HTTP 402: Payment Required

The forgotten status code that could finally make money move at internet speed.

Monad boxes were all over my feed last week. Did anyone else find themselves logging in every day just to open another one? It felt like being a kid again, opening mystery boxes, cricket cards, Pokémon packs - all that thrill packed into a few clicks. We grow up, but some habits never really die.

Speaking of old things, I often think that if anyone from the 2000s tried using payment applications and banking today, they’d hardly notice any difference. How is it that messaging has come so far that anyone can message anyone else in the world with a single tap now, but the moment I try sending money, the internet suddenly feels outdated?

It’s because the web was built for sharing information, and money has always been a secondary concern. We patched the money gap with ads, subscriptions, and payment gateways. Clever workarounds, but not really a native fix.

I’ve always found it strange that the internet made communication borderless, yet money still crawls through outdated banking rails. We’ve built AI agents smart enough to find the best flight in seconds, but they still have to wait for their slow human counterpart to type in a credit card number just to complete the purchase.

Now that agents take on tasks that we once handled, expecting them to work with outdated financial systems would be criminal to AI growth. Agents need a way to move money across the web as easily as they move data, and we need to build it for them.

That’s the gap Coinbase aims to close with x402.

On to the story now,

Nishil.

Play. Earn. Own. That’s Klink Finance.

With Klink Finance you don’t just watch crypto, you act. Complete tasks, social quests, and partner offers to earn in crypto or cash. Build reputation, unlock rewards, and gain access to special drops.

Earn for gaming, app trials, surveys and more.

Flexible withdrawals: crypto or fiat, your choice.

Backed by a global user-base and trusted integration partners.

If you’re ready to turn your time into value, join the earning revolution with Klink.

The Forgotten Status Code

x402 builds on a long-forgotten piece of the HTTP protocol - one originally intended to make payments as effortless as loading an image or a video. But to understand what x402 is, let’s first dive into how HTTP itself works and what the 402 status code was meant to achieve.

HTTP is the foundation of the modern web, the rulebook that governs how data moves between a client (like your browser) and a server. To manage this communication, HTTP uses status codes, short signals that tell the browser what happened when it tried to access a page. You’ve probably seen a few of these already:

HTTP 200 – OK: The page is loaded successfully.

HTTP 404 – Not Found: The resource doesn’t exist.

HTTP 500 – Internal Server Error: Something is broken on the server side.

These codes help the browser understand the interaction and communicate it clearly to the user.

Beyond the familiar codes everyone knows, the HTTP standard includes several others that were defined but rarely used, one of which is HTTP 402: Payment Required.

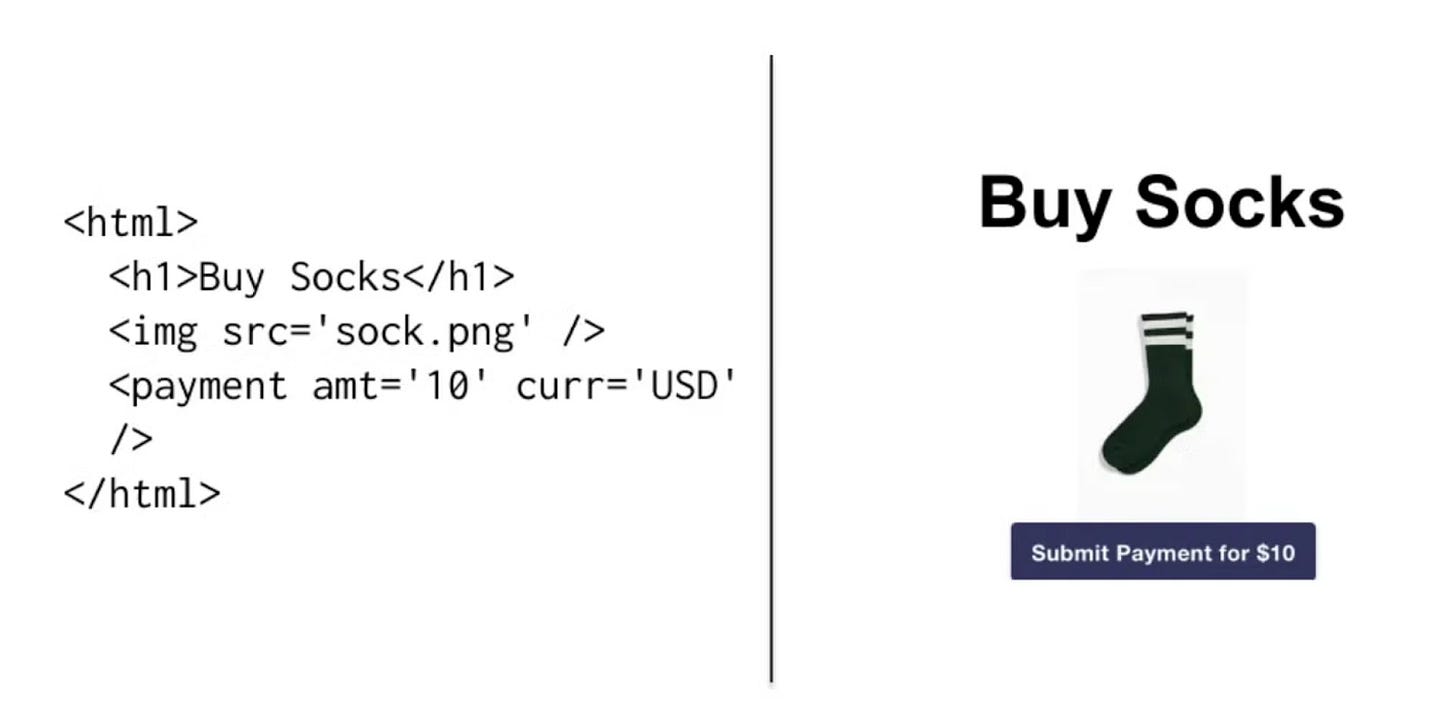

The 402 standard by itself is very simple and straightforward. It opens up space for webpages to communicate payment-related information over the HTTP standard, much like how an <img> tag tells a browser where to find an image.

It’s wild to think this idea sat dormant for decades. I believe it just needed the right financial tools capable of internet scales, aka blockchains.

Source: Pantera Capital

But here’s the real question: what actually happens after you click pay?

According to the standard, the server returns ‘HTTP 402: Payment Required’. On its own, that sounds trivial. But it can be game-changing when paired with infrastructure that can move money as fast and frictionlessly as information on the web.

Wait a second, isn’t that what Stripe and PayPal already do? Make payments possible on the web?

No, there’s a huge difference in the way Stripe works and what x402 proposes.

While internet payment solutions like Stripe and PayPal allow one-click payments on the web, there’s still a lot of friction in the process to make it happen.

These solutions bypass the HTTP server that the user was interacting with and redirect them to their own API and interfaces. This locks both the merchant and the user within a walled garden that requires KYC to enter, a credit card to pay, and charges fees that make micro payments difficult.

If I had to withdraw cash from a specific ATM every time I made a purchase at a shop, I wouldn’t even bother buying anything. This experience is similar to what PayPal is today, only online.

The core problem isn’t with how PayPal is designed, but rather with how traditional banking itself is not scalable enough to support the fluidity of online commerce.

I can send an emoji to anyone, anywhere in the world, and cost and time-wise, it’s the same as sending an article. But the same isn’t true when it comes to making a payment online.

Most cards and services like PayPal charge me around a 3% processing fee, in addition to a fixed fee. This fee makes microtransactions impossible on the web. Sending $0.01 can cost >$0.30, which is absurd.

Blockchains don’t face these limitations. What excites me the most is that with stablecoins and high-throughput networks processing thousands of transactions per second, the pieces are finally in place. We now have the infrastructure to make moving money across the internet as seamless as sending a message.

HTTP meets Blockchains - x402

In the end, x402 is just a modern upgrade to the forgotten 1990s status code. And it enables native payments over HTTP, powered by blockchain rails.

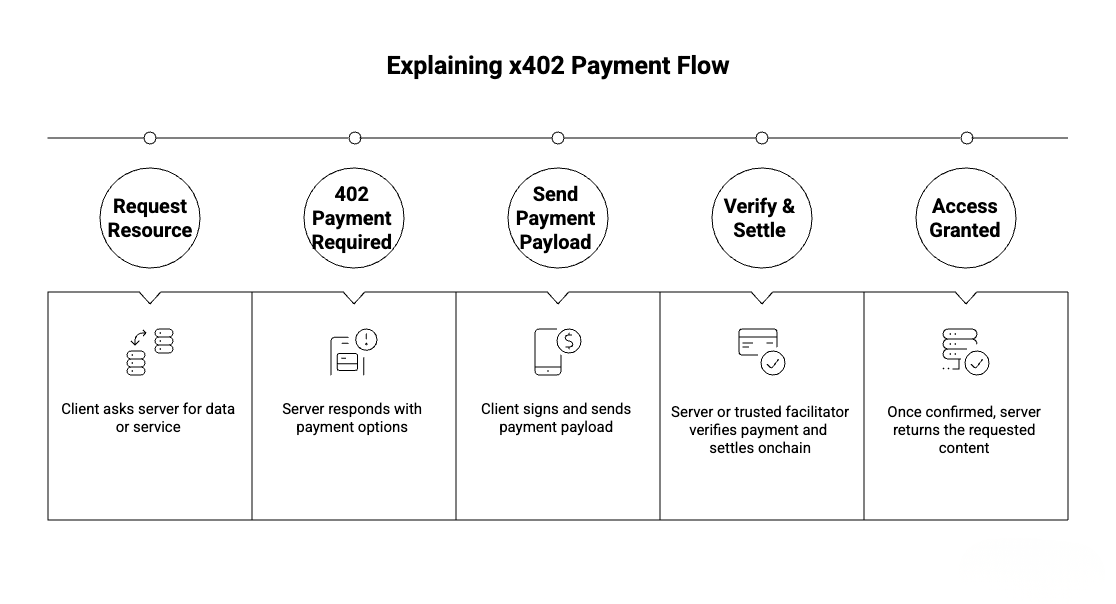

Let me walk you through how it works:

Request: When a client, whether human or AI, requests something without a valid payment, the server replies with an HTTP 402 Payment Required message and a JSON payload explaining what needs to be paid, how, and to whom.

Payment: The client then makes the payment (usually in USDC on a supported network) and re-sends the request with a header confirming payment authorisation.

Verification: A facilitator service checks the payment on-chain, and if it’s valid, the server releases the requested data.

Importantly, x402 itself does not process funds, it only defines the handshake. Settlement is done by a payment “facilitator” (payment processor or on-chain contract) that the client configures.

What’s powerful about x402 is how it lets my web2 developer friends add stablecoin payments to their existing websites, no new integrations, no complicated setup. It’s actually simpler than configuring Stripe or PayPal, which suddenly makes my web3 pitch to them a whole lot easier.

At the same time, the AI I use and I can finally browse and pay with the click of a button, making online purchases as seamless as my emails. It’s effortless for both me and my AI agents.

What excites me most about this shift in online payments is the idea that I could finally program how my money moves on the web. I could set clear policies that define how my funds are used.

I want to pay just for the single WSJ article I read rather than a monthly subscription that collects as email dust. I want my streaming apps to charge me precisely for the seconds I actually watched, no more annual lock-ins. I want to instruct my AI agents to fetch research from paywalled sources and access APIs on a pay-per-use basis. That level of control is liberating.

While the unit economics might not make sense for firms to allow micropayments for services, a case can be made for how it can allow them to scale and eventually grow beyond current revenue scales as well. Especially when we focus on how cent-level transactions could convert passive internet users into active economic participants, potentially multiplying total online GDP in the process.

Coinbase launched x402 in May this year. Since then, multiple projects have started building on the standard. Some interesting use cases include:

Questflow: A multi-agent orchestration tool that uses x402 to let agents autonomously pay for APIs in complex workflows.

Anchor Browser: Lets in‑browser agents pay for paywalled content or spin up new browsing sessions via payments.

Pinata: Account-free IPFS uploads and retrievals using x402. Allows you to pay for private or public IPFS storage and retrieval without an account or API key.

If you ask me, we’re only beginning to scratch the surface of what’s possible. Once money moves like data, we will see money becoming composable across the web. Search, discovery, and payments will shift more and more to agents.

This won’t come as a shock, but most of the current use cases of x402 revolve around crypto applications. To see demand come from outside, we need the right network effects.

Just as eBay was the launchpad that drove PayPal’s early adoption, x402 now needs its own “eBay moment”, a flagship platform that drives mainstream adoption.

Fortunately, with Coinbase leading the charge on x402, it has been beneficial in forging major web2 partnerships and bringing us closer to finding that flagship platform that can spark widespread adoption. Some of them are huge:

Cloudflare: Recently partnered with Coinbase to form an independent x402 Foundation.

Google: integrated x402 into its new Agent Payments Protocol 2 (AP2) standard, and

Visa: Visa added support for x402 in its Trusted Agent Protocol (TAP).

So what do I think?

In a few years from now, I’ll ask my AI assistant to put together a market report. And it’ll quietly tap into data sources, news reports, Reddit threads, and pay a few cents to buy articles and cross paywalls, while passing policy checks that I pre-programmed. No checkout windows. No payment forms. No tracking cookies lurking behind the scenes for ad revenues. Just pure intent, executed automatically.

This is a future I imagine x402 can enable - a world where payments are native citizens of the web.

Once x402 scales, we will see the emergence of new usecases that are not possible in the financial dynamics of today. Users will put money into a facilitator’s UI and take that account everywhere on the web. Imagine social media with likes as creator payments, fitness agents that track sports wear reports to buy diet-friendly groceries for you, a wearable tech that listens to your daily conversation to suggest potential polymarkets to bet on, or your personal agent that interacts with other agents to negotiate and pay for flight tickets, get you a reservation for your dates, and more.

This is just scratching the surface.

With x402, I can see a web capable of carrying money as easily as information, whether it’s cents or dollars, agents or humans.

The agents on my browser are excited for it. And so am I.

See you next week with another thought.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

Love the focus on removing payment friction - it’s what B2B finance has needed for decades. While x402 looks outward, the same principles apply inward: streamlining trade credit, invoice approval, and collections so cash flow keeps pace with growth. TCLM digs into those operational systems. Worth a look if you're into financial infrastructure.

(It’s free)- https://tradecredit.substack.com/

Visa's TAP integration with x402 feels like a smart move that positions them for where payments are heading. The ability for AI agents to autonomously handle payments through Visa's network without the friction of traditional checkout flows could unlock massive transaction volumes they're currently missing. It's interesting how they're essentially turning their network into native internet infrastrucure rather than just a payment rail. If they can scale this alongside Google's AP2 and get real adoption, it could be transformative for their business model.