Happy Sunday dispatchers!

The velvet rope has been lifted, and crypto's VIPs are strutting toward the entrance. After years of being told "you're not on the list," the bouncers at Wall Street's exclusive club are suddenly ushering in the digital asset elite.

A wave of crypto companies are now racing to go public. The queue outside the New York Stock Exchange is starting to look like a who's who of crypto royalty.

Circle has officially filed its S-1 this week. Kraken is reportedly raising $1 billion ahead of a 2026 IPO. Gemini just hired a new CFO as rumours swirl about its Wall Street ambitions. eToro has filed its paperwork. BitGo is eyeing a public debut as soon as Q2 this year.

The list goes on: Bullish, Ripple, Consensys and more all appear to be queuing up at the NYSE and Nasdaq gates, hats in hand.

But as they prepare to cross the threshold into the hallowed halls of public markets, a new gatekeeper has appeared: global economic uncertainty.

Special Deal for Traders: Big Funds, Bigger Profits!

Tired of trading small? What if you could trade with serious capital — without risking your own? That’s where Propexito comes in.

Here’s the deal

Pass the challenge & prove you’ve got the skills

Get funded and trade with Propexito’s capital

Keep up to 90% of your profits—because you earned it

TTD exclusive: 20% off your challenge with code TTD20

No more excuses. No more small trades. Just pure profit potential.

Grab your 20% discount & start trading with Propexito!

Why the Sudden Rush?

The timing of these moves isn't coincidental.

When Donald Trump won the presidency, crypto markets rallied in anticipation of a more favourable regulatory environment. Those hopes have largely materialised, with the SEC dropping enforcement actions against Kraken, Coinbase, and other crypto firms.

Read: Case Closed: SEC’s Crypto Cleanup🧹

SEC Chair Gary Gensler, whose "regulation by enforcement" approach was widely criticised in the industry, has been replaced with leadership more amenable to crypto's growth.

The political winds have shifted so dramatically that the White House hosted its first Crypto Summit in March, with Trump announcing plans for a strategic crypto reserve.

For companies that had shelved their public listing plans during the bear market and hostile regulatory environment, this shift represents an opportunity they can't afford to miss.

"The overall regulatory environment, worldwide, not just in the United States, has become a lot more favourable," Kraken's co-CEO Arjun Sethi told Axios in March.

10T Holdings CEO Dan Tapiero predicted at the Digital Asset Summit last month that we should expect "a crypto IPO, M&A, SPAC boom" in the coming months, noting that 10 or so of his firm's portfolio companies could potentially go public in the next few years.

Who’s in line?

Get 17% discount on our annual plans and access our weekly premium features (HashedIn, Wormhole, Rabbit hole and Mempool) and subscribers only posts. Also, show us some love on Twitter and Telegram.

Circle: The Stablecoin Giant

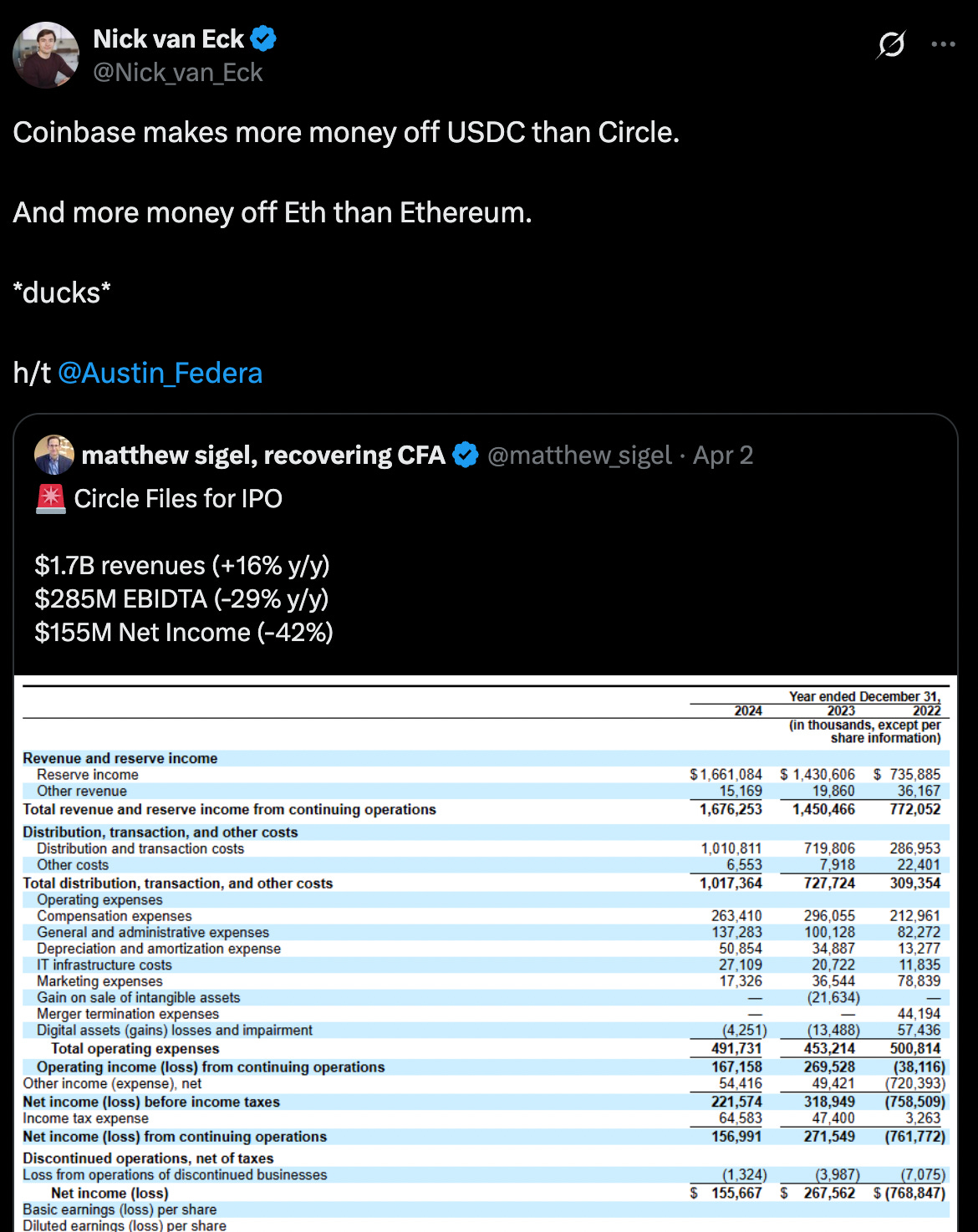

Circle filed its S-1 registration statement on April 1, planning to list on the NYSE under the ticker "CRCL." The filing revealed impressive financials: $1.67 billion in revenue for 2024, with over 99% coming from its stablecoin reserves.

Circle paid nearly $908 million last year to Coinbase, its main distribution partner, for circulating USDC on its exchange — meaning Coinbase is making more money from USDC than Circle itself.

Circle's previous attempt at going public valued it at $9 billion, but recent reports suggest it's now aiming for a more modest $4-5 billion valuation with JPMorgan Chase and Citi leading the underwriting.

However, The Wall Street Journal reported that Circle is now considering delaying its IPO amid macroeconomic uncertainty caused by President Trump's sweeping trade tariffs. The stablecoin issuer is "waiting anxiously" before taking further steps, joining companies like Klarna and StubHub in reconsidering their public offering timelines as markets react to fears of a potential trade war and global recession.

The stablecoin issuer's move to go public comes as USDC cements its position as the second-largest stablecoin with a market cap of $60.5 billion. Circle was also the first stablecoin issuer to receive regulatory approval in Japan in March 2025.

Kraken: The Exchange Powerhouse

Kraken appears to be following closely behind Circle in the IPO queue.

Bloomberg reported in March that the exchange is exploring a debt package of $200 million to $1 billion to support its growth ahead of a potential IPO in early 2026.

The exchange, which recorded over $1.5 billion in revenue in 2024 (a 128% increase from 2023), has been considering going public since at least 2021 but put those plans on ice during the crypto winter.

Kraken's fortunes dramatically improved when the SEC dropped its lawsuit against the exchange on March 3.

The company called the action "wasteful" and "politically motivated," noting that it had "clouded instead of clarified" the regulatory landscape.

Since then, Kraken has gone on the offensive, acquiring futures trading platform NinjaTrader for $1.5 billion in March — the largest-ever deal between crypto and traditional finance.

Read: The Curious Case of Kraken 🦑

"Traditional markets run on post-WWII, 1950s banking systems," said Kraken co-CEO Arjun Sethi. "This transaction is the first step in our vision of an institutional-grade trading platform where any asset can be traded, anytime."

Gemini: The Winklevoss Gambit

Gemini, run by the Winklevoss twins, is reportedly reviving IPO plans it first floated in 2021. In a significant move, the exchange appointed a new CFO, Dan Chen, in March — typically a sign that a company is preparing for a major financial event like an IPO.

"I'm looking forward to helping Gemini scale by driving financial strategy as the company enters its next phase of growth," Chen said in his announcement post.

Like many of its peers, Gemini has benefited from the improving regulatory environment, with the SEC recently closing its investigation into the exchange without pursuing enforcement action.

The twins were notably present at Trump's White House Crypto Summit in March, where Cameron Winklevoss expressed relief at the changing regulatory attitude: "We never thought that we'd get attacked the way we did in our backyard after trying to do the right thing for so many years."

eToro: The Retail Trading Platform

Trading platform eToro filed for an IPO in late March, revealing that a stunning 96% of its $12.6 billion in 2024 revenue came from crypto trading. The platform saw 23 million crypto trades during the fourth quarter of 2024 alone — up from 9 million the quarter before.

The company is looking to raise $300-400 million at a valuation around $4.5 billion, according to reports — substantially below the $10.4 billion valuation it sought in its abandoned 2021 SPAC deal.

Founded in 2007 by Yoni and Ronen Assia, eToro allows users to trade assets including stocks, crypto and commodities, and to copy other traders' portfolios. Its IPO filing follows a September 2024 settlement with the SEC, where it paid $1.5 million to resolve charges that it was operating as an unregistered broker.

BitGo: The Crypto Custodian

BitGo, the crypto custodian that provides services for wrapped Bitcoin, is reportedly mulling an IPO as soon as the second half of 2025. The company was valued at $1.75 billion in its last funding round in 2023, with backers including Goldman Sachs and DRW Holdings.

The Palo Alto-based company provides regulated crypto custody, lending and infrastructure services to US institutions. It's best known as the custodian for wrapped Bitcoin (wBTC), which has a market capitalisation of roughly $10 billion.

BitGo has been eyeing a public debut since 2021, when it almost merged with Galaxy Digital in a deal that would have valued it at $1.2 billion. That deal was terminated in August 2022 due to BitGo's "failure to deliver" audited financial statements, according to Galaxy.

Other Contenders in the Queue

Beyond these front-runners, several other major crypto firms are preparing for potential public listings:

Ripple: The crypto payments firm and XRP issuer may go public since it has finally concluded its long-running legal battle with the SEC. CEO Brad Garlinghouse had previously indicated that the company would consider an IPO after its legal issues are resolved.

Bullish: The crypto exchange that purchased DCG's ownership in CoinDesk is reportedly entertaining public listing strategies with Jefferies Financial Group and JPMorgan Chase. Bullish had previously announced plans to go public through a SPAC in 2021 but abandoned those plans.

Consensys: The Ethereum infrastructure company founded by Joseph Lubin might be eyeing an IPO, based on Lubin's cryptic response to a January tweet about going public. The company was valued at $7 billion in its last funding round in 2022.

Anchorage Digital, Figure, and Chainalysis: Asset manager Bitwise cited these three firms as likely IPO candidates in its "10 Predictions for 2025" report.

Not everyone in the crypto space is impressed by the IPO rush.

Tether CEO Paolo Ardoino took a thinly veiled swipe at Circle, declaring that "Tether doesn't need to go public" — a pointed comment clearly aimed at his stablecoin rival. Tether currently maintains approximately $148 billion in reserves (including 100,521 BTC, worth about $8.46 billion) to support its USDT tokens, significantly outpacing Circle's USDC.

Storm Clouds Over Wall Street

Just as crypto companies line up for their public market debuts, a new obstacle has emerged: Trump's sweeping tariffs.

On April 2, President Trump announced substantial tariffs on imports from virtually all trading partners, setting off a global market panic and wiping more than $2 trillion from US stock markets in a single day. The Volatility Index (VIX) — Wall Street's "fear gauge" — has surged upto 45, indicating extreme investor anxiety.

This turbulence couldn't come at a worse time for crypto's IPO aspirants. Circle is reportedly reconsidering its timeline, with The Wall Street Journal noting the company is "waiting anxiously" before proceeding further. The odds of Circle's IPO happening this year dropped from 96% to 71% on prediction market Polymarket following Trump's announcement.

Circle isn't alone in this predicament. Industry experts warn that launching an IPO during a collapsing market is unwise, drawing parallels to the 2008 financial crisis. Tech firms like Klarna have already shelved their IPO plans, and the outlook is potentially worse for crypto companies, which rarely go public.

Several factors are now working against crypto's IPO ambitions: dwindling investor appetite in an uncertain environment, interest rate concerns, reluctant underwriters, and increasingly cautious venture capital backers who may prefer their portfolio companies to wait for calmer markets.

The irony isn't lost on industry observers. The same administration that created a favourable regulatory environment for crypto may have inadvertently closed the IPO window with its trade policies — at least temporarily.

Token Dispatch View 🔍

Beyond the immediate financial benefits, these IPO attempts represent something else: a bid for legitimacy.

Crypto companies have long operated in a regulatory grey area, often viewed with suspicion by traditional financial institutions and regulators. Going public brings them under the oversight of securities regulators, subjects them to strict disclosure requirements, and forces them to operate with a level of transparency that the crypto industry has sometimes struggled to deliver.

Despite the enthusiasm, most crypto companies remain cautious about committing to specific timelines for going public.

"I think the way we think about it is that, if it's in service to our clients to going public, building that trust as a currency, then we'll think about doing it," Kraken's Sethi told Axios. "So we'll always be ready for it, but it may not be that we'll have it on a specific date."

This caution is warranted. The experience of Coinbase — which went public near the peak of the last bull market only to see its stock price crater in the subsequent downturn — serves as a cautionary tale.

There's also the question of valuation. eToro's anticipated $4.5 billion IPO valuation is less than half of what it sought in 2021. Circle is reportedly targeting a valuation of $4-5 billion, down from $9 billion in its abandoned SPAC deal.

These reductions reflect both the sobering effect of the crypto winter and more realistic expectations from public market investors who have now seen a full boom-and-bust cycle in the industry.

The industry has reached a scale where operating entirely outside the established financial system is no longer practical or desirable for many of its largest players.

Can these companies maintain their innovative edge while conforming to the quarterly cadence and disclosure requirements of public markets? Can Kraken continue its bold acquisition strategy when shareholders might prefer dividends? Can Circle keep pioneering new financial infrastructure when analysts are focused on next quarter's reserves income?

The answers to these questions will determine whether this IPO wave represents crypto's coming of age or the beginning of its assimilation.

Week That Was 📆

Saturday: The Great Altcoin Devastation 🪚

Thursday: How 'Liberation Day' May Bite Crypto? 🦂

Wednesday: Bybit, X2Y2 Join NFT Marketplace Exodus🖼️

Tuesday: Robinhood's Digital Asset Gambit 📈

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.