ETFs - BTC v ETH 🧐

First week in, look at Ethereum ETFs and how do investors approach them. Mystery movement of ETH whale - 92k ETH. Justin Sun wants China to rethink Bitcoin policies. Will Democrats do a crypto reset?

Hello, y'all. Suggest a song for the Monday blues, please.

After that, just play the 👉 Music Nerd quiz game 🎵

After a long approval process, spot Ethereum ETFs are now on.

Institutional interest? Yes

Mainstream acceptance? Yes

Massive outflows? Yesss

Read: Ethereum ETFs ▶️

Grayscale's ETHE ETF is facing a serious cash crunch.

Money has been flooding out of Grayscale's fund since the launch.

We're talking over $1.5 billion bucks already.

Why the exodus?

ETHE's 2.5% fee is significantly higher than the 0.19% to 0.25% charged by its competitors.

Newer ETFs like BlackRock's ETHA and Bitwise's ETHW are offering lower fees and have seen substantial inflows.

A recent drop in Ether's price might have also influenced investor decisions.

Running on empty?

At this pace, ETHE could run out of Ether within weeks.

Result?

Downward pressure on Ether's price as Grayscale might be forced to sell off its holdings to meet redemption requests.

While Grayscale's other Ethereum ETF, Grayscale Mini Trust Ethereum ETF (ETH), has seen some inflows - 164 million.

It's not enough to offset the massive outflows from ETHE.

Meanwhile, other ETFs, especially BlackRock's, are raking in the dough.

Read: Ethereum ETFs: All You Need To Know 🛎️

Ethereum ETF implications on the ecosystem

Self-Custody vs. Institutional Investing: The ETF launch has highlighted the complexities of self-custody.

While institutions prefer the convenience and security of ETFs, individual investors might still find value in direct ownership for DeFi participation.

Institutions prefer ETFs: They value the ease of investment, professional management, and regulatory clarity that ETFs provide.

Individual investors: Some might still prefer self-custody to participate in DeFi (decentralised finance) applications, which often require direct interaction with the blockchain.

Ethereum's unique value proposition: Ethereum's role as the foundation for a thriving ecosystem of decentralised applications gives it a distinct advantage.

The ETF's influx of capital could supercharge this ecosystem. Benefit Ethereum-based tokens and Layer 2 solutions.

Gas fees and network congestion: Increased Ethereum activity due to ETF inflows = higher gas fees.

This might temporarily divert some activity to other blockchains.

But Ethereum's dominant liquidity is likely to retain its position as the primary platform.

Crypto market remains healthy: Despite a price consolidation in Q2, the broader crypto market remains healthy.

Trading volumes, new investor inflows, and regulatory progress. All good.

Says a new report by Coinbase and Glassnode.

What about Ethereum?

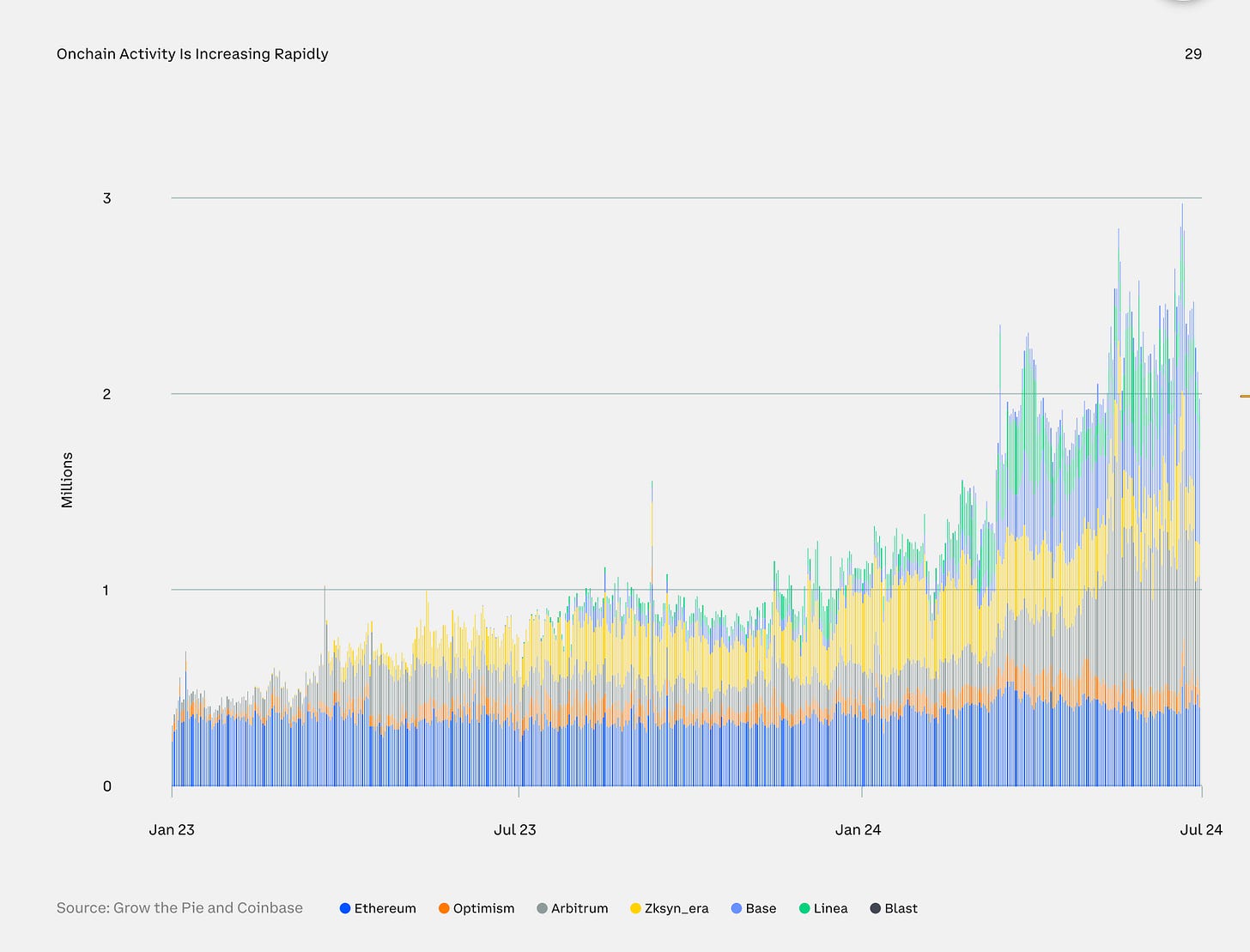

Active users are surging: The number of daily active addresses on Ethereum and leading Layer 2s has surged by 127% this year.

Most of this increase comes from the booming popularity of Layer 2 solutions.

More transactions, lower fees: The number of transactions on the network has climbed by 59% in the second quarter, while average fees have plummeted by 58% due to Ethereum's Dencun upgrade.

Ethereum ETF vs. Bitcoin ETF

While the initial launch day for Ethereum ETFs saw a decent inflow of over $100 million.

In the first four days Ethereum saw 1.5 billion outflows.

In the first four days Bitcoin counterpart saw 1.2 billion inflows.

Its two different stories

Spot Bitcoin ETFs undeniably caused a stir.

While the inflows were substantial, the bulk of the money didn't come from the institutional giants that were initially expected to drive the market.

Instead, it was primarily retail investors and existing crypto holders who jumped on the bandwagon.

Ethereum, while undeniably important in the crypto ecosystem, might not have the same broad appeal as Bitcoin.

Additionally, with a variety of existing options for institutional investors to gain Ethereum exposure, the allure of spot ETFs might be less pronounced.

Bitcoin's price dropped significantly after the ETF launch.

Ethereum, conversely, has shown more resilience, with a smaller price drop despite the outflow of funds.

Read: Bitcoin's burden of ETF 🤔🏋️♀️

Why the disparity?

Market sentiment: Bitcoin might still hold a stronger position as a "digital gold" narrative in the minds of investors.

Grayscale conversion: The conversion of Grayscale's Bitcoin Trust into a spot ETF likely contributed to the initial surge in Bitcoin ETF inflows.

Ethereum's role: While Ethereum is crucial for the crypto ecosystem, its role as a platform for decentralised applications might make it less attractive for some traditional investors compared to Bitcoin.

In The Numbers 🔢

92,000 Ethereum

That’s worth $287 million - just stirred from its seven-year slumber.

Moved for the first time.

Who’s the owner?

Initial theories suggested the funds might belong to the Ethereum Foundation, given that the wallet originally received ETH from them back in 2015.

The Foundation has officially denied any connection to the wallet - Arkham Intel.

What’s Coming This Week?

FOMC interest rate decision: The Federal Reserve will announce its decision on interest rates on July 31st.

Jupiter Token supply proposal: The Jupiter DAO will vote on a proposal to reduce the JUP token supply by 30% this Thursday.

This could potentially increase JUP's value but might also lead to short-term sell-offs.

Major token unlocks: Wormhole (W), Optimism (OP), and Sui are among the tokens with significant unlocks this week.

Major launches and updates

pSTAKE BTC liquid staking v1: Launching on July 29, this platform allows users to stake BTC and earn rewards without losing liquidity.

Router chain mainnet: Set to launch on July 30, this layer-1 blockchain aims to connect over 150 blockchains.

Drift protocol prediction market: Launching soon on Solana, this platform will offer users a new way to participate in prediction markets.

Eclipse mainnet: Set to launch this week after a successful audit, this Ethereum L2 solution aims to be the fastest and most universal.

Block That Quote 🎙️

Founder of TRON, Justin Sun

“Competition between China and the U.S. in Bitcoin policy will benefit the entire industry.”

Justin Sun is urging China to step up its Bitcoin game and embrace crypto policy reforms.

Why the sudden push? It all boils down to competition with the US.

With former President Trump potentially returning to office, his pro-Bitcoin stance could see the US emerge as a major crypto player.

Read: Hello Bitcoiners 👋

China remains skeptical.

Since 2017, they've cracked down on crypto trading.

But are they gonna soften their hearts?

Read: Chinese Checkers 🧲

Sun scored a victory in a Chinese court recently.

After a two-year legal battle, a Chinese court has ruled in favour of Sun, clearing him of false accusations levelled by the Chongqing Business Media Group.

The media outlet had accused Sun of serious financial crimes without providing any evidence.

The court ordered the media group to retract the false claims and publicly apologise.

Will Democrats do a Crypto Reset?

Some Democratic members of Congress just sent a letter to the DNC, pushing them to get on board with pro-crypto policies.

Rep. Wiley Nickel (D-NC) was at the Bitcoin Nashville conference on Saturday.

"We had a total reset of the presidential election," …"we’ve been working hard to get a reset from Vice President."

According to Rep. Nickel, Vice President Kamala Harris gets crypto and might make it a key issue in her White House campaign.

Who wrote the letter the letter to DNC? 14 House members, including Representatives Ro Khanna, Wiley Nickel, and Ritchie Torres, and 14 candidates running in various districts across the country.

“We believe this technology is non-partisan, and the Democratic Party should also champion these innovations to help reaffirm the US's position as the leader in the global digital economy.”

Harris's advisors are also making moves to fix the strained relationship. They're reaching out to top crypto companies like Coinbase, Circle, and Ripple Labs.

The Surfer 🏄

Wall Street's Cantor Fitzgerald is launching a bitcoin financing and lending business with an initial $2 billion in lending. CEO Howard Lutnick announced the plan at the Bitcoin Conference, stating they will increase lending in $2 billion increments as needed.

The University of Wyoming is launching the Bitcoin Research Institute in August, part of its College of Arts and Sciences. Bradley Rettler, a Bitcoin activist and Associate Professor, will direct the institute and emphasizes the need for better research in the field.

Ex-FTX exec Ryan Salame seeks a 45-day delay in reporting to prison due to a dog attack that left him with facial injuries. He was originally scheduled to begin his 90-month sentence on August 29 for misusing FTX user funds.

This is The Token Dispatch 🙌 and you can find all about us here 🤟

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋