The richest people in history all owned the same thing.

Every dominant civilisation, every empire, and every era of human prosperity has been defined by one thing: control over the scarcest productive resource of that age.

The Egyptians had the Nile. The Dutch had trade routes. The British had coal and steam. The Americans had oil. In each case, the people who owned, extracted, or financed that resource captured an outsized share of the wealth created during that period.

It’s not a conspiracy. It’s just how value concentration works. When something becomes essential to economic output, ownership of that resource becomes the highest-leverage position you can hold.

So here’s the question. What’s the scarcest productive resource of our age?

It’s not data. Data is abundant. It’s not even AI models themselves, as those can be replicated, fine-tuned, or forked.

It’s compute.

The GPUs that train and run every AI system you interact with are the bottleneck. NVIDIA can’t manufacture them fast enough. Hyperscalers are spending hundreds of billions trying to secure supply. OpenAI’s Stargate project alone is committing $500 billion to build out AI compute infrastructure.

Compute is the new oil. The new farmland. The new railroad.

But unlike oil or real estate, there’s been no way for regular people to own a piece of this resource and earn from its productivity. You can buy NVIDIA stock, sure. But that’s buying a company with a dozen business lines and a valuation that already prices in decades of growth. You can’t buy a fractional share of an H100 and collect rent on the compute cycles.

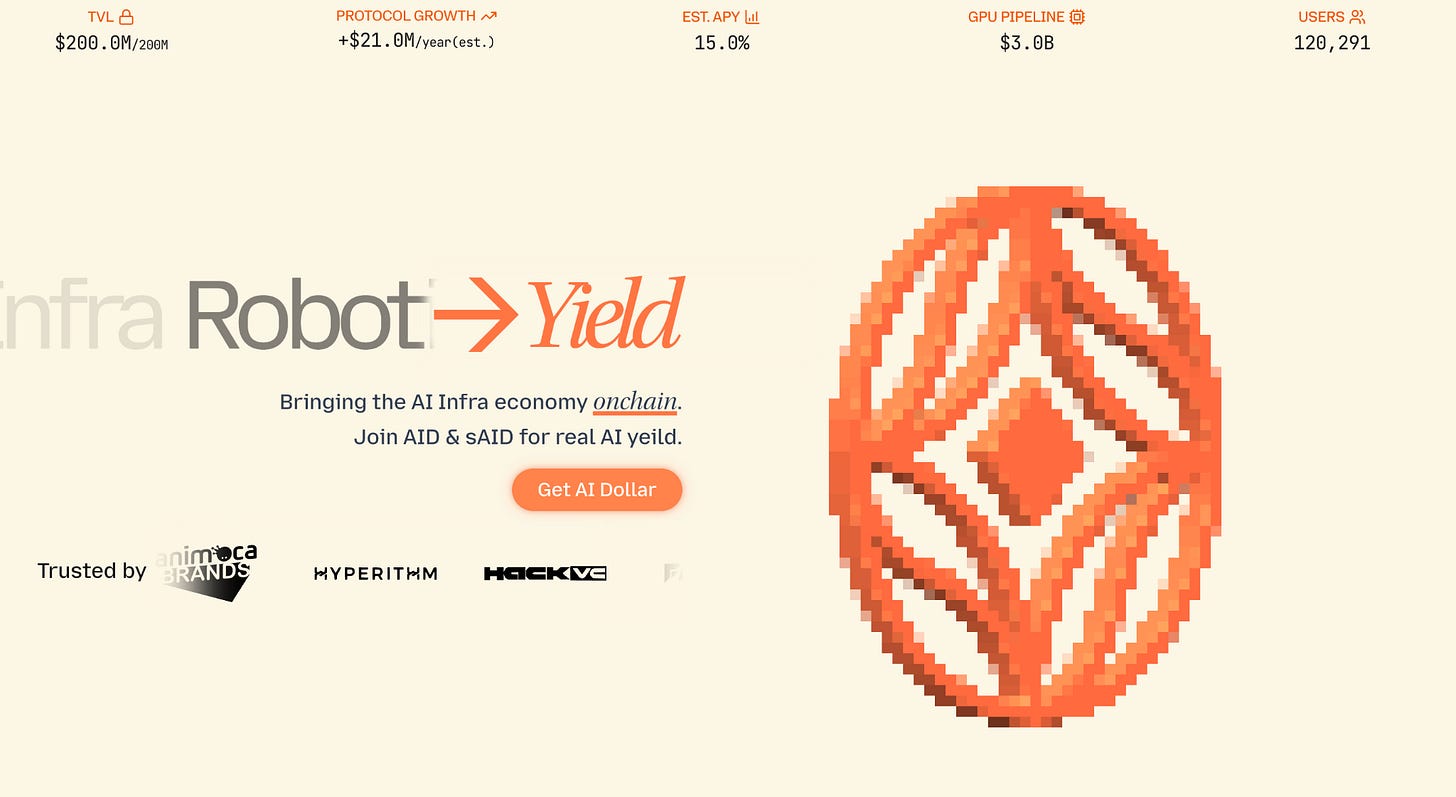

GAIB is trying to change that. They’re tokenising AI infrastructure (GPUs, robots, data centers) and turning them into yield-generating assets that anyone can hold on-chain.

👉🏼 Explore Gaib.ai

The Problem With Most Crypto Yield

Before we get into GAIB, let’s talk about why this matters.

If you’ve spent any time in DeFi, you know the dirty secret: most yield is fake.

You stake a token, you earn rewards, and those rewards come from… token emissions. The protocol prints new tokens, gives them to you, and calls it APY. But inflation isn’t yield. If the token supply doubles and your bag doubles, you haven’t actually gained anything. You’ve just held your position against dilution.

The other common source is circular liquidity. You deposit funds, someone borrows them, they deposit elsewhere, and someone else borrows. It works until there’s a bank run, and then you’re stuck holding an unbacked receipt token, wondering where your money went.

Vitalik Buterin himself has addressed this problem. He’s said that for DeFi to mature, yields need to come from “something external,” something rooted in real economic activity outside the crypto bubble.

It’s similar to how banks lend depositor funds to businesses that generate real value.

That’s what makes GAIB interesting. They’re not printing tokens and calling it yield. They’re financing physical AI infrastructure, collecting revenue from compute operations, and passing that revenue to token holders.

What GAIB Actually Does

GAIB calls itself the “economic layer for AI infrastructure.” Let’s break down what it actually means.

Here’s the business model:

Step 1: Cloud companies need GPUs

Running AI workloads requires serious hardware. A single NVIDIA H100 costs upwards of $30,000. Outfitting a data center can run into hundreds of millions. Cloud providers and data centers need capital to acquire these assets, and traditional bank financing is slow, expensive, and often unavailable for this asset class.

Step 2: GAIB provides financing

GAIB steps in with capital. They structure deals with cloud companies (most of which are NVIDIA Cloud Partners), secured by the physical GPUs and the revenue contracts those GPUs generate. The deals are over-collateralised at 1.3x to 1.5x, meaning there’s a buffer if something goes wrong.

Step 3: GPUs generate revenue

Cloud companies deploy the GPUs, rent them to AI companies, and generate revenue. These aren’t speculative bets. Most deals involve multi-year contracts with paying customers. The typical payback period for GPU investments is 12-18 months, which translates to annualised returns of 50-100% on the underlying hardware.

Step 4: Revenue flows to token holders

That revenue flows back into GAIB’s protocol and gets distributed to holders of their yield-bearing token (sAID). No token emissions, no circular liquidity. Just cash flow from actual economic activity.

They’ve already executed around $50 million in tokenised GPU deals, including a notable $30 million transaction with SIAM AI, Thailand’s first sovereign AI cloud and an NVIDIA Preferred Partner. They’re now expanding into robotics, partnering with Primech (Nasdaq: PMEC) to tokenise cleaning robots under a Robot-as-a-Service model.

The Products: AID and sAID

GAIB has two core products you need to understand:

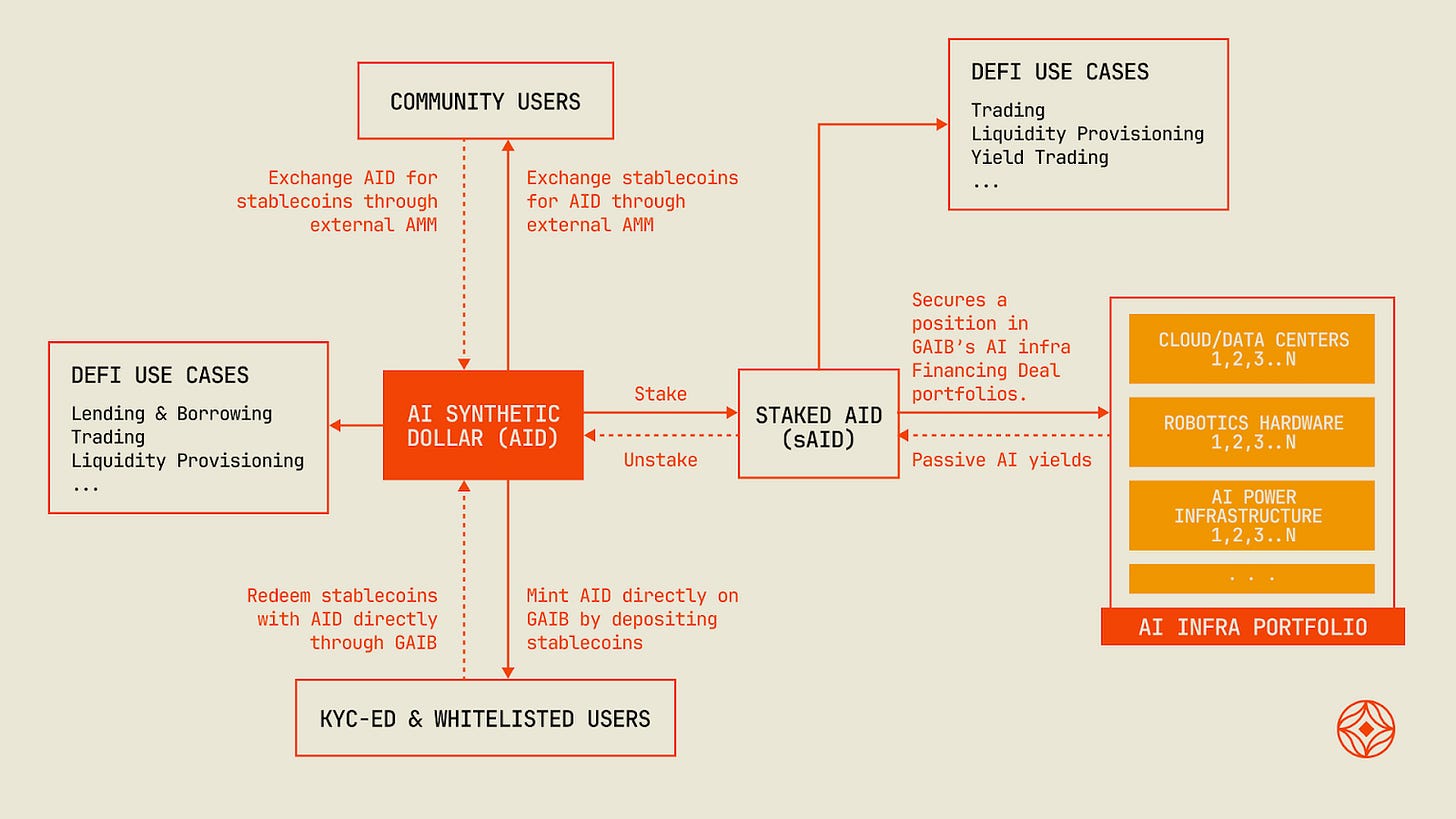

AID (AI Dollar)

AID is a synthetic dollar pegged to $1 and fully backed by US Treasuries and stable assets. You can think of it as your entry ticket into the GAIB ecosystem.

You can mint AID by depositing USDC or USDT. You can swap it on DEXs or use it for liquidity provision (LP). On its own, AID doesn’t generate yield, but it’s designed to be the base currency for everything GAIB does.

As of November 21st, AID is redeemable 1:1 for USDC on Ethereum. No lockups, no funny business. You can withdraw your funds whenever you wish.

sAID (Staked AID)

This is where the yield lives.

When you stake AID, you receive sAID, a liquid staking token that represents your share of GAIB’s portfolio of AI infrastructure financing deals. As those deals generate revenue, the value of sAID relative to AID increases. No manual claiming, no compounding. You just hold sAID and watch the exchange rate tick up over time.

The underlying portfolio consists of:

30% US Treasury bills (for liquidity and stability)

70% deployed into GPU and robotics financing deals

The sAID vault follows the ERC-4626 standard, so it’s fully composable with other DeFi protocols. You can use it on Pendle to split into principal and yield tokens. You can supply it to Morpho as collateral. The integrations are already live.

If you want to exit, you can either sell sAID on secondary markets (when those pools deepen) or unstake through GAIB’s withdrawal manager with a 30-day cooldown period.

Why This Is Different From Other RWA Projects

Real-world asset tokenisation isn’t new. You’ve probably seen projects tokenising treasuries, real estate, private credit. So, what makes GAIB stand out?

1. They’re Tokenising a Growing Asset Class

Most RWA projects tokenise stable, mature asset classes. That’s fine, but the returns reflect that stability. GAIB is tokenising AI infrastructure, which is one of the fastest-growing sectors in the global economy. The demand for compute is exponential. Every new foundation model, every new AI startup, every enterprise AI deployment needs more GPUs.

2. The Team Operates in the Industry

GAIB’s co-founder Alex runs GMI Cloud, an actual Nvidia Cloud Partner. Co-founder Kony comes from venture capital and traditional finance. They’re not tokenising GPUs from the outside looking in. They have direct relationships with cloud providers across Asia, North America, and Europe. Their current pipeline exceeds $2.5 billion in potential deals.

3. The Structure Is Conservative

They require over-collateralisation on every deal. They only work with cloud companies that have signed customers and proven payment histories. If a borrower defaults, GAIB can either liquidate the hardware on secondary markets or continue operating the GPUs through partner data centres.

4. They’re Expanding to Robotics

The same model that works for GPUs works for any physical asset with recurring revenue. GAIB has already announced partnerships to tokenise robots, specifically service robots operating under Robot-as-a-Service models. If this scales, sAID becomes exposed to a diversified portfolio of AI infrastructure, not just compute.

The $GAIB Token

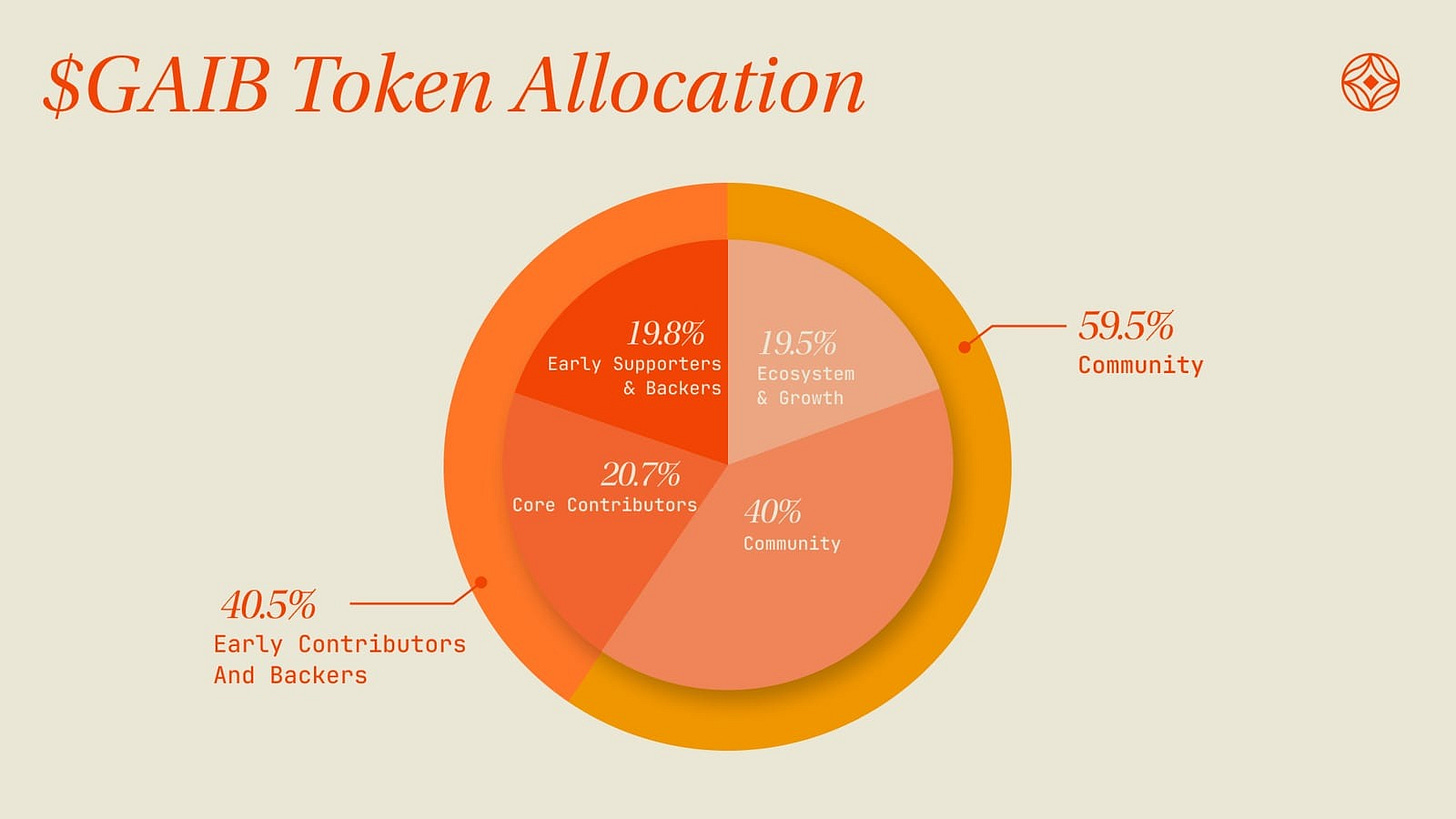

GAIB is launching its native token with a total supply of 1 billion. Here’s the allocation:

40% Community (airdrops, staking rewards, ecosystem incentives)

20.7% Core contributors

19.8% Early backers

19.5% Ecosystem and growth

That 40% community allocation is notably higher than most projects. The token has actual utility beyond governance: you stake $GAIB to secure the validator network that attests to the real-world status of tokenised assets. Validators confirm that the GPUs exist, are operational, and are generating the claimed revenue. If they misbehave, they get slashed.

The economic model is designed to be non-inflationary in the long-term. Early emissions bootstrap participation, but over time rewards come from actual protocol revenue rather than token printing.

How to Get Started

If you want to try GAIB:

Go to aid.gaib.ai

Connect your wallet (MetaMask, WalletConnect, etc.)

Deposit USDC or USDT to receive AID

Stake AID to receive sAID and start earning yield

They’re live on Ethereum, Arbitrum, Base, BNB Chain, and Sei. Ethereum is the primary chain for redemptions and DeFi integrations.

Who Should Pay Attention

Yield farmers tired of inflation games

If you’ve been burned by APYs that evaporated when the underlying token dumped, this is a different model. The yield comes from external revenue, not token emissions.

People who want AI exposure

Buying NVIDIA stock gives you a company with multiple business lines and a P/E ratio that prices in decades of growth. GAIB gives you more direct exposure to the economics of compute itself.

RWA enthusiasts

This is one of the more novel applications of real-world asset tokenisation. Instead of tokenising something static like a building, they’re tokenising productive infrastructure that generates ongoing cash flow.

DeFi natives looking for composability

sAID is already integrated with Pendle for yield tokenisation and Morpho for lending. You can build strategies on top of it, not just hold it.

Sam Altman likes to say that “compute will be the currency of the future.”

If that’s true, someone needs to build the financial infrastructure around it. Markets, yield products, liquidity layers. The same way financial innovation unlocked the value of oil in the 19th century, something similar needs to happen for AI infrastructure.

GAIB is one of the first serious attempts at this. They’re building a full economic layer: synthetic dollars, yield-bearing vaults, validator networks, and expanding asset classes.

What I find interesting about GAIB is what it says about both industries. AI infrastructure is becoming one of the most capital-intensive sectors in the world, with Big Tech planning hundreds of billions in data centre spending. That capital has to come from somewhere. Meanwhile, crypto has searched for years for “real yield,” ways to connect on-chain liquidity to actual economic production. GPU financing is a weirdly perfect fit.

GAIB’s bet is that they can build the rails for this connection. Maybe it works and they become the BlackRock of AI infrastructure financing. Maybe the sector proves more complicated than expected. Maybe a competitor eats their lunch. But the thesis, that AI infrastructure needs new financing mechanisms and crypto can provide them, seems right.

Is it a guaranteed win? No. Nothing is. But if you believe AI compute demand will keep growing (and every signal suggests it will), then protocols that can capture and distribute that value are worth watching.

At minimum, it’s a more interesting yield source than another rebase token.

That’s GAIB. GPUs in, yield out.

Until next time, stay onchain.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

This is probably the cleanest bridge between real compute scarcity and onchain capital markets I've seen. Most RWA projects tokenize stable mature assets with predictable but modest returns. Tokenizing GPU infrastrucure during the AI compute shortage is a diffrent beast entirely. The over collateralization at 1.3x to 1.5x plus the fact that these cloud partners have actual signed revenue contracts makes the risk profile way more transparent than typical DeFi yield farming. The validator network attestig to physical asset status is clever too, solves the oracle problem without relying on centralized data feeds.