One thing I learned about crypto trading in my trading years in 2024 is that success depends on processing information faster than everyone else, but the amount of information keeps exploding.

Token launches happen daily. News breaks every hour. Social narratives shift too fast. On-chain activity generates massive amounts of data that are impossible to parse manually. Whale wallets move billions without explanation.

Most traders either get overwhelmed and make emotional decisions, or they oversimplify and miss critical signals. You're either drowning in data or flying blind.

AI trading tools helped, but they're either generic chatbots that give the same analysis to everyone, or complex platforms that require a PhD to understand.

Edgen changed the game.

Edgen analyses the data and also understands context. It knows that a token trending on Twitter means nothing if whale wallets aren't buying. It knows that massive on-chain volume without social buzz often signals institutional accumulation. It knows that your specific trading style and risk tolerance should shape every recommendation.

The platform just secured backing from Framework Ventures and North Island Ventures, processed over a billion data points during its closed beta, and is now processing millions of queries daily.

It's solving the core problem that kills most crypto traders: information overload in a market that never stops moving.

How Edgen Works

Each tool in Edgen solves a specific pain point that crypto traders face daily, and they all work together instead of forcing you to jump between different platforms.

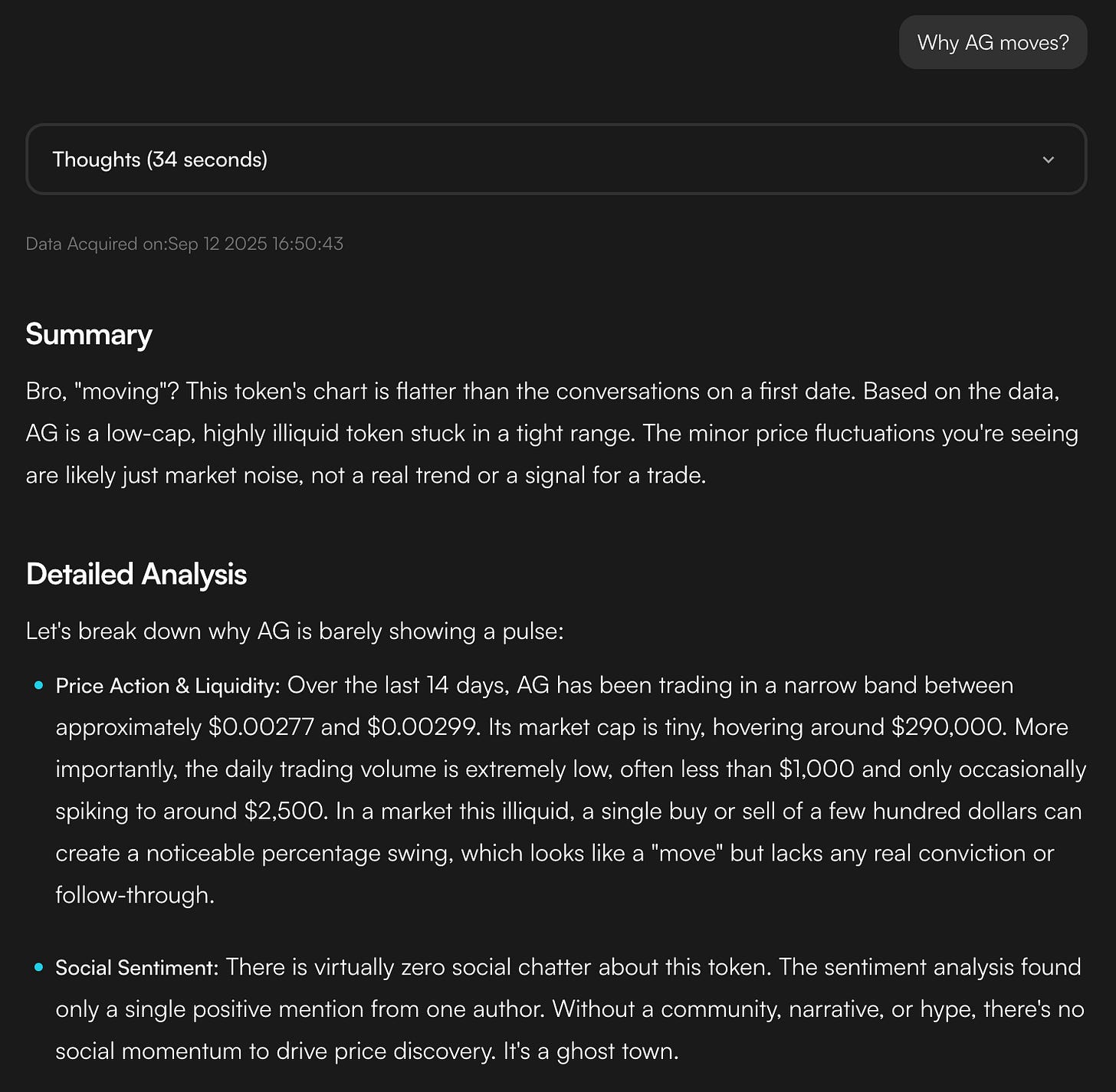

Crypto GPT

This is my most favourite part as a crypto researcher. Edgen reads everything, watches every chart, and monitors every smart wallet 24/7. You just ask questions in plain English and get instant, actionable answers.

I tested the same and apart from being called “bro” (little offended), it’s got solid insights:

Then I asked a simple question about Solana's price action. Instead of a brief response, it delivered a multi-layered analysis covering technicals, sentiment, and on-chain data.

Edgen is powered by EDGM (Efficient Decision Guidance Model). Unlike typical AI that tries to be a jack-of-all-trades, EDGM acts like a smart traffic controller. When you ask "Should I buy Solana right now?", it doesn't just throw generic analysis at you. It pulls your trading history, checks current market conditions, analyses social sentiment, reviews on-chain metrics, and combines everything into an answer tailored specifically to your situation.

Instead of spending 30 minutes reading documentation and forum posts, you get conversational explanations. It pulls from real-time data, so when you ask about a token's recent performance, you're getting current information, not outdated analysis.

The key difference from generic AI tools? Context.

It knows you're asking because you're considering a trade, so it includes relevant timing and risk factors instead of just giving you textbook explanations.

What that looks like in practice? Ask Edgen "Why is everyone talking about liquid staking derivatives?" and within seconds you get a clear explanation of what they are, why they're trending, which tokens are benefiting, and whether the hype matches the fundamentals..

Ask "Compare SOL vs SUI for swing trading" and it analyses technical patterns, social momentum, on-chain activity, and recent news to give you a side-by-side breakdown with specific entry/exit recommendations.

The system connects to live data feeds across exchanges, social platforms, and blockchain networks. So when it tells you something, it's based on what's happening right now, not what happened yesterday.

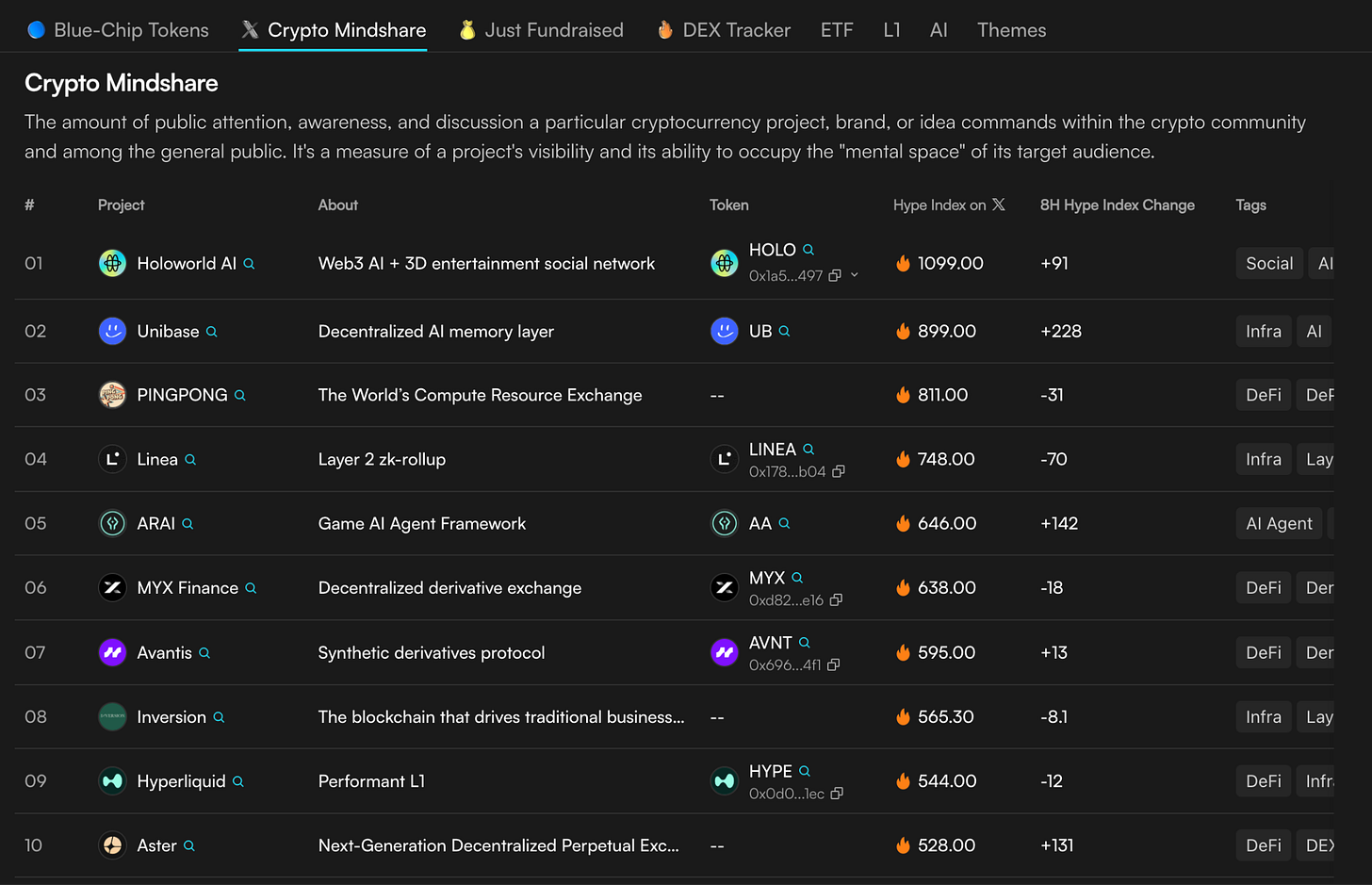

Radar

This is your early warning system. It continuously scans for momentum across different market segments - newly funded projects, trending memes, blue-chip movements, social media buzz - and presents everything in a clean dashboard.

The genius is in the categorisation. I love Edgen for this one. Instead of random token lists, you get organised aisles.

Just Fundraised shows projects that recently closed funding rounds with details on investors and amounts

Crypto Mindshare tracks what's dominating social conversations

Blue-Chip Tokens monitors major asset movements

Themes follows the latest narrative-driven plays

DEX Tracker shows DeFi protocol performance

Each category updates every 5 minutes, so you're seeing shifts as they happen. When a previously unknown token suddenly appears in multiple categories, that's usually when smart money is moving.

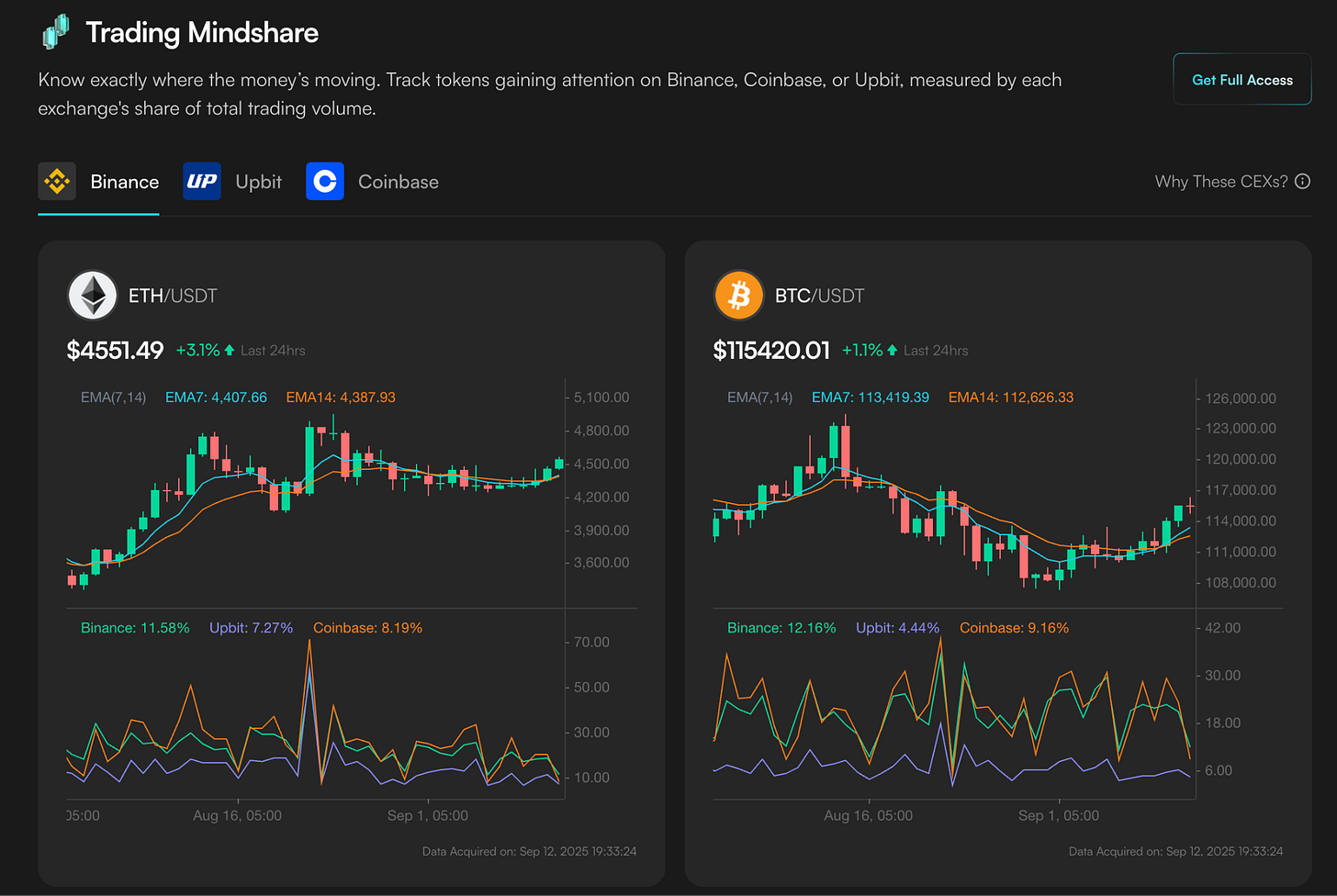

Trading Mindshare vs Crypto Mindshare

This the feature for avoiding bad trades. Crypto Mindshare shows what everyone's talking about on social media. Trading Mindshare shows what's actually being traded with real money on exchanges.

A token trending on Twitter but with no trading volume? Probably just influencer hype. A token with massive exchange volume but little social buzz? Could be institutional accumulation happening quietly.

This helps you avoid the classic retail trap of buying into social media excitement right before the dump, or missing opportunities because something isn't getting mainstream attention yet.

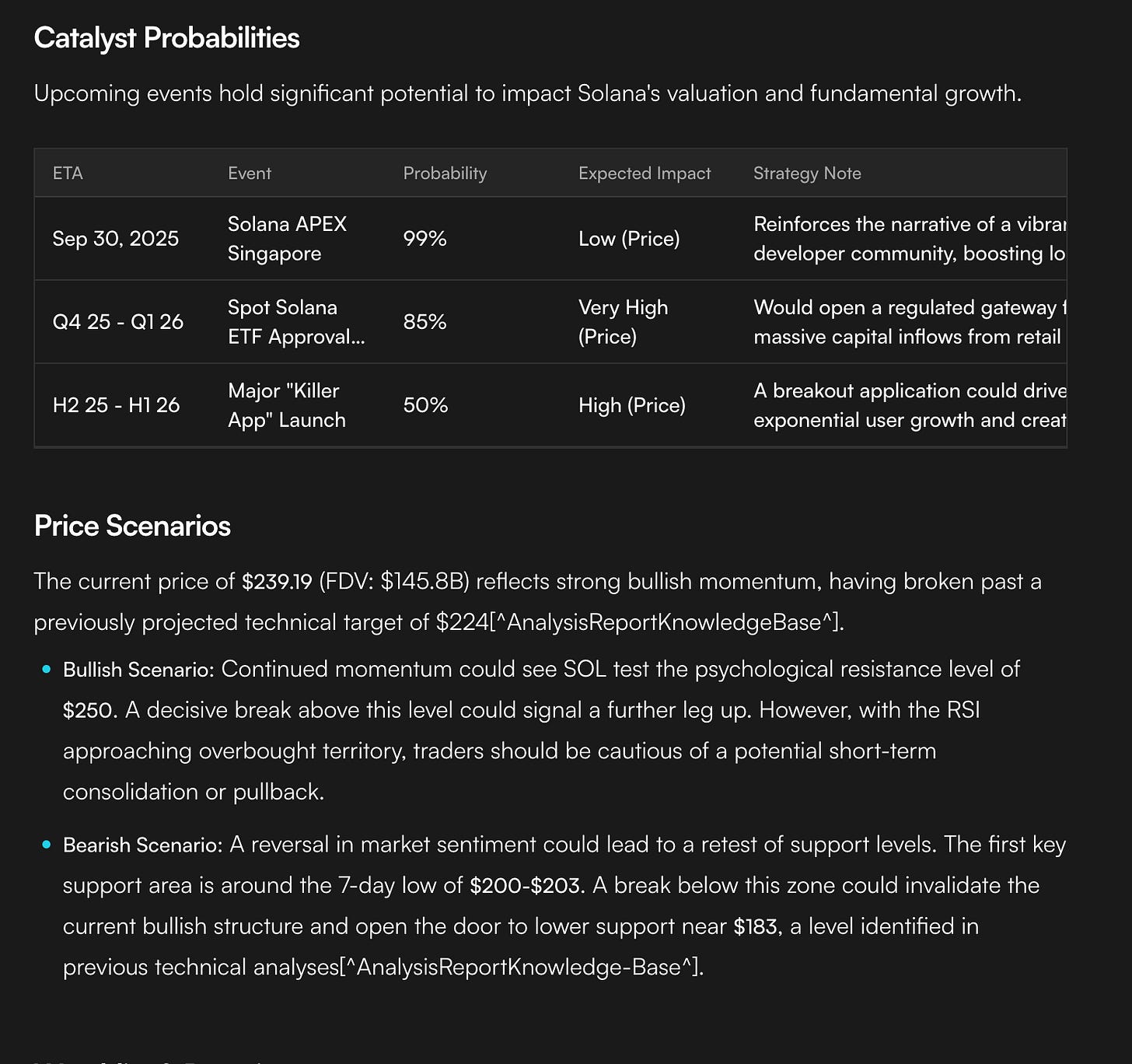

Price Prediction

Unlike traditional technical analysis tools, Edgen's price forecasting combines chart patterns with social sentiment, on-chain activity, and market context. You get short and medium-term predictions with clear explanations of the reasoning.

For example, it might show a bullish technical setup but warn that negative social sentiment could invalidate the pattern. Or it might identify strong fundamentals that could overcome weak technical signals. The predictions come with confidence levels and key factors to watch.

It explains the "why" behind each forecast. Instead of blind faith in AI predictions, you understand the logic and can decide whether it makes sense for your strategy.

Technical Signals

This identifies specific trading setups like triangles, flags, breakouts, and support/resistance levels. It factors in crypto-specific dynamics.

Traditional technical analysis often fails in crypto because social sentiment can override technical patterns, or on-chain activity can signal moves that charts don't show. Edgen's signals incorporate these factors, giving you setups that are more likely to actually work in crypto markets.

Each signal comes with clear entry and exit points, stop-loss recommendations, and confidence ratings. You're not guessing about timing or risk management.

360° Report

This is where all the tools combine. Pick any token and get a comprehensive analysis covering fundamentals (tokenomics, team, roadmap), technicals (chart patterns, support/resistance), social sentiment (community activity, influencer mentions), and on-chain metrics (whale movements, transaction patterns).

Everything gets scored and synthesised into an AI recommendation with specific reasoning. Instead of piecing together information from multiple sources, you get a complete picture that helps you make informed decisions quickly.

The report updates in real-time, so you're always working with current information. When news breaks or market conditions change, the analysis adjusts automatically.

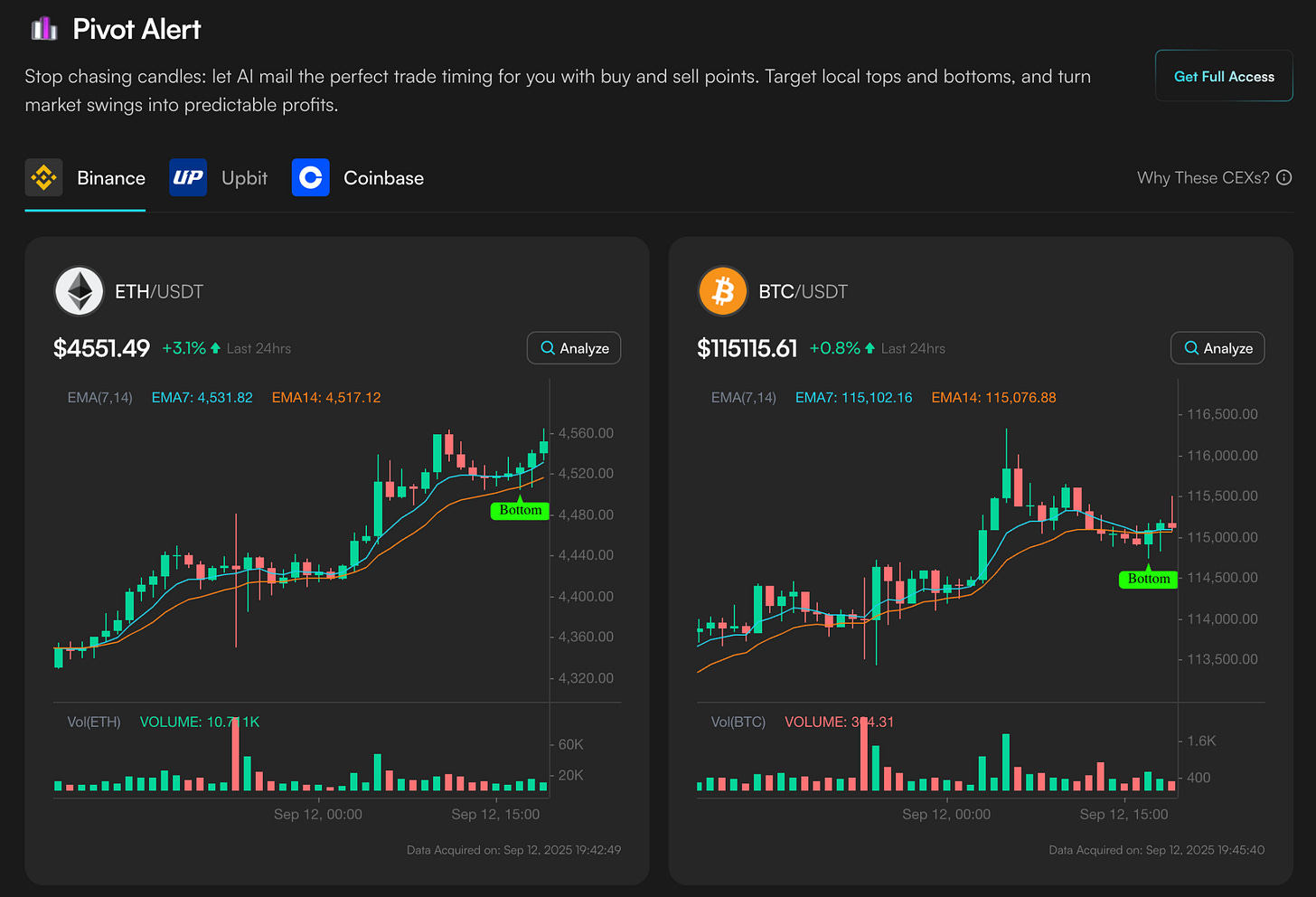

Pivot Alert

This identifies potential local tops and bottoms - the points where trends might reverse. It combines technical indicators with social sentiment shifts and on-chain activity to flag when momentum might be changing.

For example, it might detect that a token is approaching technical resistance while social sentiment is peaking and whale wallets are starting to sell. That combination suggests a potential top worth paying attention to.

The alerts help with both entry timing (buying near bottoms) and exit timing (selling near tops), which is often more important than picking the right tokens.

Comparison Tool

When you're choosing between similar tokens or trying to decide which sector to focus on, this tool does side-by-side analysis across all dimensions - fundamentals, technicals, social metrics, and on-chain data. Instead of endlessly comparing options, you get a clear assessment of which choice makes more sense for your situation and timeline.

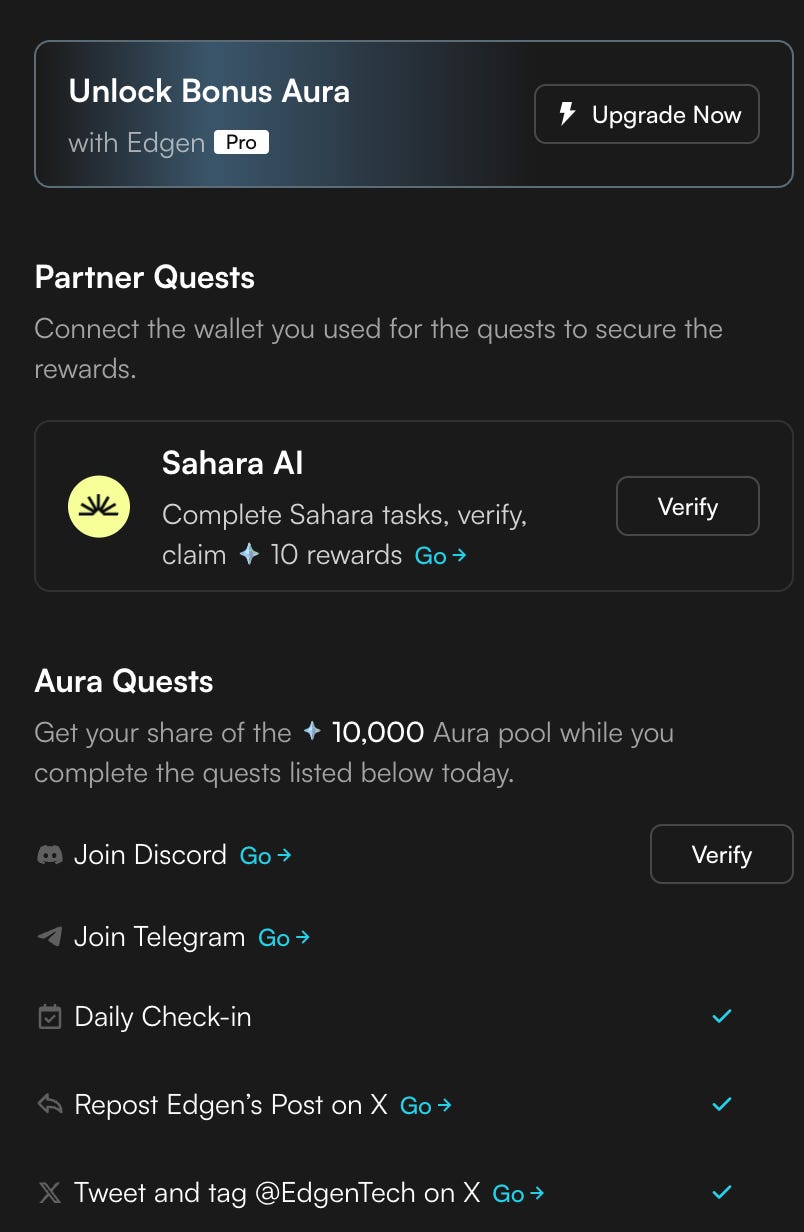

The Aura System

Edgen doesn't just consume information, it rewards people who contribute valuable insights through something called the Aura system.

When you make a good call or share useful analysis, you earn Aura - a reputation score that proves your market insight. It's not a token you can trade; it's a permanent record of your analytical track record. High-Aura users get more visibility, their insights carry more weight, and they help train the AI to be smarter.

This creates a fascinating feedback loop. Good analysts share their insights, earn recognition through Aura, attract followers, and their successful calls help improve the AI for everyone. The platform gets smarter while rewarding the people who make it smarter.

For example, if you spot an undervalued DeFi protocol before others and post analysis that proves accurate, your Aura score increases. Future insights you share get prioritised in feeds and carry more credibility. Over time, this builds a meritocratic system where the best analysts naturally rise to the top.

The Integration Advantage

The power comes from how these tools work together. You might start by scanning Radar for trending opportunities, use Crypto GPT to understand what you're seeing, check Trading vs Social Mindshare to verify the momentum is real, run a 360° Report for complete analysis, and use Technical Signals to time your entry. Apart from these there are very interesting Tweet Ghostwriter and BS-Generator in the Egentic marketplace.

This workflow used to require multiple subscriptions, countless browser tabs, and hours of manual correlation. Now it happens in one platform with AI doing the heavy lifting of connecting all the dots.

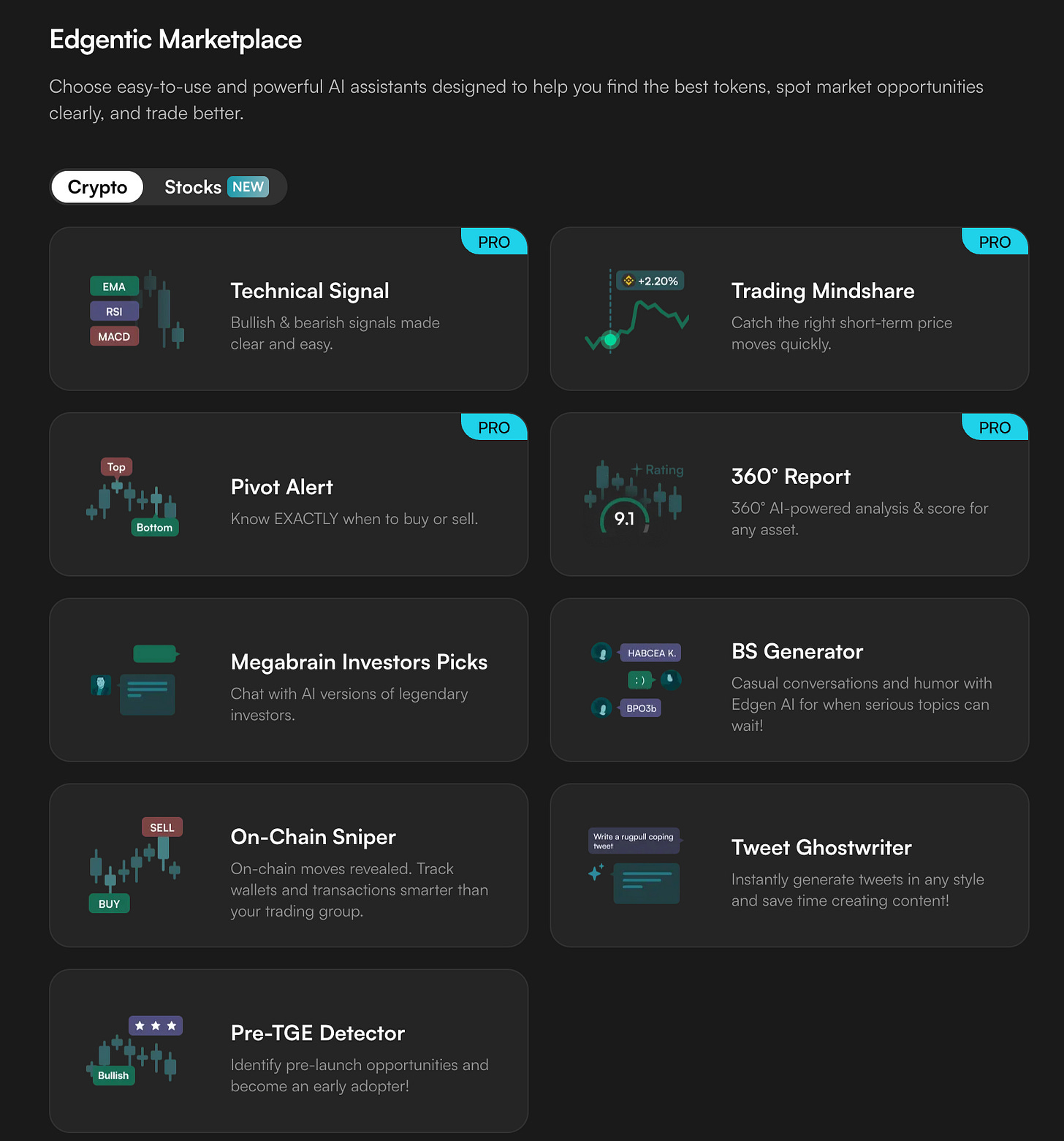

The Edgentic Marketplace

The long-term vision goes beyond Edgen's built-in tools. They're building a marketplace where developers can create specialised AI agents for specific trading strategies or market niches.

Agents that specialise in airdrop farming, MEV opportunities, governance token analysis, or specific sectors like gaming tokens or DeFi protocols. Third-party developers could build these agents on top of Edgen's infrastructure, and users could subscribe to the ones that match their trading style.

This turns Edgen from a single platform into an ecosystem where the best analytical tools naturally emerge and compete. Instead of being locked into one company's vision of what traders need, you get access to innovations from developers worldwide.

Why This Matters Right Now

Three things are converging that make Edgen's timing perfect.

Information overload has reached a breaking point. The amount of data you need to process to make informed crypto decisions has exploded. Token launches happen daily. News breaks constantly. Social narratives shift by the hour. On-chain activity generates massive datasets that are impossible to parse manually. Most traders either get overwhelmed and make emotional decisions, or they oversimplify and miss critical signals.

AI has finally become useful for real-world analysis. Early AI trading tools were either too generic or too complicated. They'd give you the same analysis everyone else was getting, or they'd require advanced technical knowledge to use effectively. Recent advances in AI allow for contextual, personalised analysis that actually helps with decision-making.

The smart money is already using these tools. Professional traders and funds have been using sophisticated analytics platforms for years. The gap between institutional capabilities and retail tools has been widening. Edgen democratises institutional-grade analysis, giving individual traders access to the same level of market intelligence.

Let me show you how this actually works for different types of traders.

For narrative hunters: Use Crypto Mindshare to spot tokens gaining social traction, cross-reference with Trading Mindshare to see if real money is following the hype, then use Price Prediction and Technical Signals to time your entry. When major news breaks about AI or gaming or whatever the hot narrative is, you can quickly identify which tokens are benefiting and whether the momentum is sustainable.

For fundamental analysts: Start with the Fundraise Tracker to find newly funded projects, use Crypto GPT to analyse their tokenomics and roadmap, then use the Comparison tool to evaluate them against competitors. The 360° Report gives you a complete picture including technical setup and market timing.

For technical traders: Technical Analysis provides charted strategies with clear entry/exit points, Technical Signals identifies specific patterns, and Pivot Alert flags potential reversal points. You also get social sentiment and on-chain context that can validate or invalidate technical setups.

The key insight is that modern crypto trading requires combining multiple analytical approaches. Pure technical analysis misses narrative-driven moves. Pure fundamental analysis misses short-term opportunities. Social sentiment analysis alone leads to buying tops. Edgen combines all these approaches intelligently.

What Makes This Different From Other AI Tools

Most AI trading tools fall into two categories: generic chatbots that give surface-level analysis, or complex platforms that require advanced knowledge to use effectively.

Edgen solves both problems. It's sophisticated enough to provide institutional-quality analysis, but simple enough that you can get value from it immediately. The AI understands context - your trading history, market conditions, and the specific question you're asking - rather than giving generic responses.

It's designed specifically for crypto markets. It understands that crypto trading is different from stock trading. Social sentiment matters more. On-chain data provides unique insights. Market cycles are faster and more volatile. Traditional financial analysis often doesn't apply.

The platform also maintains transparency about its analysis. Instead of black-box recommendations, you see the reasoning behind every insight. This helps you learn and develop better intuition over time, rather than becoming dependent on the AI.

That’s it for the Sunday. Will come to you with another cool product next week.

Until then …stay curious.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.