of Nigerians own or transact with crypto daily. On the other hand, countries like Cameroon, Central African Republic, Gabon, Guyana, Lesotho, Libya, and Zimbabwe have taken a more restrictive stance, deeming cryptocurrencies illegal.

TTD Inadequate 😡

The US Securities and Exchange Commission (SEC) has deemed the recent wave of spot Bitcoin exchange-traded fund (ETF) applications inadequate.

The SEC reportedly stated that the applications lack clarity regarding the management of a "surveillance-sharing agreement" meant to deter fraud and manipulation.

The SEC's reluctance to approve a spot Bitcoin ETF stems from concerns about price manipulation in the Bitcoin market. Investors are interested in Bitcoin ETFs as they provide access to Bitcoin without the need to handle custody of the asset.

Major asset managers like BlackRock, Fidelity, Invesco, Wisdom Tree, Valkyrie, and Bitwise have submitted applications for Bitcoin ETFs this month.

Despite the SEC's stance on spot Bitcoin ETFs, it recently approved the first leveraged Bitcoin futures ETF called Volatility Shares 2x Bitcoin Strategy ETF.

No turning back here

Cboe has resubmitted five spot Bitcoin ETF proposals to the SEC after the agency requested more information. The filings include Coinbase in the surveillance-sharing agreement. The SEC had expressed concerns about inadequate details, particularly regarding surveillance sharing with Bitcoin exchanges. The refilling follow BlackRock's filing and Fidelity's recent application. The filings emphasise surveillance-sharing agreements in hopes of SEC approval for a spot Bitcoin ETF.

TTD Blockquote 🔊

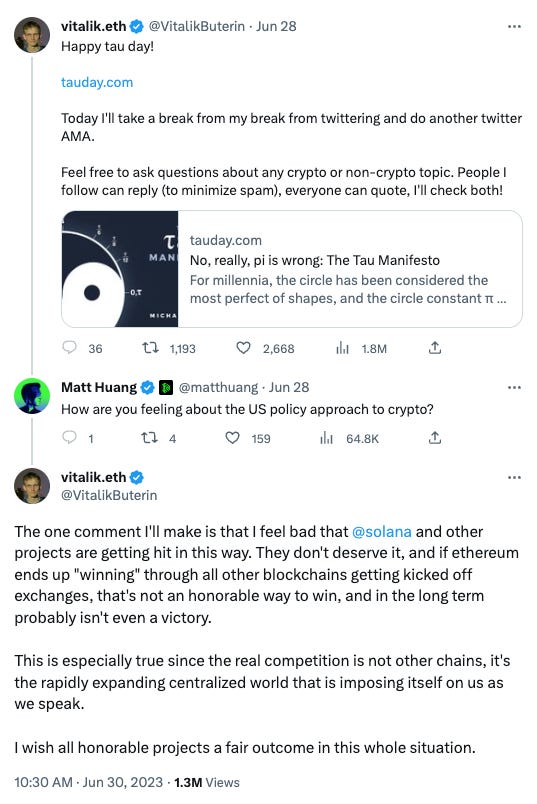

Vitalik Buterin »»» ETHEREUM

“They don’t deserve it, and if Ethereum ends up ‘winning’ through all other blockchains getting kicked off exchanges, that’s not an honourable way to win, and in the long term probably isn’t even a victory.”

What a gem of a man. Nothing to add.

TTD Numbers 🔢

63.5%

The percentage of investors who have a positive outlook for crypto assets over next 12 months, as per the Binance - Institutional Crypto Outlook Survey.

The survey was conducted among 208 Binance institutional clients and VIP users. It highlighted that the regulatory clarity and institutional involvement would be the key drivers of adoption.

What else does the survey say

88% of institutional respondents positive about crypto for the next decade.

Only 26.9% believe real-world use cases will drive adoption.

47.1% maintained crypto allocation, 35.6% increased in the past year.

50% plan to increase crypto allocation, only 4.3% plan to reduce in next 12 months.

Common use cases: intraday strategies (44.7%) and market-making/arbitrage activities (23.1%).

Majority managed under $25 Million.

22.6% had over $100 Million in crypto.

Portfolio diversification motivates funds with AUM above $75 million.

TTD Donation 🇷🇺

Russia's getting its fair share of crypto love, and we're not talking about a meagre amount here. According to the ever-watchful folks at Elliptic, Pro-Russian military groups have been showered with $20 Million in crypto donations.

It's like a dystopian charity gala, with nearly two-thirds of these digital raindrops falling into the pockets of entities that Uncle Sam isn't too fond of.

Key takeaways

Pro-Russian military procurement and disinformation groups have raised approximately $4.2 Million in crypto donations.

Half of these funds involve entities sanctioned by the United States, suggesting continued risks to virtual asset services.

Among these sanctioned entities are groups like the US-sanctioned "Task Force Rusich" group of PMC Wagner mercenaries, who use crypto for fundraising and as incentives.

Entities raising funds to finance the war have raised over $10.6 Million in crypto assets.

Numerous groups and individuals have been sanctioned by other jurisdictions or operate in the Russian-annexed regions of Ukraine.

Some groups claiming to be purely "humanitarian" in nature have shown exposure to sanctioned individuals, raising crypto for civilian aid in the Russian-occupied regions.

Over 80% of funds originating from these entities end up in exchanges, emphasising significant sanctions exposure risks.

Sanctioned pro-Russian entities have engaged with decentralised finance (DeFi) protocols, including decentralised exchanges, cross-chain bridges, and non-fungible token (NFT) services.

Speaking of Bitcoin, it's clearly the belle of the ball, holding the crown as the digital asset of choice for most Russian donations. Ether and DeFi protocols are being given the cold shoulder at this gathering!

Now, here's the kicker: Elliptic found over 80% of these funds ending up on exchanges. That's one slippery slope of sanction evasion risk if these exchanges don't pull up their compliance socks.

TTD Surfer 🏄

Cryptocurrency exchange OKX has expanded its partnership with English Premier League soccer club Manchester City. Signed a $70 Million sponsorship deal to become the team’s official sleeve sponsor.

KuCoin crypto exchange to introduce mandatory KYC in July will require new users to complete identity verification to access all services, while existing non-KYC users will not be able to deposit.

A federal court ordered crypto exchange Kraken to turn over account and transaction information to the IRS, to see if any of the exchange's users had underreported their taxes.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us some love on Twitter & Instagram🤞

So long. OKAY? ✋