Day 1: Cryptic Silence🤫

Hello dispatchers!

The most anticipated inauguration in crypto history just happened.

The outcome? Not what anyone expected.

Today we go through:

The puzzling silence of crypto's biggest champion

A $15 billion memecoin that nearly broke Solana

World Liberty's massive crypto shopping spree

Three presidents united for Bitcoin's future

Upgrade to paid to get full access to our weekly premium features (Wormhole, Rabbit hole and Mempool) and subscribers only posts. 2025 New Year special limited time offer - 38% off on our annual subscription.

The most anticipated inauguration in crypto history triggered a tone-deaf silence in the industry.

Donald Trump, who campaigned as America's first "crypto President," delivered a 40-minute inaugural address that made no mention of digital assets.

Instead, the speech focused on immigration, declaring a national emergency at the southern border, and introducing his "External Revenue Service" proposal.

The omission was market-moving.

Bitcoin, which had surged to a new all-time high of $109,000 in anticipation of pro-crypto executive orders, dropped nearly 6% to $101,440 as traders processed the silence.

Trump's own memecoin dropped over 40% in 24 hours.

A Strange Silence

Trump's crypto silence was particularly bizarre given his recent history. Just days earlier, he had launched a coin.

His DeFi project, World Liberty Financial, had just completed a $300 million token sale.

And his own son Eric had been teasing major crypto moves on social media, telling followers to "Wait until you see what they do tomorrow!"

The contrast between this frenzied activity and his inaugural restraint was stark.

Even more peculiar was the timing.

Trump had spent months positioning himself as "the crypto president," promising everything from a strategic Bitcoin reserve to the end of Operation Chokepoint 2.0.

His campaign actively courted crypto executives, raising more than $130 million from the industry for various political initiatives.

He spoke at Bitcoin 2024 in Nashville, hosted crypto roundtables at Mar-a-Lago, and repeatedly claimed he would "save" the industry from regulatory overreach.

For him to then skip any mention of crypto in his first major address as president wasn't just unexpected — it suggested either a strategic pivot or a deliberate attempt to separate his official presidential duties from his family's crypto ventures.

There were other things that happened though…

The Priorities Puzzle

The White House's official "America First Priorities" document, released shortly after the inauguration, was equally crypto-free.

The key priorities listed energy independence, public safety, reforming government bureaucracy and promoting "American values" - but nothing about making America a crypto powerhouse.

This wasn't the day one that crypto advocates had envisioned. After months of campaign promises about strategic Bitcoin reserves and regulatory overhaul, the industry found itself still waiting at the end of inauguration day.

Perhaps, World Liberty's massive crypto purchases signal actions matter more than speeches?

World Liberty's Buying Spree

While Trump stayed quiet on crypto, his family-backed DeFi project - World Liberty Financial - spoke volumes with its wallet.

In a massive inauguration day buying spree, WLF loaded up.

$46.8 million in Ethereum

$46.7 million in wrapped Bitcoin

Additional millions in smaller-cap tokens like ENA, wTRX, LINK, and AAVE

The purchases, often executed in $4 million blocks, brought WLF's total crypto holdings to $326.2 million.

The timing was particularly notable - just hours earlier, WLF had finally completed its initial token sale target of 20% supply, prompting it to open another 5% block due to "massive demand."

Breaking Down Solana

Just 72 hours before taking the oath of office, Donald Trump unleashed what would become crypto's most dramatic memecoin launch.

The "Official Trump" token (TRUMP) debuted on Solana during Friday night's Crypto Ball, triggering an unprecedented surge that would test the limits of blockchain infrastructure.

Within 90 minutes, TRUMP hit a $1 billion market cap.

Within hours, it rocketed past $10 billion. By Sunday, it peaked at $15 billion valuation, briefly becoming one of crypto's top 15 tokens - surpassing established DeFi platforms like Uniswap, Aave and Ethena.

The frenzy nearly broke Solana itself.

Record daily fees of $35 million

8 million transaction requests per minute

Over $1.25 billion in swap volume in 24 hours

Transaction fees jumping 173% in a single day

Major platforms buckled under the strain.

Phantom wallet users reported loading failures. Jupiter exchange's price API struggled. Coinbase and Binance faced severe transfer delays.

Yet remarkably, Solana's main network stayed online through it all.

The Melania Effect

On Sunday, First Lady Melania Trump announced her own token (MELANIA), sending markets into chaos. TRUMP plummeted 50% in a couple of hours, while MELANIA soared to a $1 billion market cap in the same duration.

The dueling Trump tokens helped push Solana's native SOL token to new heights. It hit an all-time high of $286, bringing its year-to-date gains to over 3,000% from its December 2022 lows of $9.

So much wealth created in just a matter of few hours. There’s a catch?

Most of this wealth was created only on paper. More than 80% of TRUMP's supply remained locked with two Trump-affiliated firms.

With such concentrated ownership and vesting restrictions, turning these valuations into real money would be nearly impossible without crashing the market.

Let’s get into it …

Choose the Right Ledger Wallet for You

Ledger wallet comes with key features to ensure accessibility and security for you wallet. With Ledger live app you can manage and stake your digital assets, all from one place. Ledger recover helps to restore access to your crypto wallet in case of a lost, damaged, or out of reach Secret Recovery Phrase.

The Token Controversy Deepens

The TRUMP token's structure raised serious red flags. Analysis revealed that just 20% of the supply was made available for public trading, while CIC Digital LLC and Fight Fight Fight LLC — Trump-affiliated entities — controlled the remaining 80%.

The lockup schedule meant early investors couldn't sell, even as prices plummeted.

10 holders owned 89% of TRUMP's supply.

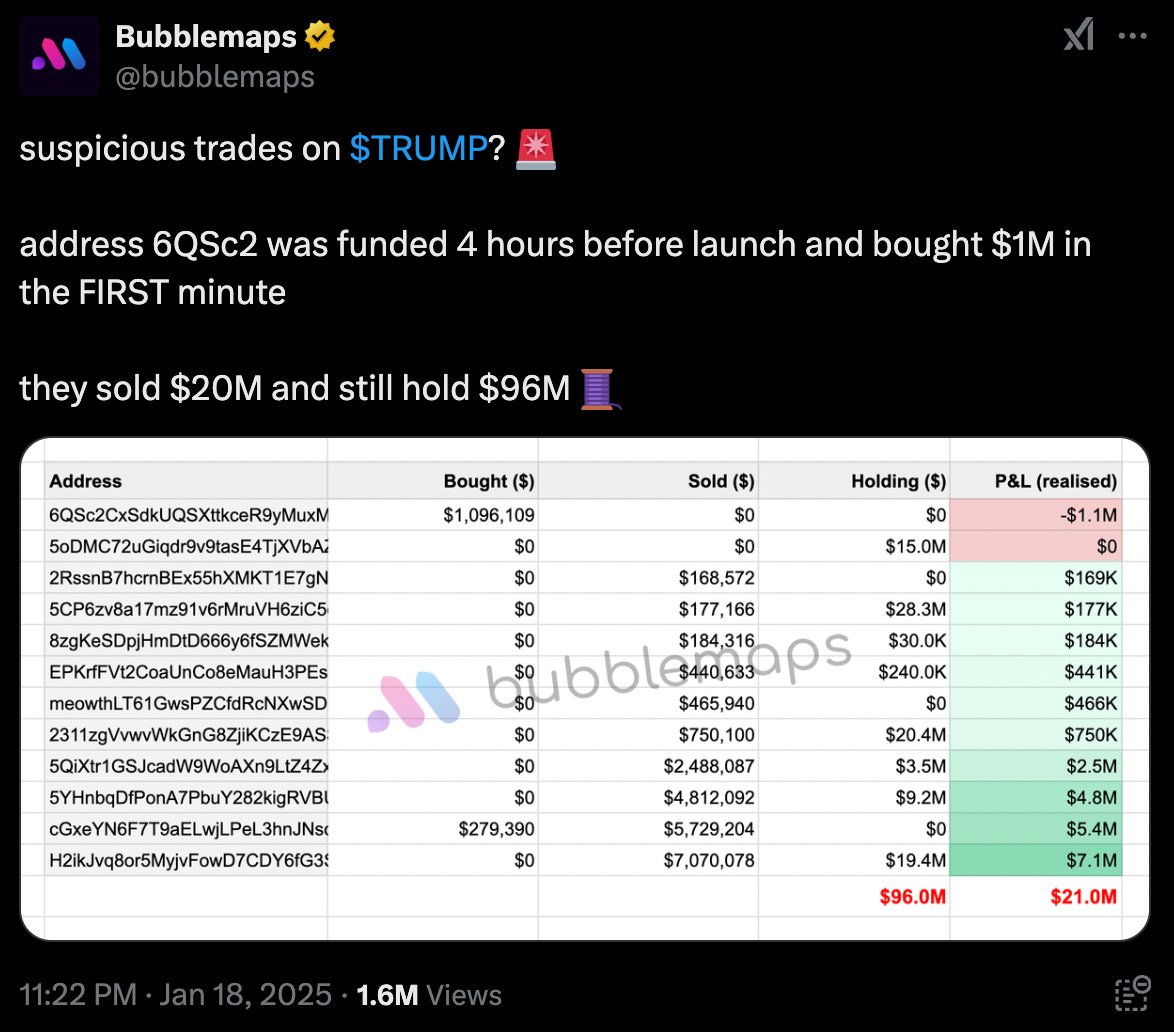

Reports surfaced of suspicious wallet activity, including one address that was funded with $1 million just hours before launch, purchased $5.9 million worth of TRUMP tokens in the first minute of trading, and later sold $20 million worth.

"Everyone knows this is a grift, this isn't going to be around in four years and there's nothing of value here," warned prominent scam hunter Coffeezilla in a detailed analysis.

The launch of MELANIA only intensified scrutiny. The rapid succession of family-branded tokens drew comparisons to previous crypto schemes.

Representative Ro Khanna (D-CA) called for immediate action, stating "Elected officials must be barred from having meme coins by law," and suggesting they should be regulated like gambling.

Vice President of communications at Citizens for Responsibility and Ethics in Washington, Jordan Libowitz told Politico.

"After decades of seeing presidents-elect spend the time leading up to inauguration separating themselves from their finances to show that they don't have any conflicts of interest, we now have a president-elect who, the weekend before inauguration, is launching new businesses along with promises to deregulate ... those sectors in a way to just blatantly profit off his own presidency."

Even supporters questioned the timing. Launching memecoins days before taking the oath of office struck many as undermining the gravitas of the presidency. The tokens' terms and conditions, which blocked class-action lawsuits, sparked particular concern about investor protection.

Block That Quote

Mark Cuban, American businessman

"Crypto is going to have a much harder time legitimizing itself”

Cuban led the criticism, arguing that Trump's token launch severely undermined the industry's legitimacy.

Suggested that Trump's memecoins had effectively erased years of progress toward regulatory acceptance.

Representative Maxine Waters, top Democrat on the House Financial Services Committee, went further, calling the TRUMP token "the worst of crypto" and warning that its terms blocked buyers from bringing class-action lawsuits even if they were swindled.

Not everyone saw doom and gloom. Analysts at Bernstein acknowledged the "wackiness" of the TRUMP token launch but argued it signalled a new era for crypto regulation.

"A new chaotic crypto era is here," they wrote, advising investors to look past the memes to "the more valuable parts of the ecosystem."

The Five Big Promises

Throughout his campaign, Trump positioned himself as crypto's ultimate ally, making five key pledges:

Fire Gary Gensler - Already accomplished, as Gensler resigned ahead of inauguration, with pro-crypto Paul Atkins nominated as replacement

Make Crypto a National Priority - Bloomberg reported Trump’s plans to issue executive orders declaring cryptocurrency a national priority

End Operation Chokepoint 2.0 - Promised to stop what crypto advocates call coordinated regulatory pressure on banks serving crypto firms

Repeal SAB 121 - Pledged to eliminate SEC's controversial crypto accounting guidance

Create a Strategic Bitcoin Reserve - Betting markets still show 60% odds of implementation this year

The New Regulatory Guard

Trump's regulatory appointments signal a dramatic shift:

Paul Atkins nominated for SEC chair

Mark Uyeda serving as acting SEC chair

Caroline Pham leading CFTC temporarily

David Sacks appointed as White House crypto czar

These picks suggest an administration staffed with crypto-friendly regulators, marking a stark departure from the Gensler era's enforcement-heavy approach.

The Global Stage

Trump's crypto agenda extends beyond domestic policy. His administration aims to position America as the global leader in blockchain technology, potentially competing with:

El Salvador's Bitcoin adoption

Argentina's crypto-friendly reforms

China's digital yuan ambitions

What will be important to see is if Trump’s actions match the sweeping scale of his campaign promises.

Read: The On-chain President ⛓️

Token Dispatch View 🔍

As the dust settles on Trump's inauguration day, a significant story to watch out for would be the unprecedented alignment of political power behind Bitcoin across geographies.

For the first time in crypto's history, three influential presidents stand united in their support for digital assets.

In El Salvador, Bukele's Bitcoin experiment has already proven profitable, with national reserves growing to $650 million. His pioneering move to make Bitcoin legal tender, once dismissed as reckless, now looks prescient as Bitcoin reaches new highs.

In Argentina, Milei's radical free-market approach has opened the floodgates for crypto adoption, allowing everything from rental payments to daily transactions in digital assets. His promise to abolish the central bank and embrace private currencies aligns perfectly with crypto's core philosophy.

And now in Washington, Trump takes office with the resources and influence to potentially reshape global crypto policy. Despite his inauguration day silence, his administration's early moves — from massive Treasury purchases to strategic appointments — suggest action may speak louder than words.

Together, these three leaders control economies worth trillions of dollars and influence that extends far beyond their borders. Their alliance, formal or informal, could accelerate crypto adoption at a pace previously unimaginable.

This trio, all in the early stages of their terms across the Americas, represents perhaps crypto's most powerful political coalition yet.

A new chapter in crypto's global story is beginning.

Are we ready for what comes next?

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.