Hello!

Every Saturday, I dive into a podcast hosted by our partners at Decentralised.co and share what caught my attention.

This week, I reflected on the episode where Mode Network’s James Ross joined Saurabh Deshpande to unpack how AI agents might reshape the way traders interact with DeFi, from basic trading to risk management and more.

Listen to the full episode here.

James Ross is no stranger to DeFi or AI. He's been investing and building in crypto for seven years, most recently as the founder of Mode Network, a Layer-2 focused on making DeFi smarter with the help of data. Before that, he had seen AI being integrated into fintech back in 2015, long before it became a buzzword cycle.

Ross sets a clear vision, both for the DeFi industry and Mode Network by asking the important question: “How can AI agents help people make more money?” While it may be a rhetorical one, for me it cuts through all the usual AI hype.

I found Ross's vision quite bold. He dreams of a future where most DeFi transactions happen without users ever touching Uniswap or Aave frontends. Instead, you'd simply tell an agent what you want through a chatbot, or deposit into a vault that's entirely managed by AI.

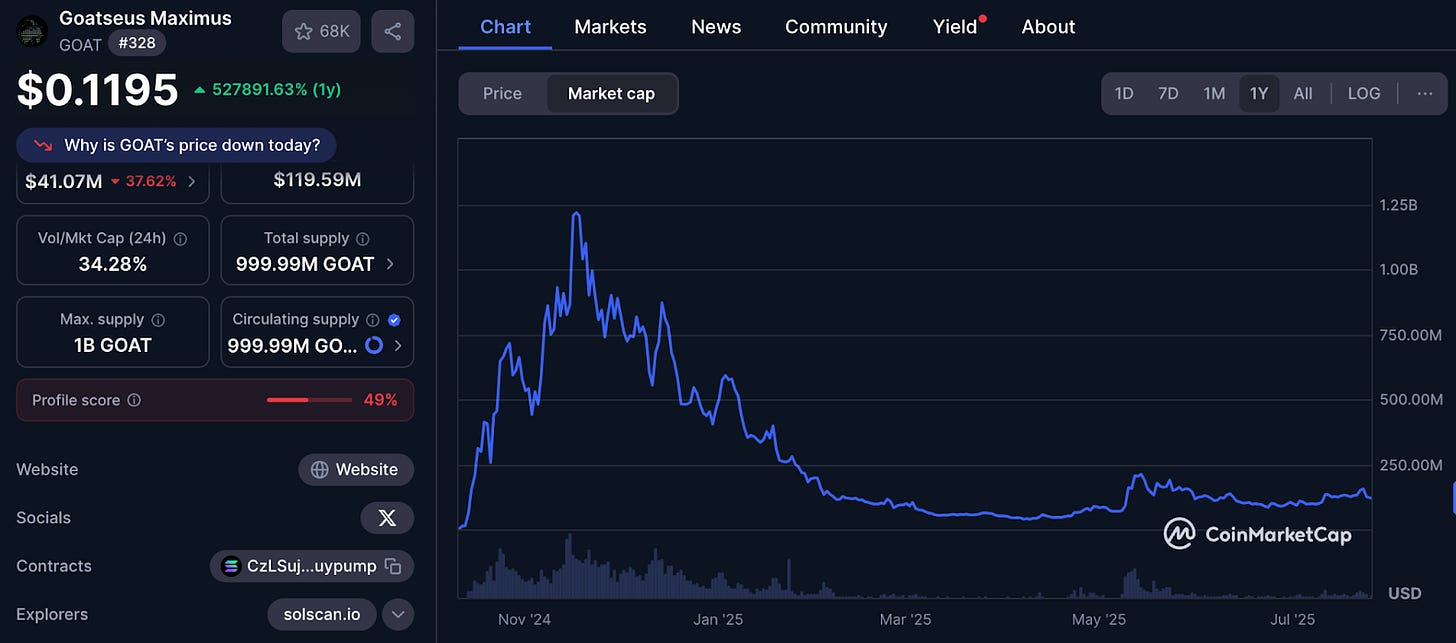

The idea reminded me of the whole $GOAT-Truth Terminal episode we saw late last year.

Read: The Goatse Singularity

Unlock Web3 Insights with Decentralised.co

Long-form stories trusted by the best in Web3. Senior executives from 140+ enterprises trust them to keep them updated on what's going on in crypto.

Good writing. In-depth conversations. Right in your inbox.

Subscribe to Decentralised.co

Took the crypto world by storm with its engagement on X, saw its market cap shoot up and seemed promising, until it wasn’t. In just a month from its launch, its market cap touched $1.2 billion. From there, it dropped 90% in three months.

Goatcoin was just one of the many we saw during that cycle of AI products.

Ross points this out, too. He distinguished between the overhyped LLMs masquerading as AI systems on Twitter and genuinely useful products. He gives the example of Giza Protocol's agents that move user capital across lending protocols to optimise yield and claim to offer over 80% higher yields than static capital.

But such projects are still early in their journey and manage a relatively smaller asset size. Giza’s agents currently manage $475 million in volume.

Still, there was one thing that Ross mentioned which I was drawn to. The idea of consolidating intelligence.

Right now, making smart DeFi decisions, whether you're parking stablecoins, figuring out when to hedge, or understanding your liquidation risk, means pulling information from multiple sources and trying to piece it together.

Many times when I experimented with trading platforms, I would stop short of completing my trade because of this specific reason. By the time I would piece together the strategy I’d like to follow, figure out the probability of liquidation and understand the fundamentals driving my decision, it’d be too late. Sometimes, I would struggle to even find some of this information.

This is where AI systems can make it simpler for users.

Whether through signal agents like AIXBT, running hedging strategies via AI terminals, or using data layers to calculate liquidation probabilities on specific trades, the goal of such systems is bringing intelligence to one place. And I think there’s definitely value for new traders in this.

Mode Network's AI Terminal also tries to do this. You type, it responds with options, risk metrics, or ready-to-execute strategies. It walks along with you in this financial journey as an assistant. It’s what Ross calls the co-pilot phase.

That’s an easy-to-follow step for retail users. No more parsing through threads or trying to make sense of noisy signals. Just a terminal that replies with insight, instead of confusing candles and criss-crossing lines and patterns.

This might be enough for some. But I feel there’s more to AI than just doing this.

What got me excited is the next wave where Ross expects AI agents to play a proactive role. One where they suggest strategies tailored to my risk appetite. If I am chatting with a bot for recommendations on trading strategies, I’d like it to play the role of a personal financial advisor rather than merely sharing the same set of strategies to all users.

I think of all those Monday mornings when I’d wake up to Bitcoin’s pump or dump, depending on US President Donald Trump’s comments about trade tariffs, Bitcoin, crypto, immigration and the war in Iran.

Ross claims this can be done with Mode Network’s Synth subnet, which was launched on Bittensor. This layer synthesises data of real-world scenarios and predicts Bitcoin’s price volatility across 24 hours. The processed data can then be used by Mode Network’s AI agents to suggest strategies accordingly. The next thing on Ross’ roadmap is to bring equities onto the Synth subnet.

I am interested to see if Synth could analyse both traditional and crypto markets and establish better correlations. Could it then predict the risk of liquidation in each of these markets in response to various real-world scenarios like interest rate cuts or high inflation print?

Ross feels eventually autonomous agents will do most trades on behalf of humans. All these do sound like sophisticated tools.

Saurabh even asks the natural question: “Do retail users even want such tools that are used by hedge funds”? People want to feel safer, not necessarily smarter. A prettier terminal doesn't make bad trades any less painful. But Ross thinks this question stems from fear.

He feels these tools educate the traders and help them feel safe.

I still have my reservations about fully autonomous agents. The idea of complete automation makes me a bit uncomfortable, regardless of how sophisticated the system claims to be. But that’s me. Maybe they are not for everyone. But I feel they will have enough buyers for it to be operationally viable.

If co-pilot tools can take away the grunt work and agent-led strategies can make smarter decisions accessible to non-traders, DeFi becomes less intimidating. Similarly, for a section of experienced traders, additional layers like Synth that bring real forecasting power into the mix, can make trading feel more like well-informed decision making.

We just need to be realistic about what tools are appropriate for each kind of user.

Maybe the auto-pilot phase of DeFi is worth the experiment for those seeking to unlock the next level of trading. Even if that means letting go of the wheel a little.

And if platforms like Mode can pull it off for that section of traders, they may not need to open five apps just to make one good trade.

See you next week.

Off to try the AI terminal and ask if I should bet on ETH or just touch grass,

Prathik

Check out the full episode to hear James Ross full conversation with Saurabh Deshpande.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

Automating financial product selection and trading in a volatile non linear and dynamic environment where the asset price depends on what other actors are doing ( not just its 'fundamentals') is unlikely a workable idea.

Past patterns break as meme stonks and current serial losses on US Treasuries show,.

I share @Prathik Desai concerns