Ethereum ETFs Day 🎉

Spot Ethereum ETFs on the way, with approval for 8 applications. OKX predicts half-a-billion inflows in first week. Bitcoin ETFs see 9th week of inflows. US passes bill banning issuance of CBDC.

Hello, y'all. Kabosu, the Doge meme dog has crossed the rainbow bridge at 17.

Let's celebrate this good girl who went from derpin' for the camera to becoming a crypto icon.

Do try the Music Quiz Game 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

Spot Ethereum ETFs are here.

The SEC has officially approved 8 applications.

All of them can now list Ether ETFs on US exchanges.

This allows investors to gain exposure to Ether's price movements without directly buying and holding the cryptocurrency.

Not trading tomorrow

While the basic framework is approved, these ETFs can't start trading yet.

S-1 documents are need to be approved to enable trading.

Each issuer still needs to get their specific ETF details okayed by the SEC.

This could take days, weeks, or even months.

Also, one application (Hashdex) didn't get the green light yet, and it's unclear if they'll be approved later.

VanEck immediately drops new Ethereum ETF ad

Ethereum is not a security (Loud and clear!)

A week ago, most experts thought approval was unlikely before a May 23rd deadline.

Why? To everyone in the industry, the SEC considered Ether as a security.

Not anymore: This view is based on the fact that approved ETFs hold Ether directly, seen as a commodity-like asset.

A recent lawsuit by Consensys against the SEC, claiming they secretly considered ETH a security, seems like a non-issue now.

By approving these ETFs, the SEC is implicitly saying ETH itself isn't a security.

This is a big win for crypto.

Staking still a target? While Ether itself appears safe, staking could still be in the SEC's crosshairs. Regulators might differentiate between holding Ether and earning rewards through staking, potentially classifying staked ETH as a security.

To get approval faster, ETF issuers removed language about staking customer ETH.

The SEC views staking services as unregistered securities offerings.

That going to be a problem?

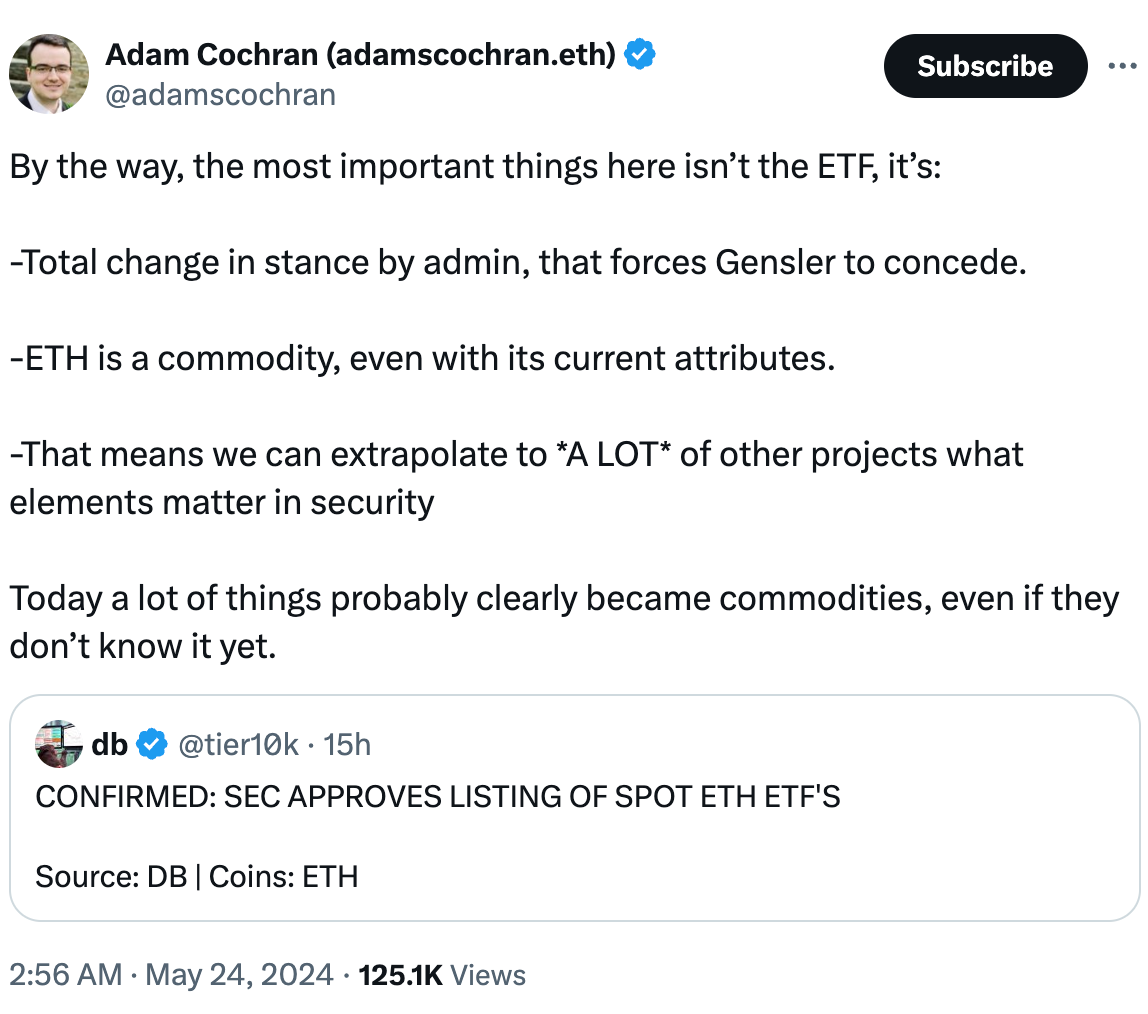

Impact on Other Tokens? Some believe this approach could extend to other crypto projects. If the features that make Ether a commodity apply to other tokens, they too might not be considered securities.

Gensler don’t approve

The key detail buried in the SEC's order approving spot Ethereum ETFs is this: the decision was made by the agency's Trading and Markets Division, not the full commission.

What does this mean? The SEC staff, not Chair Gary Gensler or the other commissioners, decided to approve the ETF forms.

When Bitcoin ETFs were approved earlier this year, the commissioners did vote, with a clear split along party lines.

The price isn't exploding yet

Ethereum is now at $3,669 with a 4% dip, despite the recent rally and the 25% shoot up in the past week.

Bitcoin dropped below $68K.

Crypto liquidations?

"Buy the rumour, sell the news". Many investors might have already bought in anticipation of the approval, causing a muted reaction to the actual news.

Bitcoin followed the same pattern.

A Boon for Solana Too?

This raises hopes that other Ethereum competitors like Solana could also be seen as commodities.

The approval of a spot Ether ETF could pave the way for similar treatment for Solana (SOL), according to a Bernstein report.

Brian Kelly, a CNBC Fast Money trader argues Solana's position as a "big three" crypto makes it a natural candidate.

But, Nate Geraci, president of The ETF Store pointed out that no spot Solana futures product exists yet, which is often seen as a prerequisite for an ETF. The SEC's past treatment of Solana in lawsuits could complicate approvals.

Analyst James Seyffart agrees, predicting high demand for a Solana ETF.

Some, like Cinneamhain Ventures partner Adam Cochran, believe Litecoin or Dogecoin are more likely next.

Block That Quote 🎙️

Bitwise Invest.

"It’s a historic move that puts the spotlight on the second-largest crypto asset."

The context? Spot Ether ETF approval.

Industry and crypto twitter reactions

"We expect the improved political backdrop will lead to further victories for digital asset investors and developers, via new laws and in the courts, that draw investment to bitcoin, ethereum and other open-source blockchain software" - VanEck's Head of Digital Assets Research Matthew Sigel.

“Study never giving up” - VanEck.

"ETH is effectively deemed a commodity as we’ve always known it to be" - Coinbase’s Paul Grewal.

"While Consensys welcomes today’s decision to approve ETH Spot ETFs as a step in the right direction, this seemingly last minute approval is yet another example of the SEC’s troublesome ad hoc approach to digital assets," Consensys.

Crypto twitter is cheerful too!

All That ETF 🔔

Bitcoin ETFs have been seeing inflows throughout the week.

On May 23, 2024, Bitcoin ETFs experienced a total net inflow of $108 million, marking the ninth consecutive day of inflows.

In the Numbers 🔢

$500 million

That's the amount OKX, a crypto exchange, predicts will pour into Ethereum ETF funds in the first week alone.

“It’s probably just as, if not more, important as the Bitcoin ETF approval,” Lennix Lai, OKX’s global chief commercial officer said.

Just like Bitcoin ETFs fuelled a rally, Ethereum ETFs are expected to do the same, potentially pushing Ether prices to $6,600.

“The potential approval of Ethereum to be traded as a proxy under a traditional framework could bring about the next wave of institutional demand.”

US House Passes Bill Banning Federal Reserve From Issuing a CBDC

The US House of Representatives voted mostly along party lines to halt the Federal Reserve's efforts to create a CBDC.

Votes? 213 Republicans and 3 Democrats in favour, while 192 Democrats opposed the bill.

Contrasts sharply with a vote the previous day on the FIT21.

The bill, known as the CBDC Anti-Surveillance State Act, was introduced by Majority Whip Tom Emmer (R-Minn.).

Republican Concerns: Republicans argue that a US CBDC could potentially be used to monitor and control American citizens.

Democratic Response: Democrats countered during the debate, saying these concerns were exaggerated and that banning a CBDC would hinder public sector innovation and research.

Read this: Crypto Wins. FIT21 IS A GO 🔝🤝🏻

The Surfer 🏄

Polymarket faced backlash over the outcome of a $13 million bet on the approval of an Ethereum ETF. The bet resolved to a "Yes" after the SEC greenlit 19b-4 filings for multiple Ether ETFs. Those who bet against the approval argue that the bet is not over yet (wait for Form S-1 they say).

Binance's trial in Nigeria has been postponed to June 20 due to the serious illness of Tigran Gambaryan, the head of financial crimes compliance. Gambaryan is in need of comprehensive medical attention and received intravenous treatment for malaria.

Crypto influencer Ian Balina has lost a case against the SEC in a Texas district court. The court ruled that Balina broke US securities laws by offering and selling SPRK tokens.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋