Crypto’s Best September Yet? 🫵

Bitcoin records highest ever returns for September in the last decade. BlackRock beats sellers. Spot BTC ETFs record over $1B inflows. China's misunderstood hashrate dominance. Binance's CZ is free.

Hello, y'all. Enjoy long-form articles trusted by the best in Web3? Get them right in your inbox 👇

September is not known to be a crypto-friendly month.

Got many names for September.

September Slump, Sell-off September, Rektember, September Blues …

The month has historically recorded an average decline of 3.64% since 2013.

But this year has been an anomaly. A good one for crypto, though.

Easily. By a wide margin. And it is a big deal.

Bitcoin’s monthly returns for September 2024 stood at around 8%.

That is the highest ever any September has seen in more than a decade.

Bitcoin accounts for more than half of the overall $2.3 trillion crypto market cap.

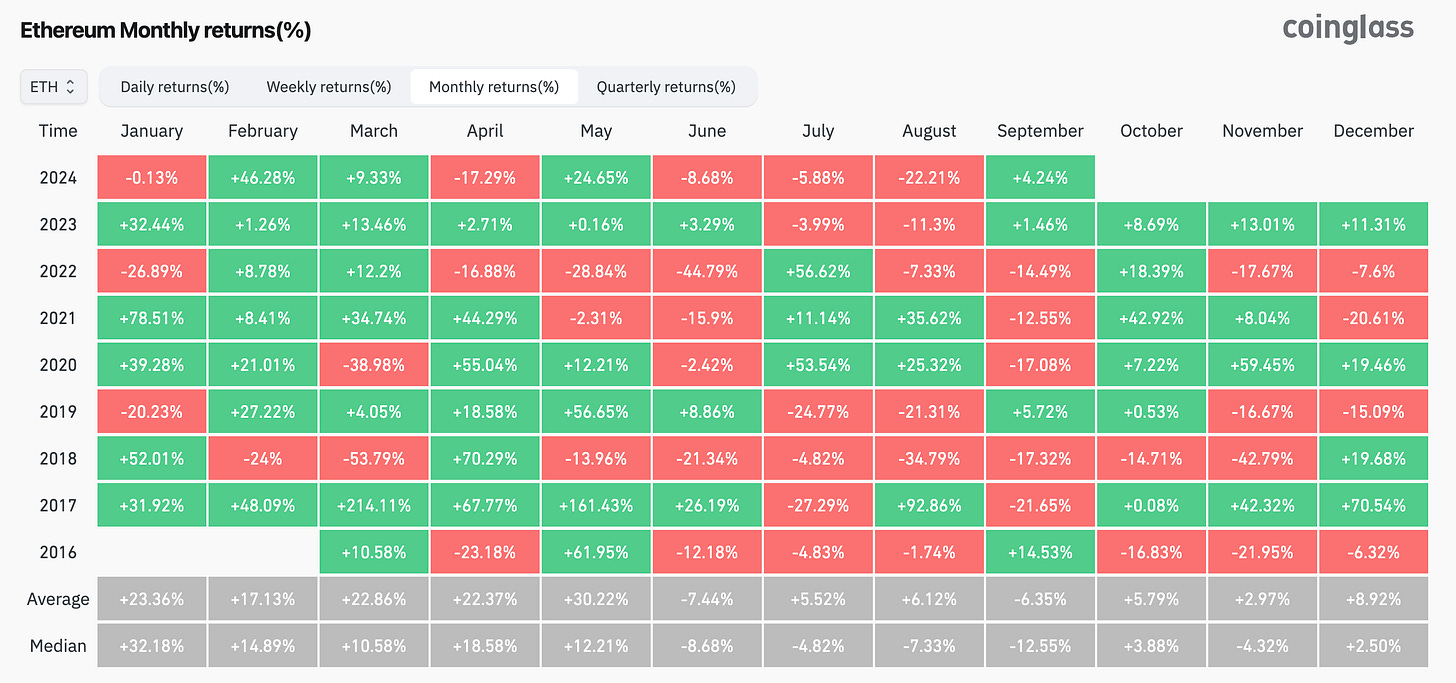

What about Ethereum?

Not as good as Bitcoin, but not too behind.

Around 4% monthly returns in September this year. Highest in half decade.

What about ETFs?

Green flags throughout.

How do we know? There could be little doubt if the world’s largest asset manager is betting on crypto in its historically weak month.

BlackRock was bullish through and through September.

So much that it bought more Bitcoin this week than any ETF has sold in the past 3 weeks.

Bitcoin spot ETFs attracted over $1 billion in net inflows in the past week, the highest since July.

US spot Ethereum ETFs have broken a six-week outflow streak. $84.5 million in net inflows last week.

Just two months after launch: BlackRock's ETHA fund hit $1 billion in assets under management, joining Grayscale's Ethereum Mini Trust in the billion-dollar club.

Crypto’s momentum in US even got China feel FOMO

Former Chinese Finance Minister Zhu Guangyao asked China to reevaluate its approach to digital assets, at a recent economic forum in Beijing.

He pointed out how Trump had been pushing for crypto policies in the US to prevent China to get away with an advantage in the space.

He also highlighted US ETFs and pushed China to adapt to global changes in the digital economy.

Unlock Web3 Insights by the Web3 Builders

A weekly podcast that takes you closer and deep into things that are shaping the world of crypto and Web3. Senior executives from 140+ enterprises trust them to keep them updated on what's going on in crypto.

Do tune in for depth, insight & numbers on how the internet is evolving.

Brought to you by Joel John, Saurabh Deshpande, Shlok Khemani and Siddharth.

The Puzzle of China’s Bitcoin Hashrate

China’s dominance in the crypto hashrate wars may have been misunderstood.

How? Last week, CryptoQuant CEO Ki Young Ju tweeted about Chinese mining pools dominating with 55% operations of the global network.

And that US pools manage 40%.

Ki Young Ju’s assertion overlooks one aspect of miner distribution.

What’s that? Prominent Bitcoin mining pools such as Antpool, F2pool, and MARA Pool are all headquartered in a certain country. But, the miners contributing to these pools are globally distributed.

Meaning? Mining pools headquartered in China may have miners from across the globe - some even based out of the US.

Similarly, the pools based out of the US also may have US-based miners that have joined mining pool operating in a different country.

Two US-based mining pools — MARA Pool and the USA Foundry Pool — mined 33.6% of all blocks in August 2024, showed a recent analysis from TheMinerMag.

But, the hashrate coming from these pools doesn’t reflect US-based miners that have joined a mining pool operating in a different country.

Plus, the opaque nature of Bitcoin mining makes global hashrate wars even more nuanced.

Attempting to locate the exact geographic breakdown of hashrate? Good luck with that.

Block That Quote 🎙️

Former Binance CEO Changpeng Zhao (just CZ, for those who don’t need his intro)

“gm, the food taste so good …”

The crypto billionaire posted this on X after serving his four-month sentence for failing to implement a strong anti-money laundering system at Binance.

He wants to focus his efforts (and money, of course) on long-term projects.

Think charity. Education. Blockchain. Decentralised technologies. AI and biotech.

World's richest inmate is out.

He was released on September 27, 2024, after a four-month prison sentence for anti-money laundering violations.

He pleaded guilty in November 2023, a $50 million personal fine and a $4.3 billion settlement for Binance.

In The Numbers 🔢

$1.2 Billion

Third consecutive week of inflows for digital asset investment products - Coinshares report.

Total assets under management (AuM) increased by 6.2% last week.

Bitcoin performance: Saw inflows of $1 billion. Short-bitcoin investment products experienced inflows of $8.8 million.

Ethereum recovery: Broke its five-week negative streak with inflows of $87 million, marking its first measurable inflow since early August.

Regional disparities

United States: Significant inflows of $1.2 billion

Switzerland: Inflows of $84 million, the largest since mid-2022

Germany: Outflows of $21 million

Brazil: Outflows of $3 million

Crypto Mining Rig Sales Are Securities?

The US Securities and Exchange Commission (SEC) thinks so. Or do they?

The case between SEC and crypto firm Green United has thrown in questions about the regulatory status of cryptocurrency mining hardware.

A federal judge denied a crypto firm's request last week to dismiss an SEC complaint alleging that the sale of its mining hardware to customers constituted an investment contract.

The SEC filed a lawsuit in March 2023 accusing Green United of defrauding investors of approximately $18 million by selling ineffective mining equipment.

Through the sale of "Green Boxes." These devices allegedly failed to mine digital tokens called GREEN as promised.

The SEC claims that the Ethereum-based GREEN tokens couldn't actually be mined, and that Green United deposited tokens into investors' accounts to create the illusion of a successful mining operation.

It claims the products were misrepresented as legitimate investment contracts rather than actual mining tools.

Is the SEC right in suing the company? It most probably is.

Ishmael Green, a partner at Diaz Reus law firm, clarified that typical mining hardware operations, where end users actively participate in mining, are not under scrutiny.

It could have implications for hosted mining services. The SEC's argument that Green United's hardware and software comprise a securities investment may affect how similar business models are regulated in the future.

The Surfer 🏄

A crypto whale lost over $32 million in a phishing attack after signing a malicious transaction involving 12,083 wrapped ether tokens (spWETH). The exploit utilised the Inferno Drainer scam-as-a-service, which has tricked over 200,000 users into signing over control of their wallets and stolen over $215 million, according to a Dune Analytics dashboard.

Mango Markets has settled charges with the SEC, agreeing to destroy its MNGO tokens and pay $700,000 in civil penalties without admitting wrongdoing. The SEC accused the platform of unregistered token offerings and acting as an unregistered broker, following allegations that it raised over $70 million from investors globally since August 2021.

Coinbase's Layer 2 solution, Base, has surpassed over $2 billion in total value locked (TVL), marking a 40% increase this month and a 370% year-to-date. DEX Aerodrome, with over $1 billion in deposits, and Uniswap with $220 million, have driven the platform's ascent since its launch just over a year ago.

The Crypto Fear & Greed Index has surged into "Greed" territory, scoring 64 on September 28, its highest since July, as Bitcoin briefly reached $66,000. The turnaround from August's low of 17, reflects a growing bullish sentiment in the market as Bitcoin gained around 11.18% over the past month.

Polymarket users are reporting wallet drain incidents after logging in via Google accounts, with attackers exploiting a "proxy" function to steal USDC balances. Affected users have had their funds sent to a known phishing account, while those using wallet extensions like MetaMask remain unharmed. Polymarket claims only a small number of users have been affected.

If you want to make a splash with us, check out partnership opportunities 🤟

Our sponsorship storefront on Passionfroot 🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋