Ethereum gets a BlackRock booster 🪨

Delaware's ink's still drying on BlackRock's ETH ETF. BTC and ETH hit the accelerator. $400M gone in a flash. Google's big AI gamble, Humane's AI Pin and Hello Alfred. Pokémon cards as NFTs.

Hello, y'all. What song are you FEELING right now? Oh yes, you can know that. Check out 👉 ImFeeling

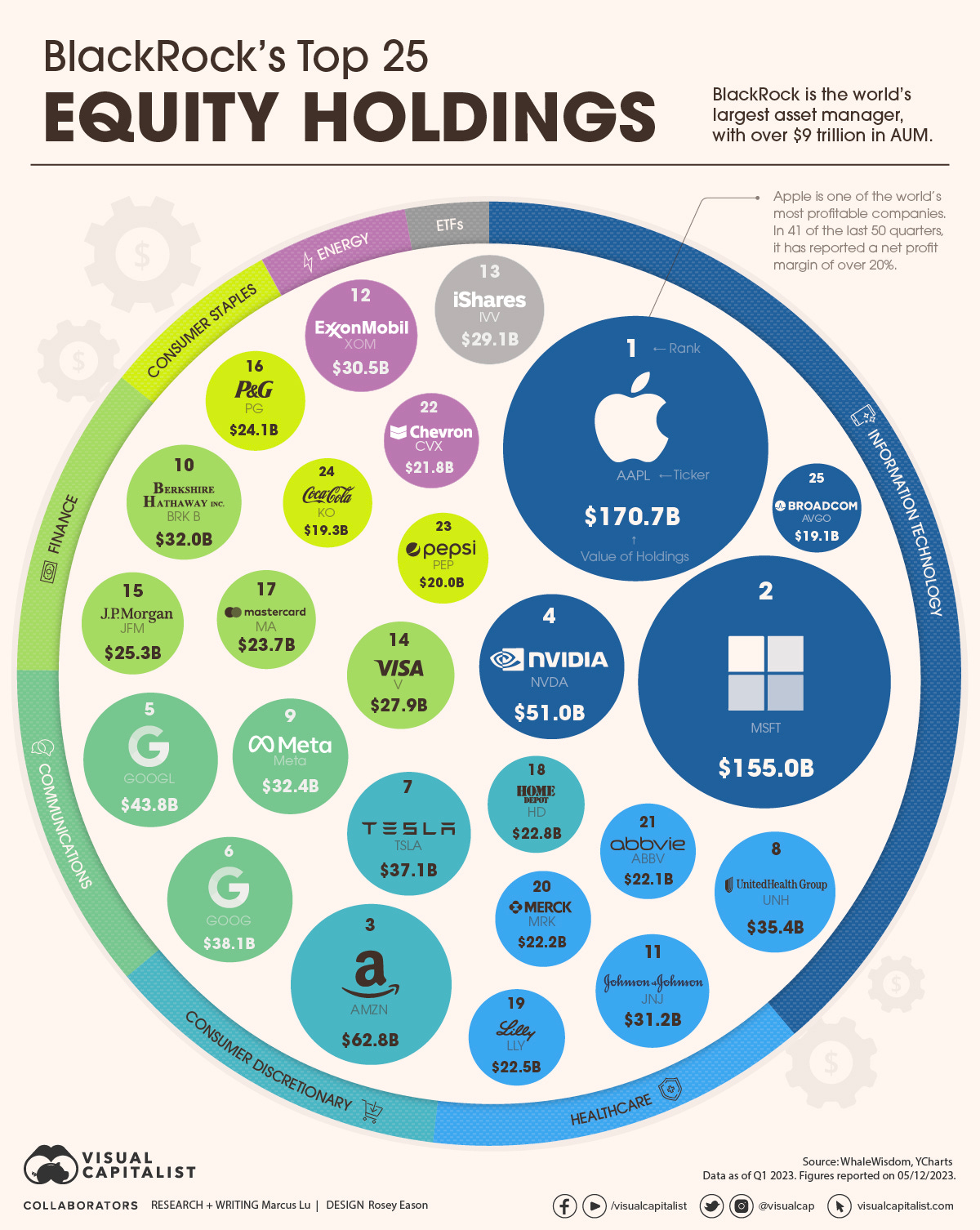

Lost in numbers over this chart👇

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Delaware isn't just a hotspot for corporations seeking a friendly home; it's now the birthplace of BlackRock's latest crypto endeavour.

BlackRock has registered the 'iShares Ethereum Trust' in Delaware, hinting at big plans for a possible Ethereum ETF.

The state's Division of Corporations has the ink still fresh on the formation date of Nov. 9 for this new entity.

The iShares Ethereum Trust has been officially registered, and Daniel Schweiger, a big shot at BlackRock, is the name on the paperwork.

And Nasdaq confirms...

Nasdaq then filed a 19b-4 form with the SEC on behalf of BlackRock.

This filing is a clear indication of BlackRock's commitment to introducing an Ethereum-based ETF, marking a significant step in the integration of cryptocurrency into mainstream financial products.

BlackRock's not alone in this Ethereum ETF race. They're running alongside VanEck, ARK 21Shares, Invesco, Grayscale, and Hashdex, all jostling for the SEC's green light.

Meanwhile, ARK Invest and 21Shares aren't just sitting around. They're launching a new suite of digital asset ETFs focused on long-term BTC and ETH futures contracts.

Bitcoin, Watch Your Back: Because of the ETF speculations, Ethereum (ETH) soared, leaping over 10% to hit $2100.

A 7-month high.

ETH has been on a rollercoaster that only goes up.

At the time of writing $2,100 - for the latest check CoinGecko.

This surge has given Ethereum some much-needed mojo to claw back its market dominance against Bitcoin. ETH's market share now sits prettier at 17%, marking a 1.3% uptick since before BlackRock's announcement.

Bitcoin, not to be completely overshadowed, hit an 18-month high on Nov 9, almost touching $38,000, before taking a sharp U-turn post the BlackRock ETH news.

Then, it dropped to around $36,300, though it still recorded a respectable 3% increase over the day.

At the time of writing at $37,000 - for the latest check CoinGecko.

Altcoins Performance

XRP, DOGE, UNI, XLM: Declined 6%-7%.

Toncoin (TON): Dropped 10% after a previous rally of over 20%.

Lido (LDO) and RocketPool (RPL): Governance tokens rose 18% and 23%, respectively.

Deja Vu?

Let's rewind to November 2021.

Bitcoin was the belle of the ball, hitting a price that had wallets and hearts swelling.

On various platforms, Bitcoin’s all-time high danced around $67,000 to $69,000.

Remember the laser-eyed Bitcoin maxis?

That was the spirit back then. Bitcoin wasn't just a currency; it was a movement, a digital crusade marching towards an inevitable $100,000 milestone.

This rally wasn't just numbers on a screen; it was fuelled by a potent cocktail of COVID-era stimulus, low interest rates, and a fair bit of boredom.

Fast forward to today, and Bitcoin seems to be strumming a different tune. It's up significantly year-to-date, and the buzz isn't just about prices; it's about institutional interest.

Wall Street is flirting with crypto in a more serious manner, with big names like BlackRock and Fidelity teasing the launch of crypto-based ETFs.

Banks are cozying up to blockchain, and "tokenisation" is the new catchphrase in finance circles.

The Game of Accumulation

Glassnode data shows a significant accumulation pattern for Bitcoin, with available supply hitting historical lows.There's a noticeable rise in Bitcoin’s illiquid supply and long-term holders.

Smaller investors, dubbed "Shrimps," are purchasing a majority of the newly mined Bitcoin supply.

Long-term holders reach new highs, while short-term holder supply hits all-time lows. The tightening of BTC supply is helping maintain Bitcoin's price above $34,000, with strong support above $30,000.

Market strategist Joel Kruger suggests a Bitcoin price breakout to $40,000 is possible, pending a surge above $36,000.

The growing number of illiquid Bitcoins, a bullish market indicator, continues to rise.

TTD Numbers🔢

$400M

All thing BTC and ETH price swings led to what?

$400M of Crypto Liquidations.

Drivers of the price surge

BlackRock's registration of the "iShares Ethereum Trust" in Delaware.

The news that Grayscale is in discussions with the SEC about converting its Bitcoin Trust (GBTC) into an ETF.

The extreme volatility triggered a massive leverage wipeout, liquidating $241 million in short positions and $200 million in longs across all cryptocurrencies.

Liquidations occur when exchanges forcefully close leveraged trading positions due to a total or partial loss of the trader's margin, or if there isn't enough capital to maintain the trade.

This process can amplify market volatility, as traders scramble to cover their positions and excessive leverage gets flushed out of the market.

The Biggest Liquidation Day Since August

This whirlwind of trading activity marked the largest single-day liquidation since August 17, when a sharp sell-off in cryptocurrencies saw Bitcoin plummet to as low as $25,000 from around $29,000, culminating in $1 billion in liquidations.

Volume Concerns Amid Price Appreciation

However, it's not all smooth sailing. The uptick is happening amid declining trading volumes, a phenomenon that's causing some unease among market watchers.

The trend of price appreciation on waning volume is generally seen as a precarious scenario, and many are watching with bated breath to see if "this time is different."

Traders are also keeping an eye on whale activity, especially as Bitcoin inches closer to the psychologically significant $40,000 threshold.

Adding another layer to the plot, Bitcoin's rising open interest (OI) has been a critical factor behind sudden price jumps in recent weeks and months.

According to CoinGlass, Bitcoin futures OI is now over $16.31B, the highest since mid-April.

TTD ETF🚨

As Bitcoin rides the waves of ETF optimism, a different narrative is unfolding in the crypto world: the resurgence of altcoins.

With traders' appetites for risk reviving and the allure of double-digit yields returning, altcoins are reclaiming their spot in the limelight.👇🏻

TTD NFTs 🐝

From Netflix to NFTs

Moisés Zamora, known for creating Netflix's "Selena: The Series," is taking a groundbreaking leap from Hollywood to the digital frontier with Videomart, his new NFT-backed platform. After reaching 25 million households with "Selena," Zamora faced a harsh reality: Hollywood success didn't equate to financial security. This epiphany led him to rethink success in the entertainment industry.

Videomart is set to revolutionise indie filmmaking by leveraging the power of NFTs.

An NFT-backed platform for indie filmmakers.

Enables launching films, finding fanbases, and earning revenue through NFTs.

This model challenges traditional film production norms, promising a more equitable and sustainable approach for creators.

Who wants Pokémon cards?

Crypto collectibles startup Courtyard is giving away hundreds of mystery packs containing tokenised Pokémon cards as NFTs.

Each pack will contain an NFT tied to a graded Pokémon card, which can be traded or redeemed for a physical version.

The cards include vintage base set cards, modern cards, and promo cards, with rare cards like a 2020 Sword & Shield Shiny Star Charizard and a 1998 Starter Red Green Gift Set Holo Scyther hidden among the packs.

Courtyard will give away 100 packs per day across four daily drops, totalling 400 packs. The company has previously sold out nine similar card drops, bringing in $200,000 worth of graded Pokémon cards as tokenised assets.

David's dream

Roblox CEO David Baszucki envisions the possibility of incorporating NFTs into the popular gaming platform.

He suggested that limited edition NFT items could be launched on Roblox and then potentially move off-platform.

“There’s a bit of a dream here about objects and NFTs moving from platform to platform,” Baszucki said.

Baszucki gave the example of a celebrity like Elton John launching limited-edition capes for charity on Roblox, which could be sold as NFTs.

This move could be significant for Roblox, as it has a large user base, especially among younger audiences.

While Roblox has already introduced Limiteds, a category of virtual wearable products with similarities to NFTs, they do not utilise blockchain technology.

TTD AI📍

Google is betting big on AI, and they're putting their chips (literally) on the table.

Anthropic, the brain behind the Claude LLM, is now turbocharged with Google's TPU v5e chips.

So, what’s the big deal with these TPUs? Designed specifically for machine learning, these TPUs are like the Ferraris of AI processing, leaving traditional GPUs in the dust when it comes to speed and efficiency. This gives Claude LLM a significant boost in handling large datasets, which is crucial for refining its AI models.

Claude vs. GPT-4

This partnership sets the stage for a showdown of epic proportions in the AI world. On one side, you have Claude, now juiced up with Google’s TPUs and ready to rumble.

On the other, OpenAI’s GPT-4 Turbo, a formidable opponent with a 128K context token capability.

Read more: OpenAI's DevDay 🎉

With Google’s TPUs, Anthropic’s Claude could potentially outpace its rivals in processing massive data sets. This means faster learning, more nuanced interactions, and possibly a new leader in the AI arms race.

Google's commitment to Anthropic goes beyond just technical support. The tech giant has made a substantial financial investment, acquiring a 10% stake for $300 million and providing additional funding that totals $500 million.

TTD Launches 🎁

The Humane AI Pin

Humane, an AI startup, has partnered with OpenAI and Microsoft to create a wearable AI pin.

The deets

Lapel Pin Design: Compact, wearable as a lapel pin for convenience and style.

Voice-Activated Assistant: Tappable interface to interact with a virtual AI-powered assistant.

OpenAI Integration: Equipped with OpenAI technology, including ChatGPT functionalities.

Microsoft Cloud Computing: Utilises Microsoft's cloud computing capabilities for enhanced performance.

Multi-Modal Interaction: Offers various interaction methods, including a touchpad, physical gestures, and object recognition.

Laser Ink Display: Unique display technology that projects information onto the user's palm.

Personalised Communication: Capable of crafting messages in the user's tone of voice and sorting emails.

AI-Driven Experiences: Provides AI-powered music experiences and photography.

Language Translation: Functions as a foreign language interpreter.

Nutrition Assistance: Supports nutrition goals with food identification using computer vision.

Dedicated Wireless Service: Connected through a mobile virtual network operator (MVNO) linked to T-Mobile.

The pin is available for order in the US starting from $699, along with a monthly subscription of $24. Humane, founded by ex-Apple employees, has raised $241 million in investments.

Alfred the Telegram Bot

Stephane Gosselin, co-founder of Flashbots, has launched a Telegram trading bot called Alfred. The bot aims to simplify token swaps on Ethereum and protect against maximal extractable value (MEV) profits generated by transaction re-ordering.

Gosselin, now the CEO of Frontier Research, partnered with Kolibrio to develop Alfred and address the issue of MEV in on-chain swaps caused by front-running and liquidity pool rebalancing.

The bot provides advanced trading tools and aims to enhance user experience in the web3 space. Gosselin left Flashbots in 2022 due to disagreements over the firm's reported censorship of transactions.

Alfred enters a competitive niche with existing projects like Unibot, Banana Gun, and Maestro.

TTD Surfer 🏄

Taiwanese prosecutors have detained two key personnel from JPEX Taiwan on suspicion of fraud and violations of banking and anti-money laundering laws.

Venture capital firm Lightspeed Faction has launched a $285 million fund for early-stage blockchain projects.

Crypto lending company Celsius Network is set to emerge from bankruptcy after a judge approved its customer repayment plan.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋