Hello

As we go past three quarters of 2025, I thought it’d be a good time to reflect on how money has flowed into the crypto ecosystem so far.

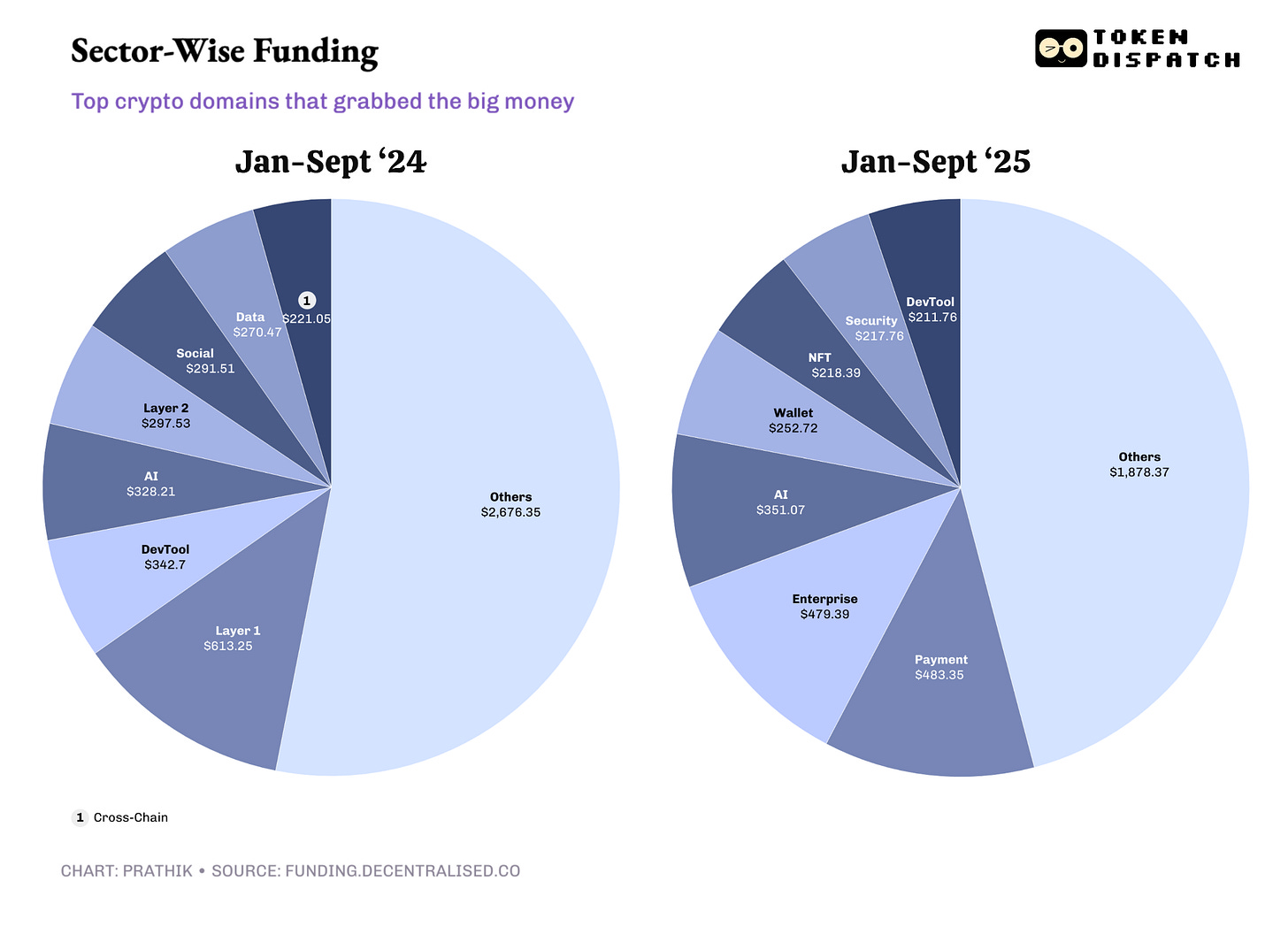

While 2024 saw a heavy influx of funds into Layer-1 and Layer-2 projects, developer tools, and AI products, this year was mainly about backing payment and enterprise-grade infrastructure.

The funds that had chased every shiny idea the year before had become selective, concentrating on a select few sectors. What resulted was fewer deals, fatter cheques and a venture market that seemed clearer about where it saw value coming from in the crypto landscape.

Although the overall funding dropped year-on-year in the nine months through September, the data tells us that it may not be as bad a sign for those building in the landscape.

On to the story now,

Prathik

Crypto Investing Without the Crypto Chaos

Forget seed phrases, exchange hacks, and late-night wallet setups.

With Grayscale, you can invest in Bitcoin, Ethereum, and other digital assets the same way you’d buy a stock — through regulated, SEC-reporting products.

No private keys to manage

No unregulated exchanges

No steep learning curve

It’s the easiest way for individuals and institutions alike.

The total crypto venture funding from January 1 to September 30 totalled $4.09 billion across 463 rounds, of which 392 disclosed their cheque sizes. That’s a 19% drop in total capital from the same period last year, data from Decentralised.co’s funding tracker showed. In 2024, the total funding for the nine months stood at $5.04 billion across 980 deals, of which 725 disclosed their funding amounts.

Despite the decline in total funding, the average deal size across disclosed rounds has jumped 50% to $10.4 million, while the median cheque rose from $3 million to $4 million in 2025. As a result, we have a market that appears quieter than it was in the previous year, yet has become more capital-dense.

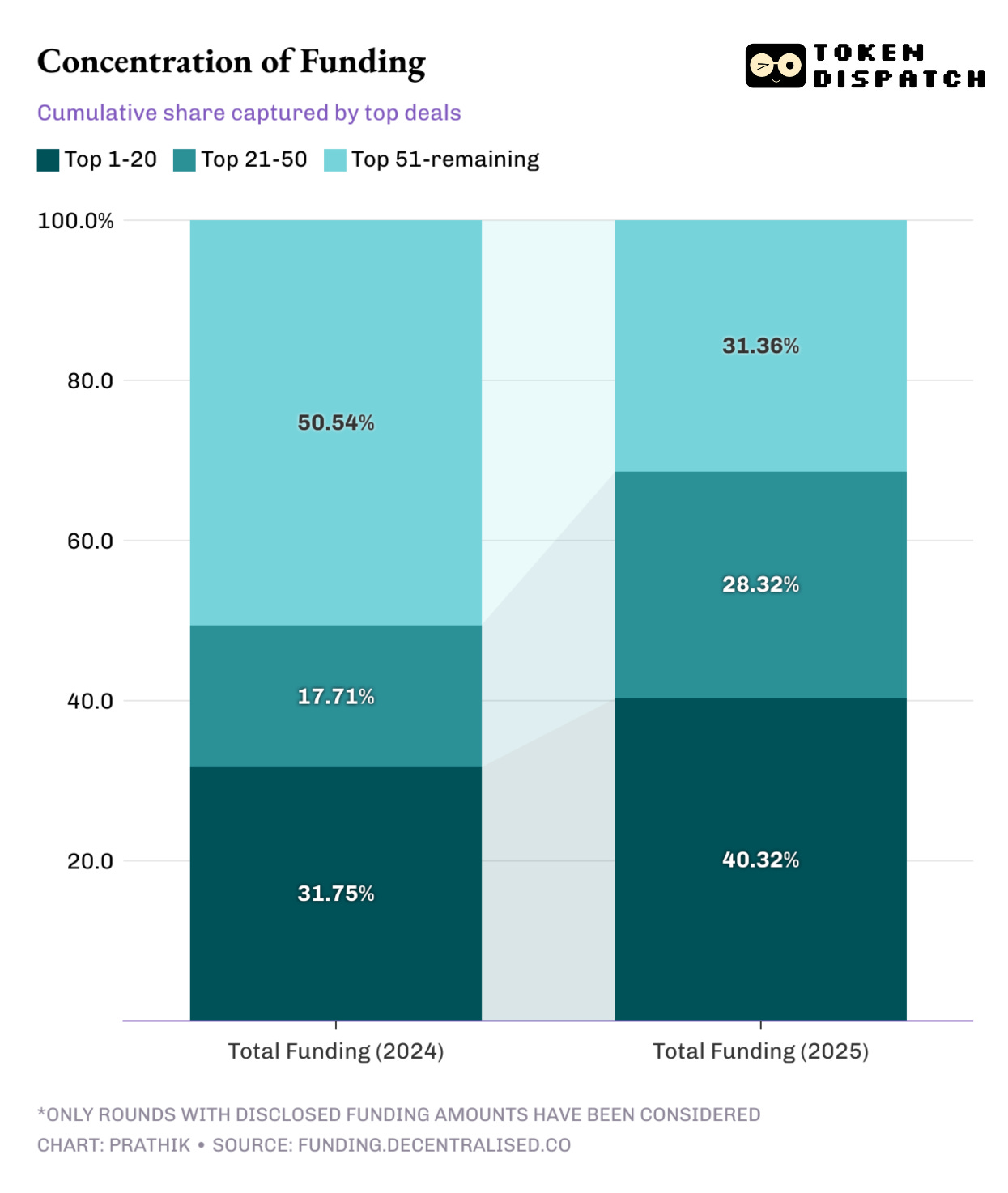

The top 20 rounds captured 40% of all 2025 funding, compared to 32% in 2024. Zoom out to the top 50 rounds, and their share swells from 49% in 2024 to 69% this year.

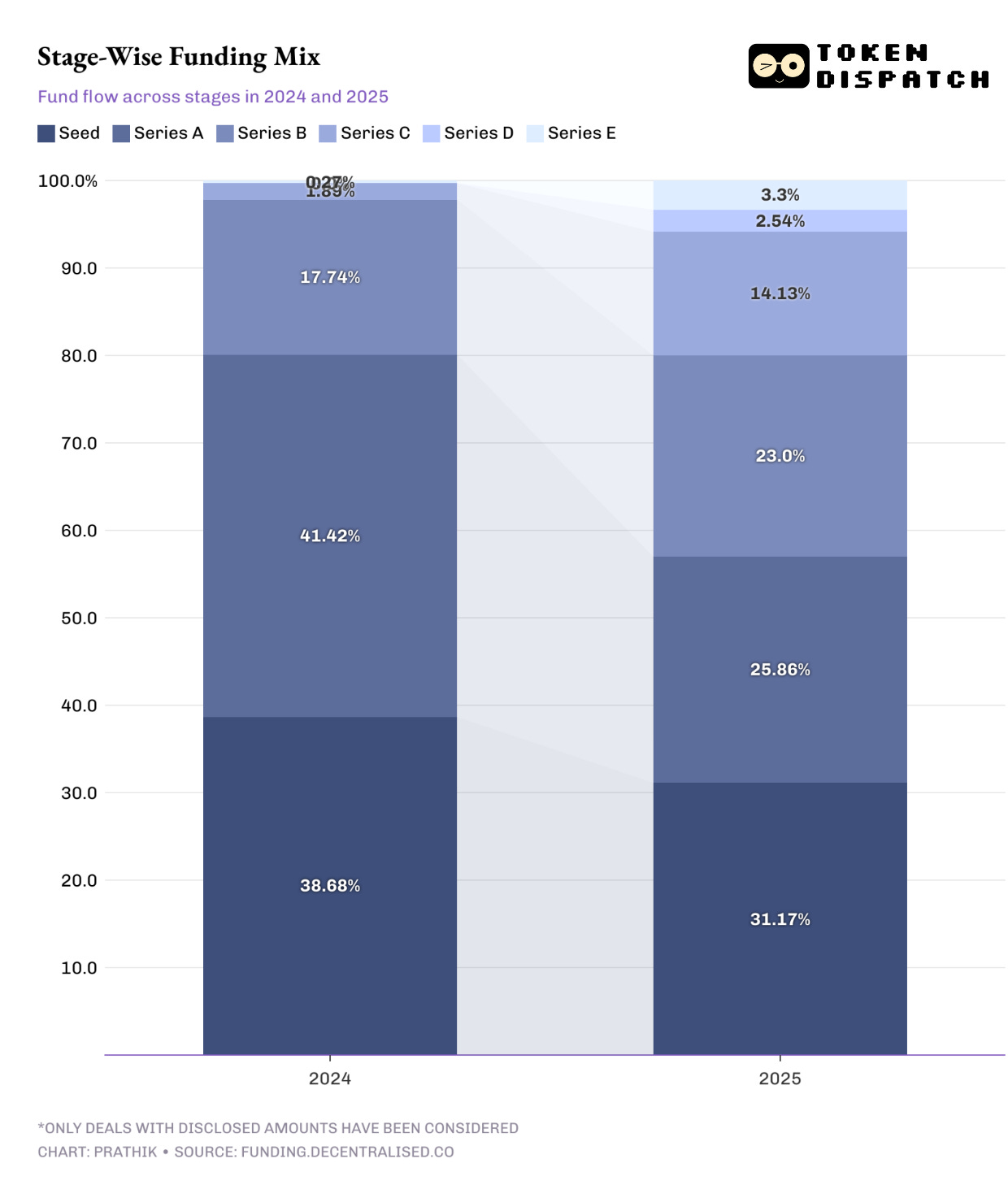

This year’s fund flow shows the stage of funding also levelling up.

Seed and Series A rounds lost share, while the later stages gained a share of the overall funding. Approximately 57% of all funds were invested in the early stages (Seed and Series A) of crypto projects, compared to 80% in the first nine months of 2024.

This signals that investors are shifting their risk from ideation to the execution phase.

Venture capitalists now require proof before backing a project. They chose to double down on projects that promised an established distribution system and a clear regulatory standing over newer entrants.

Investing more dollars in later stages means fewer wipeouts and fewer moonshots. Returns flatten into steadier, cash-flow-backed gains. On the flipside, this could mean a leaner 2026 idea pipeline. If activity in Series A and the Seed level doesn’t recover soon, it could mean lower venture capital interest in emerging domains.

The concentration of fund flow shifts where venture capitalists expect value to come from.

The sector-wise numbers show that only AI remained consistently as investors’ favourite sector across 2024 and 2025. The rest of the domains that were among the top-5 money magnets in 2024 didn’t manage to grab as much investor interest in 2025.

For founders, the message is that if you are building in the domains of AI, payments, enterprise infrastructure and real-world tokenisation (RWA), then the cheques exist. Outside these domains, funding has dried up in areas such as Layer-1 and Layer-2 infrastructure, developer tools, and social, which formed the cream in 2024.

All this signals a few takeaways.

First, the cap-table is skewing toward fewer but deeper leads. This is often observed in maturing industries. As any industry gains experience from its experiments in its life cycle, more measured and calculated bets follow. It brings structure to the ecosystem, helping with late-stage cases, but leaves little room for small cheques toward newer players.

Second, price discovery shifts from hype cycles to metric-driven movement. Investors are now signing cheques when they see margins instead of chasing narratives.

Third, velocity slows. Fewer newer experiments being funded means fewer innovations to test market demand in newer areas. New products will still arrive, but are more likely to emerge from established players or bootstrapped projects, as seen in the cases of Aster (BNB Chain) and Hyperliquid (non-VC project), respectively.

This new approach rewards meaningful metrics, such as revenue-generating capacity, and enterprise-grade storytelling. It will also help expose the optimism bias by highlighting the fragility of ideas. Overall, the venture market will become more stable as it narrows.

We might want to return to certain aspects of 2024, such as a more uniform distribution of investment across stages with thicker midsections. But until that happens, we will have to make do with fewer bets, bigger cheques.

That’s it for this week’s quants story.

I’ll see you next week.

Until then … stay sharp,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.