How Kalshi Can Monetise Your Predictions 🔮

The regulated prediction market that's redefining how we trade reality

You've been watching the Fed meetings for months knowing they're about to pivot on rates. The economic data is screaming about it. The inflation numbers support it. Even Powell's subtle language changes signal it's coming.

But how do you actually trade that conviction?

Sure, you could buy bonds and hope they rally when rates drop. Or short the dollar and pray the correlation holds. Maybe load up on rate-sensitive tech stocks and cross your fingers that the market interprets the news the way you expect.

But what if you could just... trade the Fed decision itself? What if instead of playing these second-order derivative games, you could put money directly on "Will the Fed cut rates at the next meeting?" and collect $1 for every contract if you're right?

Or take sports betting. Sure, you could buy New Balance stock and hope Coco Gauff wins the Australian Open because that might boost athletic apparel sales. You could short Nike because their sponsored players got knocked out early. Maybe invest in DraftKings and pray that increased tennis viewership drives more betting volume. But what if you could just... bet on whether Gauff wins the Australian Open? Put $100 down, get $200 if you're right, and skip all the corporate earnings analysis.

You could buy TKO Group stock hoping WrestleMania draws record crowds, short competing entertainment stocks, or bet on merchandise sales spiking. But what if you could just... trade whether Roman Reigns retains his title? Put money directly on the storyline outcome and skip all the media company analysis.

That's exactly what Kalshi lets you do.

Kalshi is the first CFTC-regulated prediction market where you can trade the outcomes of real-world events directly. Not the stocks that might be affected by those events. Not the currencies that could move based on the news. The actual events themselves.

👉🏼Put your predictions to work

Fed decisions. Election outcomes. Supreme Court rulings. Whether Bitcoin hits $150k. Whether inflation exceeds 4%. Whether your favorite team wins the championship. If you can form an opinion about it and there's a way to measure the outcome objectively, there's probably a Kalshi market for it.

While Polymarket pioneered the modern prediction market concept and proved massive demand exists processing billions in election betting, Kalshi just raised $185 million at a $2 billion valuation. Major trading firms like Susquehanna are providing liquidity. Robinhood integrated Kalshi markets directly into their platform, giving millions of retail traders access. Even Elon Musk's Grok AI is now embedded in the trading interface.

This is regulated, institutional-grade infrastructure for trading reality itself. Building on the foundation that Polymarket established globally, Kalshi brings prediction markets into the regulated US financial system.

Think about what this means. For the first time, you can monetise your edge in predicting real-world events without the friction of traditional financial markets. No complex derivatives. No counterparty risk. No wondering if your hedge will actually work when the event occurs.

If you think the next jobs report will surprise you, there's a market for that. If you believe Trump will win the 2028 election, you can trade it today. If you're convinced AI companies will dominate the next decade, you can bet on specific milestones and regulatory outcomes that will determine their fate.

The platform transforms every piece of non-public information, every analytical edge, every informed prediction into a potential profit opportunity. And unlike traditional markets where information advantages get arbitraged away through complex strategies, prediction markets reward knowledge directly.

How Kalshi Actually Works

Understanding Kalshi's mechanics is crucial because event contracts work differently from any other financial instrument you've traded. Let me walk you through exactly how this works using a real example.

Step 1: Account Setup and Funding

Create your account at kalshi.com and complete the required identity verification (KYC). Since Kalshi operates under CFTC regulation, you'll need to provide standard documentation like government ID and address verification.

For funding, Kalshi offers multiple options with different limits and speeds. Bank transfers are free but take 1-2 business days. Debit cards are instant but carry a 2% fee with a $2.5k daily limit. For crypto users, USDC deposits are supported with a $500k daily maximum and settle within 30 minutes. Wire transfers work for larger amounts but have minimum requirements.

Step 2: Understanding Market Pricing

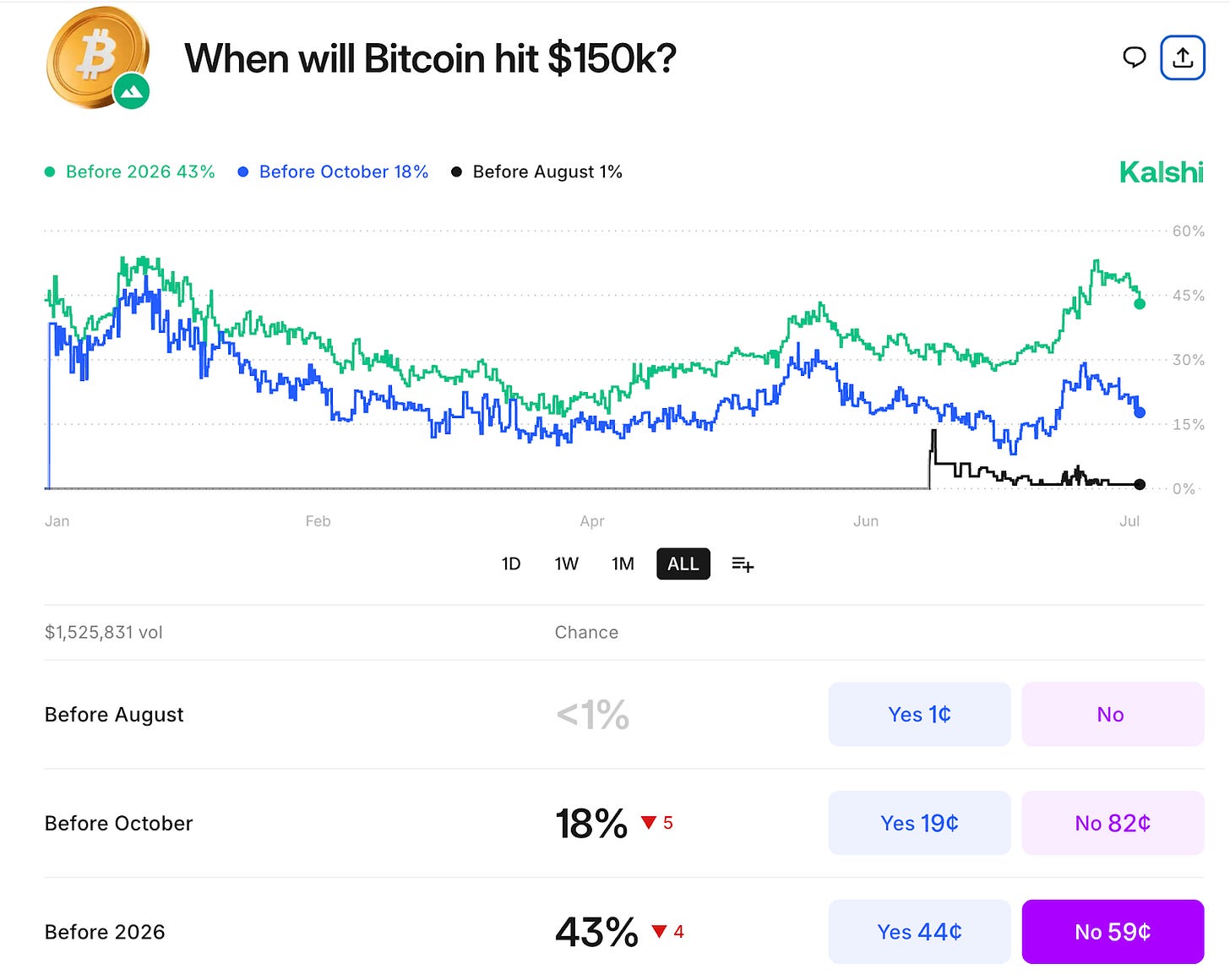

Navigate to any market to see the current pricing structure. Take the current "Will Bitcoin hit $150k before 2026?" market. Right now, "Yes" contracts are trading at 44¢ and "No" contracts at 59¢. This means the market believes there's a 44% chance Bitcoin hits $150k before 2026.

The interface shows your potential payout clearly. If you buy "Yes" at 44¢ and Bitcoin reaches $150k, you'll receive $1 per contract, a 56¢ profit per contract purchased. If Bitcoin doesn't hit $150k, your contracts expire worthless.

Here's what happens when you trade. Say you believe Bitcoin will hit $150k and want to buy 100 "Yes" contracts at 44¢ each. You'll pay $44 total (100 contracts × $0.44). If Bitcoin reaches $150k before 2026, each of your contracts pays out $1, giving you $100 total, a $56 profit. If Bitcoin stays below $150k, your contracts expire worthless and you lose your $44.

Step 3: Placing Your First Trade

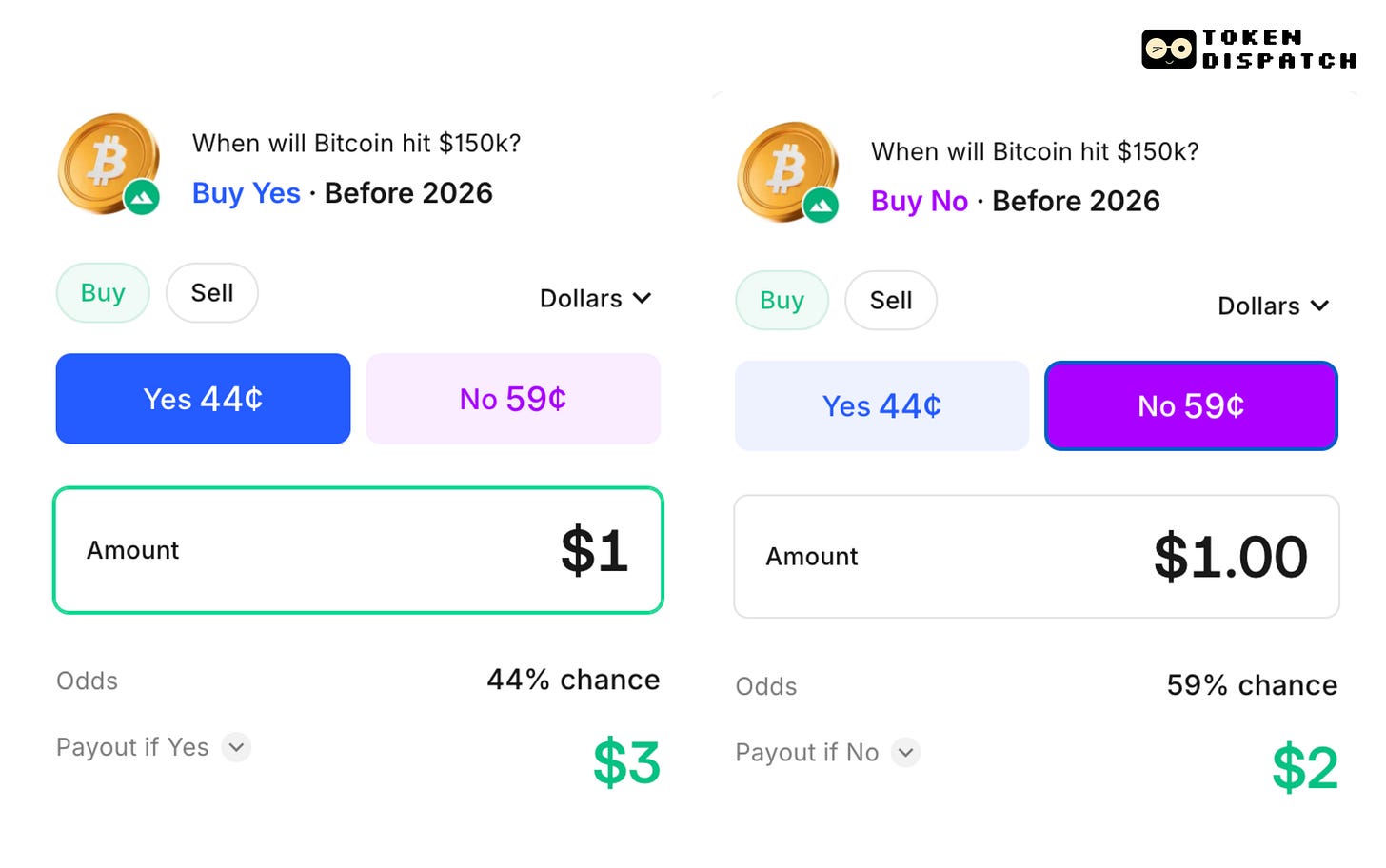

Select whether you want to buy "Yes" or "No" contracts. Enter your dollar amount (minimum $1) and the platform automatically calculates how many contracts you're purchasing and your maximum payout.

For the Bitcoin example, buying $1 worth of "Yes" contracts at 44¢ gives you about 2.27 contracts. If you're right, you'll receive $2.27 total, a $1.27 profit. The math is always transparent before you confirm.

The beauty is in the simplicity. Your maximum loss is always what you paid. Your maximum gain is always $1 per contract minus what you paid. No margin calls, complex Greeks, or overnight financing costs.

Step 4: Multiple Time Horizons

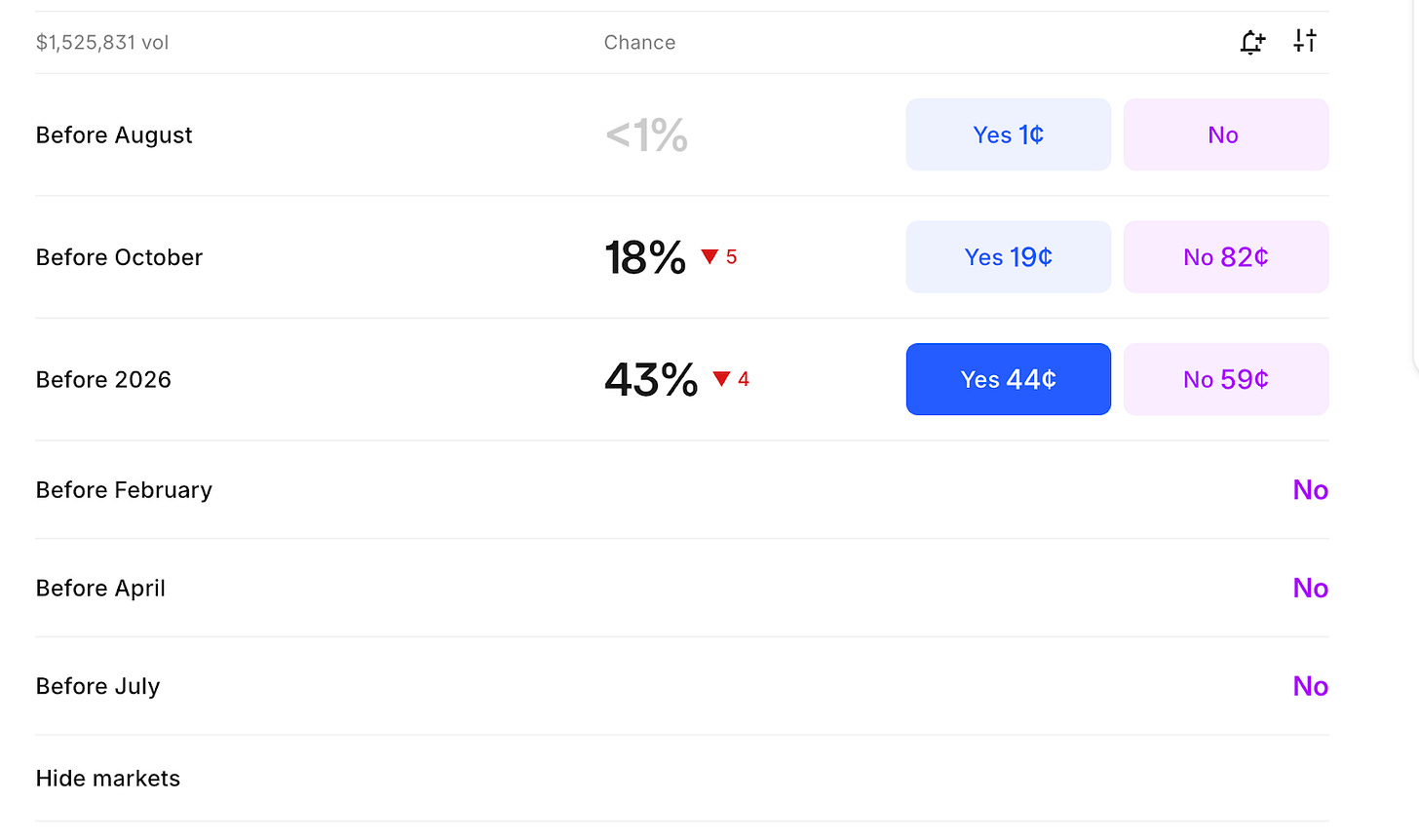

Many markets offer different time horizons for the same event. The Bitcoin $150k market has options for "Before August" (currently <1% chance), "Before October" (18% chance), and "Before 2026" (43% chance).

Each time horizon trades independently. You could buy "Yes" on the 2026 deadline while selling "Yes" on the August deadline if you think Bitcoin will hit $150k but not until next year.

Step 5: Monitoring and Trading Out

You don't have to hold until expiration. Contract prices move constantly based on news and market sentiment. The platform shows real-time price charts so you can track how probabilities change over time.

If major news breaks that affects your position, you can sell immediately. For instance, if you bought Bitcoin "Yes" contracts at 44¢ and positive news pushes the price to 60¢, you can sell for an immediate 16¢ per contract profit without waiting for the final outcome.

The platform makes this trading seamless. You can place market orders (trade immediately at current prices) or limit orders (wait for your target price). The interface shows your potential profit and loss before you confirm any trade. Settlement happens automatically using predetermined data sources—no disputes, or interpretation, just math.

Position limits prevent any single trader from cornering markets. Most retail users can trade up to $25,000 per contract, while institutions get higher limits. Fees range from 0.7% to 3.5% of contract value depending on the market probability—trading near 50/50 odds costs more than trading extreme longshots.

Market Categories and Discovery

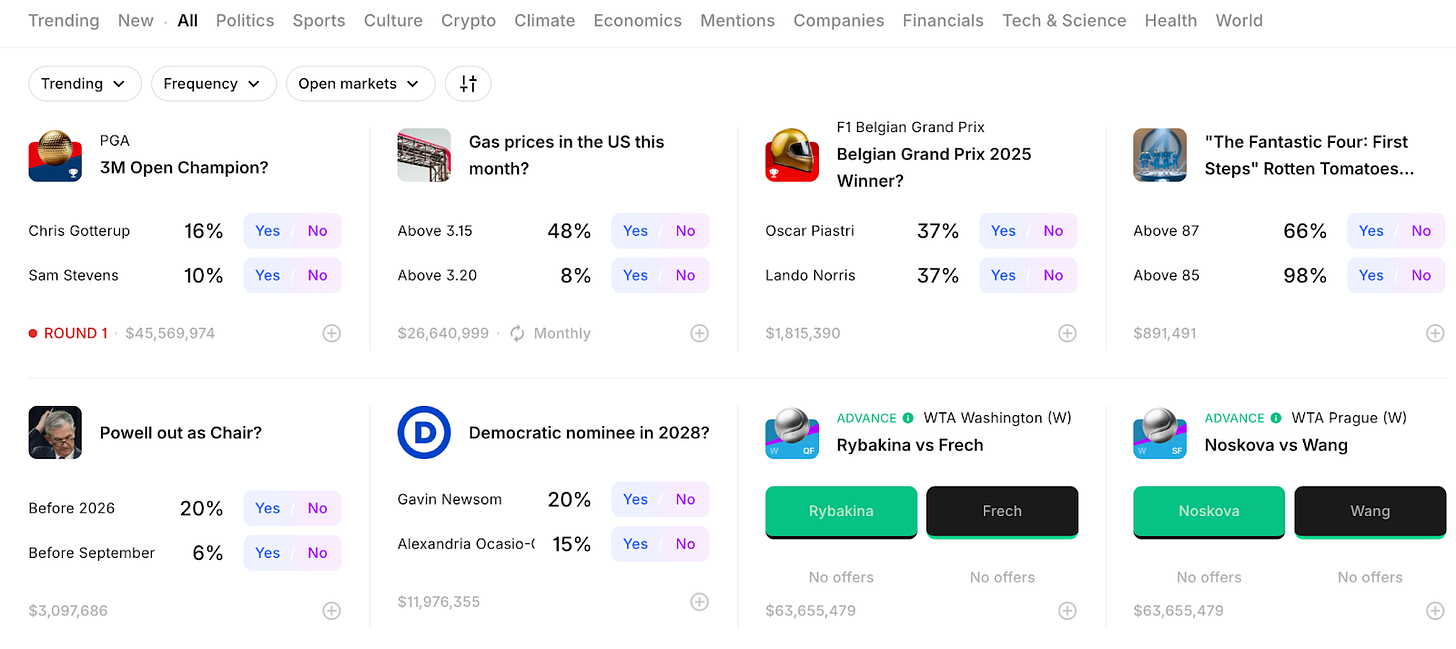

Kalshi organises markets across multiple categories: Politics, Sports, Economics, Crypto, Climate, and more. The trending section highlights markets with high activity or recent price movements.

The platform also features an "Ideas" section where users discuss market analysis and share trading rationales. This community aspect helps you discover new markets and understand different perspectives on event probabilities.

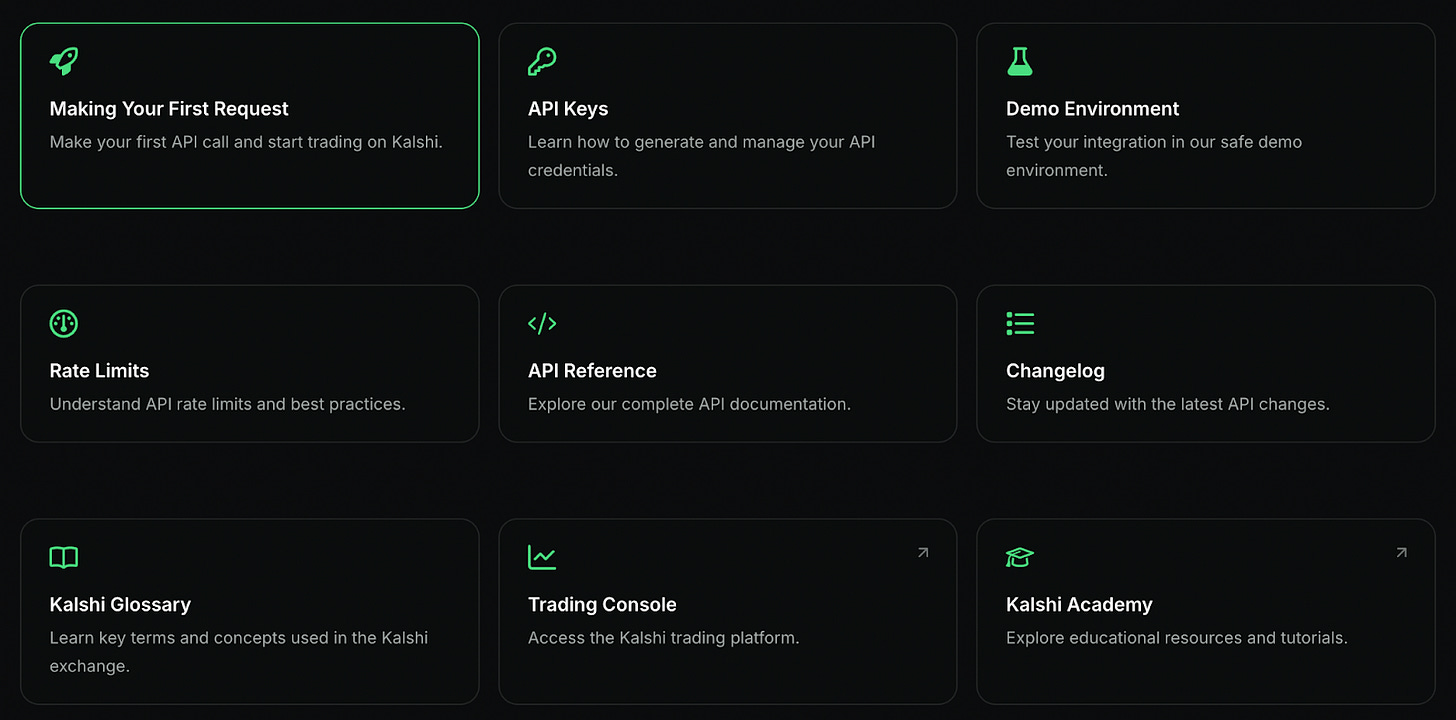

For active traders, Kalshi offers API access for algorithmic trading and data analysis. You can pull historical price data, automate trades, and integrate Kalshi markets into broader trading strategies.

The platform also provides detailed volume and open interest data for each market, helping you assess liquidity before placing larger trades.

The genius is in the simplicity. No complex derivatives. No leverage. No counterparty risk beyond the exchange itself. Just pure information markets with transparent, regulated settlement.

Investment managers are using Kalshi to hedge event-specific risks that traditional instruments can't capture efficiently. A clean energy fund worried about regulatory changes can hedge directly by trading policy outcome contracts. A tech-heavy portfolio can hedge against antitrust actions by trading relevant legal markets.

If you hold $1 million in assets that would lose 20% from a specific policy change, spending $50,000 on a 25% probability hedge gives you $200,000 if the event occurs, exactly offsetting your portfolio loss.

Traders with specialised knowledge can monetise their expertise directly. Political insiders trade election markets. Economic analysts trade Fed decision contracts. Industry specialists trade regulatory outcome markets. Unlike stock markets where information advantages get arbitraged away quickly through complex derivative strategies, event markets offer direct paths to profit from superior forecasting. Your edge in predicting FDA approvals or Supreme Court decisions translates immediately into trading profits.

The Grok Integration

The recent xAI partnership is a glimpse into the future of informed trading.

Grok's integration provides real-time analysis of on-chain data, historical odds, and breaking news directly within Kalshi's interface. Before placing trades, users can query Grok for contextual information about events, probability assessments, and relevant data trends.

This creates a feedback loop where AI helps traders make better predictions, while the prediction market outcomes train AI systems on real-world forecasting accuracy. Grok gets stress-tested on live probability assessments, while traders get AI-enhanced information analysis.

The implications extend beyond individual trading decisions. As AI systems become better at processing vast information sets and identifying probability patterns, prediction markets become more efficient. Better efficiency means tighter spreads, more accurate price discovery, and greater utility for hedging applications.

Kalshi vs Polymarket

The prediction market space now has two leaders with complementary philosophies. Polymarket pioneered the space with crypto-native innovation, while Kalshi built for Wall Street compliance.

The Key Differences

Kalshi operates under full CFTC regulation. Your funds sit in federally insured accounts, disputes get resolved through clear processes, and everything works like traditional finance. Fund with bank transfers, trade in dollars, withdraw to checking accounts.

Polymarket proved the model works globally with USDC settlements and decentralised oracle resolution. It offers global accessibility and blockchain transparency, and recently acquired proper US licensing to expand into regulated markets.

Why Each Appeals to Different Users

Institutional money flows to Kalshi because regulation provides certainty. Susquehanna and other major market makers provide liquidity, creating tighter spreads. Over $1 billion in monthly volume proves mainstream adoption favors compliance.

Polymarket's innovation and global reach attracted crypto-native users and international traders who value decentralisation and permissionless access. Their early success validated the entire prediction market category.

The Verdict

For US users prioritising regulatory protection and traditional finance integration, Kalshi offers clear advantages. For global users comfortable with crypto infrastructure who value the innovation Polymarket brought to the space, the original platform provides unique benefits. Both platforms are pushing prediction markets toward mainstream adoption, just from different angles. The combined growth reflects institutional and retail appetite for this new asset class.

What This Means For Your Strategy

Whether you're managing a portfolio, building a trading strategy, or just trying to understand where finance is headed, Kalshi's emergence demands attention.

For portfolio managers: Event contracts offer precise hedging tools for risks that traditional instruments handle poorly. Political risk, regulatory risk, and macro event risk can now be hedged directly rather than through imperfect correlations.

For active traders: Information advantages in predicting real-world events can be monetised directly. Your expertise in specific domains, whether politics, economics, or industry developments, has a clear path to profitability.

For long-term investors: Understanding how prediction markets evolve helps position for the broader trend toward financialising all forms of measurable uncertainty. The companies building this infrastructure early will likely capture disproportionate value.

The regulated prediction market space is where DeFi was in 2019. Nascent but showing clear product-market fit, with massive growth potential as infrastructure improves and adoption accelerates.

Kalshi's $2 billion valuation and growing institutional adoption suggest we're past the experimental phase. Event contracts are becoming a legitimate asset class, and the traders who adapt quickly will have first-mover advantages in a rapidly expanding market.

Kalshi is the infrastructure layer for trading reality itself. As the boundary between information and markets continues to blur, that infrastructure becomes increasingly valuable.

I’ll see you next week with another cool product.

Until then … DYOR and make wise decisions.

Thejaswini

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.