Hong Kong's Crypto Happy 😊

Chinese investors eye return to crypto with Hong Kong's Bitcoin ETFs. JPMorgan questions on crypto market growth. Worldcoin app clocks 10M users. El Salvador's tokenised funding for hotel investment.

Hello, y'all. If you think you know your music, then this is for you frens. A complete go. Check out 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Hong Kong is on the verge of becoming Asia's crypto hub.

Regulators are poised to approve Hong Kong's first-ever spot Bitcoin ETFs, potentially opening the door for Chinese investors.

Here's the breakdown

Could happen as soon as April 15th.

Provides a legal way for them to get back into crypto after a government ban.

Fresh money influx that could fuel the ongoing crypto bull run.

Bolsters Hong Kong's image as a Web3 leader.

Not everyone's on board

The SFC is cautious: They educate investors about crypto scams while approving ETFs.

Hong Kong's Boom Times Are Back (Mostly)

Ads are back on buses and trains, with companies like Hashkey reminding everyone that Bitcoin's doing great. Gone are the warnings from last year's JPEX collapse, replaced by bullish messages.

The warning ad: The Hong Kong Monetary Authority released a song warning investors how to avoid scams.

Meanwhile, China is cracking down on scams too. Warnings about online fraud are popping up in hotels and shopping malls.

One snag: Memecoins like Floki are still out. They can't explain their high returns to regulators' satisfaction. However, Floki is finding ways to reach mainland Chinese users through its blockchain game, despite China's virtual asset ban.

Read: China's Underground Crypto Scene 🇨🇳

Block That Quote 🎙️

JPMorgan analysts, led by Nikolaos Panigirtzoglou

"Our various proxies for crypto VC flows look rather subdued YTD [year to date] relative to previous years."

What are they saying

Crypto VC funding in 2024 is lagging behind 2023 despite a market rebound.

JPMorgan sees this as a potential risk for continued crypto market growth.

VC firms are raising new funds, but investment hasn't reached previous highs.

Crypto hedge funds, however, are showing more activity in 2024.

JPMorgan still believes the SEC will eventually approve spot Ethereum ETFs, but not necessarily by May.

Fraud Victims Seek China's Help

To recover $4.3B worth of Bitcoin seized by UK police.

The Investment Scam: A Chinese electronics company, Tianjin Lantian Gerui Electronic Technology, is accused of running a fraudulent investment scheme from 2014 to 2017 worth $6.2 billion.

Bitcoin Seizure by UK Authorities: UK police seized 61,000 Bitcoin during a raid in 2021. The Bitcoin was connected to Jian Wen, who attempted to launder funds through a failed mansion purchase with Bitcoin.

Victims Seek Government Intervention: A group representing the fraud victims submitted a letter to the Chinese foreign ministry. The letter requests the Chinese government to negotiate with the UK for the return of the seized Bitcoin, valued at approximately $4.3 billion.

In the Numbers 🔢

10 million

Worldcoin's app users.

The identity coin project with a focus on universal basic income (UBI), has exploded in popularity.

Here's the scoop

More daily users now than their entire user base in early 2024.

This rapid growth comes in less than a year.

One of the interesting use cases of Worldcoin👇

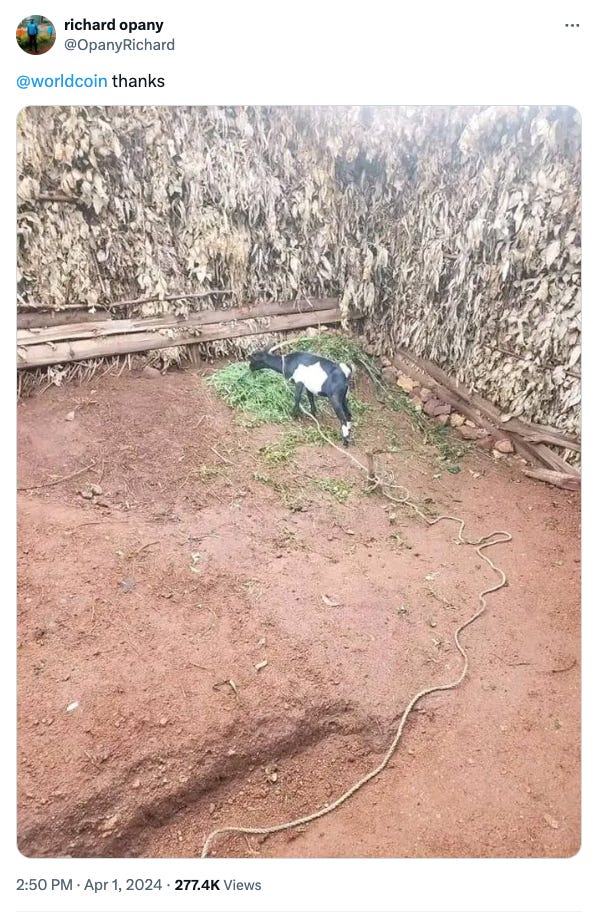

A heartwarming story emerged from Kenya involving Worldcoin.

A user there used their free Worldcoin airdrop to buy a goat.

This inspired the crypto community, who donated additional cryptocurrency to the user.

With this extra help, they were able to purchase even more goats, bringing their herd to at least 13 and possibly growing.

Own a piece of El Salvador's New Hilton

History is being made in El Salvador.

The country's first tokenised debt offering lets you invest in a brand new Hilton hotel using Bitcoin.

Here's the deal

Invest in the hotel using tokenised debt on Bitcoin's layer 2 network.

Minimum investment: $1,000.

Earn a 10% annual return over 5 years.

Big investors get free nights at the hotel.

The Surfer 🏄

Elon Musk's new AI company, xAI, is looking for a whopping $4 billion to boost their AI chatbot Grok. They're aiming for an $18 billion valuation after the funding round.

Blast-based lender Pac Finance experienced $26 million in unnecessary liquidations. The liquidations occurred after the platform decreased the liquidation threshold for user positions.

Avi Eisenberg, accused of manipulating DeFi platform Mango Markets for a $110 million gain, might defend himself in court. The stakes: Up to 20 years in prison.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋