Ethereum ETFs This Summer 🌞

SEC's Gary Gensler sees ETF S-1 approvals in summer 2024, but still won't call ETH a commodity. ETFs demand diminished without staking? Paradigm raises $850M venture crypto fund. Spot Solana ETF next?

Hello, y'all … ☀️😎⛱️ 🎶

Do try the Music Quiz Game 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

Yesterday was the US Senate Appropriations Committee hearing.

What? Committee discussion for the fiscal year 2025 budget requests for the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

These are interesting debates.

Basically, you make a case for why you need what you asking - WATCH.

Demand for 2025 fiscal year, which begins on Oct 1, 2024.

SEC Chair Gary Gensler - $2.6 billion.

CFTC Chair Rostin Behnam - $399 million.

Why the difference in the budgets? Well, SEC has the larger spread with the public securities markets, which dwarfs the futures markets that the CFTC regulates.

So, come to the point? Gary Gensler dropped a little bombshell.

It's almost Ether ETF approval time.

“Individual issuers are still working through the registration process. That’s working smoothly. I would envision sometime over the course of the summer”

SEC has approved 19b-4 rule change filings for spot ETH ETFs from stock exchanges, but that individual issuers were still working through the S-1 registration forms from issuers.

Smooth. The final registration details are being ironed out.

Read: Ethereum to $5k?🪁

Crypto clarity? Not so much.

"Is Ether a commodity?" they asked.

Gensler probably thought about answering, then remembered his true calling - keeping everyone in suspense.

He didn’t say “yes” or “no”

Instead, he continued about ETFs.

“We actually, as an agency, did approve Ethereum [ETFs]. Partially — the approval is not complete.”

And said that while some crypto assets might fall under the CFTC's purview, those considered securities need to adhere to strict disclosure rules.

But someone gave them a solid "Yes."

Who? CFTC chief Rostin Behnam when asked whether ETH is a commodity.

This question is crucial. Why?

SEC will oversee securities tokens, while CFTC will have authority over others.

CTFC’s concern for overseeing crypto? Resources.

The CFTC has significantly fewer resources compared to the Securities and Exchange Commission (SEC).

This disparity is especially concerning as Congress aims to establish crypto-specific regulations.

Behnam claims his agency is "adequately equipped" for its current duties.

Not the add-ons.

“But if we were given authority over crypto markets, I would certainly expect there to be an increase in the budget.

We don't have those traditional regulatory tools – registration, custody, surveillance, oversight – that have really made American capital markets and derivative markets so strong.”

Lawmakers worry: Democratic Senator Dick Durbin of Illinois speaking during the hearing said that the CFTC “is biting off a hell of a lot more than it can chew” in wanting to regulate crypto markets.

When the Congress passed post-financial crisis legislation during the Obama years, the CFTC was given a big chunk of the swaps markets to oversee, without increasing its budget.

The SEC not just has a bigger budget, but is partly self-funded, as it collects fees from market participants that offset its cost to taxpayers.

Why the crypto industry prefer the CFTC? Many crypto players see the CFTC as a more lenient regulator compared to the SEC.

Behnam rejected the leniency claim in handling crypto industry.

“Over the past 10 years, we brought 135 crypto cases, we’ve brought in billions of dollars [in penalties], and we’ve successfully policed a market where we don’t have direct authority and jurisdiction.”

The recently passed FIT21 Act proposes the CFTC as the primary crypto regulator.

But the bill doesn't address the CFTC's funding limitations.

Read: Crypto Wins. FIT21 IS A GO 🔝🤝🏻

Block That Quote 🎙️

Ethereum co-founder and Consensys CEO, Joseph Lubin

“And so, we’re doing [crypto] maybe the hardest thing in software history because in terms of the number of potential threats, vulnerabilities, complexity, etc., it’s massive”

Lubin thinks crypto might be the most complex and vulnerable software ever built.

Compares it to the Wild West of early banking.

“One hundred and something years ago, the bank robbers would point out where the security vulnerabilities are. And there’s a sort of a back and forth between how you identify vulnerabilities, which we do very actively, with bounties and our own security audits.”

Hackers are constantly probing for weaknesses.

Lubin’s security tips

Social media is not your financial advisor. Don't take investment advice from random online personalities.

Never send crypto to strangers. This is a golden rule.

Beware of phishing links. Don't click on suspicious links in emails or websites.

Cold storage is king. If you're actively trading, keep your main crypto holdings offline in cold storage for maximum security.

ETH ETFs Demand Diminished Without Staking

Institutional investors might be cooling on spot ether ETFs in the US.

The reason? No staking.

Why was that removed? For easy approvals from the SEC.

Staking allows investors to earn passive income on their Ether holdings.

Without it, spot ether ETFs offer a less attractive return compared to directly holding Ether or using on-chain solutions for staking.

The investors will likely wait for staking to be included in spot ether ETFs before allocating funds. This is because they have the resources to access on-chain staking options that offer better returns.

JPMorgan agrees.

Their forecast expects spot Ethereum ETFs to attract up to $3 billion in net inflows over the rest of the year, but this figure could rise to $6 billion if staking is allowed.

That hasn’t swayed the HODLERS

Ether (ETH) experienced its second-biggest buying day ever by long-term holders on June 12th.

A good sign despite Ethereum struggling to get past $4k mark, and hovering around $3.5k over the last few weeks.

In The Numbers 🔢

$850 Billion

The amount Venture capital firm Paradigm has raised for early stage crypto projects

This is their third fund. In 2021, Paradigm set up a $2.5 billion venture fund to support crypto companies and protocols.

Matt Huang and Fred Ehrsam, who co-founded Coinbase alongside Brian Armstrong, founded the firm back in 2018.

Paradigm boasts an impressive portfolio of crypto companies - Coinbase, Fireblocks, Blast, Optimism, Uniswap, MakerDAO, Chainalysis, MoonPay and Gitcoin.

The firm also invested $278 million in the now-collapsed crypto exchange FTX and FTX.US, with Huang appearing as a witness in the trial of co-founder and former CEO Sam Bankman-Fried.

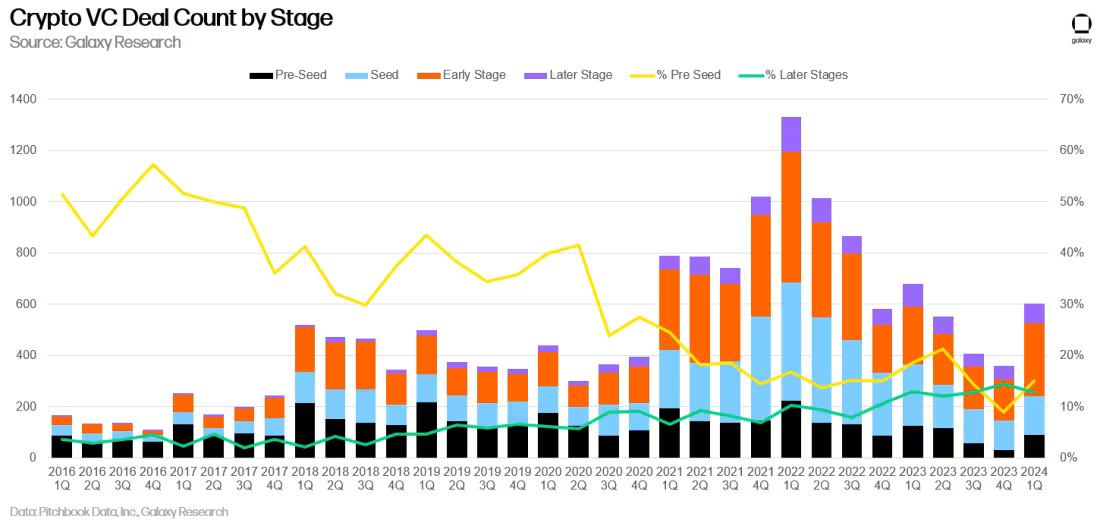

The broader trend?

Paradigm isn't the only VC firm bullish on crypto. Pantera Capital is also reportedly seeking over $1 billion for a new fund. Andreessen Horowitz (a16z) raised $7.2 billion in April 2024 to invest in several technology sectors, including crypto.

Venture capital is back pouring into crypto startups.

A Spot Solana ETF Next?

Industry leaders believe Solana could be next in line for an ETF.

SOL is the fifth largest crypto currency with a market cap of over $68 billion, once cannot deny it’s growing prominence in the cryptocurrency market.

Brian Kelly, a CNBC presenter: “You got to think about Solana as probably the next one. Bitcoin, Ethereum, and Solana are probably the biggest three in this cycle.”

Joe McCann, CEO at Asymmetric Hedge Fund: “I think Solana is probably going to be next… there is actually some interest in Solana, mostly because people missed the Ethereum trade in the last cycle.”

Regulatory Challenges

Absence of regulated futures contracts for SOL is a primary hurdle for Solana ETFs.

Futures contracts linked to Bitcoin and Ethereum are accessible on the Chicago Mercantile Exchange (CME), which played a pivotal role in securing SEC approval for ETFs tied to these cryptocurrencies.

James Seyffart (Bloomberg) points out: “[A Solana ETF] will happen within a few years of getting a CFTC regulated futures market … think a Solana ETF would see most demand vs other digital asset. But the SEC isn’t dancing around Solana’s status like they have Ethereum. Those lawsuits against Coinbase and Kraken and others flat out say ‘Solana is a security.'”

US elections could be a catalyser for altcoin ETF approvals

Bloomberg ETF analyst Eric Balchunas explains: “If Trump wins, we could see other coins as ETFs, in my opinion. He could go really liberal on crypto and support it with everything, as he has pledged. He could put in place a new SEC commissioner who doesn’t care about the process followed by the SEC in the last few years. If Trump wins, I suspect people will test the waters and try all kinds of stuff [ETFs]. If Democrats keep on power, it’s unlikely there’ll be an altcoin ETF.”

US elections aside, an ETF approval needs specific requirements.

It must offer liquidity, decentralisation, resistance to price manipulation and regulatory classification.

Are altcoins ready to meet these conditions?

The Surfer 🏄

Ripple argues for lower fines than SEC's proposed $2 billion in its legal battle with the agency. Cites the recent Terraform settlement to support its case for lower penalties. Terraform Labs agreed to pay $4.47 billion in fines, which Ripple compares to its own proposed fine of $10 million.

SEC may only receive a fraction of Terraform Labs' multibillion-dollar settlement. Terraform had assets of $430.1 million and liabilities of $450.9 million when it filed for bankruptcy.

Tornado Cash developer Alexey Pertsev is fighting to be released from prison as he prepares his appeal. He was found guilty of laundering $2.2 billion last month. Pertsev's lawyer argues that his detention hinders his ability to prepare for his case.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋