Donald Trump 🧨

Former president gets shot. America shaken. His presidency odds shoot up. Crypto celebrates. Shoots up. Where is all of this heading? Crypto is an election issue this year, but is that a good thing?

Hello, y'all. Centre stage drama … 🎙️

Do try the Music Quiz Game 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

Don’t know how we got here.

But here we are.

Election year. Uncertain economy. Choppy markets. Crypto lobbying.

If that was not enough … Presidential candidate assassination attempt.

What happened in Pennsylvania on July 13?

Trump was speaking on stage at a rally in Butler, Pennsylvania

Out of nowhere - bam.

Shots fired from an unknown direction.

Instant chaos.

Trump was spotted clutching his ear.

In seconds, we were recreating action straight out of them Hollywood movies.

In no time, the US Secret Service swooped in, creating a human shield and whisking him offstage.

In a moment that could only be described as pure Trump, he paused, raised his fist, and gave a shout to the crowd.

Trump is reportedly doing well, even though the incident was quite serious.

Still up for it: After the incident, Bitcoin Magazine CEO David Bailey said that he had just communicated with Donald Trump's team and Donald Trump is still committed to delivering his speech in-person at Bitcoin 2024.

The Bitcoin 2024 conference will be held in Nashville, Tennessee from July 25-27, 2024.

This whole incident had a significant ripple effect on crypto.

The crypto market was lifted up.

Crypto marketcap is 2% up.

Bitcoin is back at $60K.

The memecoins?

The MAGA coin, linked to Trump's famous slogan, shot up by nearly 58% to $9.88 per coin. This big increase came right after the news of the incident broke.

Super Trump, another meme coin related to Trump, increased by over 51%, trading at just under a penny.

MAGA Hat, yet another related token, also jumped by 35.7%. These increases show how news and politics can shake up the crypto market.

But why this has an effect on crypto?

Trump shot = High probability of Trump’s victory = crypto friendly government in US.

Who wins in the crypto world? With a huge difference, Trump.

Crypto and the elections

2024 isn’t just another election year in the US.

It’s got everyone buzzing about crypto.

Donald Trump wants to be the “crypto president,” and Democrats are ready to chat about crypto reforms too.

For context

'Give Me Liberty, or Give Me Death!' 🤌

House to Vote on Overriding Biden's Veto

Why the sudden love?

Crypto adoption is skyrocketing.

There are an estimated 560 million crypto holders worldwide, which is around 6.8% of the world’s population holds crypto - says the 2024 Cryptocurrency Ownership report by Triple-A.

“There’s 50 million crypto holders in the US”...“That’s a lot of voters.” - Ryan Selkis, a crypto executive.

“Within two years there will be at least two times or three times more crypto holders worldwide. This is where we get more adoption everywhere and in terms of payments as well” - Pavlo Denysiuk, CEO of crypto payments firm Lunu.

“I actually think we’ll see mass adoption in the next 12 to 18 months,” - Animoca Brands co-founder and chairman Yat Siu.

“Both Republicans, like Donald Trump, and Democrats, like Governor Jared Polis of Colorado, see the potential in cryptocurrency, which is a far more valuable asset class than it was five years ago” - Grant Ferguson, an instructor, at Texas Christian University.

According to a National Crypto Council poll, 80% of respondents think a candidate's crypto stance matters to their vote. About 83% prefer candidates who back clear regulations to boost the industry and protect investors.

According to Blockchain Association, 79% of crypto owners and 65% of registered voters believe that it is important for the US to be the leader of the blockchain space.

What the top candidates say about crypto?

Joe Biden: Initially, Biden’s team took a tough stance on crypto with strict regulations.

But, as Trump embraced a pro-crypto stance, Biden’s administration softened its approach, showing more openness to crypto innovations like Ethereum ETFs.

Despite this shift, some past actions like Operation Choke Point 2.0 have left the crypto industry wary of Biden’s true intentions.

Donald Trump: Trump has flipped to a pro-crypto stance, influenced by advisors like David Bailey from Bitcoin Magazine.

He’s promised to push the US as a leader in Bitcoin mining and halt the development of CBDCs, which are unpopular among crypto users. While some doubt his sincerity, his pro-crypto messages are resonating with voters concerned about innovation and financial freedom.

Robert F. Kennedy Jr.: Running as an independent, Kennedy has positioned himself as a staunch crypto supporter. He’s proposed radical ideas like putting the US budget on the blockchain and opposing CBDCs. His plans to make Bitcoin transactions tax-free aim to integrate crypto into everyday financial activities.

The big money behind crypto politics

Crypto’s influence isn't just talk.

It's backed by substantial financial muscle.

Major crypto players like Ripple, Coinbase, and Andreessen Horowitz are pooling about $150 million into super PACs. These funds are aimed at steering congressional races towards candidates who favour crypto-friendly policies.

That is… mostly TRUMP.

Though these PACs are staying out of the presidential fray, they're a significant force in other critical electoral battles.

The backdrop is a landscape where the Biden administration has taken a tough stance against the crypto industry, marked by lawsuits and stringent SEC actions.

This crackdown has turned crypto into a partisan issue, with executives like Brad Garlinghouse from Ripple declaring the 2024 elections as pivotal for the industry’s future.

While the PACs focus on Congress, crypto's narrative weaves through the presidential campaign as well.

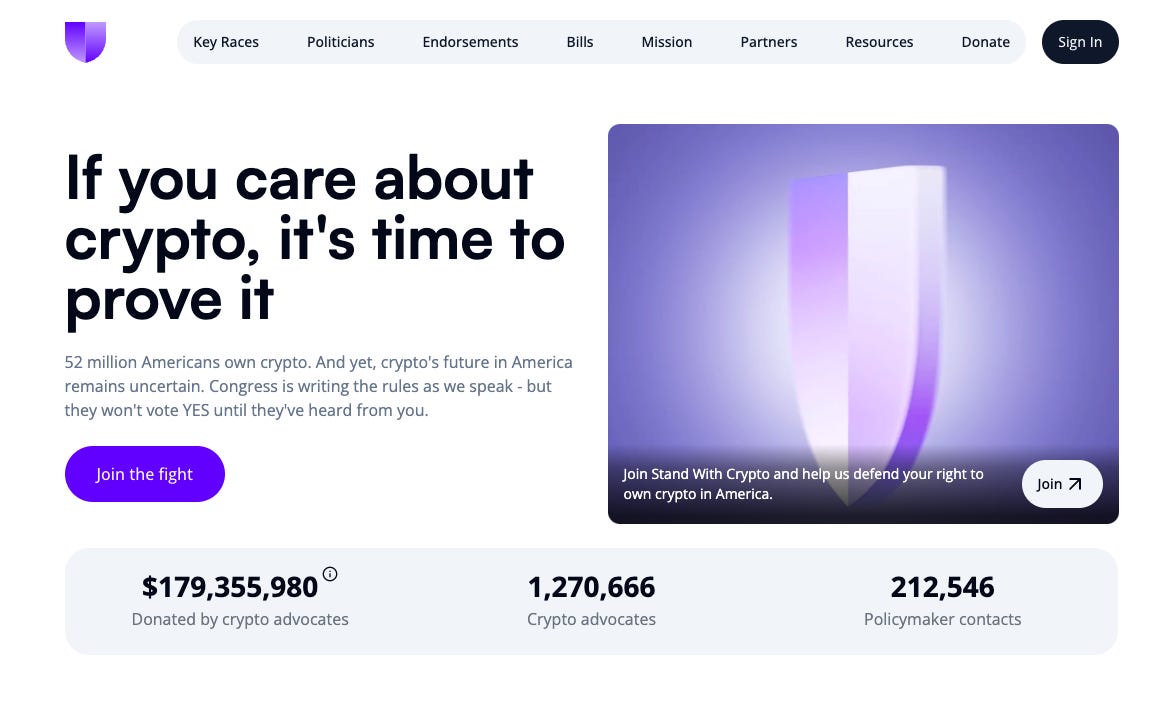

Stand with crypto: Launched in August 2023 by Coinbase as an effort to give crypto supporters more access to information about policymakers and candidates.

It has partnered with companies and over 1 million people to fight alongside them in supporting pro-crypto policies and legislation.

Coinbase CEO Brian Armstrong is one of the major donors to the organisation.

The Trump vs Biden war

Trump, previously skeptical of crypto, has recently become a vocal supporter, promising to dial back regulations and champion Bitcoin mining in the US.

His pro-crypto stance is clear, with declarations and promises made in gatherings at his Mar-a-Lago estate, signalling a shift that's resonating within the industry.

Ryan Selkis, head of crypto data firm Messari, is dining at Mar-a-Lago and suddenly gets called up by former President Donald Trump to speak.

Standing before an influential crowd, Selkis highlights the vast number of crypto holders in the US - 50 million potential voters.

On the other side, President Biden, traditionally viewed as anti-crypto due to aggressive SEC oversight under his administration, is seeing pressures within his campaign to soften this stance.

Figures like Mark Cuban are pushing for a more reconciliatory approach towards crypto policies, suggesting an evolving position as the election nears.

Will crypto swing the election?

The focus on crypto in this election reflects its growing influence in American life and politics.

While it's clear that crypto policy is important to a segment of voters, it’s tough to say if it will be a decisive issue across the broader electorate.

As the campaign heats up, how candidates handle crypto could indeed tip the scales in key battlegrounds.

Some say politicians flaunt their crypto love to distract from other issues or to snag young votes.

Read: Hayes ain’t buying the Trump for crypto Republican script.

But playing games with crypto talk might backfire, turning off voters who value straightforwardness.

Week That Was 📆

Saturday: Choppy Market Ahead 🪵🪓

Friday: Will AI Push Bitcoin Higher? ⏫

Thursday: $11B Crypto Scam Operation 🥷

Wednesday: What Is WATER 🚰

Tuesday: Germany's Flash Sell-Off 🚨

Monday: Magnificent Seven vs Crypto 🤼

Week in Funding 💰

Partior. $60M. Blockchain platform for payments clearing and settlement, founded by J.P. Morgan, DBS and Temasek, and backed by MAS.

Term Finance. $5.5M. Decentralised DeFi lending protocol that utilises auction model to support scalable fixed-rate/fixed-term lending.

Kulipa. $3M. Let non-custodial wallets issue branded payment cards to their users. Branded cards with a flexible API, and dashboard for the support team.

Tread.fi. $3.5M. Crypto trading infrastructure for institutions. Trading engine, advanced algorithms and direct market access for spot, futures and options.

RECRD. $4M. Platform for creators to earn up to 100% of advertisement revenue with instant monetisation based on views rather than follower count.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋