Hello,

We’ve seen plenty of big ideas rise and fall in crypto. Many teams have tried to carve out their share of Ethereum’s market by arguing that the base chain isn’t good enough - too expensive, too slow, not scalable, or too restrictive for developers. Recent examples include Plasma launching a separate stablecoin-focused Layer-1 (L1) and Monad pushing a high-throughput EVM L1.

But Ethereum has, over time, disproved these claims. The Merge upgrade did that by showing Ethereum could indeed transition to proof-of-stake, and Dencun debunked the idea that rollups — Layer-2 scaling solutions that help decongest Ethereum’s network — would always be too expensive to scale.

Ethereum launched its Fusaka upgrade on Thursday, challenging the narrative that it can’t meet high-throughput rollup demands, which is the very premise on which many modular chains were built.

In today’s story, we will explore what modular blockchains were about and what changes with Fusaka.

AI Agents that Trade, Predict, And Evolve, On-chain

DeAgentAI has built the largest AI Agent infra across Sui, BSC & BTC, solving what every AI developer struggles with: Identity, Continuity, and Consensus, the holy trinity for making AI actually autonomous.

Their flagship products?

AlphaX → A crypto prediction engine that hits 9/10 signals

CorrAI → A no-code quant playground for designing and deploying DeFi trading strategies

Truesights (launching soon) → InfoFi network that rewards real alpha, not just noise

Backed by top-tier VCs, and a team from Carnegie Mellon, UC Berkeley, and HKUST, they’re scaling what’s basically the “ByteDance of Web3.”

Except instead of serving you TikToks, their algorithms are training autonomous AI Agents.

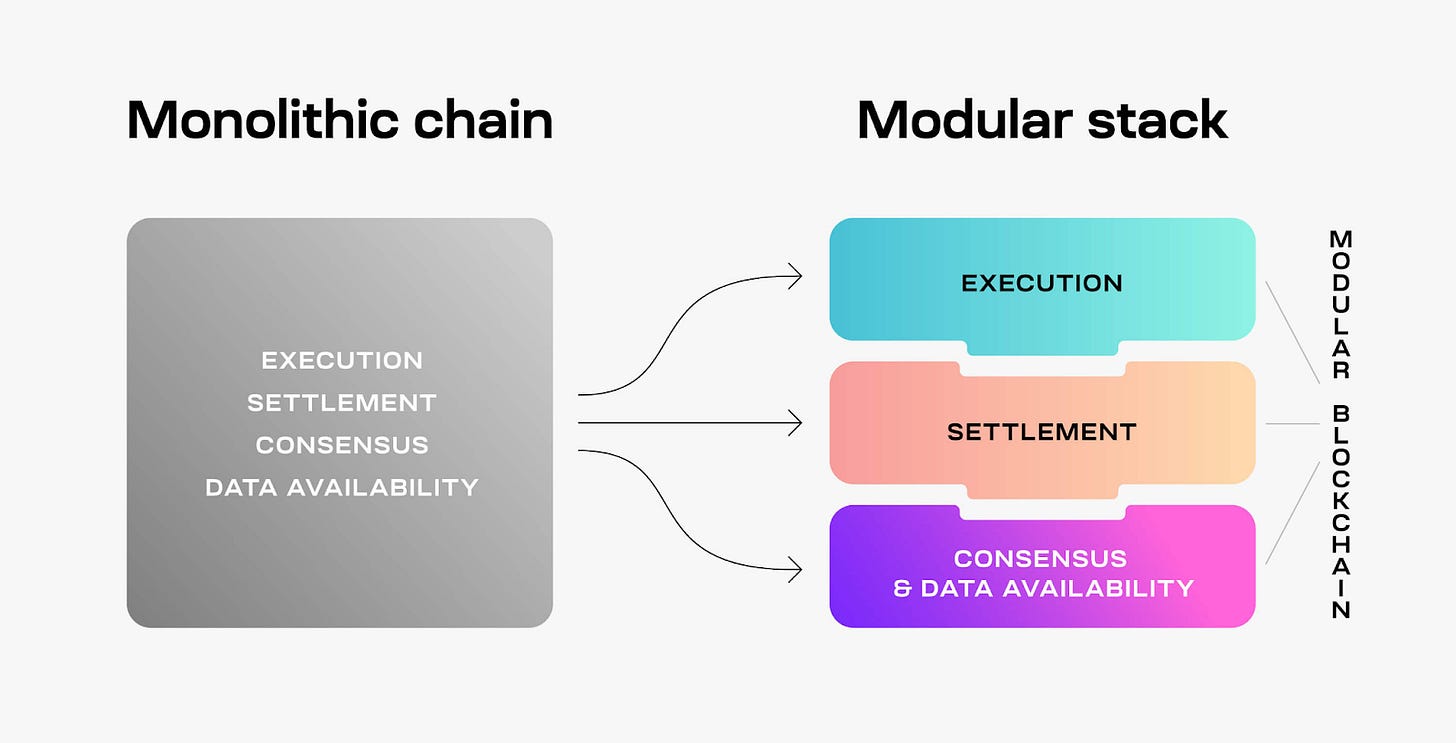

In late 2023, a team with strong knowledge of distributed systems introduced the concept of modular blockchains, the idea of building a blockchain with three modular components: execution, settlement, and data availability. That team was Celestia.

The Celestia network was designed to offer one of these pieces: Data Availability. DA is about proving that data was published to the network. So, when a chain produces new blocks, nodes verify DA by downloading all the data.

Celestia’s idea was to make it easier for anyone to launch a blockchain by drawing on parts of the puzzle from existing infrastructure companies. Projects could build their blockchains by choosing Arbitrum Orbit for execution, Ethereum for settlement and perhaps Celestia, EigenDA or Avail DA for their data availability needs.

Celestia initially bet that Ethereum’s low throughput and high gas costs in 2023 made it a poor fit for rollups with high-throughput DA requirements.

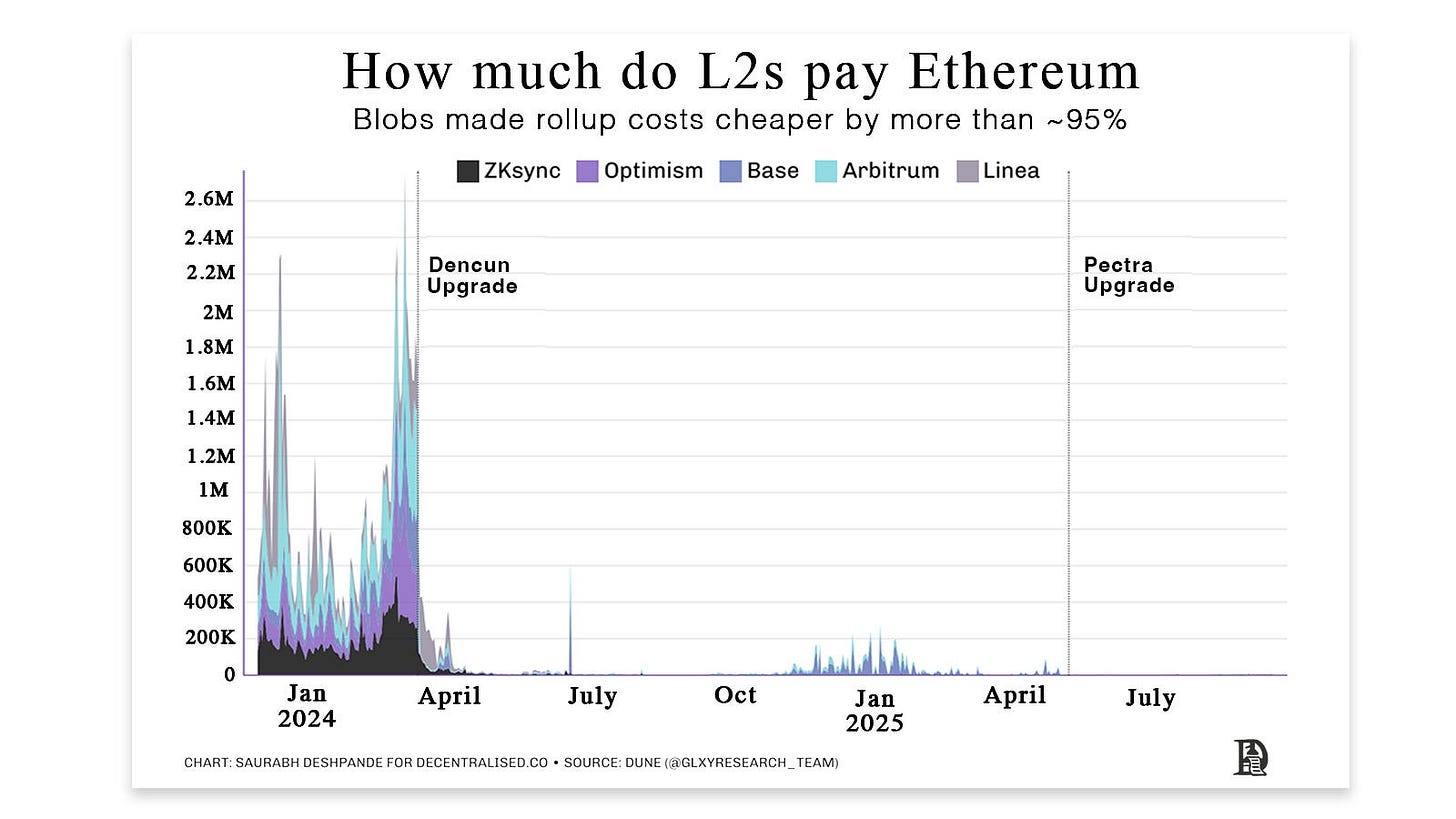

Profit margins for rollups were thin on Ethereum then. Teams often retained only about 20% of the fees they generated, and in some cases, they even paid more to settle than they earned from users. Dencun and Pectra shifted that equation, easing settlement costs and improving the economics for rollup operators.

The Dencun upgrade introduced a new space called blobs to store rollup data, replacing previously used “calldata”. Blobs are approximately 95% cheaper than calldata. The Dencun upgrade was the first step in making rollup costs more affordable.

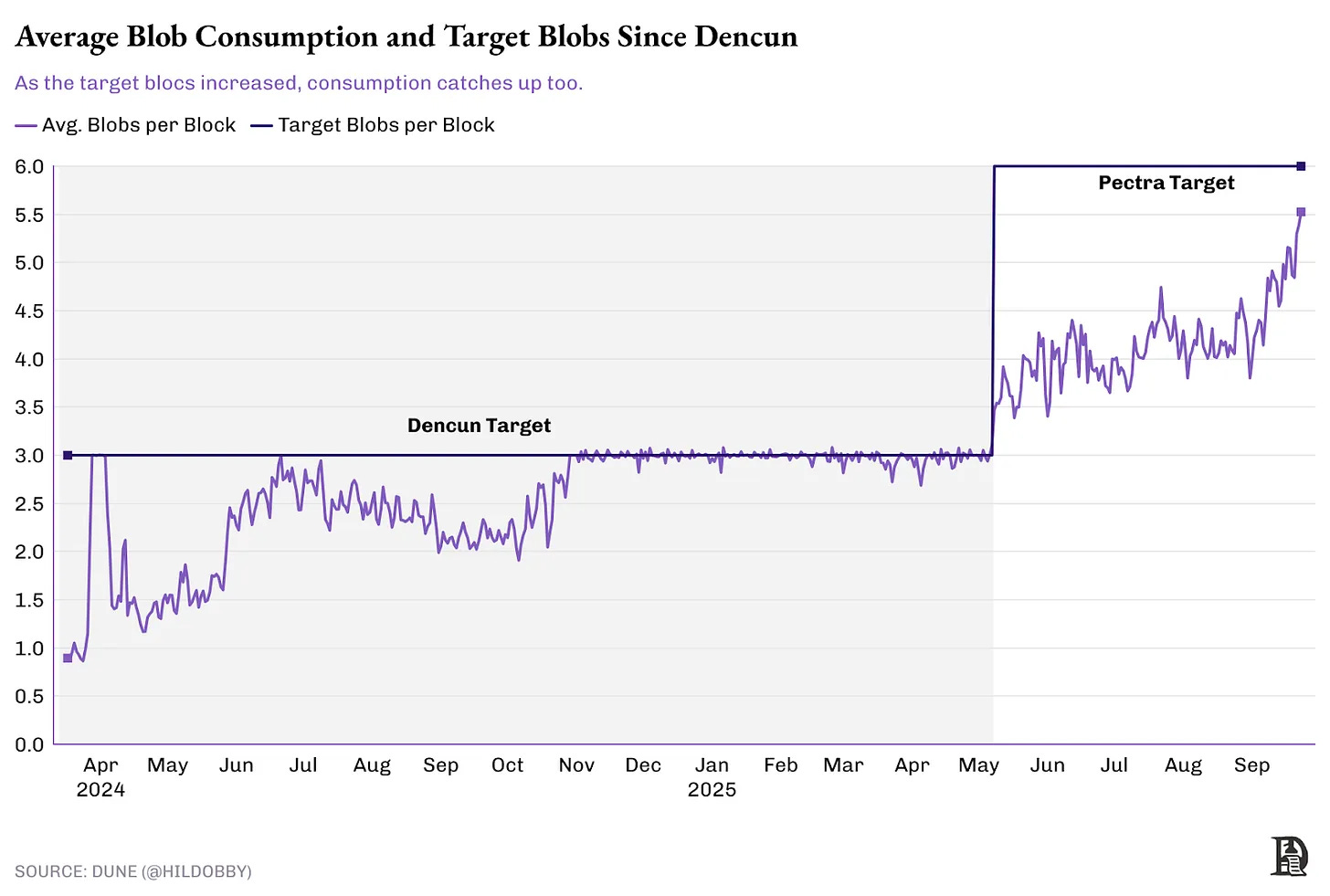

Then came Pectra. This upgrade increased the number of blobs per block. While the first step was to create a separate space for rollup data, the second was to increase its capacity. With Pectra, the target was raised to six blobs per block.

Rollups passed on the cost savings to users. The result was lower L2 transaction costs, down from 50 cents to about 3-4 cents.

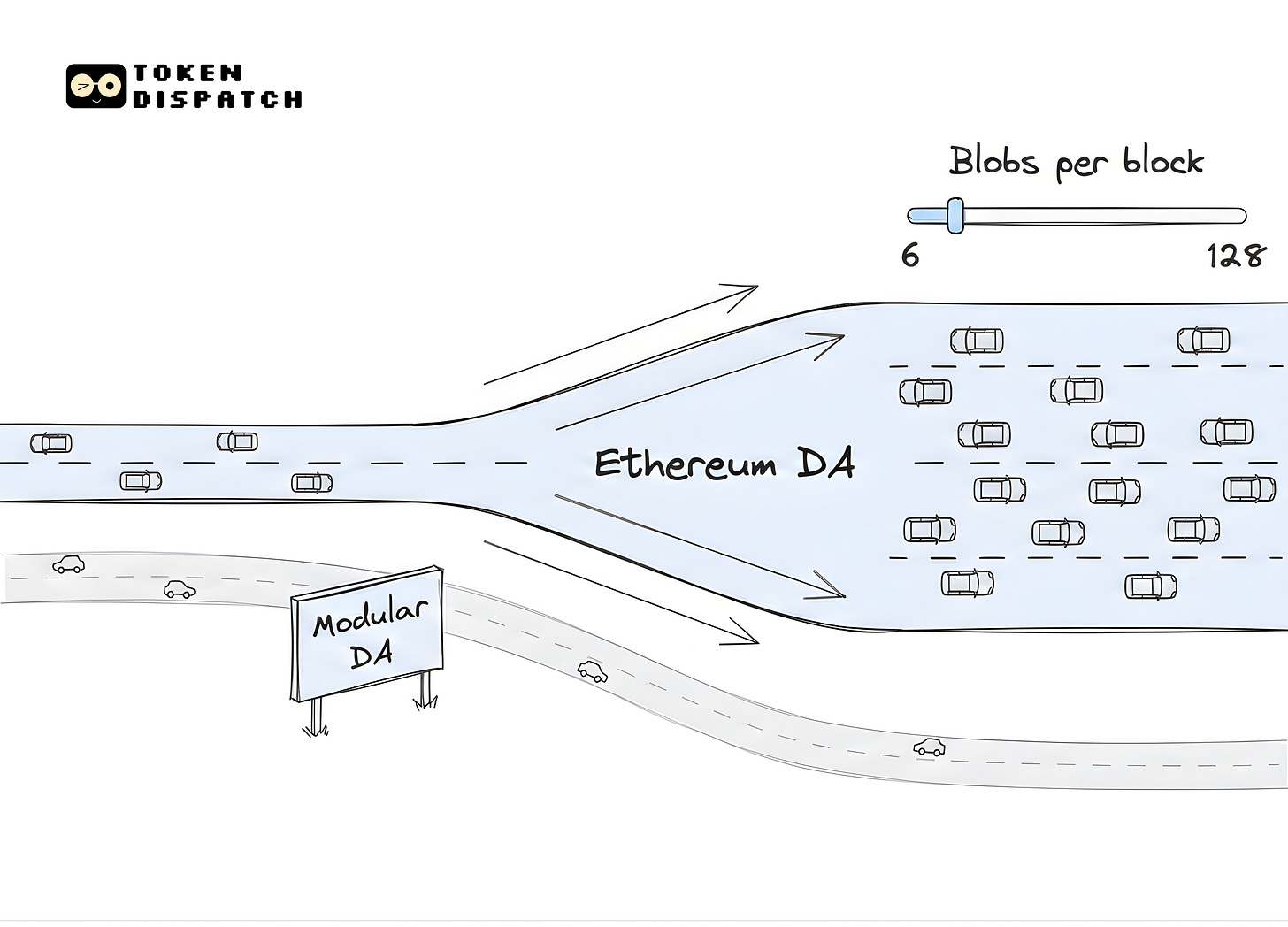

Celestia’s vision was to separate data availability from execution, enabling blockchains to scale easily by reducing the load on the underlying L1. It hopes to have a future with multiple rollups on top of a single DA layer.

While the vision of multiple rollups came true, that market was captured by Ethereum. The upgrades have benefited the chain by providing DA solutions for over 55 rollups and securing more than $40 billion in total value locked (TVL).

Meanwhile, the DA layers struggle with adoption today. Celestia has earned a daily fee of $67 in the last 24 hours and processed 1600 blobs, compared to 41,000 on Ethereum.

These numbers will look rookie to us soon.

With Ethereum’s most recent Fusaka upgrade, the chain has implemented PeerDAS, a new data-sampling approach that significantly enhances the efficiency of verifying data availability.

Each node checks small, random pieces and collectively ensures the network has complete data. With sampling, Ethereum has raised the capacity from today’s ~six‑blob target to roughly 10-15 blobs per block, along with a way to increase the amount of blobs per block over time without requiring a hard fork. Blob capacity will double after a month, and increase gradually over time from 10 per block -> 128 per block. All of this can happen without forcing home stakers (small validators) to upgrade their hardware.

Increased blockspace supply lowers blob prices and L2 operating costs, making it easier to sustain a profitable L2.

This takes me back to 2023, when DA chains such as Avail and Celestia would post comparison tables showing their throughput numbers against Ethereum’s EIP-4844 Denarius upgrade. The DA layer throughput numbers were too huge then, compared to Ethereum’s near future. However, with the Fusaka upgrade, Ethereum is set to reach a 128 blobs per block limit, which is roughly 16MB/block, double of what Celestia offers today.

Fusaka marks a significant milestone for Ethereum. The chain successfully scaled its transaction capacity without centralising the network by pricing out home stakers with high hardware requirements.

Fusaka is a celebration for the chain’s movement towards a rollup-centric future. From L2 transactions being priced at par with other transactions back in 2023 to PeerDAS blobs today, the network has come a long way.

Surprisingly, PeerDAS was only one of the 13 EIPs (Ethereum Improvement Proposal) implemented in the historic upgrade. Other than PeerDAS, Fusaka also includes a gas limit increase and introduces a blob base fee bounded by execution cost, ensuring blob fees can’t drop to zero. Thus, potentially increasing the validator payouts per blob.

Rollups now have a more predictable, scalable data layer, removing the constant fear of overwhelming the network during usage spikes. That stability gives teams room to focus on infrastructure upgrades: they can decentralise their sequencing, experiment with lower-latency designs, and push for smoother user experiences without worrying that DA costs will suddenly swing against them.

It’s worth noting, though, that blob capacity after Fusaka starts at 10 blobs per block and is only expected to double monthly through in-built network mechanics. How smoothly these monthly increases roll out will be a real test of PeerDAS in practice. The same goes for blob pricing. While the new price floor strengthens validator incentives, the impact on rollup UX isn’t yet fully known.

In the next couple of months, I’ll be looking at the interesting new second-order effects of Fusaka on the rollups and their user experience. I will come back once I have updates.

Until then, enjoy the holiday month,

Nishil

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

Excellent breakdown of how Fusaka undermines the original Celestia thesis on modular DA. Your observation that Ethereum went from expensive calldata to PeerDAS sampling in under two years really highlghts how quickly the base layer adapted to rollup demands. One nuance worth adding is that while blob capacity will evenutally reach 128 per block, the monthly doubling mechanism means we're looking at atleast 4-5 months before hitting those numbers, which gives Alt DA layers a narrow window to differentiate on latency or finality guarantees rather than pure throughput. The pricing dynamics you mentioned around the blob base fee floor are going to be critical for understanding whether rollups actually pass savings through or just pocket the margin.

Regarding the article, realy insightful on Ethereum. AI agent tech in crypto is truly next-level.