Galaxy Digital's Nasdaq Debut

Michael Novogratz's crypto empire went mainstream yesterday, but the market's early verdict suggests the spotlight brought more glare than glory.

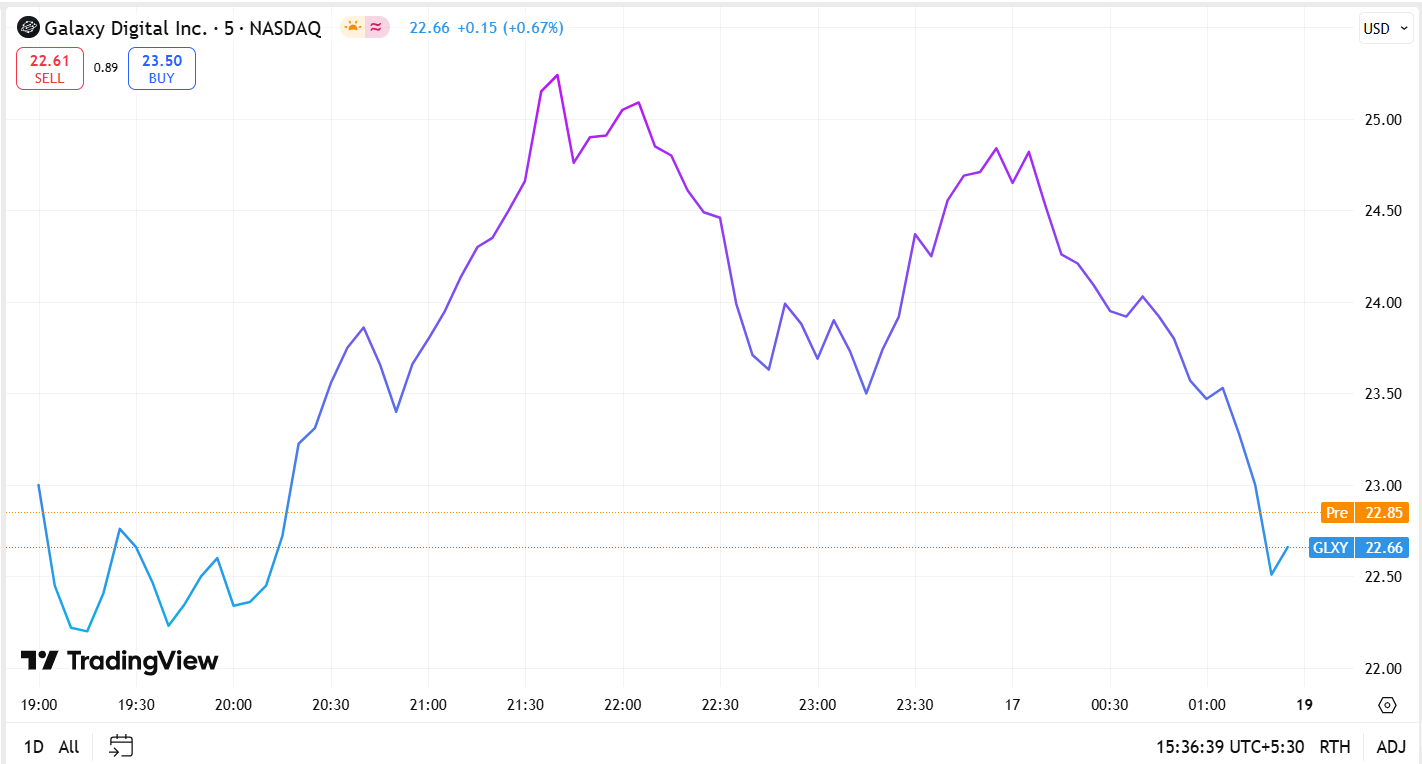

After seven years on the Toronto Stock Exchange, Galaxy Digital finally made its grand entrance onto Nasdaq yesterday under ticker GLXY. Market's reaction? A rather underwhelming 5% drop to $22.57.

"We are moving to the Nasdaq for one simple reason: liquidity, liquidity, liquidity, we've loved our time in Canada, but it's a much smaller capital market," Novogratz explained.

The numbers back up his logic. Canada's entire stock market is worth roughly $3 trillion. The US? $50 trillion.

Galaxy reported $43.8 billion in revenue for 2024. The revenue includes the full value of digital asset trades, not just the profits.

The company's actual net income was $365 million — still respectable, but hardly earth-shattering for Wall Street standards.

The Q1 2025 reality was brutal: $295 million in losses. Crypto prices tanked, and Galaxy took a $57 million hit on impaired assets.

Galaxy's Nasdaq listing isn't just about one company, it's about an entire industry growing up.

Coinbase went public in 2021 and recently got listen on S&P 500

eToro debuted this year, shares jumping from $52 to $66

Novogratz's personal journey mirrors crypto's own evolution. From Goldman Sachs partner to crypto evangelist to now ringing the Nasdaq bell, it's been quite the transformation.

"This is more than just a corporate milestone, it's the fulfillment of a deeply personal bet I made over a decade ago that the financial system was overdue for transformation," Novogratz reflected.

Galaxy even plans to tokenise its own stock on blockchain platforms, a move that could accelerate the $22.5 billion real-world asset tokenisation market.

Read: Is Tokenisation's Breakthrough Moment Here? 🔗

The 5% share price drop on day one might seem disappointing, but markets are treating Galaxy like any other financial services company — subject to fundamentals, not hype.

That's probably exactly what Novogratz wanted.