DePIN 2025: The Great Unbundling 📌

Today’s edition is brought to you by Infinity Hash. Transparent and reliable system to own part of a real mining farm. Sign-up here and get 10% bonus shares on the first purchase 👇

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Hello dispatchers! Welcome to Tuesday’s crypto dose.

Today we're diving into DePIN, acronym for Decentralised Physical Infrastructure Network, where blockchain meets brick-and-mortar, and tokens finally touch grass.

From AI's insatiable appetite for compute power to Helium's army of router revolutionaries, we'll explore why 2025 might be the year when "touching grass" becomes a legitimate investment strategy.

This infrastructure revolution won't be centralised.

Upgrade to paid to get full access to our weekly premium features (Wormhole, Rabbit hole and Mempool) and subscribers only posts. 2025 New Year special limited time offer - 38% off on our annual subscription.

In a dusty warehouse somewhere in Arizona, a rack of GPUs hum quietly, crunching numbers for the next AI breakthrough.

But this isn't a Google data centre or an Amazon AWS facility – it's someone's garage.

And those computing cycles? They're being sold on a decentralised marketplace for more money than the owner makes at their day job.

In the world of DePIN, your spare computer power, unused internet bandwidth, or extra storage space isn't just sitting idle – it's becoming part of a global infrastructure revolution.

You probably missed it.

Most people did.

Render Network's token surged 150% as AI companies scrambled for GPU power. Helium built a network of over 125,000 mobile subscribers from scratch.

It's the first time blockchain technology is directly challenging the tech giants where it hurts the most – their infrastructure monopolies.

And if 2024 was any indication, 2025 could be the year this "toy" starts looking a lot more like an unstoppable force.

But to understand where this rocket ship is headed, we first need to understand how we got here, why it matters, and more importantly – why the biggest opportunities might still lie ahead.

A Look Back at 2024

The rise of DePIN marked crypto's first serious attempt at bridging the digital and physical worlds. Numbers suggest that it's working.

100x —that's how much DePIN revenue exploded in 2024.

Total revenue: $500 million

Active devices: 13 million+ daily

Market share: 5% of total crypto

Projects over 1 million nodes: 5

The growth story gets wilder

20 projects crossed 100K nodes

Community raised $230 million

Seed stage investment dominated

AI-powered projects led revenue

Who's winning?

Virtuals Protocol: 30,000% gain since TGE

NEURAL: 2,000%+ returns

NodeAI: 2,000%+ growth

The platform wars

Solana: Winning infrastructure plays

Base: Dominating consumer apps

Sui: New player entering the game

Why these numbers matter? Only 4 out of top 22 DePIN tokens lost value since launch. That's a 82% success rate in crypto - practically unheard of.

By December 2024, the DePIN sector had swelled to a staggering $38 billion market cap.

The Birth

Think of DePIN as the lovechild of blockchain technology and physical infrastructure. It's what happens when you take the decentralised ethos of crypto and apply it to real-world resources like storage, computing power, and wireless networks.

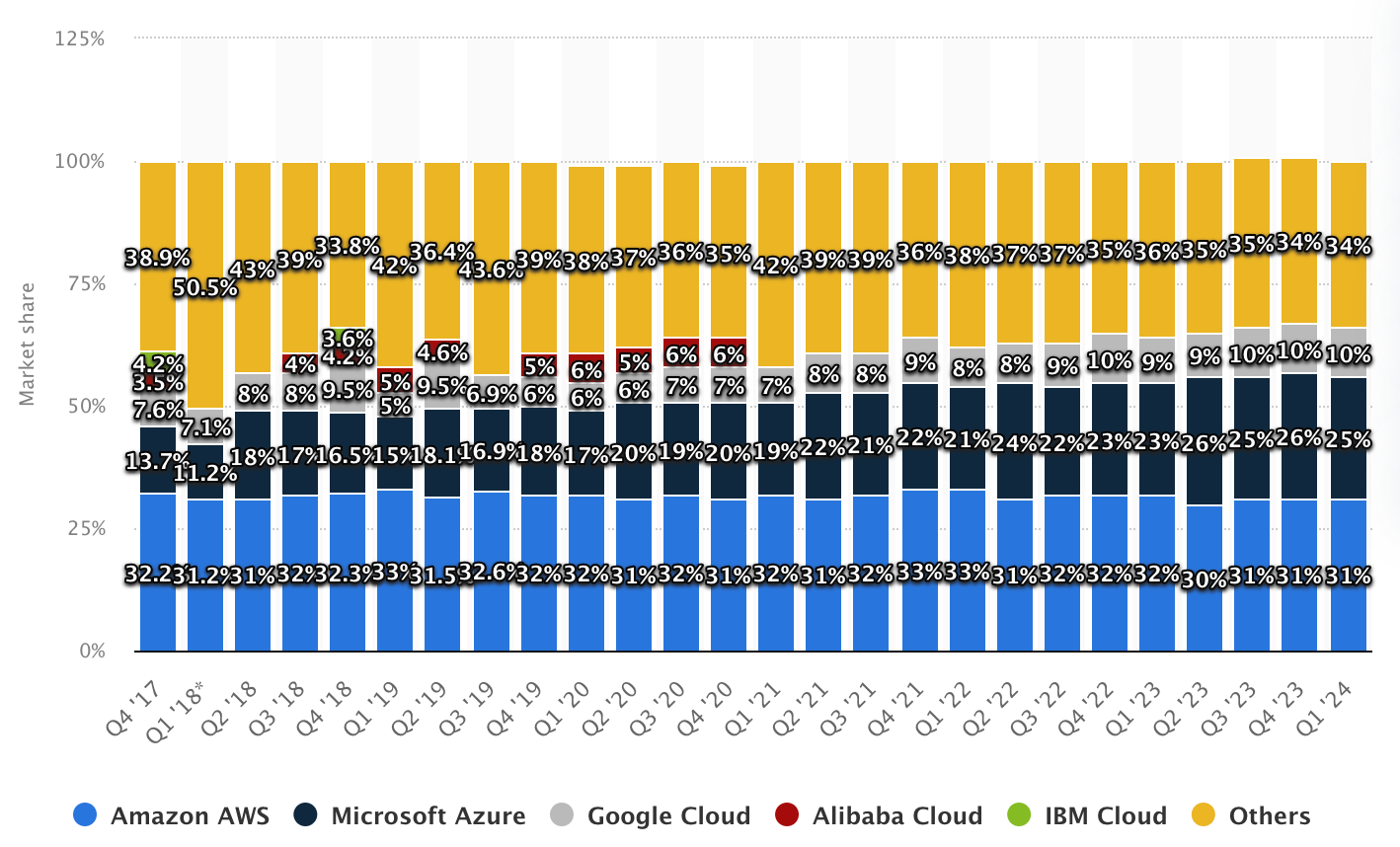

Traditional infrastructure is controlled by a handful of tech giants. Amazon Web Services alone controls 32% of cloud infrastructure. Google and Microsoft divvy up most of the rest. This centralisation creates what economists call "honey pots" – massive repositories of data and resources controlled by a few powerful entities.

DePIN flips this model on its head.

Instead of relying on centralised data centres, DePIN networks harness the power of individual contributors.

Your unused hard drive space, your spare GPU cycles, even your home's internet connection – all can be tokenised and put to work in a decentralised marketplace.

Three Pillars of DePIN

What makes DePIN different from previous crypto narratives is its foundation on three solid pillars.

Physical Assets

Unlike pure software plays, DePIN requires actual hardware. Whether it is Helium's wireless hotspots or Filecoin's storage nodes, these networks are built on tangible infrastructure. This creates real barriers to entry and genuine scarcity – something often lacking in crypto.

Utility Value

DePIN tokens aren't just speculative assets; they're required for network operation. Want to store data on Arweave? You need AR tokens. Need rendering power from Render Network? That'll cost you RNDR. This utility creates natural demand that exists independent of market speculation.

Network Effects

As more users join these networks, they become exponentially more valuable. It's the same principle that made Facebook unstoppable – except in DePIN, the value accrues to the network participants rather than a centralised corporation.

Breaking Down the Building Blocks

DePIN has evolved into two distinct but interconnected categories: Physical Resource Networks (PRNs) and Digital Resource Networks (DRNs). Think of them as the hardware and software of the decentralised future.

Physical Resource Networks: The New Utilities

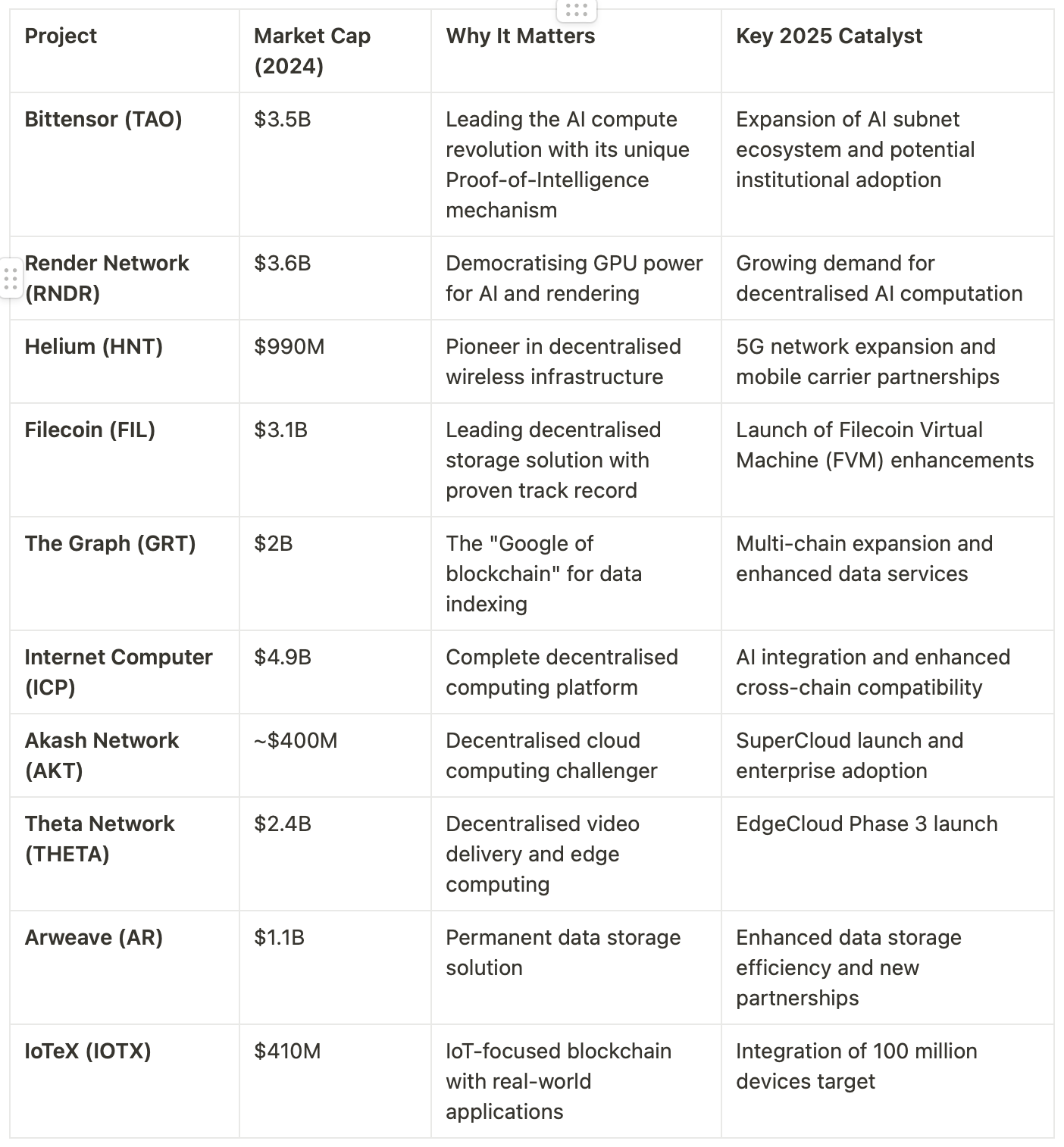

Wireless Networks: Helium (HNT) emerged as the poster child here, growing its network to over 125,000 mobile subscribers by late 2024. But what's really interesting is how they pulled it off – by turning regular people into telecom operators. Buy a hotspot, plug it in, earn HNT.

Energy Networks: While everyone was watching Helium, energy DePINs were quietly building the future of power distribution. Projects like Fuse are creating decentralised grids where excess solar power can be traded between neighbours without middlemen.

Digital Resource Networks: The Heavy Lifters

Compute Networks: Remember when Nvidia became the world's most valuable company? It was about AI's insatiable appetite for computing power. Enter projects like Render Network (RNDR), which saw its token surge significantly in 2024 by letting anyone with a decent GPU earn money training AI models.

Storage Networks: Filecoin and Arweave are reinventing how we think about data storage. Filecoin's approach of incentivising unused storage space helped it reach over $200 million in Total Value Locked (TVL) by late 2024.

The Rise of the Hybrid Models: The most successful DePIN projects of 2024 weren't pure plays in either category – they were hybrids. Take Bittensor (TAO), which combines physical infrastructure for AI training with decentralised marketplaces for machine learning models. It's this convergence that helped TAO achieve a market cap of over $3.5 billion.

Buy Once, Earn Daily Bitcoin Forever

Infinity Hash brings the best aspects of cloud and colocation mining into a transparent and reliable system that provides long-term cash flow.

Why 2025 Could Change Everything

The DePIN sector enters 2025 at a fascinating crossroads. After a year that saw the total market cap surge beyond $38 billion, we're no longer asking if DePIN will work – we're asking what happens when it does. And the answers might surprise you.

The AI Catalyst

Here's what everyone missed: DePIN isn't just riding the AI wave – it's becoming essential to it. Think about it.

Every time OpenAI trains a new model, they need more computing power than exists in most small countries.

Every time Anthropic releases a new Claude, they need more storage than a small tech company's entire data centre.

This is where projects like Render Network and Bittensor are enabling it.

When Render's token jumped 150% in 2024, it wasn't just speculation. It was the market realising that decentralised GPU power might be the only way to satisfy AI's insatiable appetite.

The real problem isn't building AI models – it's finding enough compute to train them. And that's exactly what DePIN solves.

The Great Unbundling

2025 could mark the start of what industry insiders are calling "The Great Unbundling." Just as Bitcoin unbundled money from banks, DePIN is unbundling infrastructure from tech giants.

AWS controls 32% of cloud infrastructure

Google and Microsoft dominate the rest

Together, they form an infrastructure oligopoly

But what if you could take that same infrastructure and spread it across millions of participants? What if instead of AWS earning $90 billion a year, that value went to network contributors?

Of course, it's not all smooth sailing. Three major hurdles stand in the way:

Regulatory uncertainty: The SEC's dance with crypto isn't over, and DePIN's real-world touchpoints make it particularly interesting to regulators. Will they see it as infrastructure or securities? The answer could reshape the sector.

Technical scalability: Running decentralised infrastructure is hard. Really hard. Projects like Helium learned this the hard way. Success in 2025 will depend on solving thorny, technical challenges around reliability and performance.

Corporate resistance: The tech giants won't give up their infrastructure monopolies without a fight. Expect aggressive pricing, enhanced features, and possibly even their own "decentralised" solutions.

Here are the top 10 DePIN projects we are watching in 2025

The prediction matrix looks something like this.

Token Dispatch View 🔍

Despite these challenges, we're betting big on DePIN.

The convergence of AI's resource needs, growing distrust of tech centralisation, and maturing DePIN technology creates a perfect storm of opportunity.

We expect the total DePIN market cap to reach $100 billion by the end of 2025.

We expect to see the first Fortune 500 company migrate significant infrastructure to a DePIN network.

That won't just be a victory for one project – it will validate the entire sector.

If you've made it this far, you might be wondering: is this just another crypto narrative, or are we witnessing something truly transformative?

The answer lies in understanding what makes DePIN fundamentally different from previous crypto waves.

Unlike NFTs or DeFi, which largely existed in the digital realm, DePIN is grounding crypto in physical reality.

This physicality changes everything. For one, it creates natural constraints. You can't simply fork a network of physical infrastructure like you can fork code.

The road ahead isn't without challenges.

Our predictions for 2025 might seem optimistic, but they're grounded in the understanding that paradigm shifts take time. The technical hurdles are real.

The regulatory landscape is uncertain. The incumbents won't give up their territory without a fight.

Here's the thing about infrastructure revolutions: once they start, they're almost impossible to stop.

Just as electricity networks and the internet fundamentally changed how society operates, DePIN has the potential to reshape who owns and controls the backbone of our digital world.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.