Evolution of Crypto ft. Vitalik Buterin 🎙️

Early adoption of crypto is progressing towards practical usability - Ethereum takes stage at Token 2049. Buterin’s new standards for L2 decentralisation and solo staking for network decentralisation.

Hello, y'all. We are going to be at Token 2049, are you?

Please DM us on X with a link to your project. We are going to publish friends of Token Dispatch at Token 2049 list starting tomorrow until September 20, 2024.

Check out today’s list below 👇

That’s you and your project landing in over 130,000 inboxes. Seven days in a row - September 14-20, 2024. Limited to five people and projects each day.

The US Federal Reserve sings today.

You know what we mean, right?

The FED meet will shape the path of financial markets in the medium to long term.

Read: Good, Bad and Ugly of Rate Cuts 👀

On the other side of the world, far east in Singapore Ethereum co-founder Vitalik Buterin sang the crypto tune. Quite literally. We were there 👇

Vitalik Talk (TL;DR): The Evolution of Crypto

Overcoming early challenges

Early adoption of crypto is progressing towards practical usability.

High fees previously hindered Bitcoin's adoption for payments.

In 2024, Ethereum Layer 2 fees have dropped to under $0.01.

Transaction confirmation times on Ethereum improved to 5-15 seconds.

User experience and UI quality of decentralised applications have significantly enhanced.

The true value proposition of crypto

Crypto's benefits focus on creating persistent digital structures rather than mere efficiency.

Blockchains enable the construction of 'digital castles in the sky.'

The goal is to meet mainstream adoption needs while preserving open-source and decentralisation values.

Evolving wallet security

New wallet security approaches are needed beyond extreme self-custody and centralised custody.

Traditional self-custody protects against centralised bad actors.

Centralised exchanges offer protection from personal mistakes.

Smart wallets with multi-signature (multi-sig) provide protection from both risks.

Emerging technologies and approaches

ZK wrappers can integrate Web2 trust anchors into Web3.

Decentralised social media UX examples include VARcaster.

Ethereum-based wallets with Web2-quality UX, such as Dymo, are emerging.

Privacy Pools offer privacy and compliance without backdoors.

ZK Social Media provides simultaneous privacy and trust.

Ethereum Layer 1 improvements enhance performance and decentralisation.

The path forward

Technological limitations are no longer barriers to crypto adoption.

The focus should be on achieving both decentralisation and practicality within the crypto ecosystem.

Friends of Token Dispatch at Token 2049

Stacks: Bitcoin L2 enabling smart contracts and apps with Bitcoin as secure base layer.

Pudgy Penguins: The coolest NFTs that’s still making head spin, good vibes only.

Jupiter: Decentralised trading platform, liquidity aggregator on Solana.

Movement: Secure and scalable network of Move-based rollups secured by Ethereum.

Evolv: Launchpad-as-a-Service for brands and IPs to launch their own tailored decentralised applications.

Why is Ethereum Struggling Against Bitcoin?

ETH/BTC ratio hits 40-month low: Ethereum's price is at a 40-month low against Bitcoin. The ETH/BTC ratio reached 0.04057 on September 11.

It might drop further, to the 0.02-0.03 range, unless there's a change in investor sentiment or regulatory clarity to favour riskier assets like Ethereum and other altcoins.

Bitcoin outperforms in 2024: Ethereum has barely moved since the start of the year, trading just 0.02% above its January 1 opening. Bitcoin has surged approximately 36% in 2024, highlighting diverging performance.

ETF impact favours Bitcoin: Spot Bitcoin ETFs have a significant impact on BTC's price, influencing about 8% of spot volume. In contrast, Ethereum ETFs only affect 1% of spot volume, indicating a stronger appetite for Bitcoin investments.

Bitcoin dominance rises: Bitcoin's market dominance reached a 40-month high of 58% on August 5. Increased investment in Bitcoin at the expense of Ethereum and other altcoins.

Ethereum network activity declines: The 30-day average of daily active addresses on Ethereum has decreased by 7.7% over the last 90 days.

DApp usage on Ethereum has declined by 19% in the past month, while competitors like Solana and Tron saw increases of 257% and 343%, respectively.

Outlook for Ethereum: For ETH to rise above $2,400, the network needs sustained growth, increased transactions, and higher DApp usage.

Current data indicates challenges in recapturing investor interest and network activity for Ethereum.

The Quiz Game For The Music Lovers

The music quiz game that’s got over million plays. Who are you playing with then 👇

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

It provides an interactive experience through quizzes and exploration tools. For artists it’s a powerful tool for artists to connect with their fans.

Block That Quote 🎙️

White. Black. Grey. An analogy of life - Vitalik Buterin

“Choose both. Choose purple.”

Buterin’s New Standards for L2 Decentralisation

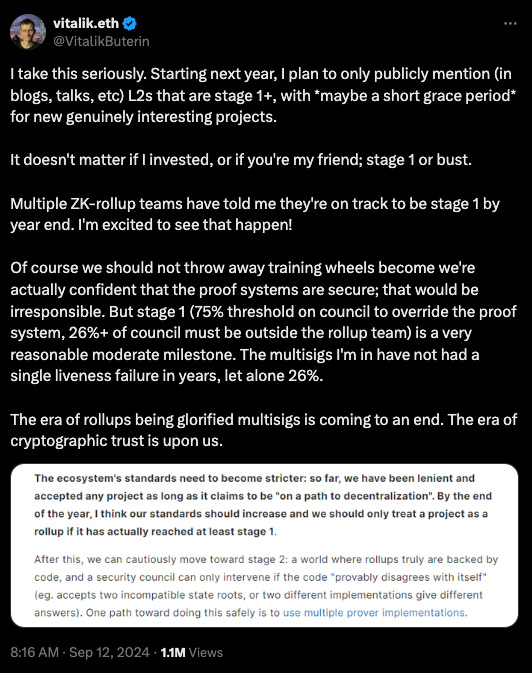

Buterin announced he will only recognise layer-2 networks that reach "stage 1+" starting next year.

Three stages of Layer-2 decentralisation

Stage 0 (full training wheels): Basic rollup functionality with minimal decentralisation and no fraud or validity proofs.

Stage 1 (limited training wheels): Requires active fraud-proof or validity-proof schemes, a multi-signature override mechanism, and a seven-day upgrade delay.

Stage 2 (no training wheels): Full decentralisation with limited override capabilities only for clear bug cases and a 30-day upgrade activation delay.

Stage 1 recognition requirements

Implement active fraud-proof or validity-proof schemes.

Establish a multi-signature override mechanism with strict conditions.

Introduce a seven-day delay for upgrades.

Industry progress: Buterin noted that several zero-knowledge rollup teams aim to achieve stage 1 by year-end, marking the end of "rollups being glorified multisigs."

Future outlook: Major layer-2 teams, including Linea, ZKsync, Arbitrum, and Optimism, project reaching full decentralisation (stage 2) within a few years, a significant shift towards greater decentralisation in the Ethereum ecosystem.

Successful strategy: Coinbase's Layer 2 solution, Base, has set a new record with over 4.5 million transactions on September 14. Positioned as the leading Layer 2 network. This milestone, along with the recent launch of cbBTC on both Ethereum and Base, showcases Base's rapid adoption.

Read: Coinbase Wants To Wrap Your Bitcoins 🌯

In The Numbers 🔢

$13.5 billion

The amount restaking platforms - EigenLayer, Symbiotic, and Karak - hold in restaked crypto collateral.

EigenLayer leading at about $11 billion in total value locked (TVL) as of September 17.

Actively validated services (AVS): Dozens of decentralised applications, or "actively validated services" (AVS), are now being secured by restaking platforms.

While EigenLayer's data storage and management protocol, EigenDA, is currently the only AVS paying rewards, others like ARPA Network are set to begin rewarding restakers as soon as this month.

Two-sided marketplace: Restaking is creating a dynamic marketplace for crypto-economic security.

dApps and protocols seek on-chain security, while on the other, retail and institutional restakers provide crypto collateral in exchange for a share of protocol revenues.

Emerging asset class: The evolving restaking ecosystem is a new asset class.

DeFi protocols like Byzantine Finance are developing targeted risk exposure strategies, while institutional players such as Nomura's Laser Digital are entering the space.

S&P Global predicts the potential emergence of an "internet bond" market.

Revenue Potential: While current rewards are mainly token-based, experts anticipate a shift to sustainable revenue models as restaking improves network performance and on-chain activity.

Read: Ethereum Staking [Feat. Eigen Layer] 🧑🌾

Solo Staking for Network Decentralisation

Vitalik Buterin spoke at Ethereum Singapore 2024 on September 16 about the critical role of solo stakers in enhancing Ethereum's security and decentralisation by reducing reliance on centralised entities.

He reckons that solo stakers, as an uncoordinated and diverse group, play a crucial role in reducing reliance on centralised entities and protecting the network.

“The stronger that we can have solo [...] I think there is a lot of ways in which that can serve as this really important extra layer of defense regarding security and privacy.”

Defense against 51% attacks: The need to raise the block finality threshold from two-thirds to a higher percentage, such as three-quarters, to make 51% attacks more challenging.

Proposal for enhanced security: Increasing the quorum threshold for block finality to strengthen network protection against potential attacks.

Support for Google’s automated sign-In: He endorsed Google’s automatic sign-in feature, suggesting a multisig-like security model for servicing wallets to safeguard sensitive data and assets.

The Surfer 🏄

Republican lawmakers McHenry and Emmer have requested clarity from SEC Chair Gensler on the agency's view of crypto airdrops, accusing the SEC of fostering a hostile regulatory environment. They seek answers by September 30 ahead of upcoming hearings on digital assets and SEC oversight.

Bhutan has amassed $780 million in Bitcoin, nearly one-third of its GDP, through state-run mining operations. The investment arm, Druk Holdings, is partnering with Bitdeer to expand mining capacity to 600MW by 2025, leveraging the country's abundant hydropower resources.

Binance has refuted claims of responsibility for the $230 million WazirX hack, stating it never acquired or controlled the Indian exchange. The cryptocurrency giant criticised WazirX's attempts to shift blame, emphasizing that WazirX's team should be held accountable for the lost user funds.

Circle has integrated its USDC stablecoin with Brazil's PIX and Mexico's SPEI national payment systems. Direct access to USDC from local financial institutions, reducing transaction times from days to minutes for cross-border transactions and remittances in these major Latin American economies.

Wintermute has announced the launch of OutcomeMarket, a decentralised prediction market platform for the 2024 US presidential election, featuring HARRIS and TRUMP tokens. The multi-chain platform will operate on Ethereum, Base, and Arbitrum, users can participate without bridging assets.

If you want to make a splash with us, check out sponsorship opportunities 🤟

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋