HODL tight fellas 🤌🏻

VanEck files for a Bitcoin ETF with the ticker symbol 'HODL.' Solana had a friday surge. Elon Musk misinterprets crypto mantra. Sotheby's has an announcement. Tether freezes wallets.

Hello, y'all. Music fans can now discover new and unique sounds from up-and-coming artists. Check out 👉 Asset - Your Music Stats.

What are we feeling?👇

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

VanEck, the asset management giant, has filed a fifth amended application for a spot Bitcoin ETF.

But the real excitement isn't about the ETF itself but the ticker symbol: "HODL."

What's in a Ticker?

On December 8th, VanEck filed the amended application with the United States SEC for the VanEck Bitcoin Trust.

The choice of ticker symbol: "HODL." Which is a playful misspelling of "hold" or an acronym for "hold on for dear life."

It's a term deeply embedded in Bitcoin culture and signifies a strategy of buying Bitcoin and never selling it.

So, of course the crypto community lit up with excitement over the "HODL" ticker.

Nate Geraci, President of The ETF Store says it might leave "boomers" scratching their heads.

VanEck joined the chat👇

The Race for Approval

VanEck previously attempted to register a Bitcoin ETF with the SEC in 2018.

Like many other applicants, it faced repeated denials from the top regulator on Wall Street.

VanEck is not alone in the pursuit of a spot Bitcoin ETF.

Several companies, including BlackRock, Fidelity, Valkyrie, and Franklin Templeton, are in the race.

While the SEC hasn't given a green light to any of these filings, there have been recent discussions with applicant firms to address technical details in their proposals.

Read: Mark your calendars 🗓️

VanEck Predictions

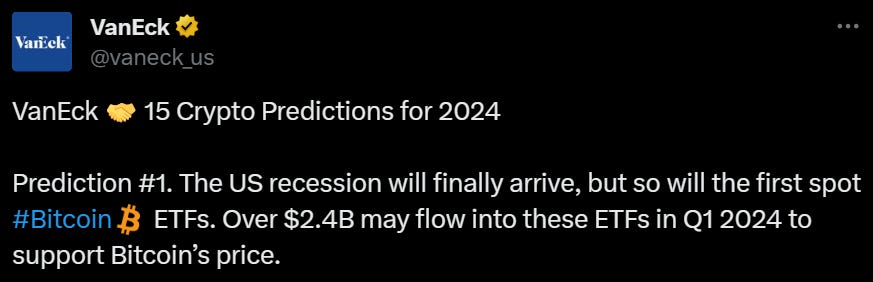

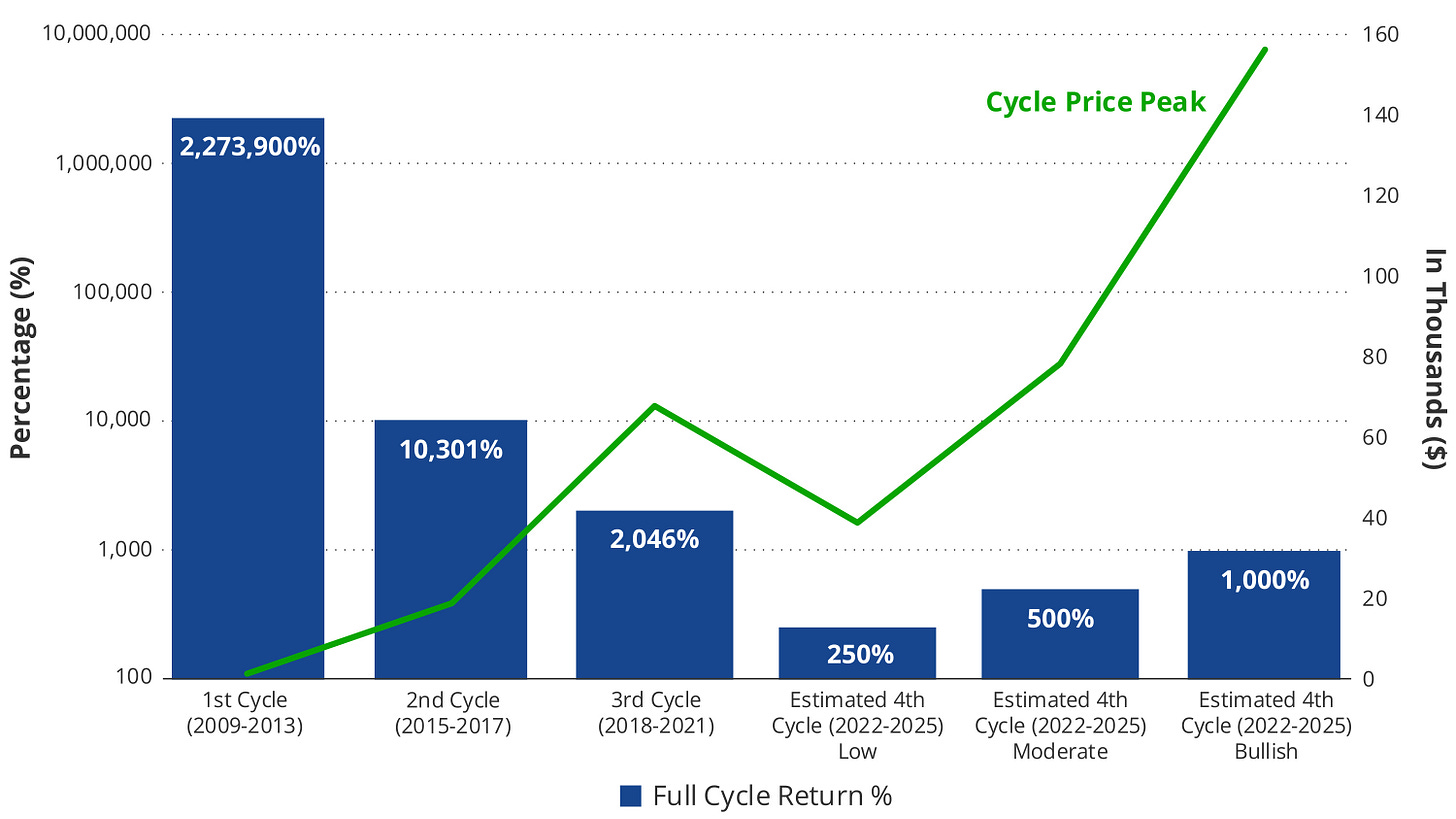

VanEck predicts several developments in the crypto space for 2024, including:

Bitcoin (BTC) hitting a new all-time high in late 2024.

The possibility of a United States recession contributing to this BTC price surge.

Anticipated regulatory shifts following the next U.S. presidential election.

Binance will lose the 1 position for spot trading.

VanEck is optimistic about SEC approval for its Bitcoin ETF in January and anticipates a $2.4 billion in inflows during the Q1.

The Bitcoin halving, expected in April or May, is forecasted to cause minimal market disruption and lead to a post-halving price increase.

While Ethereum (ETH) is expected to outperform major tech stocks in 2024, VanEck does not foresee it flipping Bitcoin in terms of market dominance.

It suggests that Ethereum will start to outperform Bitcoin after the halving and may maintain this trend throughout the year.

The Sudden Low

Crypto didn’t have a great start to the week.

In the early trading hours on Monday, Bitcoin and Ethereum experienced a downturn, with BTC dropping to $42,200 and ETH declining to $2,230.

This led to the liquidation of over $320 million in long positions across the crypto market.

The majority of the liquidations were in bitcoin: $94 million.

Overall, there were $360 million in liquidations across various exchanges.

TTD Solana ⬆️

Solana hit a major milestone on Friday.

Outperformed Ethereum in NFT trading volume.

Also👇

Why?

Jito effect

Liquid staking protocol Jito conducted an airdrop worth $165 million of its native token to users on Thursday.

Following the airdrop, Solana experienced a notable surge in NFT sales, totalling nearly $15 million in transactions on the same day.

Bonk effect

A Solana-based dog-themed memecoin emerged: Bonk (BONK)

Now, it is the third-largest memecoin by market capitalisation. Surpassed Pepe (PEPE) on December 8.

Listed on on centralised exchanges such as Binance and KuCoin.

370% gain in the last month. market cap surged to $762 million, exceeding Pepe's $675 million market cap.

Over the past 30 days, Bonk's price increased from $0.0000028 to $0.000012, attracting traders' interest in the Solana ecosystem.

Bonk's rapid price growth outpaced more established dog-themed memecoins like Shiba Inu (SHIB) and Dogecoin (DOGE), which saw gains of 20% and 35%, respectively, in the same period.

What's in it for FTX?

During his detention since August, Bankman-Fried faced communication and financial limitations.

Bitcoin's price surged by about 160%, and the total crypto market cap increased by nearly $900 billion during this period.

Before FTX's bankruptcy filing, Bankman-Fried created a balance sheet dated Nov. 10, 2022, valuing FTX's assets at nearly $9.6 billion.

Crypto assets accounted for $4.9 billion, with Serum (SRM) making up half of it, and cash and stocks were valued at $827 million.

Comparing those prices to current values, FTX's portfolio could be 40% higher, potentially worth around $9 billion, with Solana's (SOL) 400% surge playing a significant role, turning $982 million into a possible $5 billion.

SOL's surge can increase FTX's asset value, potentially improving its financial health.

TTD Blockquote🎙️

Elon Musk, the richest man alive.

"Not your keys, not your wallet, as they say"

This was Elon Musk's response to Jack Dorsey's announcement of Bitkey, a new self-custodial Bitcoin wallet from Block.

However, Musk's statement was a misinterpretation of the classic crypto mantra, "Not your keys, not your coins," which emphasizes the importance of self-custody for digital assets.

The mantra underscores the idea that individuals should personally hold the keys to their crypto wallets rather than relying on third parties, as it ensures control over their assets.

Musk's misunderstanding of the phrase led to Twitter users pointing out his error and poking fun at his gaffe.

This incident follows Musk's recent involvement in another crypto-related news cycle when his public rant on Twitter inspired a meme coin with a market capitalisation of $7.28 million, which later became worthless.

TTD Ordinals 🅾️

Sotheby's, last week announced the first sale of pieces from the BitcoinShrooms collection, an ordinals project by pseudonymous artist Shroomtoshi.

This marks the first time that works from the BitcoinShrooms collection will be available to the public.

What Shrooms?

The collection comprises pixel art pieces that reference Bitcoin's history, technical concepts, and memes, aiming to provide a pixelated recap of Bitcoin's 13-year history and raise awareness about its principles while critiquing certain aspects.

Sotheby's head of digital art, Michael Bouhanna, described Shroomtoshi as a "trailblasing figure in the Ordinal ecosystem" and highlighted the collection's ability to capture the cryptocurrency zeitgeist.

Three pieces from the collection are currently available for sale, each priced between $20,000 and $30,000, with bids accepted in cryptocurrency.

The auction for these artworks will conclude on December 13 at 12 pm EST.

TTD Tether 🌳

Tether, the issuer of the world's largest stablecoin USDT, would freeze wallets belonging to individuals sanctioned by the US Office of Foreign Asset Controls (OFAC).

Why? to prevent potential misuse of its tokens = more security.

Total Wallets Affected

Tether's sanctions affected a total of 161 Ethereum wallets.

150 out of these currently do not hold any USDT tokens.

It's unclear if these wallets ever held USDT.

Concentration of USDT Tokens

Among the 11 remaining wallets with USDT tokens, 3.4 million of them is held by just one address.

This specific address has been linked to a recent hack of the betting platform Stake.

Shortly before the freeze was initiated, this wallet was actively involved in hundreds of transactions during the past week.

The other wallets holding USDT tokens have varying amounts:

Two addresses hold approximately 20,000 tokens each.

A third wallet contains nearly 60,000 USDT tokens.

The rest hold smaller sums, with one wallet having only 16 cents in frozen USDT.

Two days before the freeze, one wallet moved over 400,000 USDT received from THORChain through two other wallets, making the funds challenging to trace.

Neither of the two routing wallets was frozen by Tether.

TTD Surfer 🏄

Ark Invest, the investment management firm led by Cathie Wood, sold over $100 million worth of Coinbase shares last week.

Decrypt Media Inc. and Rug Radio are merging to create a global Web3 publishing company.

Google will update its cryptocurrency-related advertising policy at the end of January to allow ads for crypto trusts in the United States.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋