Hemi Stuck Bitcoin Inside Ethereum

Not through a bridge. Through an actual Bitcoin node running in the EVM.

There’s this old philosophy thought experiment called the Chinese Room. The idea is you simulate consciousness by having people pass notes around following specific rules. Nobody actually understands anything, but collectively they’re supposed to behave like a brain. The whole point of the experiment is basically “this seems needlessly complicated and probably stupid.”

Someone in crypto looked at that and thought “we should do this with blockchains.”

The project is called Hemi. They put a full Bitcoin node inside an Ethereum Virtual Machine. Not a bridge to Bitcoin. Not an oracle. An actual Bitcoin node, running inside the EVM, downloading real Bitcoin blocks, maintaining the full UTXO set, which smart contracts can query directly.

This sounds like something you’d propose at a hackathon at 3am, but there’s over $1 billion sitting on it.

Bitcoin is secure but limited. Ethereum is flexible but less secure. What if you just stuck one inside the other?

If smart contracts can directly read Bitcoin’s state without trusting anyone, you can build things that weren’t practical before. A lending protocol where collateral checks happen by querying Bitcoin’s UTXO set from inside Solidity. An exchange where the smart contract watches Bitcoin transactions in real time. No oracle, no bridge. The contract sees Bitcoin itself.

The team is Jeff Garzik (early Bitcoin core developer, spent a decade at Red Hat on Linux) and Max Sanchez (invented Proof-of-Proof consensus, worked at Coinbase). They raised $15 million from Binance Labs and others.

So, is this the Chinese Room thought experiment for blockchains, or does it actually solve something? Let me show you how it works.

What Hemi Actually Does

Hemi is a Layer 2 protocol that connects Bitcoin and Ethereum into what they call a “supernetwork.”

The core idea is to let developers build applications that can read Bitcoin’s blockchain state directly while running on an Ethereum-compatible virtual machine. This means smart contracts can interact with Bitcoin data, verify Bitcoin transactions, and respond to Bitcoin events without relying on external oracles or third-party data providers.

It’s worth understanding how this actually works, because the implementation details matter when you’re talking about securing potentially billions in assets.

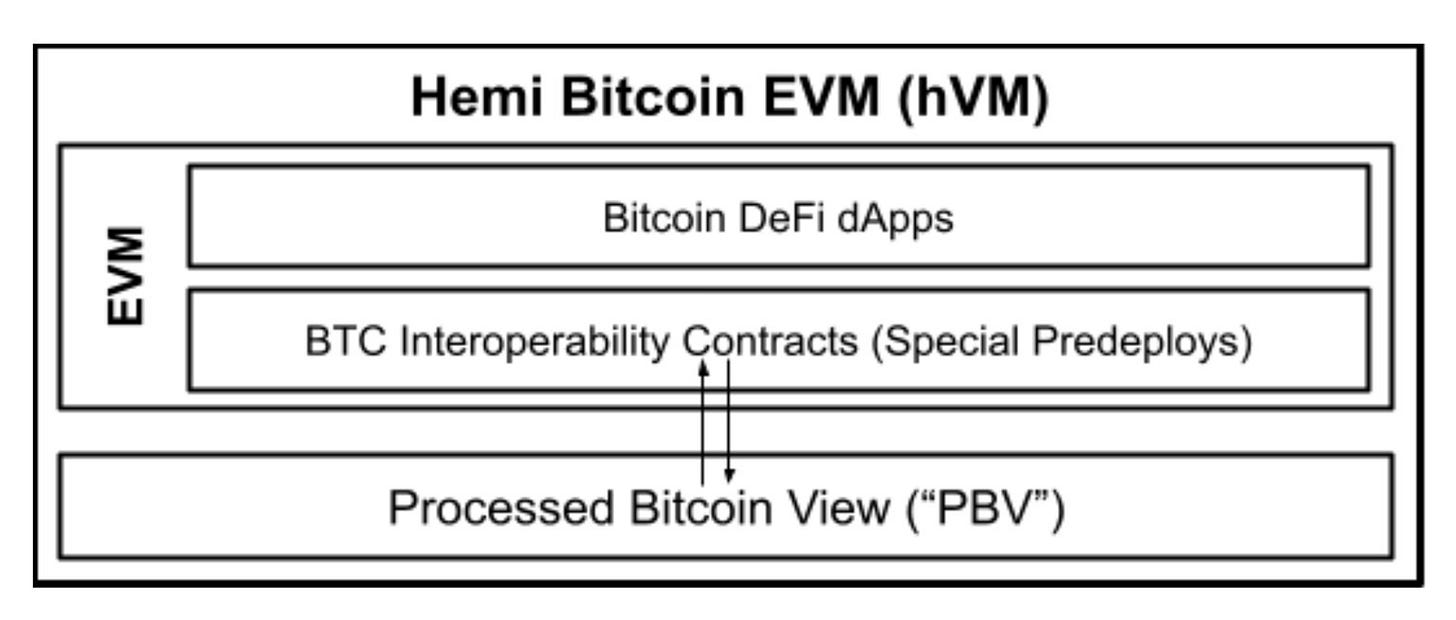

The Hemi Virtual Machine (hVM)

The hVM is a full Bitcoin node embedded inside an Ethereum Virtual Machine. Not conceptually. Literally. A complete Bitcoin full node running within an EVM environment.

This unlocks smart contracts that query Bitcoin directly. Check transaction history. Verify UTXOs. Confirm balances. Track specific satoshis moving through the network. No oracles. No third-party data feeds.

For developers, the workflow stays familiar. Write in Solidity. Use the same tools and frameworks you already know. Except now your contracts see Bitcoin’s state natively.

Building a lending protocol with Bitcoin collateral? Verify deposits on-chain yourself. Creating BTC-settled options? Your contract confirms the Bitcoin transaction directly. No trust required.

The hVM uses custom precompiled contracts as built-in Bitcoin query functions. They pull transaction data, check confirmations, retrieve fee stats, and track metaprotocols like Ordinals and BRC-20 tokens.

Synchronisation happens through the Tiny Bitcoin Daemon (TBC), a lightweight process on each Hemi node. It connects to Bitcoin, downloads blocks, and ensures every node sees identical Bitcoin state at each block height.

Proof-of-Proof Consensus

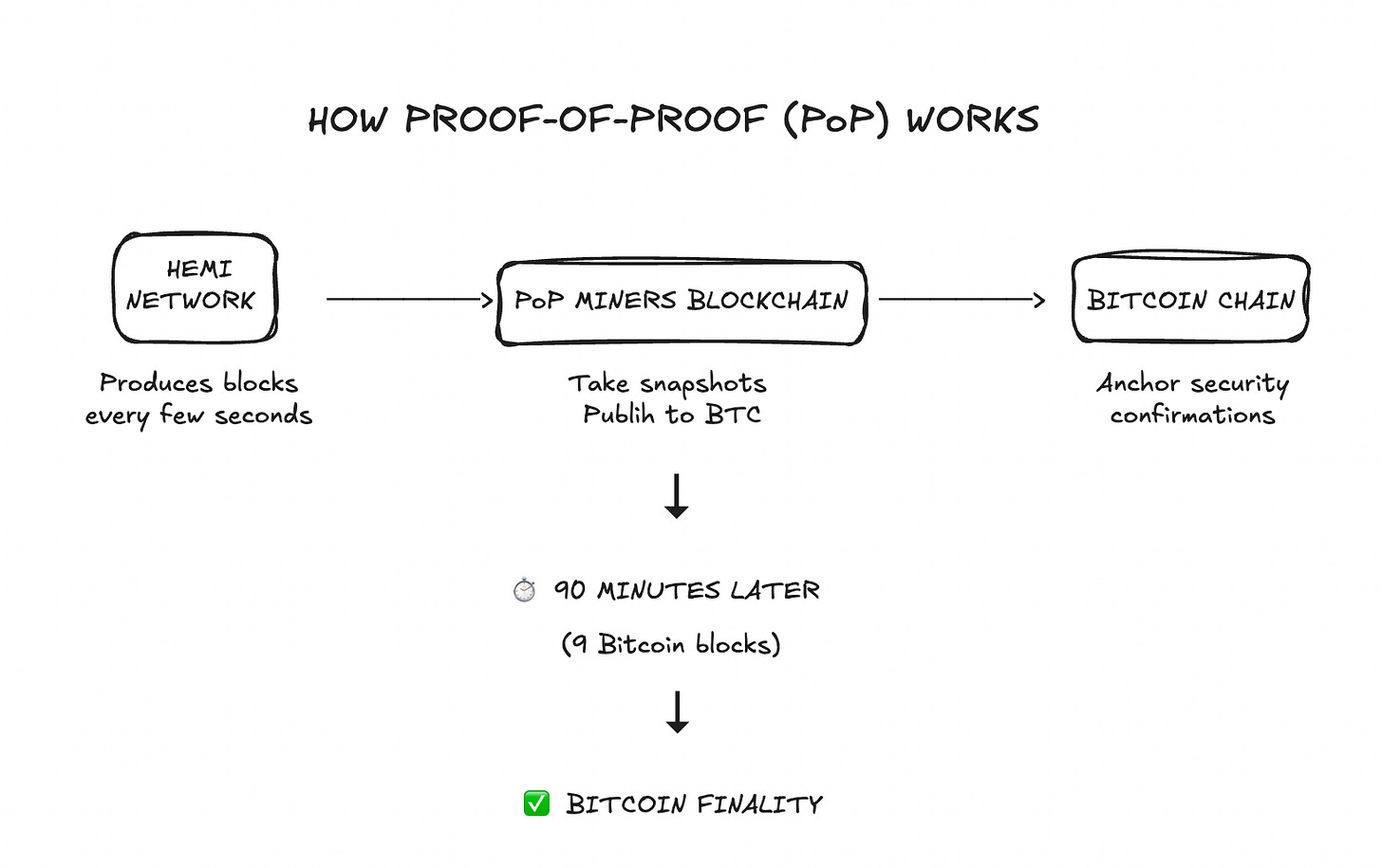

Hemi anchors its security to Bitcoin through Proof-of-Proof (PoP), co-invented by Hemi co-founder Max Sanchez.

Hemi produces blocks like any Layer 2. Every few blocks (a “keystone period”), PoP Miners snapshot Hemi’s state and publish it as a Bitcoin transaction.

https://x.com/hemi_xyz/status/1977828866615046288

PoP Miners aren’t Bitcoin miners. They’re specialised participants who monitor Hemi, create cryptographic proofs of its state, embed them in Bitcoin transactions, pay BTC fees, and earn HEMI rewards.

After a PoP transaction confirms in a Bitcoin block, Hemi detects it through its native Bitcoin awareness. Wait 90 minutes (nine Bitcoin blocks), and the transaction achieves “Bitcoin finality.”

Meaning? Reversing it requires a 51% attack on Bitcoin itself. You’d need to reorganise Bitcoin’s blockchain, remove the PoP publications, create an alternate Hemi chain, and publish it faster than the legitimate one.

Cost estimate: over $20 billion in hardware alone, plus ongoing electricity. Economically impossible, even for nation-states.

This dual-security model is what Hemi calls “Superfinality.” An attacker needs majority control of both Bitcoin and Hemi simultaneously.

Tunnels for Asset Movement

Hemi’s “Tunnels” system moves assets between chains using two custodianship models:

High-Value Vaults (BitVM) use large validator sets with a 1-of-n trust assumption. Even one honest validator prevents theft. Disputed withdrawals take 2-4 weeks and cost $1,000 to $10,000 in Bitcoin fees. For institutions moving millions, acceptable.

Low-Value Vaults use overcollateralised custodians staking 1.5x the asset value. Two-thirds must approve withdrawals. Faster and cheaper than BitVM, but requires trusting economic incentives.

Liquidity Providers speed things up by maintaining assets on both chains, enabling instant swaps for a fee while processing actual vault operations in the background.

The Numbers Behind Hemi

Hemi launched its mainnet in late 2025 with backing from a $15 million funding round. The round was co-led by Binance Labs (now YZi Labs) and Breyer Capital, with participation from Republic Digital, HyperChain Capital, Big Brain Holdings, Crypto.com, DNA Fund, Selini Capital, and others.

This brought Hemi’s total funding to $30 million, following an earlier seed round.

The HEMI token went live on Binance in September 2025 as part of their HODLer Airdrop program. The airdrop distributed 100 million tokens (1% of total supply) to users who staked BNB. The token launched with trading pairs against USDT, USDC, BNB, FDUSD, and TRY.

Following the Binance listing, the token also launched on Gate, Toobit, BYDFi, WEEX, and later on Hyperliquid for perpetual futures trading with up to 3x leverage.

As of late September 2025, reported metrics include:

Total Value Locked (TVL): Between $250 million and $1.2 billion depending on the data source. DefiLlama reports around $279 million, positioning Hemi as the second-largest Bitcoin sidechain by this metric. Other sources suggest higher numbers.

Active protocols: Over 90 projects building on Hemi

Verified users: More than 100,000

Community members: Around 400,000

The token has a maximum supply of 10 billion HEMI. The allocation includes community rewards, ecosystem development, team tokens, and investor shares. An additional 100 million tokens were reserved for marketing campaigns within six months of the announcement.

What You Can Actually Build on Hemi

The platform enables several categories of applications that weren’t previously viable.

Bitcoin DeFi Without Wrappers

Lending and borrowing protocols can use native Bitcoin as collateral. Users can interact with DeFi protocols without converting to wrapped versions. Projects like Gearbox Protocol and Spectra have already integrated with Hemi.

Cross-Chain Trading

Decentralised exchanges can facilitate trading between native Bitcoin assets and Ethereum tokens in a single interface. SushiSwap V3 and izumi Finance are live on the network, providing liquidity pools that span both ecosystems.

Bitcoin-Backed Stablecoins

Developers can create stablecoins backed by native Bitcoin rather than synthetic versions. This potentially attracts institutional capital that wants Bitcoin exposure but needs stable payment rails.

Bitcoin Restaking

Similar to EigenLayer’s concept on Ethereum, Hemi enables Bitcoin restaking. Users stake their BTC, and protocols can use that staked Bitcoin to enhance their own security models.

AI Model Verification

Because Hemi anchors to Bitcoin, developers can timestamp AI model weights and inference outputs to the Bitcoin blockchain. This creates immutable proof of when models were trained and what results they produced.

The Realistic Assessment

Hemi addresses the architectural question of how to connect Bitcoin and Ethereum at the protocol level rather than through bridges. The technology is sophisticated. Embedding a full Bitcoin node in an EVM is not trivial engineering.

But there are considerations Token Dispatch readers should understand:

Hemi isn’t the only project targeting Bitcoin programmability. Stacks has been building Bitcoin DeFi for years using a Proof-of-Transfer mechanism. RSK offers EVM compatibility through merged mining. BOB (Build on Bitcoin) is pursuing a modular approach with zkVM support.

The market will likely support multiple solutions with different tradeoffs, but not dozens. Hemi needs to execute well to capture meaningful market share.

Also, complexity creates friction.

The dual-custodianship model for Tunnels adds operational overhead. High-value BitVM vaults can take 2-4 weeks for withdrawals if there’s a dispute. This limits their utility for active trading or situations requiring quick liquidity.

Bottom Line

For 16 years, Bitcoin and Ethereum have existed as separate ecosystems. Hemi is the first serious attempt to treat them as components of a unified system rather than isolated networks connected by bridges.

Unlike Stacks (which uses its own smart contract language) or BOB (which relies on bridges to other ecosystems), Hemi embeds a Bitcoin node inside an EVM-compatible environment, giving smart contracts direct access to Bitcoin’s state.

The technical approach is novel. Embed a full Bitcoin node in an EVM so smart contracts can read both chains natively. The team has credibility. The funding is substantial. The early metrics show real usage, even if the exact numbers are disputed.

Whether this becomes the dominant Bitcoin L2 or one of several viable options depends on execution, developer adoption, and whether the market actually wants Bitcoin-Ethereum interoperability at the protocol level.

For Token Dispatch readers interested in genuine architectural innovation rather than another yield protocol, Hemi is worth examining closely. The technology is real, the approach is differentiated, and the question it answers is one the industry has largely ignored.

Just remember: no investment is without risk, and early-stage protocols face challenges in security, adoption, and competition. Do your own research, understand the tradeoffs, and never invest more than you can afford to lose.

That’s all about Hemi. More cool products are coming.

Until then … stay curious,

Thejaswini

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

The idea of running a full Bitcoin node inside EVM is wild but it shows how infrastructure is becoming more modular. This kinda approach could actually help mining operations validate blocks across different chains without maintaining seperate nodes. The computational overhead must be insane though.