Crypto was conceived to disrupt banks in a permissionless, decentralised manner.

“The problem is that … the fate of the entire money system depends on the company running the mint, just like a bank” Satoshi Nakamoto had said in the Bitcoin whitepaper they authored in 2008.

The disruptors now want to become the very thing they set out to replace.

Earlier this week, both Circle and Ripple filed applications for US banking charters. Circle wants to establish "First National Digital Currency Bank" while Ripple is chasing both federal oversight and a Fed master account, which the Fed maintains for eligible institutions such as banks and allows them to conduct transactions and access the Federal Reserve's payment systems and services.

Circle manages over $62 billion worth of USDC tokens, while Ripple's RLUSD stablecoin is still growing with ~$480 million in market cap.

In today's News Rollups edition, we examine:

Why crypto players are seeking banking licences

What Circle's stock crash tells us about market reality

How the GENIUS Act is forcing everyone's hand

Whether this betrays crypto's original mission

Got questions about a hot crypto topic that you want help understanding? Ask your question by replying to this email and our crypto experts may answer it along with your name in our weekly News Rollups.

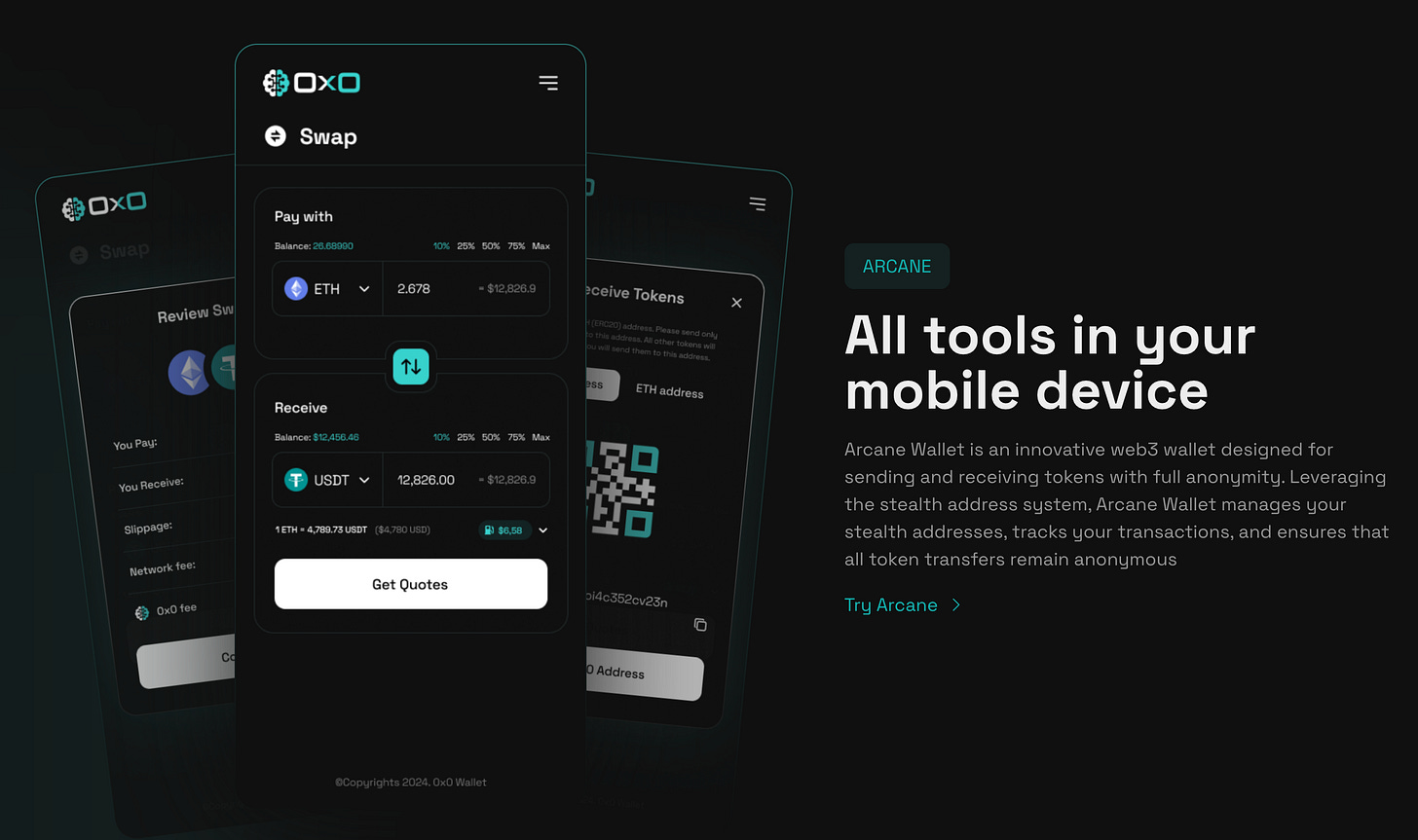

Trade Crypto Like It Should Be

0x0 Exchange lets you swap crypto across blockchains — no sign-ups, no KYC, just fast, low-fee trades.

Privacy-centric on-chain ecosystem with Arcane stealth wallet, Spectre private DEX + leveraged trading, and AI-powered smart contract auditing via 0x0.ai token share rewards.

✅ Cross-chain swaps in one transaction

✅ No sign-ups – start trading instantly

✅ Low fees with best-rate aggregation

✅ Open-source and community-driven

Your crypto, your rules. No permissions needed.

👉 Start trading at 0x0.exchange

Q1: Why are Circle and Ripple applying for banking licences?

Legitimacy.

It’s straightforward. After years of operating in regulatory grey zones, crypto companies have understood that a banking licence is basically a golden ticket to institutional acceptance.

Should we remind you what a Wall Street debut did to Circle’s stock?

Read: Circle’s Wild Ride

"Circle has long sought the highest standards of trust, transparency, governance, compliance," chief executive CEO Jeremy Allaire said.

Circle wants to establish "First National Digital Currency Bank" to manage USDC's $61 billion in reserves directly. Right now, BlackRock manages those reserves and BNY holds them. That's a lot of middlemen taking their cut.

Brad Garlinghouse wants to set a "benchmark for trust in the stablecoin market" by bringing Ripple under proper federal oversight. "If approved, we would have both state (via NYDFS) and federal oversight, a new (and unique!) benchmark for trust in the stablecoin market."

They want every possible regulatory stamp of approval to convince institutional investors they're legitimate.

Think about it this way: if you're a pension fund manager considering crypto, would you rather deal with a crypto player with patchy regulatory background or a federally regulated bank?

It also coincides with regulatory tailwinds.

With the GENIUS Act (stablecoin legislation) moving through Congress and a crypto-friendly administration under US President Donald Trump in power, there wasn’t a more conducive landscape before now.

Circle and Ripple are likely racing to get their applications in before the queue gets too long.

Q: Isn't this ironic? Didn't crypto start out wanting to replace banks?

Early crypto was about "be your own bank" and cutting out financial middlemen, true. Bitcoin's genesis block literally referenced bank bailouts. Circle and Ripple positioned themselves as alternatives to the slow, expensive banking system.

Then why go back to the traditional system of banking? Perhaps pragmatism took over purism. The rebel phase (shouting from outside the bank's walls) is giving way to a collaborative phase (working from inside the vault). It's a bit like you lose some edge but gain a much bigger audience.

The upside? Operating within the rules could bring crypto tech to far more people. And if that means dilution of some of that original revolutionary spirit and purist philosophy, the trade-off is a no-brainer from the perspective of running a business.

Q: How exactly does becoming a bank help?

Numbers show why they want this so badly.

Direct control means direct profits: Circle's proposed trust bank would let them manage USDC's $61 billion in reserves directly instead of paying BlackRock and BNY Mellon to do it. Stablecoin issuers earn interest on those reserves – Circle pulled in an estimated $1.7 billion last year from that alone.

Why share that revenue when you can keep it all?

Fed access is the holy grail: Ripple's master account application is a bid for direct access to the Federal Reserve system. If approved, they could hold USD reserves backing RLUSD with the central bank and settle USD transactions without routing them via other intermediaries that are currently holding Ripple’s USD reserves.

Beyond just cost savings, that would bring a credibility boost that money can't buy. Try explaining to institutional clients that your stablecoin is backed by reserves "directly with the Fed."

Regulatory clarity: A banking charter means playing by the same rules as JPMorgan. Regular audits, capital requirements, and compliance obligations. Sounds like a hassle, but it's actually liberating, no more guessing what regulators want.

The default trust from customers that comes with all this procedural paperwork makes the hassle worth it.

Q: How have investors responded to the news?

Despite the banking charter news, investors didn’t find Circle’s sky-high valuation justified. After a bumper IPO saw CRCL rocket from $31 to nearly $299, the stock saw massive correction at the bourses. It crashed over 40% during the past eight trading sessions, closing Thursday at $189.

Q: Have there been other precedents?

Circle and Ripple aren't the first in chasing a banking licence. Anchorage Digital was the first crypto company to get a national banking charter back in 2021.

Kraken took a different route with Wyoming's Special Purpose Depository Institution charter, a state-level banking licence designed specifically for crypto firms. The walls between crypto and traditional finance are crumbling fast.

That's it for this week's News Rollups.

See you next Friday.

Until then … stay curious,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.