Global Outage 🚨

Faulty Microsoft security update causes disruptions across the world. Crypto stays unaffected by the global outage. Messari CEO Ryan Selkis resigns. $844,600 for a roundtable seat with Donald Trump.

Hello, y'all. Have you played the 👉 Music Nerd 🎵 quiz game yet?

This is The Token Dispatch 🙌 and you can find all about us here 🤟

So Microsoft let the world down.

So or it feels.

Crypto folks be like - That’s why we need decentralisation.

Centralisation is and will always be a risk.

ALWAYS.

Hang on. What happened?

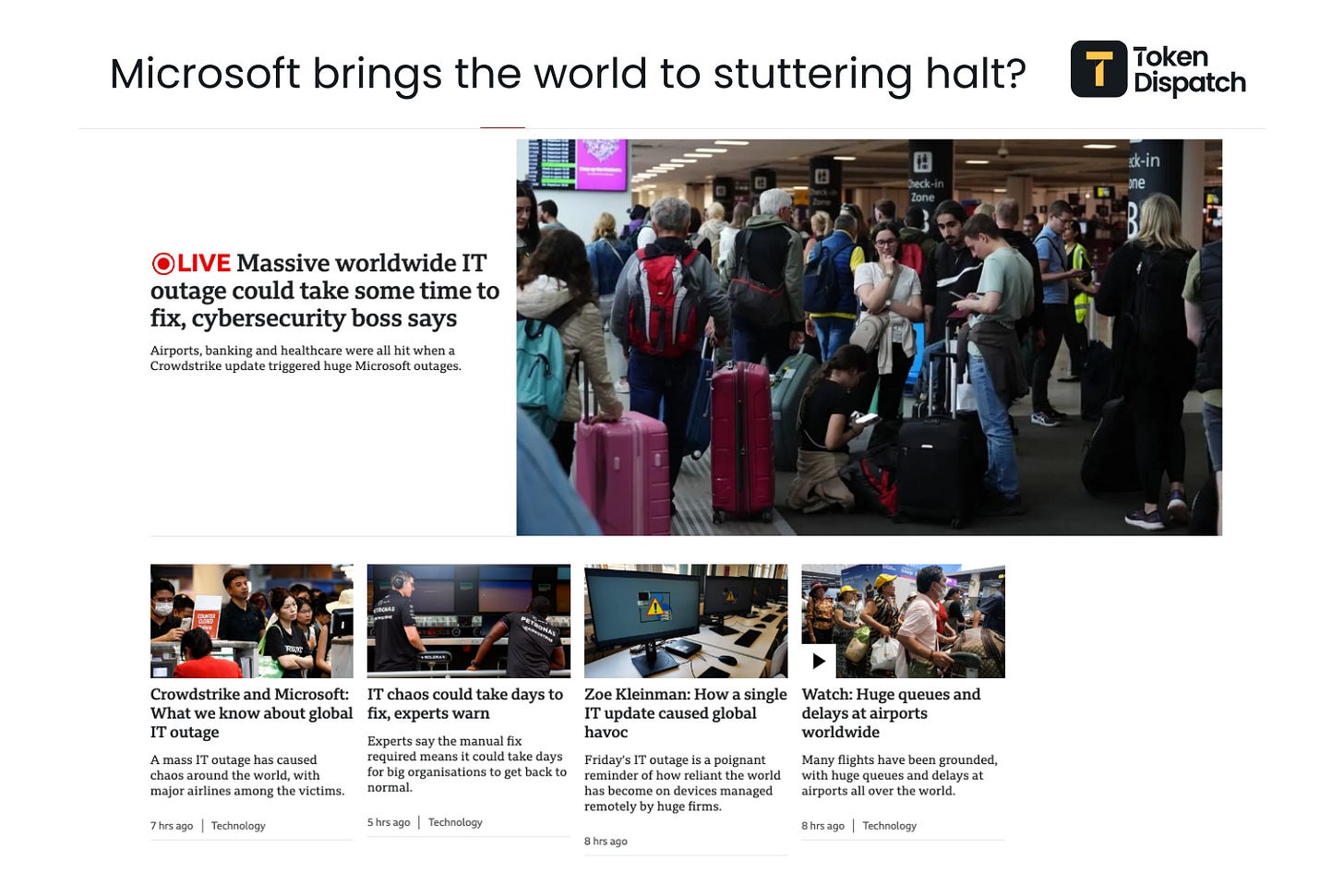

A significant global IT outage affecting Microsoft services occurred on July 19, 2024.

So then? Widespread disruptions across across the globe in various sectors, including airports, banks, hospitals, and broadcasters.

Track: The live updates on Guardian.

This incident was triggered by a faulty cybersecurity update from CrowdStrike, a company responsible for security solutions for many Windows systems worldwide.

How did the CrowdStrike update go wrong?

The CrowdStrike update that led to the global IT outage was primarily caused by a defect in a software update for the CrowdStrike Falcon platform, which is widely used for cybersecurity on Windows systems.

This flaw resulted in millions of Windows computers displaying the "Blue Screen of Death" (BSOD), rendering them temporarily unusable.

The case for Decentralisation

Did crypto get impacted by this? Not much. Bumper in fact.

Look at the sea of green.

Ethereum Layer 2, Polygon CISO Mudit Gupta clarified that Polygon uses Crowdstrike technology, but that they “weren't impacted because we don't roll out non-critical updates to our staff before testing them.”

Why crypto remained unaffected by the global outage?

The inherent resilience, transparency, security, and decentralised architecture of blockchain-based systems allowed the crypto space to remain operational during the global outage triggered by the CrowdStrike incident.

Decentralised infrastructure ensures core functionality can continue even with disruptions in other parts of the tech ecosystem.

Decentralised servers distribute data storage and processing across multiple nodes, so if any node goes down, data transfer remains unaffected.

Decentralised systems offer transparency to quickly identify issues, unlike the initial confusion in the CrowdStrike incident.

Reduced reliance on centralised control points enhances resilience and mitigates large-scale failures in decentralised networks.

Cryptographic security and verification of data in decentralised systems makes it difficult for attackers to breach security, protecting critical systems.

Decentralised apps like Arweave, IPFS, Ethereum, Filecoin, Holochain, and BitTorrent provide robust alternatives to traditional web services.

Block That Quote 🎙️

Founder and CEO of crypto data platform Messari, Ryan Selkis

"I ran too hot this week, and will address that in full soon."

He has been a rollercoaster on social media.

… and so he pays the price - he resigns from Messari.

Trump Almost Banned Bitcoin

Former President Donald Trump allegedly attempted to ban Bitcoin during his presidency in 2020.

What? A claim made by Mike Brock, an executive at Block Inc. Brock.

Rooting for Dimon?

In an interview with Bloomberg Businessweek, Trump said that if elected, he would consider Jamie Dimon, the CEO of JP Morgan Chase.

If he going to be the surprise pick for the Trump team, after J.D. Vance?

Read: Trump Picks VP ✅

The two have had a somewhat strange relationship. Trump called Dimon a “highly overrated globalist” in a November 2023 post on Truth Social.

Not anymore though. He said this of him in the interview.

"I have a lot of respect for Jamie Dimon … He is somebody that I would consider, sure."

Dimon ain’t no crypto fan. We know it all too well.

Time is a great healer. Though this hasn’t aged well, has it?

Read: Donald Trump 🧨

It’s a different tune now.

Read: Vitalik warns of pro-crypto candidates.

“Crypto-friendly now does not mean crypto-friendly five years from now”

Is against choosing your political allegiances based on who is "pro-crypto".

In The Numbers 🔢

$844,600

Price you pay to attend a roundtable event with Donald Trump at the upcoming Bitcoin 2024 conference, in Nashville, Tennessee, from July 25-27.

According to Bloomberg, the invitation for the roundtable was sent via email to select attendees, indicating that this is a fundraising effort.

Fundraising details

Cost to attend roundtable: $844,600 per participant

Photo shoot costs

Individual: $60,000

Couple: $100,000

Attendee Limit: Up to 150 donors

Benefit: Front-row access to Trump’s speech at the conference

Notable attendees

Trump's Vice Presidential choice: Senator J.D. Vance (R-Ohio).

Other attendees

Senator Bill Hagerty (R-Tenn.).

Former presidential candidate Vivek Ramaswamy.

Former Congresswoman Tulsi Gabbard.

This is the first time a former US president will address the global Bitcoin community, with over 20,000 participants and nearly 400 industry leaders.

Winklevoss twins donate $1 million in Bitcoin to Sen. Warren's rival

Tyler and Cameron Winklevoss, co-founders of the cryptocurrency exchange Gemini, have donated $1 million in Bitcoin to support John Deaton's campaign against Senator Elizabeth Warren.

Each brother contributed $500,000 in Bitcoin, emphasising their strong opposition to Warren's stance on cryptocurrency.

The Winklevoss twins have criticised Warren for her regulatory stance, claiming she uses government agencies to undermine the crypto sector.

Ripple Labs has also donated $1 million to a new super political action committee created to help Deaton beat Warren in the upcoming election.

The twins had earlier donated $1m each to Donald Trump’s campaign.

The Gemini co-founders have also donated $250,000 each to a pro-Trump super PAC.

Crypto Investor Protection Law

South Korea has officially implemented the Virtual Asset User Protection Act, in the backdrop of the high-profile incidents like the Terra-Luna crash and FTX collapse.

Safeguarding crypto investors.

Addressing unfair trading practices.

This legislation is part of South Korea's broader efforts to regulate the crypto industry, which has faced scrutiny following significant market disruptions.

Key provisions of the act

Mandates that crypto exchanges deposit user funds in banks to protect them in case of bankruptcy.

Requires exchanges to pay interest on these deposits, with rates set between 1% and 1.5%.

Exchanges must store some user assets in cold wallets to mitigate risks from hacking and system failures.

Enhanced regulatory oversight

Virtual asset service providers (VASPs) are obligated to monitor and report suspicious transactions to enhance market integrity.

The Financial Services Commission (FSC) has stated that the law will empower regulators to impose severe penalties against unfair trading activities.

The Surfer 🏄

Developers have launched USDh, a new dollar-pegged stablecoin on the Bitcoin blockchain, utilising the Runes token standard and backed by Bitcoin rather than cash. This stablecoin offers holders a potential yield of up to 25% annually, operating independently from traditional banking systems.

Tornado Cash, a crypto mixer sanctioned by the US, has seen a 50% increase in deposits to $1.9 billion in the first half of 2024, despite ongoing legal and regulatory challenges. The platform remains popular among hackers for laundering stolen funds.

Italy's state-owned bank Cassa Depositi e Prestiti SpA has successfully issued a $27.2 million digital bond using Ethereum layer-2 Polygon, marking the first transaction under the country's new fintech regulations. This issuance by the $520B state-owned Italian bank us part of a European Central Bank trial.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋