Ethereum Turns Inflationary? 🐝

Ethereum no longer ultrasound money after Dencun upgrade, analysts. ETH co-founder, Joe Lubin calls regulatory action paralysing. Vitalik and Co. changing so many things. The wait for Ethereum ETF.

Hello, y'all. Jesus loves you more than you will know. Whoa, whoa, whoa 😇

Heaven holds a place for those who pray. Hey, hey, hey… 🎶

Do try the Music Quiz Game 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

Ethereum is no longer deflationary.

What does that mean? The supply is increasing (not a great thing for price).

Thanks to Dencun Upgrade?

Read: Ethereum's Dencun Upgrade 🦋

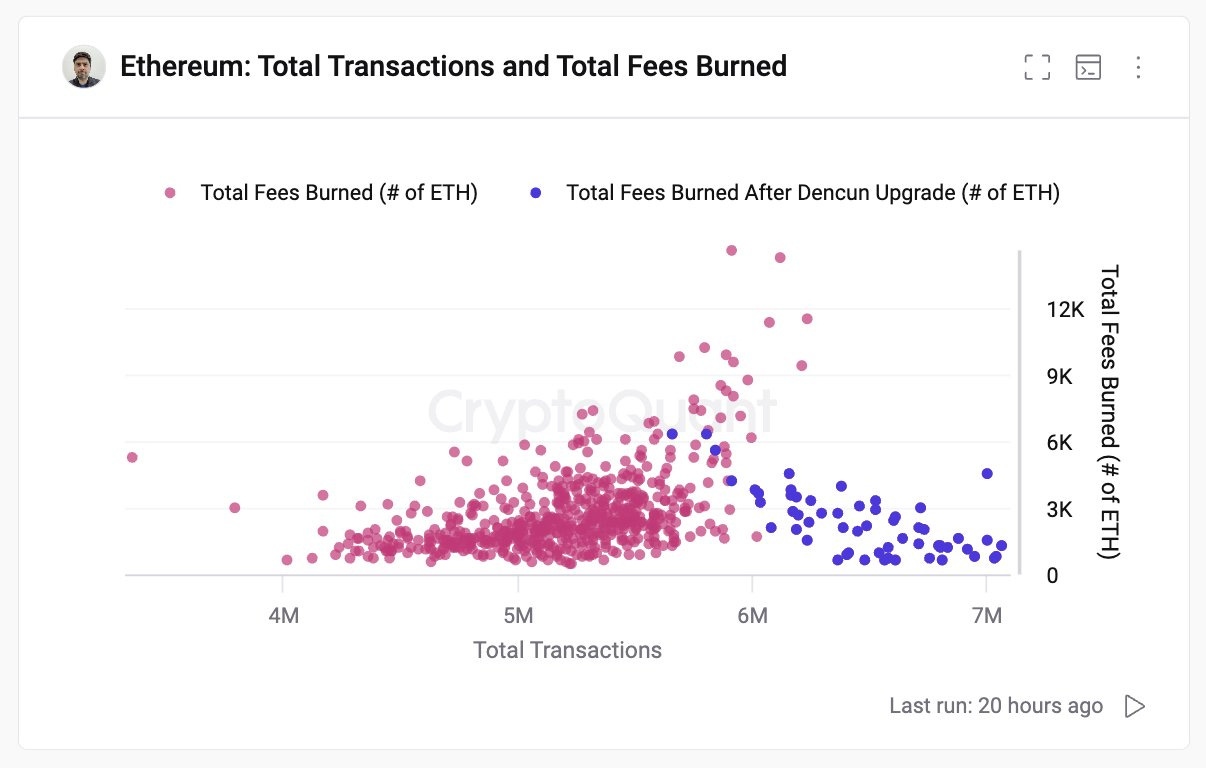

The recent report by CryptoQuant says that Ethereum's supply is on the rise for the first time since the Merge.

This comes after the Dencun upgrade, which significantly reduced transaction fees - pushed it towards a state of inflation.

How did this happen?

EIP-1559 and the Burning Mechanism: Remember, EIP-1559 introduced a system that burned a portion of transaction fees, directly reducing the total supply of Ether. This burning mechanism was a major contributor to Ethereum's initial deflationary phase after the Merge.

Dencun and Transaction Fee Reduction: The Dencun upgrade focused on improving scalability and lowering transaction fees (by over 90% on multiple Ethereum layer-2 networks) on the Ethereum network.

The Downside of Lower Fees: While lower fees are beneficial for users, they come at a cost to the burning mechanism. With transaction fees reduced, the amount of Ether burned also decreased significantly. This decrease wasn't offset by the natural issuance of new Ether through staking rewards.

Supply and Demand Imbalance: As a result of Dencun, the rate at which new Ether is created (through staking rewards) began to outpace the rate at which Ether is burned (through reduced fees). This imbalance tipped the scales towards inflation, meaning the total supply of Ether started to increase slightly.

Ever since EIP-1559, Ethereum users have burnt some 4.3 million Ether, worth around $12.7 billion.

But it's slowing down now.

Is Dencun the Sole Culprit?

High network activity, lower burning. Even before Dencun, if network activity surged significantly, the burning mechanism might not keep pace if transaction fees didn't rise proportionally.

This could lead to temporary periods of inflation.

Ethereum's network activity has been quite impressive lately.

On May 4, 2024, Ethereum saw the creation of a whopping 196,000 new addresses, marking the highest single-day growth in nearly 19 months.

Dencun amplified the effect. Dencun's focus on reducing fees structurally lowered the "burn rate" of Ether.

Is this a big deal?

Some say no: Ethereum's core strength lies in its decentralised applications (DApps), not necessarily deflationary status.

Others say yes: This could be the end of "ultrasound money" for ETH, a term used for its deflationary nature.

Ethereum earned the playful nickname "Ultrasound Money" after its Merge.

This switch from PoW to PoS slashed the creation of new ETH by 90%.

Plus, the network started burning transaction fees, pushing the total supply of ETH into great decline.

Block That Quote 🎙️

Ethereum co-founder, Joe Lubin.

"An attempt to paralyse us, or have us move off-shore."

What Lubin thinks about the regulator actions against his firm, Consensys (the company behind the most popular crypto wallet - Metamask).

He calls out SEC for its recent enforcement actions, "intended to create FUD."

Lubin argues the SEC is secretly reclassifying Ethereum as a security without clear communication.

He suspects the SEC's actions are timed to derail the approval of spot Bitcoin ETFs, potentially stifling innovation in the financial sector.

“I think they’re concerned that so much attention and capital will flow to our ecosystem, considering it is improving enormously in terms of scalability and usability.”

Consensys is fighting back: They've filed a lawsuit against the SEC to get a court ruling on Ethereum's status. Lubin believes courts will ultimately classify Ethereum as a commodity.

“The SEC appears to have reclassified Ether as a security without telling anybody that that’s the case. They are going about a strategic series of enforcement actions rather than open discourse and clear rule-making.”

Vitalik and Co. Ringin Changes?

Changing so much about Ethereum (for better).

Ethereum account abstraction?

Vitalik Buterin and his team proposed EIP-7702, a new idea to improve how users interact with Ethereum.

It's an alternative to EIP-3074, another proposal for account abstraction.

Account abstraction basically means letting your crypto wallet act like a fancy smart contract, unlocking features like multi-factor authentication and social recovery.

What's new with EIP-7702?

It lets regular accounts (EOAs) temporarily turn into smart contracts during a transaction, then go back to normal afterwards.

This allows them to interact with advanced features like those in ERC-4337, a broader standard for smart contract wallets.

Lower Fees with Multidimensional Gas Pricing

Buterin is proposing a major overhaul to transaction fees.

This system would introduce different gas units for different resource types. This allows for more precise pricing and allocation of resources.

Faster Path for Zero-Knowledge Proofs

He recently introduced "Binius," a new system that promises to significantly speed up zero-knowledge proofs. It works directly with binary bits (0s and 1s).

This allows it to handle common data types like counters and flags much more efficiently. Traditional proof systems like zk-SNARKs work with large numbers, slowing things down.

Multi Signature Wallet Suggestion

Buterin believes multi-signature wallets are safer than hardware wallets.

Multi-signature wallets distribute control over funds among multiple parties, providing decentralised security.

In the Numbers 🔢

€12 trillion

The European Union securities watchdog is considering a new move: allowing crypto assets into a €12 trillion investment market known as UCITS.

What is UCITS? Undertakings for the Collective Investment in Transferable Securities is a regulatory framework for the creation and distribution of mutual funds in the European Union. Network of mutual funds in Europe.

This means a ton of investment money could potentially be used to buy crypto.

That's even bigger than the Bitcoin ETFs launched in the US and Hong Kong this year.

Why is this a big deal? An influx of new money could drive up crypto prices. UCITS funds are well-established and easy for investors to access. This could make it much simpler for people to invest in crypto.

When Ethereum ETF?

1) The wait for a decision on the Invesco Galaxy spot Ethereum ETF continues.

The SEC has postponed its ruling, with a new deadline set for July 5, 2024.

This follows a previous delay and request for public comment in February.

The SEC has also pushed back deadlines for similar spot Ethereum ETF proposals from other companies like Grayscale, Franklin Templeton, VanEck, and BlackRock.

2) Grayscale withdraws Ethereum Futures ETF application.

Grayscale filed a notice to withdraw its Grayscale Ethereum Futures Trust application on May 7th.

The SEC's decision on Grayscale's futures ETF was due on May 30th.

Why withdraw now? Grayscale wants to focus entirely to getting a spot Ether ETF approved.

CEO Michael Sonnenshein: “At Grayscale we decided to focus our energy on our spot products. That’s really core to our DNA.”

3) Suits won’t deter the ETF.

JPMorgan says the SEC's “Well Notice” to Robinhood about its crypto offerings shouldn't derail the approval of spot Ether ETFs. They believe the SEC is using these actions to influence lawmakers who will eventually regulate crypto.

The SEC might be stricter on other cryptos, but Ether seems to have a better shot at ETF approval according to them.

4) The Odds?

The Surfer 🏄

Digital Currency Group (DCG) saw a 51% increase in revenue in Q1 2024, reaching $229 million. Grayscale's Bitcoin fund, GBTC, experienced $17.4 billion in outflows since converting to an ETF in January. Despite the outflows, Grayscale's revenue remained steady at $156 million due to rising asset prices.

Marathon Digital, a Bitcoin miner, missed Q1 revenue estimates due to bad weather and equipment failures. Q1 revenues increased 223% YoY to $165.2 million, but fell short of the $193.9 million estimate by 14.80%. The company mined 2,811 BTC in Q1, worth $176.7 million, a 28% increase YoY but down 34% from Q4 2023.

Core Scientific reports $210 million gain in Q1 2024. Revenue of $150 million from digital asset mining, a 46% increase in gross margin. Net income of $210.7 million, a significant improvement from previous year's net loss.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋