Ethereum Staking [Feat. Eigen Layer] 🧑🌾

EigenLayer, a decentralised Ethereum restaking protocol for Ethereum's validator network. Rising Total Value Locked, big funds backing, it's making a splash; but it also comes with associated risks.

Hello, y'all. Sunday night, to another crypto week ahead … 🥁

You gotta know, I'm feeling love | Made of gold, I'll never love a | Another one, another you | It's gotta be love I said it | I might as well be in a garden | I said, ah … 🎶

A complete go for music lovers 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Heard about EigenLayer?

It's like the ultimate wingman for your Ethereum.

EigenLayer has been a hot topic for its innovative approach to Ethereum staking and big-name backers (a16z crypto, Coinbase Ventures, Polychain Capital).

Do we know what it is? EigenLayer is taking Ethereum from snoozing-at-the-staking-pool to DeFi party animal.

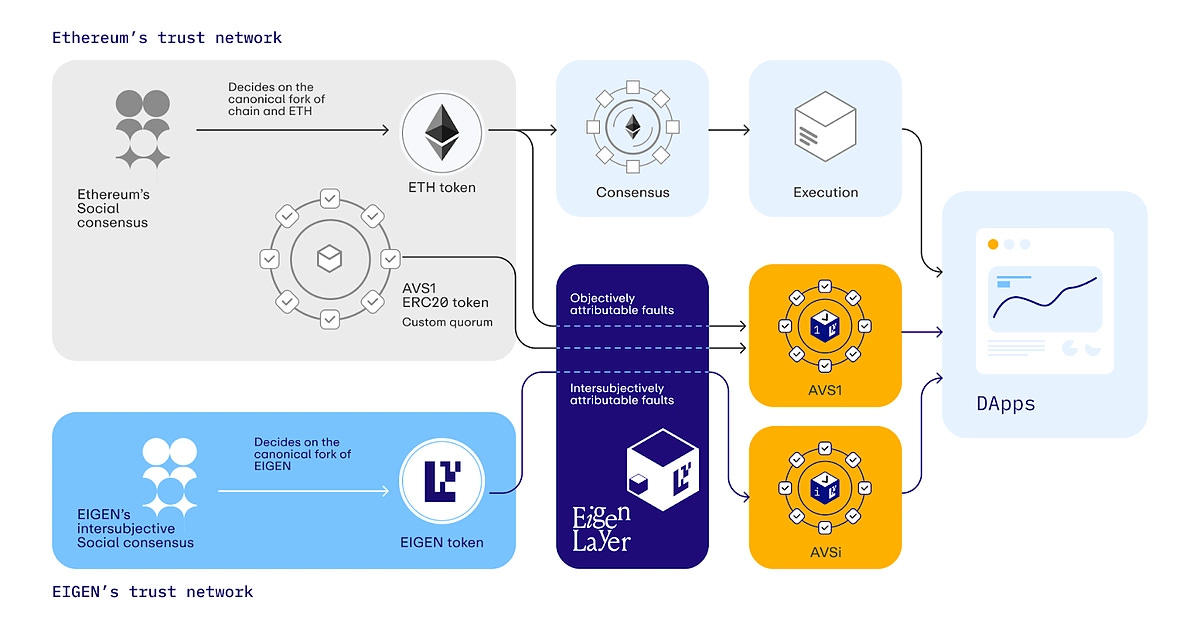

And how? EigenLayer is a protocol that builds on top of the Ethereum blockchain. It's designed to enhance Ethereum's Proof-of-Stake system by allowing users to restake their Ether (ETH).

Boosting Staking Efficiency: Traditionally, staked ETH (Ethereum) is locked up and cannot be used for other purposes.

EigenLayer allows users to re-use their staked ETH.

This essentially means putting your already staked ETH to work in other DeFi applications to earn additional rewards.

Extending Security: By allowing staked ETH to be used for other applications, EigenLayer creates a "restaking collective." This collective pool of staked ETH can be used to provide security to other protocols built on Ethereum. This essentially extends the security benefits of Ethereum to these new applications.

Official Blog Read: EIGEN: The Universal Intersubjective Work Token

Who is behind it? Sreeram Kannan is the CEO of EigenLayer. He founded the company in 2021 while working as an associate professor of electrical and computer engineering at the University of Washington, where he also led the Blockchain Lab.

Benefits for Different Parties

Developers: They can leverage the security of the Ethereum network without needing to build their own validator set, reducing development costs.

Stakers: They can earn additional rewards by restaking their ETH on EigenLayer-integrated applications.

Users: They benefit from a more secure and efficient Ethereum ecosystem with innovative applications.

How does EigenLayer work?

EigenLayer uses a concept called a "restaking collective."

Stakers can "restake" their ETH on EigenLayer, basically saying they're willing to help secure other DeFi projects.

EigenLayer acts as a middle layer. It connects these stakers with DeFi projects in need of security. Users opt-in to grant EigenLayer some control over their staked ETH.

EigenLayer can then restake this ETH on other applications built on Ethereum.

DeFi projects pay stakers rewards for their help, making EigenLayer a win-win for everyone.

How to Restake

Multiple restaking methods offered by EigenLayer (risk level from least to most):

Native Restaking: Validators restake their staked ETH

LSD Restaking: Validators restake assets that are already staked via liquid staking providers, including Lido, Rocket Pool etc.

LSD LP Restaking: Validators restake the LP token of a pair which includes a liquid staking ETH token

ETH LP Restaking: Validators restake the LP token of a pair which includes ETH.

Traditional Staking vs. EigenLayer Staking

Currently there is more than $15 billion staked on EigenLayer.

In less than a year, it was launched in June 2023.

What is EigenDA? EigenDA, built on EigenLayer, is a separate data storage layer for Ethereum's rollups (L2s). This frees up space on the main network (L1), reducing gas fees for L2 users. Unlike L1s where data storage is built-in, EigenDA offers a secure and scalable solution, boasting 10x the bandwidth (10MB vs 80KB).

Here comes EIGEN

EigenLayer is launching their own token with a 15% airdrop for stakers.

Read: Stakedrop Season 1

Total Token Supply: 1.67 billion

Community Allocation: 45%

Stakedrops (including this airdrop): 15%

Community initiatives & ecosystem development: 30%

Investors & Early Contributors: 55% (locked up for 3 years)

EIGEN token generation: This is a "stake drop," not an airdrop, as tokens can only be staked on EigenDA initially.

Yes, 45% of tokens are for the community, but...

After claiming, tokens are initially unmovable and have a limited monthly "split" (distribution).

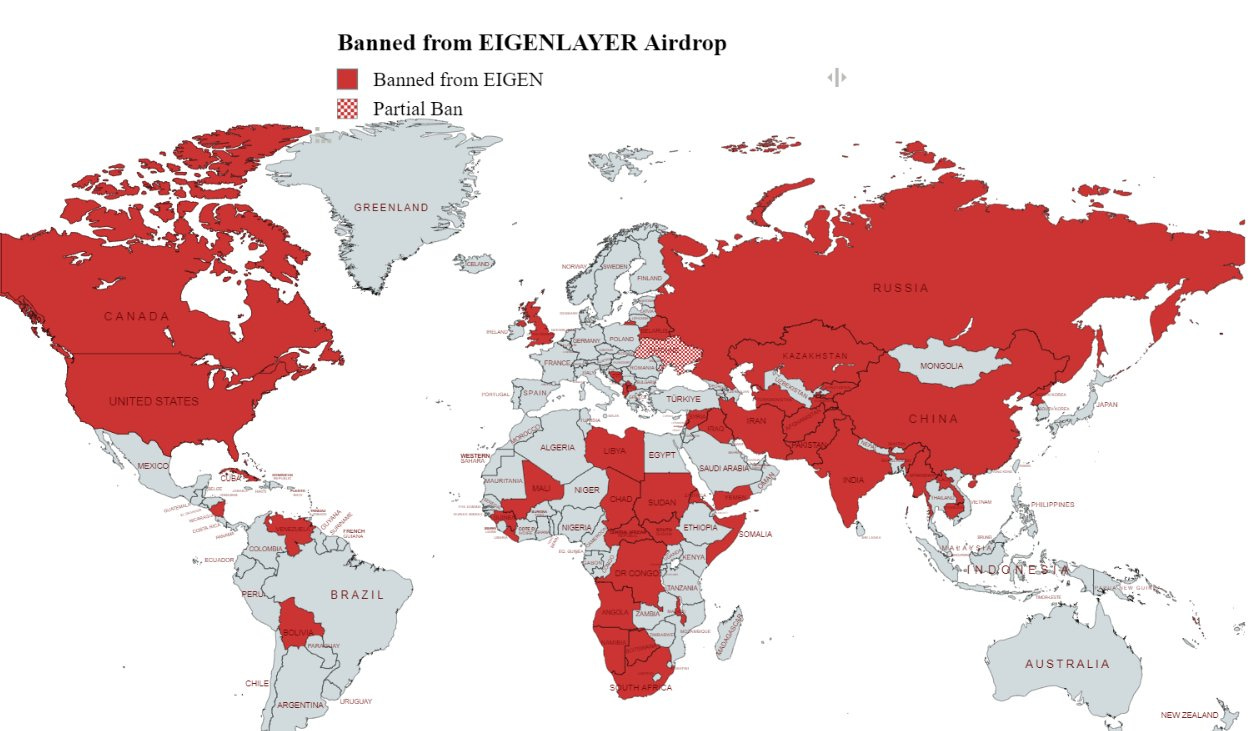

Users from certain countries (including USA, China) are excluded from the airdrop. Using VPNs to bypass restrictions could lead to disqualification.

The result? A backlash from users

The locked tokens and geo-blocking have angered many participants.

Many feel the rewards for early users (5% of tokens) are too small compared to what Eigen Labs and investors get (55%).

They are pulling their assets from EigenLayer's restaking service. Dune shows that more than 7,000 withdrawal requests were initiated.

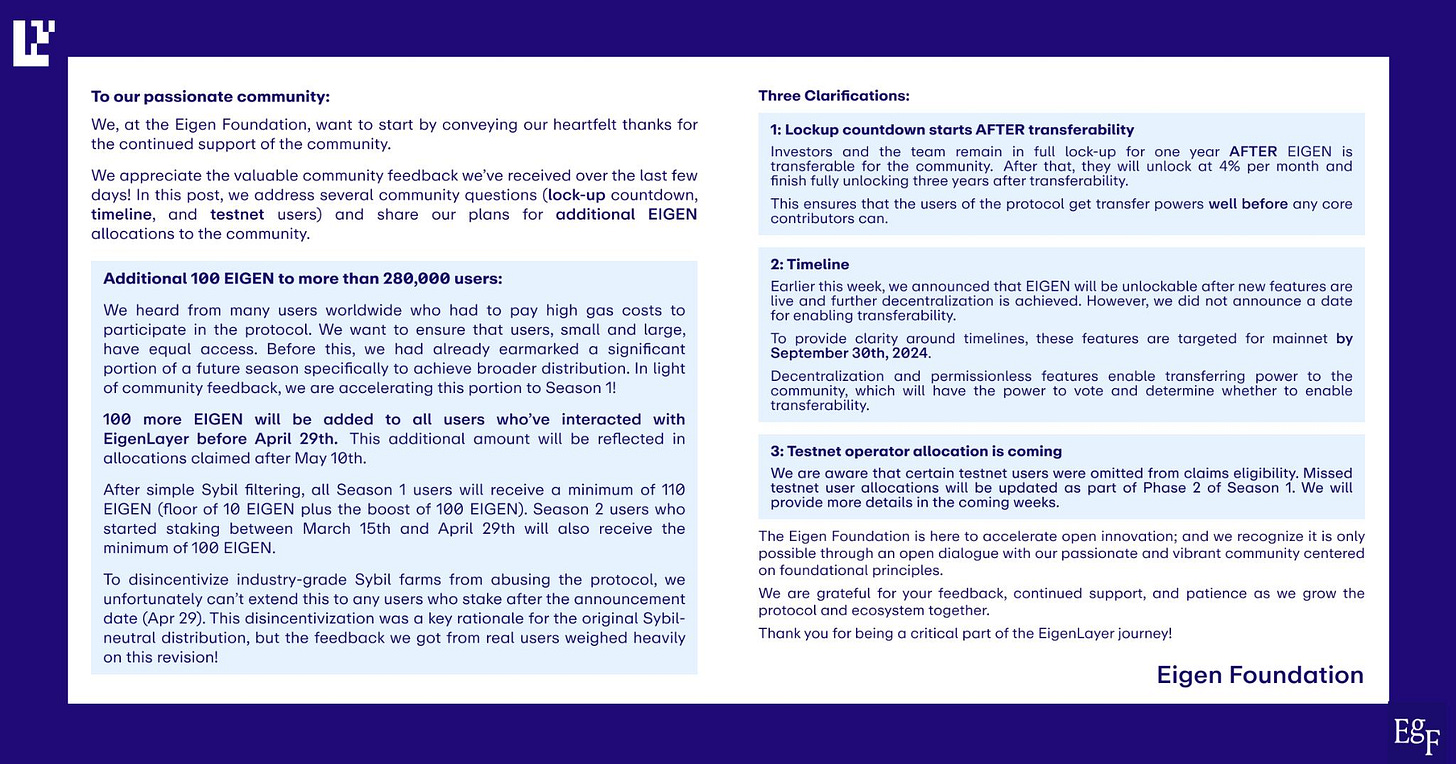

And their fix? another airdrop

They will be airdropping around 28 million additional EIGEN tokens to over 280,000 wallets.

Who benefits? Over 280,000 wallets that interacted with the protocol before April 29th.

Minimum payout: At least 100-110 EIGEN per qualifying wallet.

This move aims to appease users and potentially jumpstart wider adoption of the EIGEN token.

But restaking could be a big risk for Ethereum

Imagine a domino effect where one failing restaking protocol could destabilise the entire underlying blockchain.

Read: Restaking is a ticking time bomb - Stack enough financial risk onto a blockchain system, and you’re inviting more fundamental instability, Writes Steven Walbroehl of Blockworks.

Restaking lets users lend their staked assets to multiple systems, amplifying risk if something goes wrong.

Restaking protocols are new and unproven, with potential bugs or hacks that could threaten the security of the entire blockchain they're built on.

A large-scale restaking failure could trigger a "credit freeze" in the crypto space, similar to what happened in 2008.

Must read: Vitalik says "don't overload Ethereum's consensus."

TTD Week That Was 📆

Saturday: Friend Tech. Unfriendly Airdrop Ⓜ️

Friday: Money Pouring In? 💰

Thursday: Looking For The Bottom? 👀

Wednesday: Crypto Goes Red 🔴 CZ Gets Jail ⛓️

Tuesday: Crypto ETFs Go Live In Hong Kong 🎈

Monday: Altcoin Season Incoming? 🌈

TTD Week in Funding 💰

Mitosis. $7 million. Liquidity protocol for cross-chain liquidity. Mitosis LPs receive derivative tokens that are 1:1 convertible to their locked assets.

Airstack. $4 million. Web3 developer platform that provides quick and easy access to on-chain data across projects and blockchains.

Backed. $9.5 million. Infrastructure for capital markets to bridge real-world assets onto the blockchain. ERC-20 tokens for assets like stocks or ETFs.

Securitize. $47 million. Tokenisation platform for issuing, managing, and trading digital asset securities, consistent with the existing US regulatory framework.

Kiosk. $10 million. Farcaster client that brings onchain assets on social. Bringing onchain assets commerce to the Farcaster's decentralised social media.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋