Hello

Bitcoin broke through its resistance level of $107,000 early Monday after holding below it for over 10 days, surging toward its all-time high near $112,000.

However, these new highs have yet to be retested and will serve as crucial levels to hold for a sustained rally toward fresh all-time highs.

Check out yesterday’s edition to know more.

Two weeks ago, Joe Lubin, cofounder of Ethereum and founder and CEO of Consensys, announced his decision to chair SharpLink Gaming's board and lead their $425 million Ethereum treasury strategy.

This adds a new page in the efforts to revive the second largest cryptocurrency, which has remained stuck below $3,000 for over four months.

The move mirrors a strategy popularised by Michael Saylor, whose Bitcoin-focused treasury playbook has inspired a whole crop of listed companies to take to Bitcoin treasury building.

In this week’s Wormhole, we analyse if it’s one of Ethereum’s best shots at revival.

When SharpLink Gaming announced its fundraise to build an ETH treasury, markets reacted immediately and with clarity.

Its stock price exploded more than 450% in a single day — from $6.63 apiece to over $35. Across five trading sessions, it shot up more than 17x from $6.63. Even after the correction, it still trades more than 3x from where the rally started.

What’s driving the rally?

The belief that Lubin could help SharpLink emulate what Saylor did with Strategy (fka MicroStrategy).

Read: Joe Lubin: Ethereum's Silent Partner 🤫

Ethereum allows Lubin to do at least one better than what is possible with Bitcoin treasuries: build an active ETH treasury that doesn't merely store value like Bitcoin does, but generate more value.

How?

The Active Treasury Thesis

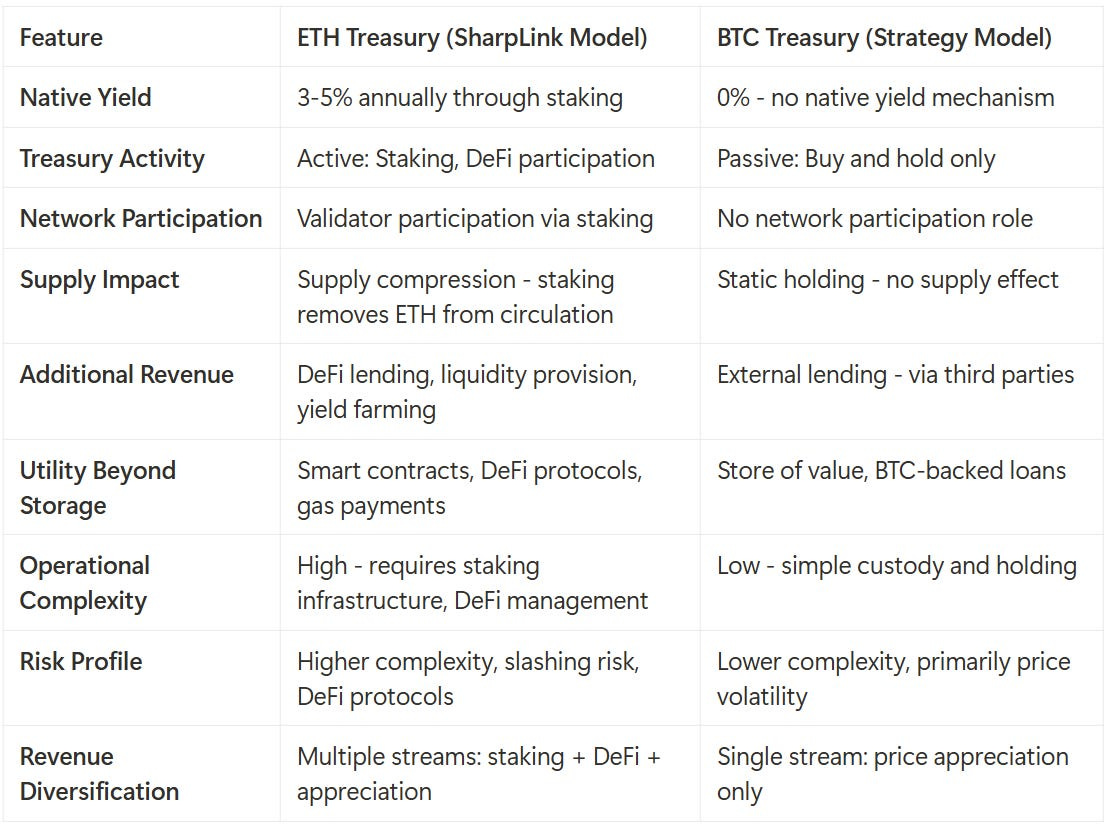

The distinction between Bitcoin and Ethereum treasury strategies is pronounced. Bitcoin treasuries operate on a simple premise: buy Bitcoin, hold Bitcoin, benefit from price appreciation. It's elegant in its simplicity, but ultimately passive.

Read: The Zero Interest Magic

Ethereum’s treasury playbook diverges from Bitcoin's approach: the bulk of ETH tokens will be staked, creating what Ethereum core developer Eric Conner describes as "a high-beta, yield-bearing ETH lever."

The staking strategy will turn corporate treasuries from static vaults to active participants in network security.

Strategy's Bitcoin holdings generate zero native yield, but SharpLink's staked ETH will earn a minimum of 2% annually, simultaneously strengthening Ethereum's consensus mechanism.

Conner also mentions the "flywheel effect" as a key advantage in ETH treasuries.

The corporates could raise cash below net asset value, buy and stake ETH, then if the stock trades above ETH per share value, raise more cash and repeat. It's a classic Strategy cycle, but supercharged with yield generation that Bitcoin treasuries cannot replicate.

The advantages extend far beyond basic staking.

DeFi protocols offer additional yield strategies through lending, liquidity provision, and sophisticated financial instruments that don't exist in Bitcoin's ecosystem. SharpLink's backing from DeFi-savvy firms like ParaFi Capital and Galaxy Digital suggests they understand this potential.

ETH vs BTC Treasury

Ethereum's Initial Coin Offering (ICO) in 20214 brought in $18 million. ETH traded at $0.30-$0.40, providing the foundational capital that built today's $320+ billion Ethereum ecosystem.

SharpLink's $425 million commitment is more than 20x times the money raised by the ICO and is enough to acquire more than 150,000 ETH at current prices. That’s still just 0.25% of ETH sold during the ICO (60 million).

The ICO laid the foundation for Ethereum in 2014. The current treasury strategies could validate its maturity as an institutional asset and help build financial infrastructure for the next decade.

The Institutional Rush

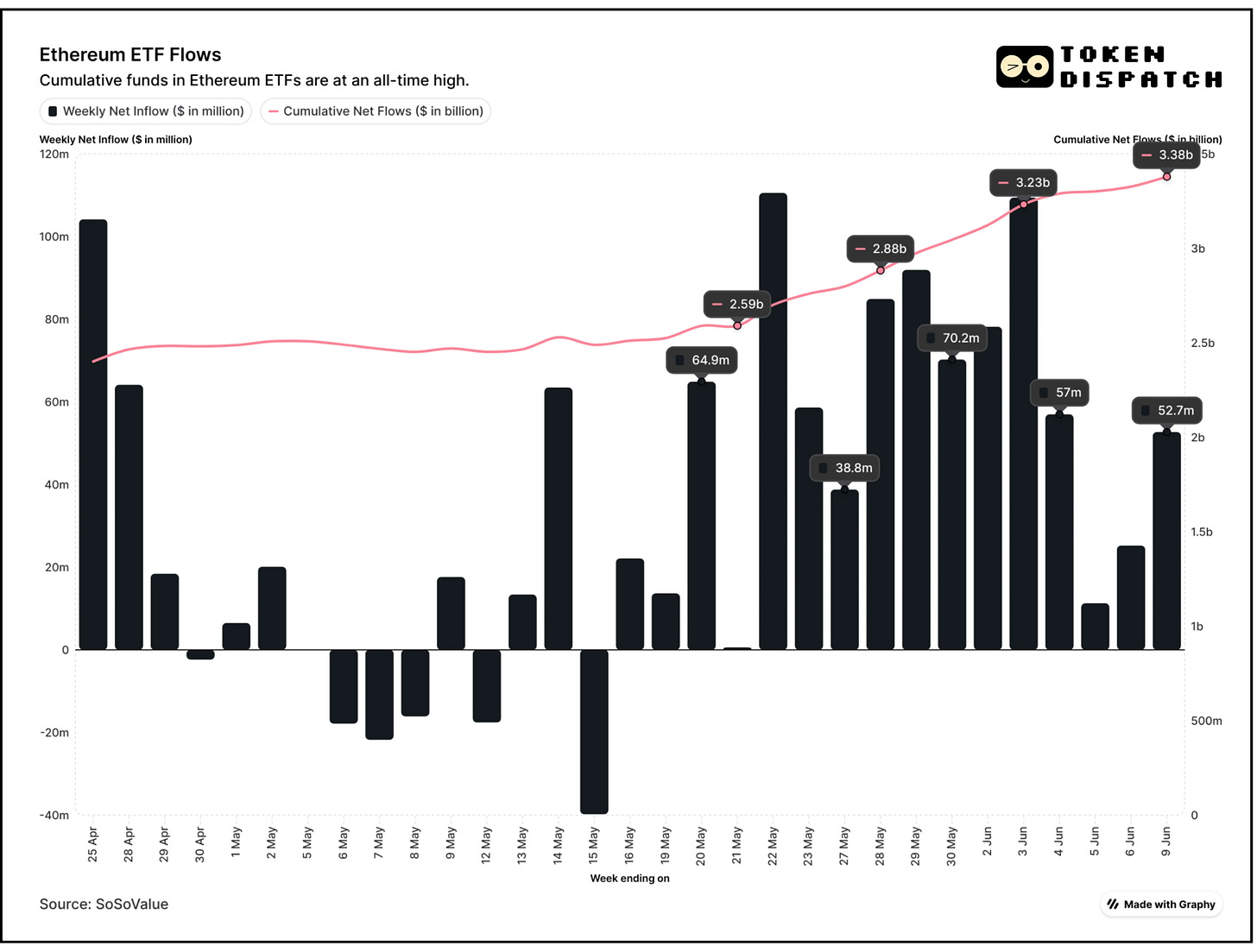

Besides treasury, Ethereum ETFs have also seen consistent inflows in institutional corridors for the past two weeks.

As of June 9, it recorded 16 consecutive daily sessions of net inflows — the second longest streak since its approval in July 2024.

The last two weeks, with $281 million and $285 million in inflows, were the best-performing ones for Ethereum ETFs in four months.

BlackRock, the world's largest asset manager, has accumulated more than $500 million worth of ETH over 11 trading days. Their ETHA ETF now commands nearly $4 billion in assets under management.

“ETH ETF inflows stood at $815 million over the last 20 days, with year-to-date net inflows turning positive at $658 million," Bernstein analysts noted in their recent research.

The seven consecutive weeks of ETF inflows totalling $1.5 billion mark what CoinShares calls "a significant recovery in sentiment amongst investors."

Ethereum-based products now comprise 10.5% of total crypto ETP assets under management.

"The narrative around value accrual of public blockchain networks is at a critical inflection point," and this is "starting to reflect in investor interest in ETH ETF inflows,” Bernstein said.

Token Dispatch View 🔍

More than the immediate financial impact, Lubin's SharpLink move signals Ethereum's evolution from speculative technology to essential financial infrastructure.

When payment giants like Visa and Mastercard develop stablecoin strategies, when Coinbase builds merchant payment systems, when Robinhood plans tokenised assets —they're all essentially betting on Ethereum's rails.

This is perhaps what Bernstein meant by "a critical inflection point" where blockchain networks transition.

The timing appears deliberate.

With stablecoin legislation advancing through Congress and regulatory clarity emerging, institutional investors finally have the framework needed for confident allocation. Circle's successful IPO this week, closing 160% above its listing price, demonstrates Wall Street's appetite for crypto infrastructure plays.

For Ethereum specifically, the convergence of corporate treasury adoption, institutional ETF inflows, and regulatory clarity creates conditions that didn't exist during previous cycles.

If SharpLink's experiment succeeds, it could trigger a "domino effect" of corporate adoption, just like Saylor’s Strategy did for Bitcoin. If anything, the adoption in ETH’s case is likely to be faster and bigger, considering a similar model of risk has already been proven manageable in Bitcoin’s case.

Along with corporate adoption, if BlackRock's accumulation continues and regulatory clarity solidifies as expected, then Lubin's move might be remembered as the first step into Ethereum’s institutional chapter.

That's it for this week's Wormhole.

See ya next Tuesday.

Until then … stay curious,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.