Hello,

A couple of weeks ago, I wanted to buy NVIDIA. If you’ve ever tried to do that from outside the US, you’d know the easiest way to buy it is to not buy it.

After a Google search, a couple of broker apps, remittance forms and a forex spread that ate away a chunk of my capital, I decided to just shut the tab. Then I turned to crypto. Crypto has often pitched the opposite. Anyone with a wallet should be able to access markets and buy assets without having to chase banks and brokers for permission. It started with tokens and NFTs, and has evolved to offer all kinds of assets, today.

Hyperliquid’s perpetual DEX allows any protocol to deploy perpetual (perp) markets for any assets. One such protocol, trade.xyz, has deployed XYZ100, an index tracking the top 100 non-financial US companies. It has also added perpetual markets for some of Nasdaq’s most favourite stocks. I don’t need to deal with foreign brokers or forex spreads to touch any of this. All I need is a wallet and some USDC.

This is what got me interested in Hyperliquid’s latest HIP-3 experiment.

In this week’s deep dive, I will tell you why it could change the way people trade US equities globally, and how it can boost Hyperliquid’s revenue engine.

Onto the story now,

Prathik

Play. Earn. Own. That’s Klink Finance.

With Klink Finance, you don’t just watch crypto, you act. Complete tasks, social quests, and partner offers to earn in crypto or cash. Build reputation, unlock rewards, and gain access to special drops.

Earn for gaming, app trials, surveys and more

Flexible withdrawals: crypto or fiat, your choice

Backed by a global user-base and trusted integration partners

If you’re ready to turn your time into value, join the earning revolution with Klink.

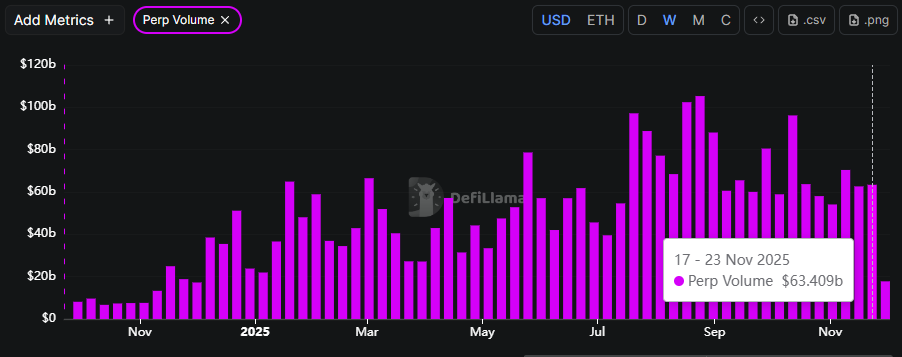

Hyperliquid’s average weekly perps volume has jumped 75% from $40 billion in the first half of 2025 to above $70 billion in the second half. It has so far recorded over $3.3 trillion in cumulative volume, cumulatively.

For users, this meant that if they wanted to trade BTC, ETH, or SOL with leverage, Hyperliquid was where they found deep liquidity and an intuitive user interface. Trading was limited to the markets Hyperliquid listed on its exchange. With its new Hyperliquid Improvement Proposal (HIP)-3, that changes.

Any builder willing to stake 500,000 HYPE can bring their own perpetual market to life on Hyperliquid’s chain. The deployer defines the asset, wires in an oracle — which pulls the price data of real-world asset from off-chain exchanges, sets leverage limits and other parameters, and in return, earns a share of the trading fees on that specific market. That’s what HIP-3 offers. Instead of Hyperliquid’s core team deciding which markets go live on its chain, they opened it up to deployers.

With HIP-3, deployers became mini-exchange operators within the mega exchange that Hyperliquid has become.

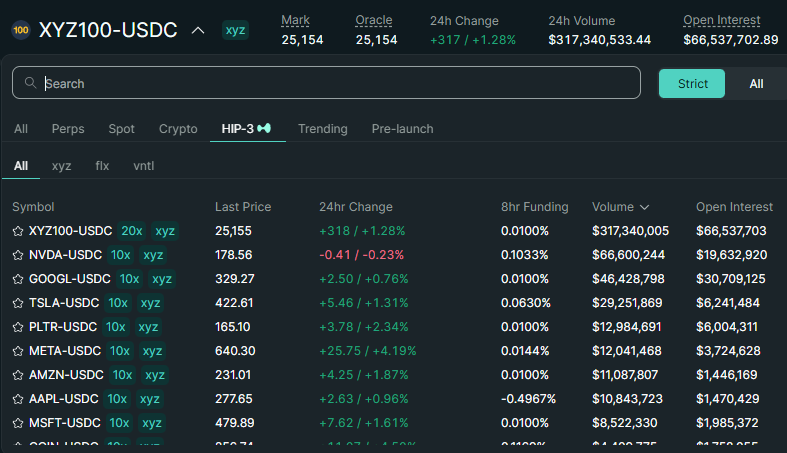

Unit protocol, the asset tokenisation layer on Hyperliquid, built trade.xyz, the first major deployer on HIP-3. They deployed the ticker XYZ100, an on-chain index contract tracking the top 100 US stocks. Within a month, it was already recording nine-figure daily volumes.

On November 24 and 25, the index recorded over $300 million in 24-hour trading volume.

On top of XYZ100, trade.xyz added single-stock perps on the Magnificent-7 and other Nasdaq favourites: NVIDIA, Tesla, Apple, Amazon, Google, Microsoft, Meta, and Palantir. On November 25, the combined 24-hour volume on HIP-3 across trade.xyz surpassed $500 million, with XYZ100 accounting for around $317 million.

A perps trader can now switch between trading cryptocurrencies, perpetual markets for stocks on Wall Street, or an entire index of the top 100 US companies within the same ecosystem. Traders across the globe will no longer have to hold capital in different accounts across different platforms.

This makes HIP-3 the missing link between a retail trader in an emerging market like mine. It offers access to the U.S stocks I could only previously view as part of a fund on my local brokerage app. What makes it even more accessible is not just what it lets me trade, but also when I can trade and how cheap it has made the entire process.

On-chain perps don’t stop on weekends. If NVIDIA posts poor results at 2 AM my time, I can still make a trade from my phone in bed. That’s the upside you get because it doesn’t shut you down, depending on where you live. But there’s a flipside to it.

When you buy NVIDIA through an off-chain broker, you get exposure to the asset behind the ticker. A stock perp is just a bet on the price movement. The wick can swing 5–10% on a rumour, a misbehaving oracle print or a thin book and then snap back.

While HIP-3 allows anyone to create a perpetual market for stocks like TSLA or NVIDIA, it doesn’t guarantee traders will consistently show up. Across crypto, we have seen many permissionless tickers flatline after doing a victory lap immediately after launch. Hyperliquid’s answer to that was the Growth Mode: “Are you a deployer on HIP-3? You want more activity? Cool, then make it obscenely cheap to trade here.”

The deployers can toggle Growth Mode on a market-by-market basis. When they do, the protocol slashes the taker fee for that HIP-3 market by more than 90%, from a standard rate of around 0.045% to a band between 0.0045% and 0.009%.

The Growth Mode economics reminds me of the familiar model we saw in the world of app subscriptions. Think of how Spotify offers a free trial for four months, only to charge you $11.99 per month after they have you locked into the habit of using the app.

HIP-3’s fee cuts are significant because they are happening alongside aggressive competition from centralised brokers. The fee cut goes a long way for small traders who have to choose between opening a foreign brokerage account with a high-spread centralised app and opening a wallet to trade XYZ100 on HIP-3.

Equities are just the first act. HIP-3 doesn’t care whether the thing you are trading is a tech stock, a barrel of oil or a tokenised slice of a property. As long as someone stakes 500,000 HYPE, wires in an oracle and configures the risk, the engine will happily treat it as just another perp.

Oracle teams around HIP-3 are already pitching feeds for commodities and indices, and early builders like Ddot are using the framework to build a commodity exchange and other tradable real-world markets instead of purely crypto-native derivatives.

For a small trader, a single interface to bet on almost anything with a price is a dream that lets you onboard once, deposit stablecoins, and flip between spot and perpetual trading. I can trade BTC, ETH, or SOL on spot markets one moment, and the very next, I could be going long or short with 10x leverage on crypto, NVDA, a Nasdaq basket, or any other real-world asset from the same margin pot at any hour of any day.

However, some risks sit between traders and the underlying asset.

A deployer picks the oracle, decides which exchanges to read prices from, how to average them and update the system. If the human or team responsible for this falters, the price of the perpetuals can move out of sync with the underlying asset. It could liquidate someone with high leverage even if the underlying asset barely moved. Unlike traditional market breakers, the on-chain markets also don’t have the luxury of hitting a pause button to halt the liquidation.

There are also regulatory concerns about contracts for difference (CFDs), in which traders bet on the price of a share without owning it.

Hyperliquid’s on-chain markets don’t promise direct custody of stocks or ownership, and the chain avoids using words like “shares”, but if these markets scale, the line between “crypto derivative” and “offshore equity product” can be called into question.

Yet, it is hard to ignore what this unlocks for certain traders. If you live outside the U.S markets and want exposure to U.S assets, time differences, markets being shut on weekends, and siloed products across different brokers will trouble you in traditional markets. All such traders will welcome a global, stablecoin-settled, 24/7 derivatives layer that lets them trade U.S stocks, gold, bonds, or any commodity on-chain, instead of a brokerage app.

A careful trader will hedge, diversify, and approach these markets with caution. At the same time, it can become an ‘everything, everywhere, all at once’ lesson in liquidation for a bored degen who experiments right away with 10x bets.

That’s it for today. I’ll see you with the next one.

Until then … stay sharp,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.