Hello,

When I think of stablecoins, I often see them as mere bridges between dollars and blockchains. Nothing more. They can be powerful infrastructure components that quietly enable on-chain products in ways that are often easy to miss.

As a business, a stablecoin issuer’s revenue is straightforward and linked to the interest rates announced by the U.S. Federal Reserve. The higher the interest rates, the fatter the top-line the issuer earns on U.S. Treasury Bills (T-Bills) backing its stablecoin circulation.

However, in recent years, the world’s largest circulating stablecoin issuer has evolved its reserve strategy to better align with macroeconomic conditions.

In this week’s quantitative analysis, I will dive into why and how Tether is transforming its enormous carry engine by replacing a part of that with gold and bitcoin, especially as we approach a shift in the rate cycle.

Let’s jump to the story,

Prathik

Polymarket: Where Your Predictions Carry Weight

Bet on the future by trading shares in outcomes, elections, sports, markets, you name it. Polymarket turns collective wisdom into real-time probabilities.

Now merged with X, predictions integrated with live social insights from Grok & X posts.

Think you know what’s coming next? Prove it.

The T-Bill Machine

One look at Tether’s T-Bill Reserves explains how it became a profit machine when interest rates were high. USDT holders earned 0%, while Tether earned 5% on a massive $100 billion pile of U.S. Treasuries in the last couple of years.

Even with a lower average rate of around 4.25% for most of 2025, Tether reported a year-to-date net profit of over $10 billion as of September 30, 2025. In comparison, Circle, the second-largest stablecoin issuer, reported a net loss of $202 million for the same period.

For most of the past three years, Tether’s business model perfectly aligned with the macroeconomic backdrop. The U.S. Fed kept rates between 4.5% and 5.5%, Tether held over $100 billion in T-bills, and every percentage point of yield produced roughly a billion dollars in annual income.

At a time when most crypto companies were struggling with operating losses, Tether built a multibillion-dollar surplus by simply being long on short-term government debt.

But what happens when the interest rate cycle turns, and cuts are expected in the coming years?

The Rate-Cycle Problem

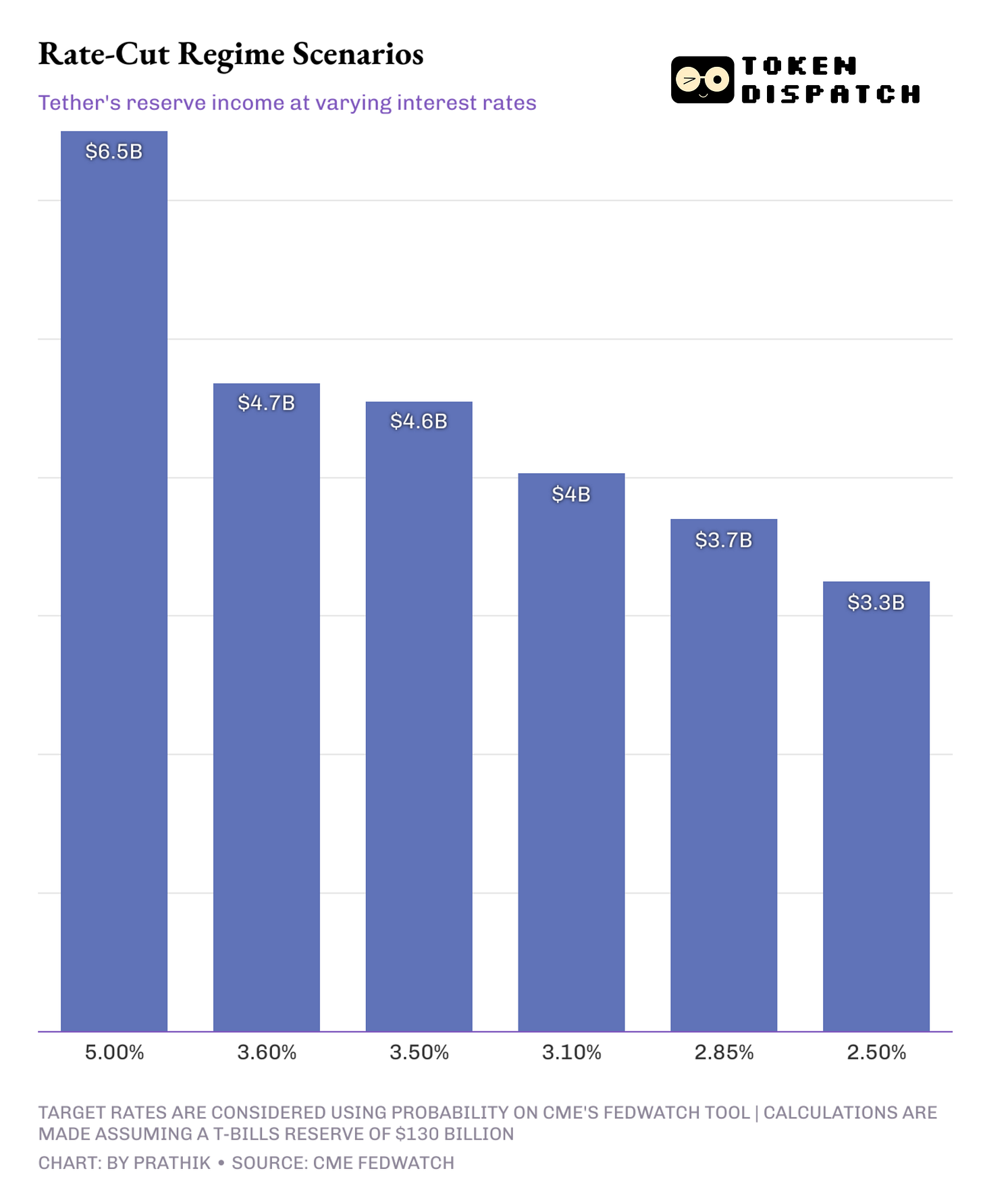

The CME FedWatch data suggests that by December 2026, the Fed Funds rate is over 75% likely to fall between 2.75-3% and 3.25-3.50% from the current range of 3.75-4%. It is already down sharply from the 5% regime Tether benefited from through 2024.

Lower interest rates could shrink Tether’s revenue from interest on the T-bills it holds.

A percentage-point cut in liquidity across the US economy could shave at least $1.5 billion off Tether’s annual revenue. That’s more than 10% of its annualised net profit for 2025.

So, how does Tether protect its profitability in this world? One where the incoming Fed chair, after Jerome Powell’s term ends in 2026, is more likely to make larger and faster rate cuts in line with U.S. President Donald Trump’s expectations.

This is where Tether’s reserve strategy has diverged the farthest from that of any other stablecoin issuer.

The Diversification Strategy

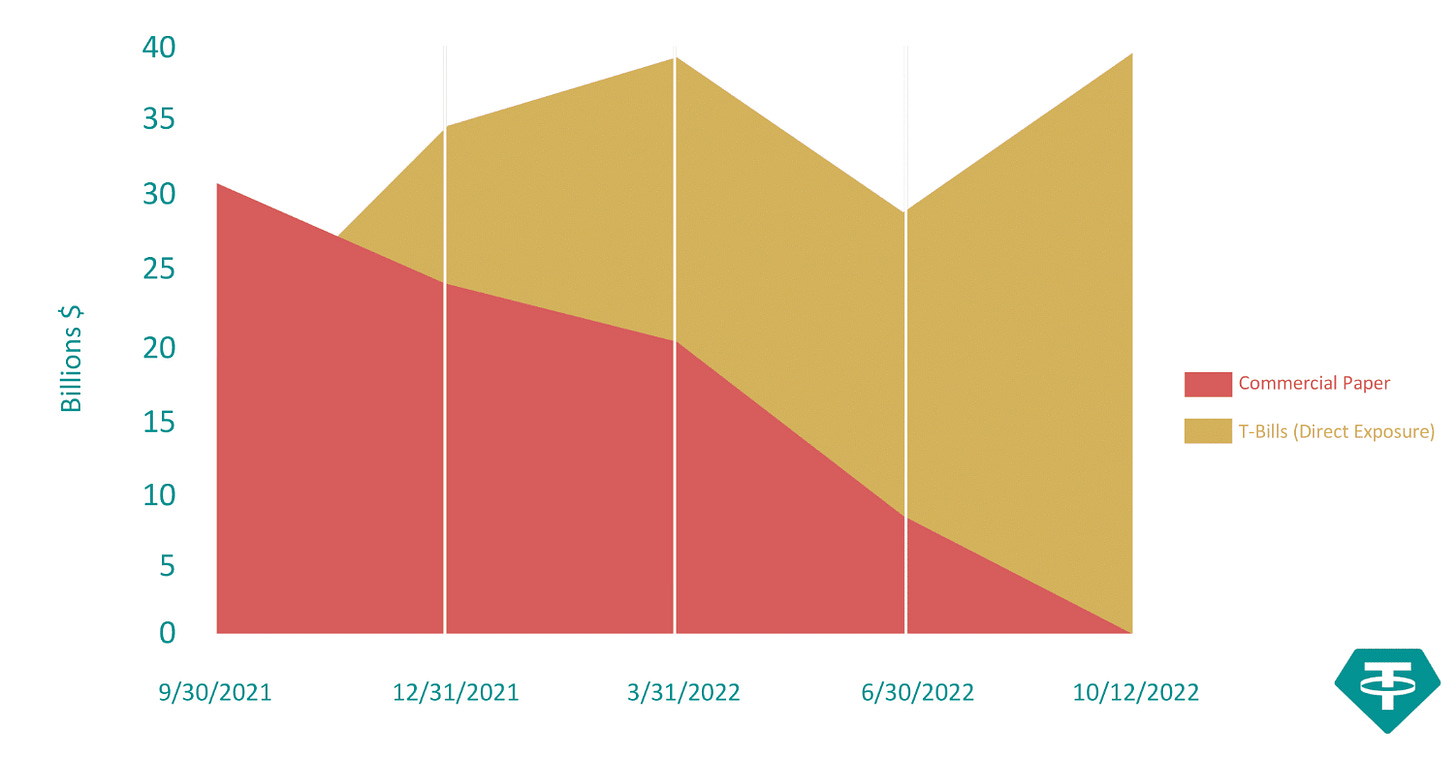

Between September 2021 and October 2022, Tether cut its reliance on commercial papers — unsecured, short-term debt instruments issued by large corporations — by over 99%. From over $30 billion in September 2021, it slashed the investments to almost zero.

It replaced these with U.S.-backed T-Bills to increase transparency among investors.

During the same period, Tether’s T-Bill reserves grew from under $25 billion to $40 billion.

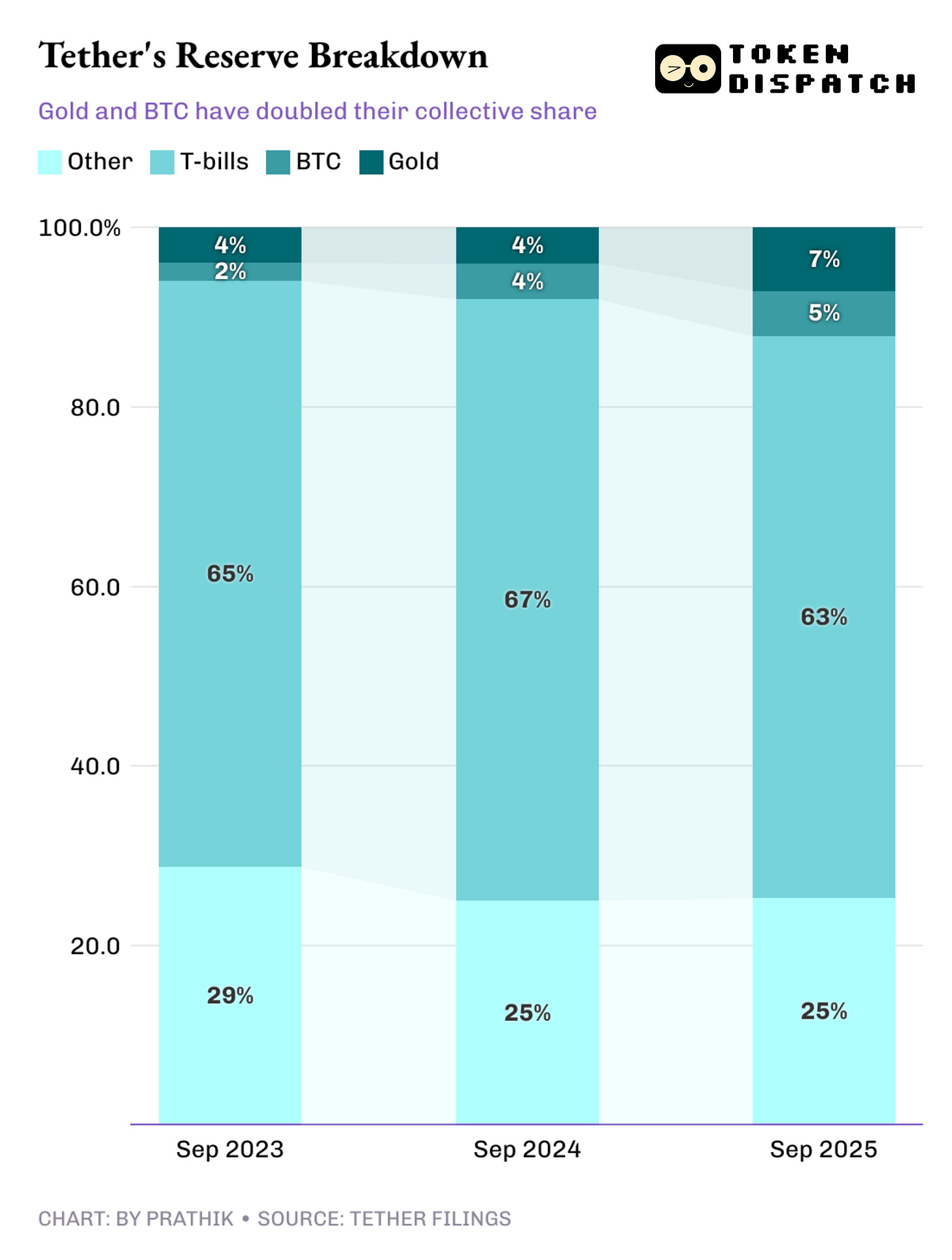

Between Q3 2023 and Q3 2025, Tether’s reserve components have transformed with assets that you would seldom find on the balance sheets of stablecoin issuers.

As of September 2025, Tether had accumulated roughly 100+ tonnes of gold, valued at approximately $13 billion. It also held over 90,000 BTC, valued at close to $10 billion. Together, these two account for 12-13% of its reserves.

In comparison, its rival Circle held just 74 Bitcoin (BTC) worth around $8 million.

Why pivot now?

The rise in gold and Bitcoin allocations aligns with the period when forward curves stopped pricing in interest rate hikes.

The interest rate jumped from under 1% to over 5% between May 2022 and August 2023 to tackle rising inflation. It made economic sense to maximise topline through exposure to T-Bills during this period. But once interest rates peaked in 2023, with no further hikes expected, Tether saw it as a time to start preparing for when the rate cycle turned.

Why Gold and BTC When Yields Fall?

Gold tends to perform well when yields on T-Bills decline. This is driven by expectations of rising inflation and the reduced opportunity cost of holding gold rather than lower-yielding T-bills.

We saw this happen this year, when gold prices jumped by over 30% between August and November, when the Fed cut the interest rate by 50 basis points.

Even when the Fed cut rates by 1.5 percentage points to pump liquidity into the economy during the COVID-19 pandemic, gold prices rose 40% over the following five months.

BTC has lately followed the same macro behaviour. With loosening monetary policy and expanding liquidity, bitcoin often responds like a high-beta asset.

So, while a high-interest-rate environment can maximise revenue through T-Bills, exposure to BTC and gold can provide potential upside in a low-interest-rate regime.

This allows Tether to account for unrealised gains, or even realise some of it by selling gold or Bitcoin from its treasury, especially during a low-interest phase when its revenue is squeezed.

But not all are convinced about increasing exposure to gold and BTC on Tether’s balance sheet.

The Peg Problem

While T-Bills still account for 63% of Tether’s reserves, the growing exposure to high-risk assets such as Bitcoin and unsecured loans has raised concerns among rating agencies.

Two weeks ago, S&P Global Ratings reassessed Tether’s ability to maintain USDT’s peg to the U.S. dollar to 5 (weak) from 4 (constrained). It flagged increasing exposure to corporate bonds, precious metals, bitcoin and secured loans as part of its reserves.

The agency flagged that these assets accounted for almost 24% of total reserves. What’s irked the agency more is that although T-Bills still back a majority of reserves, the USDT issuer provides limited transparency and disclosure about what the riskier class of assets constitutes.

Then there’s also the fear of destabilising the peg to the USDT token.

S&P said in its note, “Bitcoin now represents about 5.6% of USDT in circulation, exceeding the 3.9% overcollateralisation margin, indicating the reserve can no longer fully absorb a decline in its value. A drop in the bitcoin’s value combined with a decline in the value of other high-risk assets could therefore reduce coverage by reserves and lead to USDT being undercollateralised.”

On the one hand, Tether’s shift in reserve strategy seems rational to tackle an imminent low-interest-rate regime. The $13-billion profit engine will not be sustainable when the rate cuts come, and they will. An upside in gold and BTC held could help offset some of the lost revenue.

On the other hand, the shift unnerves rating agencies, and rightly so. A stablecoin issuer’s first and foremost job is to protect the peg to the underlying currency — in this case, the US dollar. Everything else, including the yield it generates, its reserve diversification strategy and the unrealised gains it can make, becomes secondary. If the peg fails, the business falls.

When volatile assets back the circulating token, the peg’s risk profile changes. A significant enough markdown in BTC, which we have continued to experience over the last two months, will not necessarily break USDT’s peg, but will shrink the buffer between them.

Tether’s story will unfold with the impending loosening of monetary policy. This week’s rate cut decision will be the first indicator of the stablecoin giant’s ability to defend its peg and signal toward its future trajectory.

That’s all for this week’s quantitative analysis. I will be back with the next one.

Until then, stay sharp,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.