Welcome to our weekly Bitcoin macro and news analysis: Mempool.

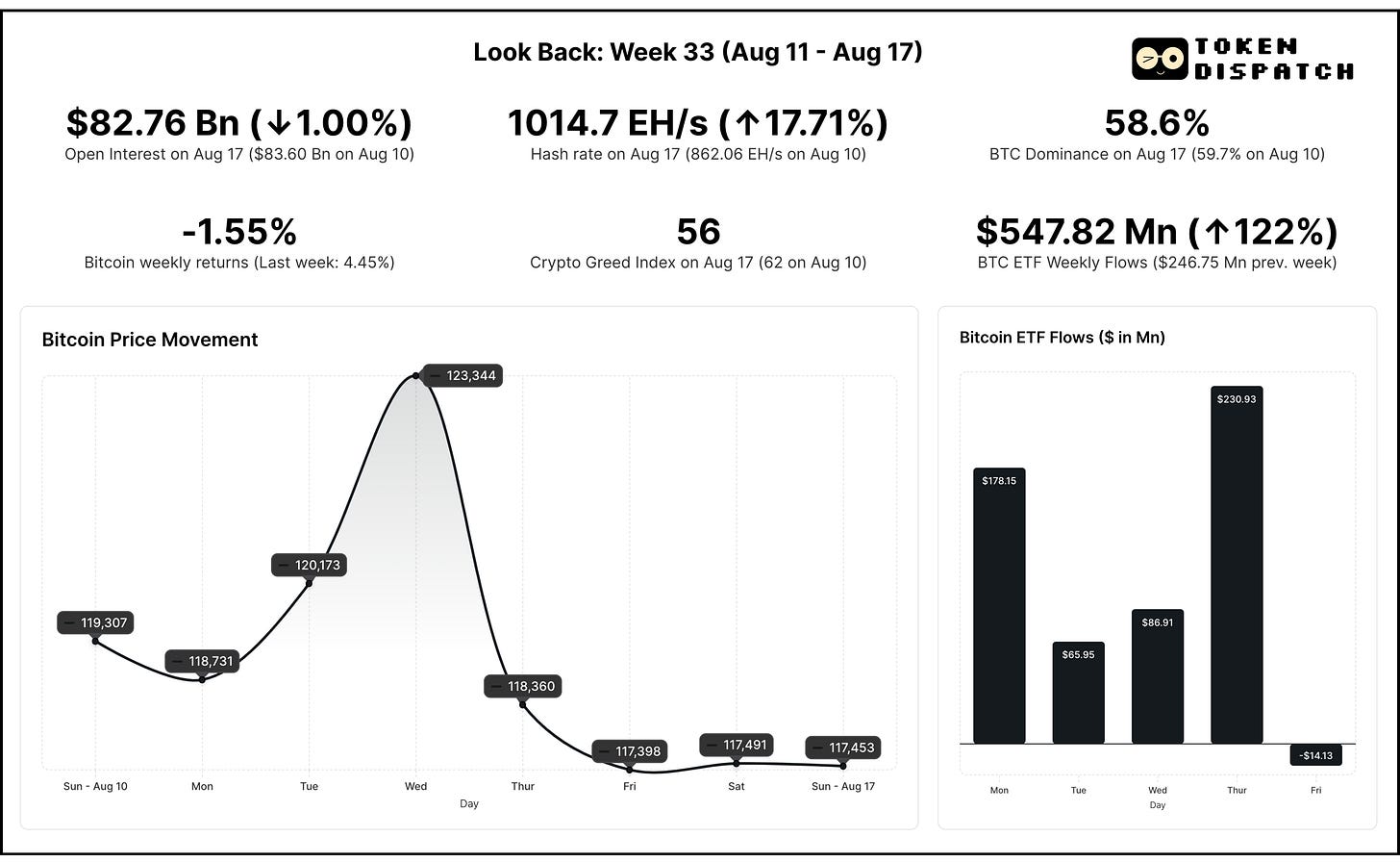

We're looking at Week 33 of 2025 (August 11-August 17):

BTC all-time high rally cut short after hot inflation data

US Treasury rules out fresh Bitcoin buys for reserves, cooling expectations

Dip absorbed as BTC+ETH ETFs see record $40B trading volume

Short-term holders sell in panic, but flows show buyers absorbing the pressure

Crypto Investing Without the Crypto Chaos

Forget seed phrases, exchange hacks, and late-night wallet setups.

With Grayscale, you can invest in Bitcoin, Ethereum, and other digital assets the same way you’d buy a stock — through regulated, SEC-reporting products.

No private keys to manage

No unregulated exchanges

No steep learning curve

It’s the easiest way for individuals and institutions alike.

Week That Was

Bitcoin squandered a dream start to the week that saw the cryptocurrency hitting a new all-time high of $124,457 late Wednesday before sliding 7% intraday. The euphoria of crossing $124,000 was short-lived as hotter-than-expected inflation data and policy uncertainty dented BTC’s rally.

On Thursday, Bitcoin faced an immediate rejection as the US Producer Price Index (PPI) data showed annual inflation at 3.3%, well above the 2.5% forecast and marking the largest monthly rise since June 2022.

BTC dropped further on the weekend and slipped close to the $115,000 mark in the early hours today, tumbling below key support levels.

The inflation surprise was compounded by Treasury Secretary Scott Bessent's clarification that the US government would not be purchasing additional Bitcoin for its strategic reserve, instead relying solely on confiscated assets. This statement directly contradicted market expectations for potential government buying programs.

He later tweeted that the Treasury will be “committed to exploring budget-neutral pathways to acquire more Bitcoin to expand the reserve.”

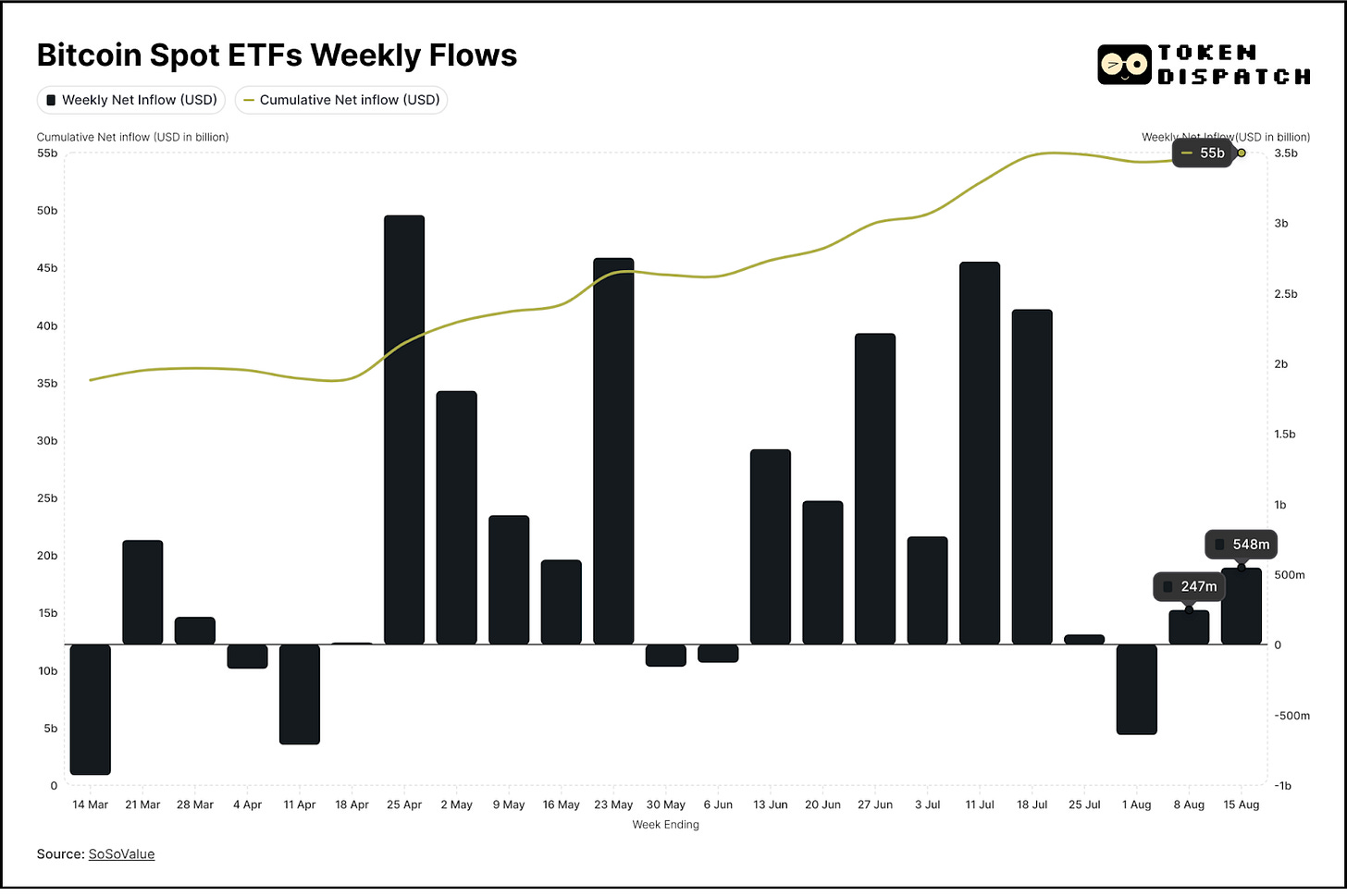

Despite the sharp correction, institutional buyers led by BlackRock's IBIT aggressively purchased the dip, with combined Bitcoin and Ether ETF trading volumes reaching a record $40 billion for the week.

Bitcoin ETF flows surged to $547.82 million, representing a 122% increase from the previous week's $246.75 million.

This "buy the dip" mentality from sophisticated investors suggested that the pullback was viewed as a healthy correction rather than a fundamental shift in sentiment.

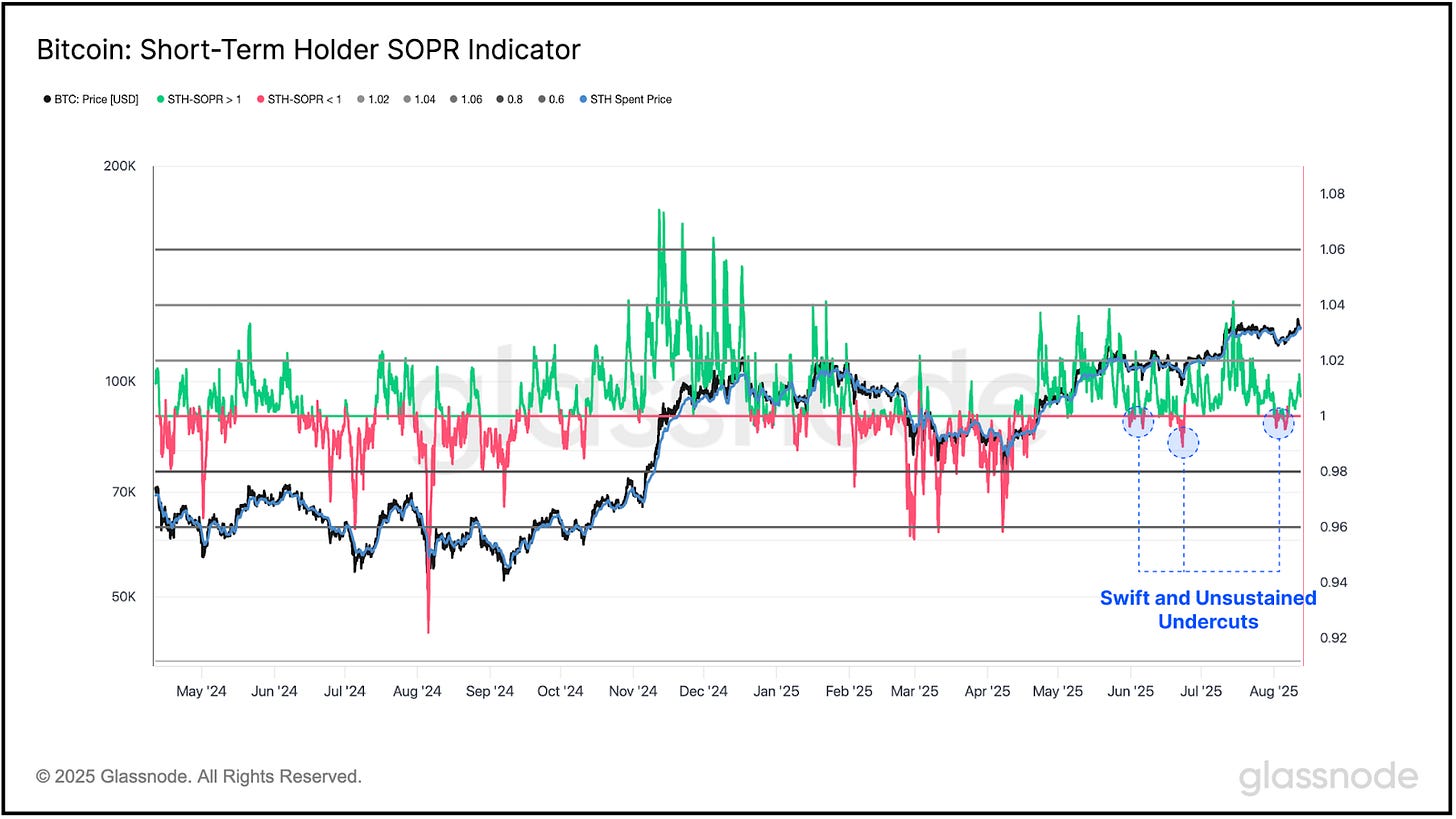

The line showing Short-Term Holder—Short-Term Output Profit Ratio (STH-SOPR) around the 1.0 mark in the graph tells you if recent buyers are realising profits (>1) or losses (<1). Those quick undercuts below 1, then snap-backs, show that the sell-pressure was not prolonged and got quickly absorbed, consistent with the “buy the dip” narrative.

Above 1 means coins that moved were sold at a profit. Below 1 means they were sold at a loss. The STH version looks only at “hot money” coins younger than ~5 months, so it tells us what recent buyers are doing.

What to perceive?

If STH-SOPR holds at or above 1 on a 7-day view while price chops, it usually means pullbacks are being bought and a base is forming.

If it rolls under 1 for several days, risk rises for a deeper move toward the STH realised-price zone in the low $110,000 range.

Bitcoin dominance slipped to 58.6% from 59.7% the previous week, reflecting the continued rotation into altcoins, particularly Ethereum, which captured significant market share during the period. This 1.1 percentage point decline occurred despite Bitcoin setting new all-time highs, suggesting that investors were diversifying their crypto exposure rather than concentrating solely in BTC.

The Crypto Greed Index retreated to 56 from 62, moving back toward neutral territory from the "greed" zone. The cooling of sentiment coincided with the price correction and likely reflected the market's more cautious stance following the inflation data and policy uncertainty. The reading still remained well above "fear" levels, indicating that the correction was viewed more as a healthy pause.

From a technical perspective, some key price levels emerged during the week.

Support Structure: The $115,000 level, the earlier support level, was breached just as we wrote this after 12 days of trading above the level. The immediate support below that is around $112,000, which was the all-time high until May end.

Resistance Zones: The $120,000-$122,000 range now represents significant resistance, with multiple failed attempts to reclaim these levels during the correction.

High-volume trading during the correction suggests that this level may serve as a new accumulation zone, similar to patterns observed during previous cycle corrections. Expect the market to discover BTC’s true price with trades in the range of $115,000-$120,000

The Relative Strength Index (RSI) cooled from overbought territories above 80 to more sustainable levels between 30-50 in the last week. However, with Monday’s slip below $115,000, BTC’s RSI has slipped below 30, which is considered as oversold conditions. This will likely set up the market for more accumulation activity at this price range.

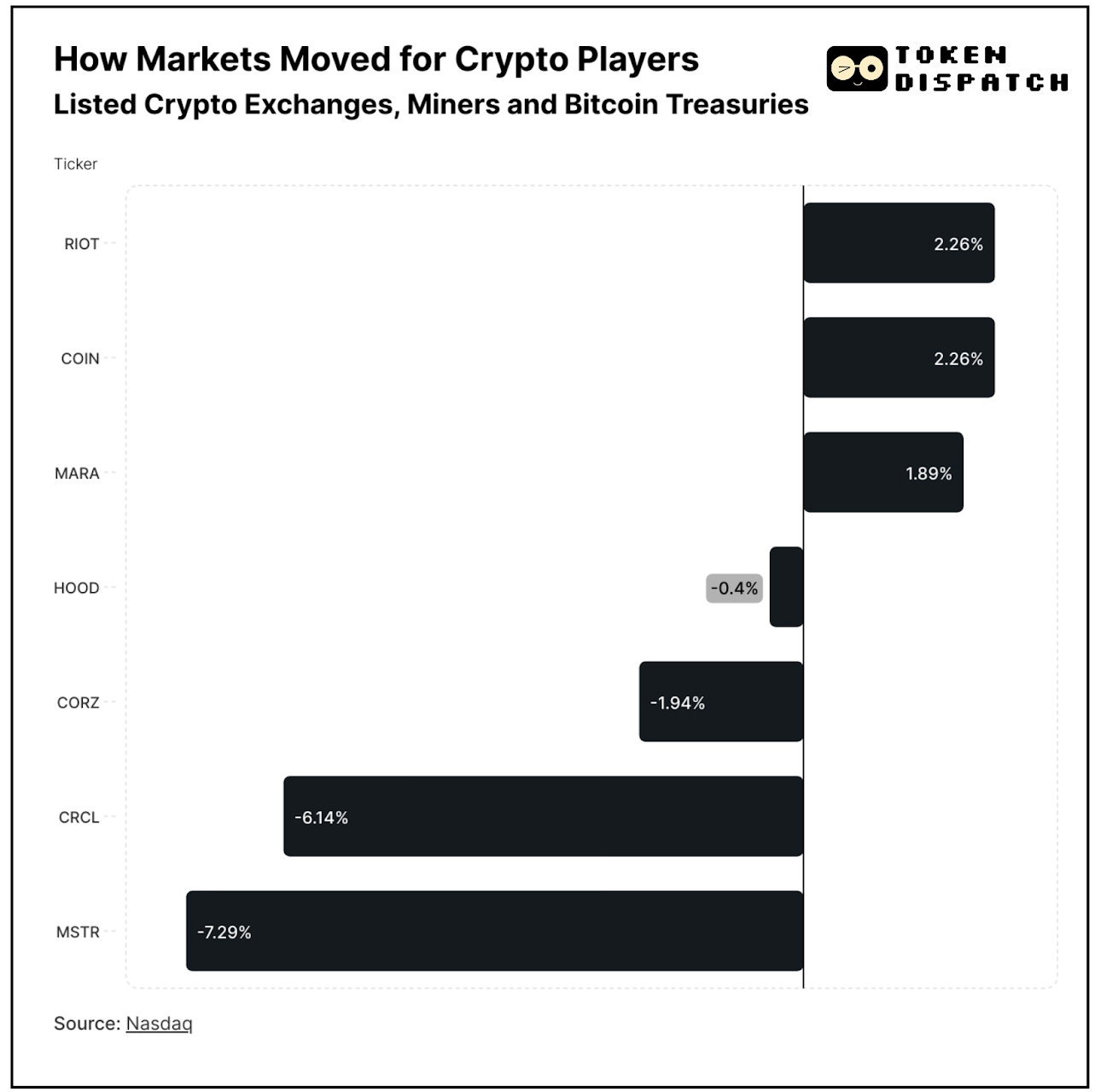

Crypto-exposed equities experienced a rollercoaster week, with most names following Bitcoin's volatility while some standout performers bucked the trend through company-specific catalysts.

MicroStrategy (MSTR) led the decline with a 7.29% drop, as the company's leveraged Bitcoin exposure worked against it during the correction. MSTR's premium to its underlying Bitcoin holdings compressed as investors reassessed risk appetite alongside BTC’s price drop.

Circle (CRCL) extended its retreat from June highs, falling 6.14% during the week.

The week's standout performers demonstrated the benefits of diversified business models. Riot Platforms (RIOT) and Coinbase (COIN) both posted modest gains of 2.26%. Riot's performance reflected operational improvements and efficiency gains, while Coinbase benefited from increased trading volumes during the week's price swings. The exchange's ability to generate revenue from volatility in both directions provided some insulation from Bitcoin's directional moves.

Robinhood (HOOD) showed surprising weakness with a 0.4% decline, despite typically benefiting from increased retail trading activity during volatile periods.

Surfer 🏄🏾♂️

Institutional investors accounted for 75% of Bitcoin trading volume on Coinbase, a level historically followed by BTC price gains within a week. Analysts say surging institutional demand and expectations of U.S. rate cuts are setting the stage for a bullish move in Bitcoin.

The US federal debt has hit a record $37 trillion, prompting analysts to predict that increased money supply and looming quantitative easing could drive Bitcoin prices to $132,000 by the end of 2025. Rising deficits and inflation fears are expected to drive up demand for Bitcoin.

WiseLink has become the first Taiwan-listed company to invest in a Bitcoin treasury strategy, leading a $10 million convertible notes raise for Hong Kong-based Top Win International. WiseLink aims to integrate Bitcoin reserves into its cross-border financial operations.

Central Asia's Crypto Mining Heist

There’s a different kind of Bitcoin story going on in Central Asia alongside the rollercoaster rise and fall in the rest of the world. The old-fashioned electricity theft kind.

Tajikistan just reported that illegal crypto miners caused $3.52 million in damages during the first half of 2025 by stealing electricity, with authorities discovering 135 mining rigs hidden inside residential buildings like some kind of digital speakeasy operation.

But Tajikistan's troubles pale compared to Kazakhstan, where a two-year electricity theft scheme netted miners $16.5 million worth of stolen power – enough to supply a city of 50,000-70,000 people. The scheme's mastermind used the proceeds to buy two apartments and four cars.

What's driving this underground mining boom? After China's 2021 mining ban, displaced miners have been flocking to Central Asia for its cheap energy and "inconsistent enforcement" – diplomatic speak for "authorities can't catch everyone."

That's it for this week's Mempool edition.

See ya next Monday.

Until then …stay sharp,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.