Hello

Welcome to our weekly Bitcoin macro and news analysis: Mempool.

Last Monday, we said the line to watch was whether BTC could defend $110K. It did, but with little conviction. The softer macro backdrop gave gold a record run, equities a lift, and traders reason to bet on a 50 bps cut this month. Bitcoin, meanwhile, still looks indecisive as it struggles to break past the $113,000 mark.

Today, we're looking at Week 36 of 2025 (Sept 01-September 07):

BTC stalls at $113K, gold breaks records

Jobs data weakens, Fed cut bets intensify

Strategy misses S&P slot, Robinhood gets in

Treasury demand shifts to smaller but broader buys

TOKEN2049 Origins Hackathon: Deadline Extended

TOKEN2049 Origins is crypto’s premier hackathon. From Sept 30 - Oct 2, the world’s top coders will convene for an epic 36-hour marathon. Forming teams of four, they will take ideas from concept to working product.

This is your chance to build the next wave of crypto, right in the heart of TOKEN2049 Singapore.

160 crack developers

40 teams

Full access to TOKEN2049 Singapore

Mentorship from ETHGlobal, GCR, Draper University, Alchemy and AltLayer

US$85,000 prize pool

Merch, free-flow food & drink, and much more

Due to popular demand, the application deadline has been extended to Sept 14. Applications will be reviewed in batches so don’t wait. This is your last chance to compete.

Week That Was

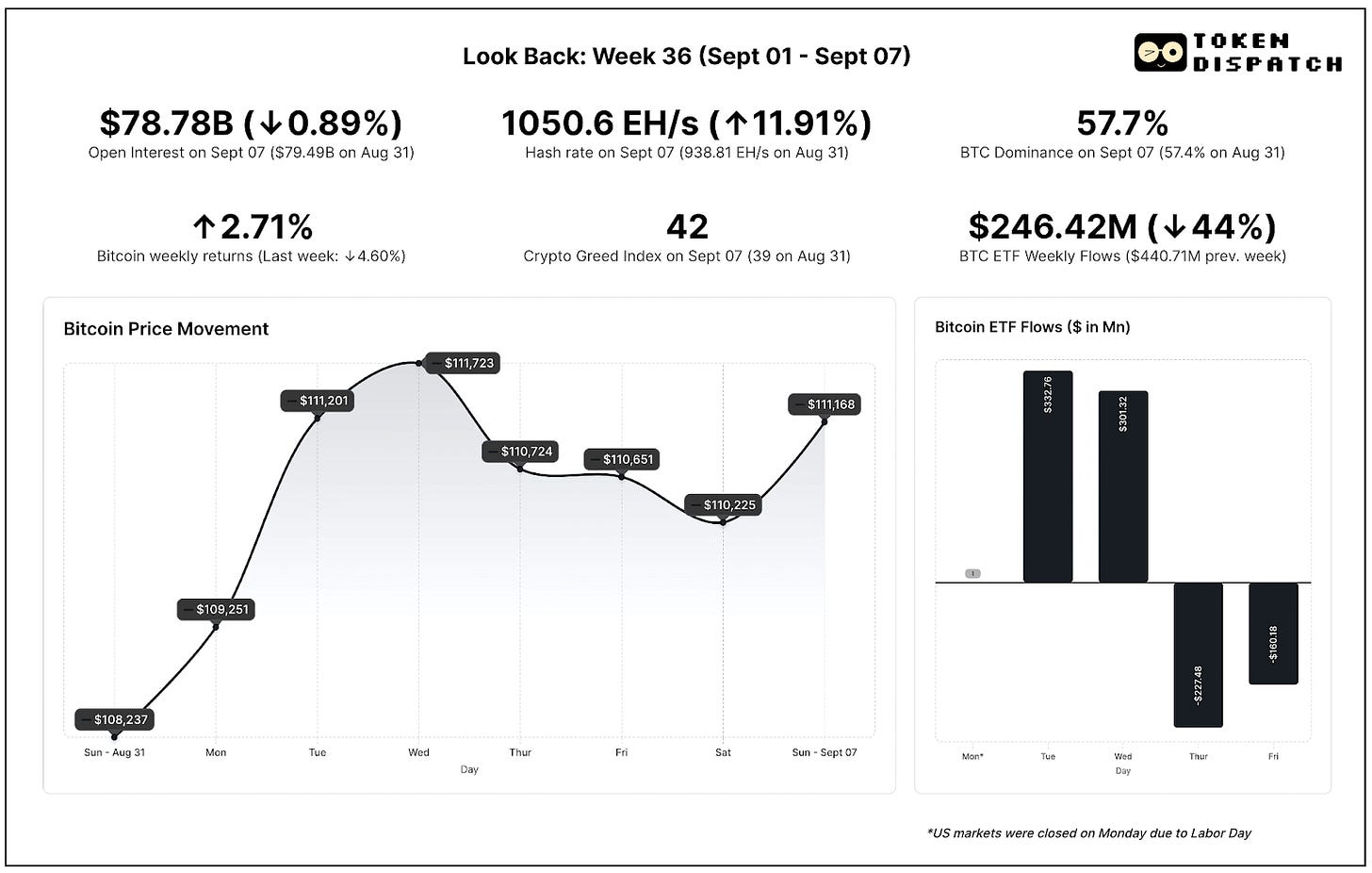

Bitcoin spent the past week doing a whole lot of running to stay in place. From a low start near $108,000 on Monday, it climbed back over $111K through the middle of the week.

That conviction only hardened on Friday, only to lose steam over the weekend.

The US labour market delivered one of its weakest prints in years, with just 22,000 jobs added in August against expectations for 75,000. The unemployment rate ticked higher to 4.3%. Suddenly, traders weren’t debating whether the Fed will cut rates this month but by how much, 25 basis points or a surprise 50.

Gold shot to new record highs above $3,640 an ounce. Bitcoin, in contrast, flinched. After spiking to $113,400 in the minutes following the release, it slid almost $3,000 within an hour, ending the week back in the familiar $110,000–$111,000 range.

The market structure underneath explains the hesitation.

Futures open interest eased less than a percentage point as funding rates softened, pointing to traders de-risking rather than chasing upside.

The network itself, however, looks stronger than ever with hashrate hitting a record 1.279 zettahash per second during the week and difficulty climbing to a fresh high of 134.7 trillion. For all the price fragility, the backbone of Bitcoin has never looked sturdier.

Bitcoin hashrate closed the week with 12% gains.

BTC’s dominance stayed below 58% during the week, marking one whole month under 60% — something that’s happened for the first time in the last seven months. Crypto sentiment inched up slightly from 39, above fear territory yet on the border, to 42 in the neutral territory.

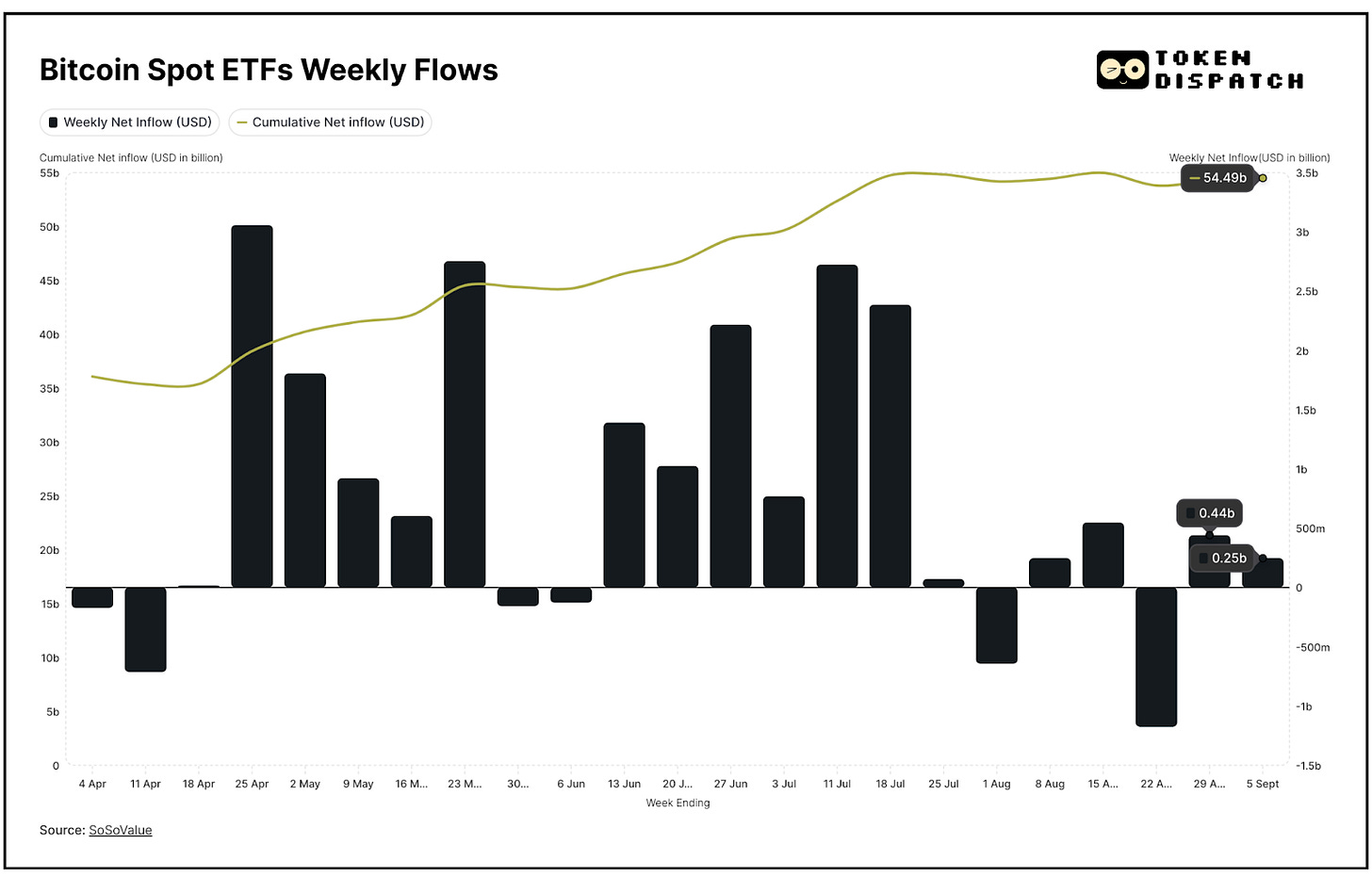

On the institutional front, Bitcoin Spot ETFs started the week with two days of inflows followed by two days in the red. They closed the week with ~$250 million in positive net flows, almost half of the net flows seen in the preceding week.

Exchange-traded products now account for more than 7% of BTC’s total supply, with BlackRock’s IBIT alone holding nearly 747,000 coins.

Crypto Equities Bleed

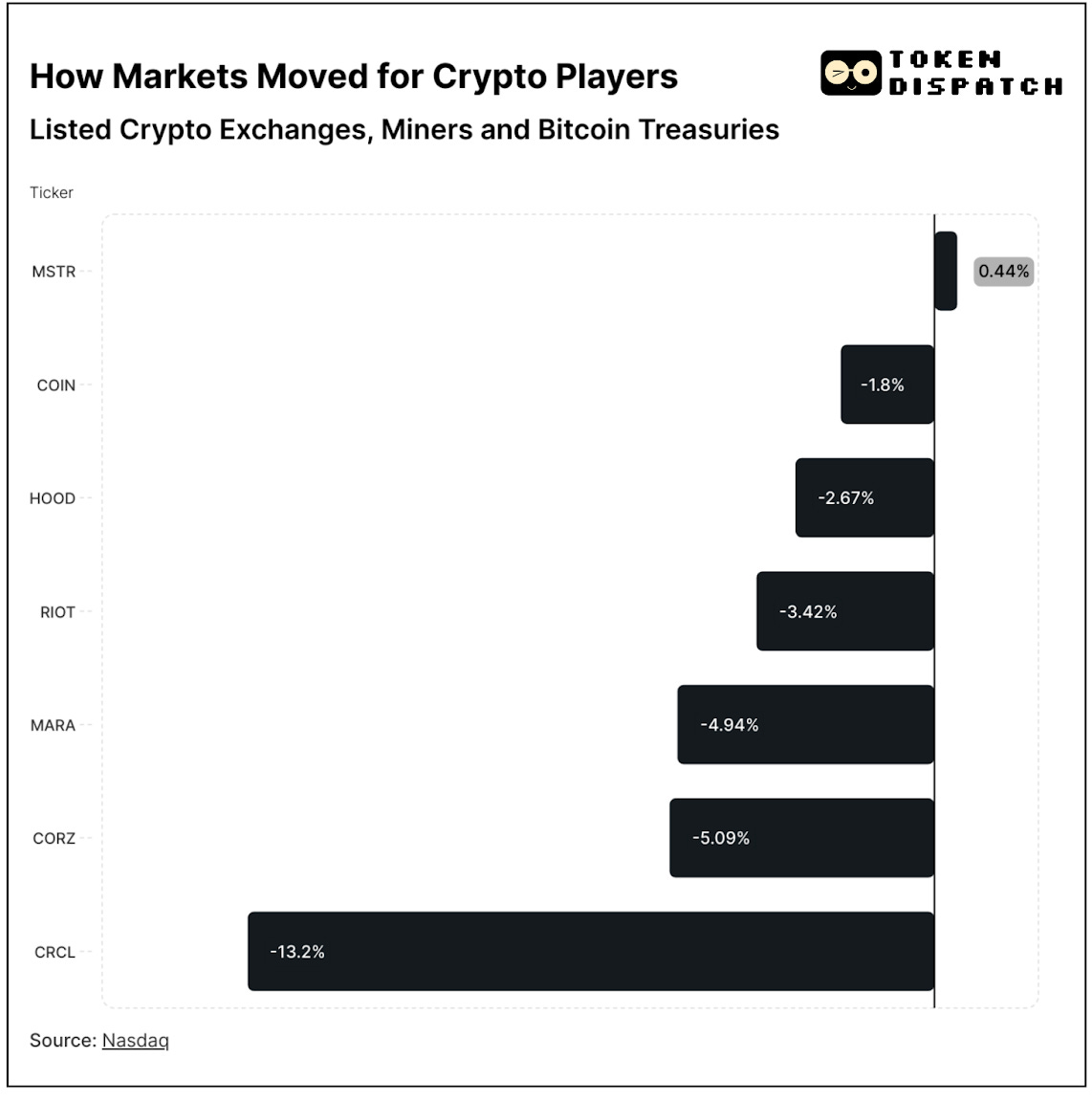

While Bitcoin was stuck under $113,000, crypto stocks were in reverse gear through the week. The sector closed the week mostly in red, with exchanges, miners and treasuries all dragged lower.

Circle was the standout loser, tumbling more than 13% to its lowest in three months and down over 60% from its June peak. Core Scientific shed 5%, while Marathon and Riot slipped 4.9% and 3.4% respectively, despite both reporting year-on-year jumps in August Bitcoin output.

Robinhood and Coinbase fell 2.7% and 1.8%, as investor appetite for trading platforms cooled after a brief summer rally.

The lone gainer was Michael Saylor’s Strategy, eking out a 0.4% rise. Yet, it came with bad news as the company was snubbed for S&P 500 inclusion despite meeting criteria, a milestone that would have plugged it into the portfolios of countless index-tracking funds. Robinhood, instead, took the slot in the benchmark index, about four months after Coinbase was included. As of writing this, Robinhood share price has jumped over 15% on Monday, September 9.

Price Action

Bitcoin’s on-chain metrics signal multiple paths forward.

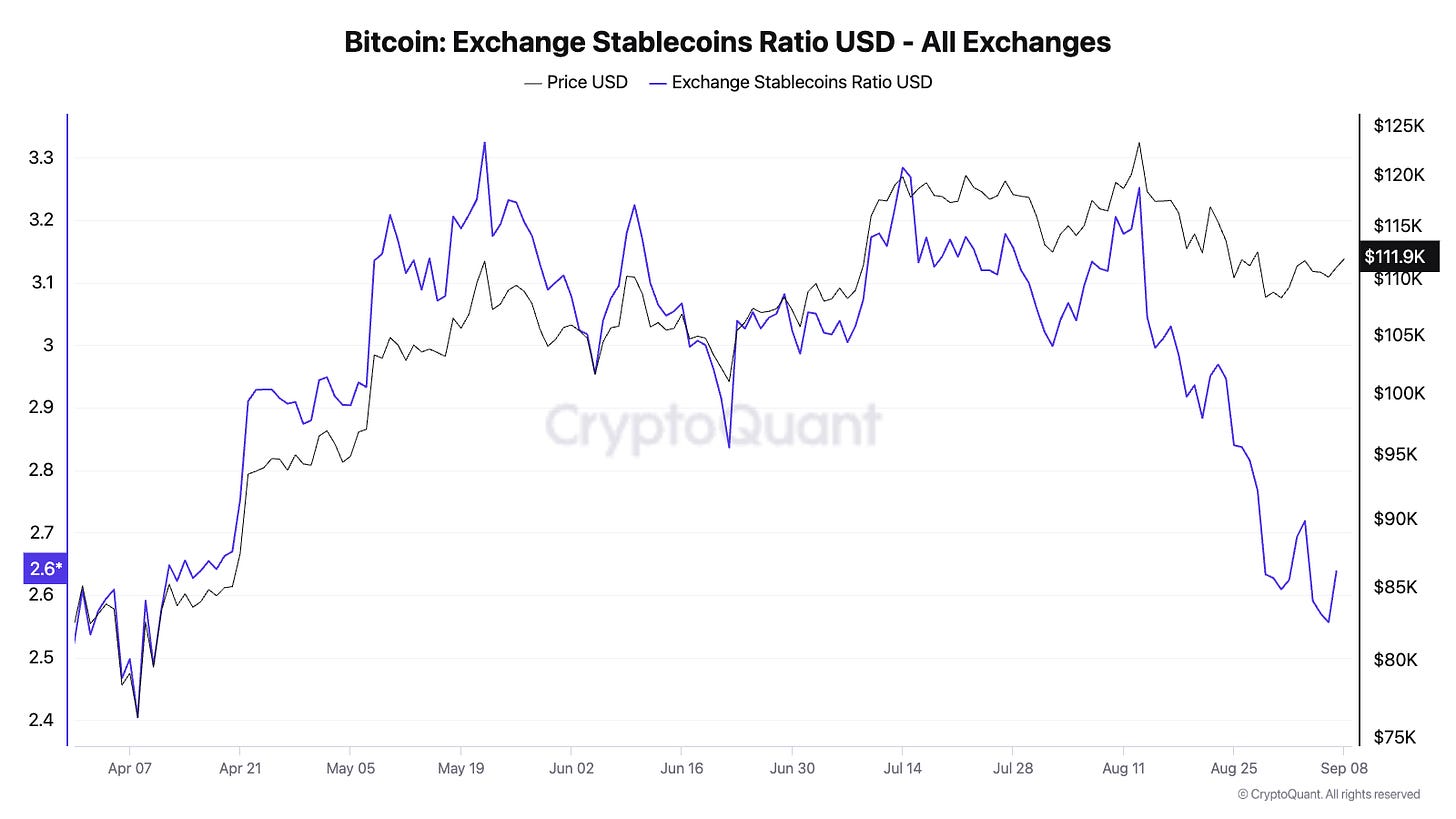

The stablecoin-to-Bitcoin ratio on exchanges has fallen to multi-month lows, meaning there’s now more cash sitting idle relative to BTC balances.

Historically, that kind of divergence has preceded rallies as sidelined liquidity eventually rotates into the market. Spot trading has already begun to stir as volumes on Coinbase and Binance show signs of a regime shift, hinting that re-accumulation could be underway.

But derivatives tell a different story.

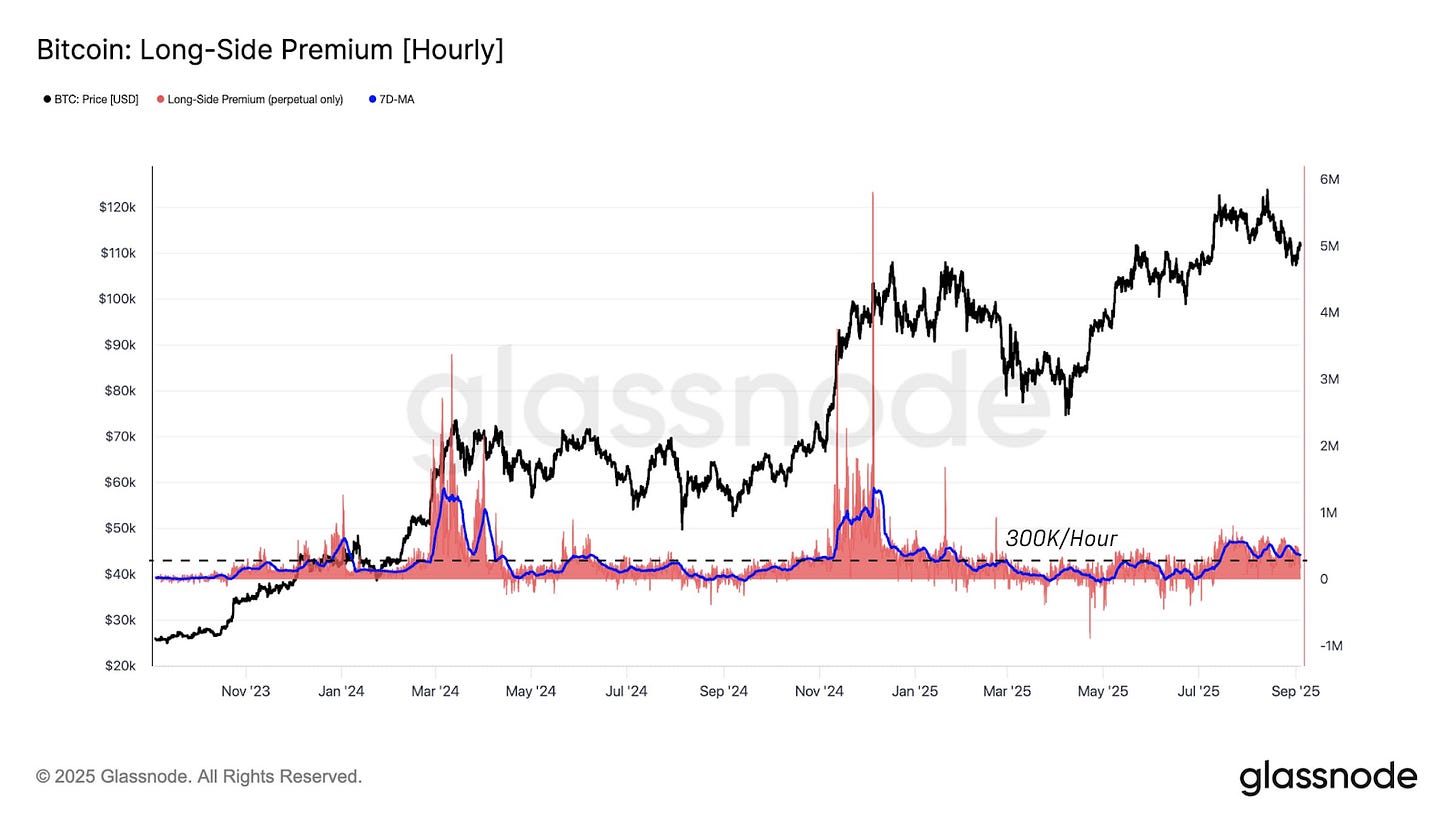

The Long-Side Premium, a measure of how much traders are paying to keep leveraged longs open, has cooled sharply compared to the euphoric spikes of earlier this year. Current levels signal that speculative appetite is muted.

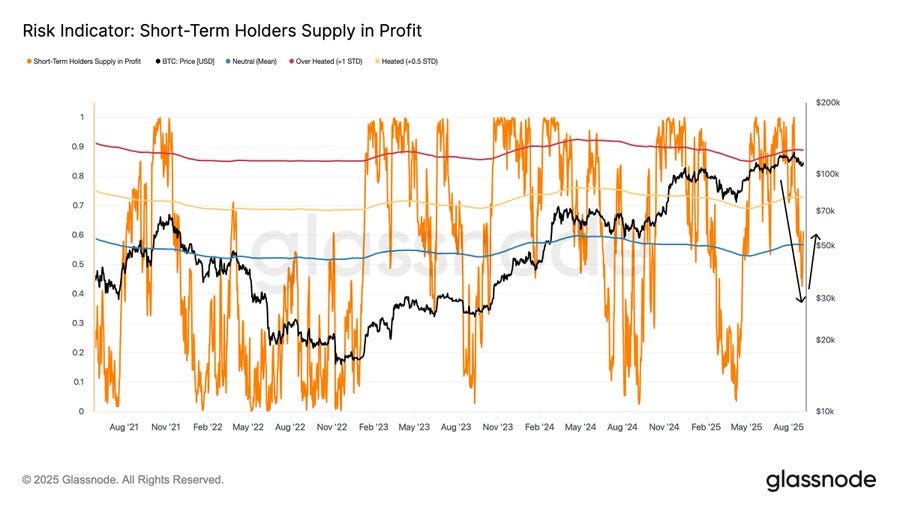

Short-term holder dynamics add to this fragility.

At the peak in mid-August, more than 90% of recent buyers were sitting on profits, fuelling a wave of distribution. That number collapsed to barely 40% after the slide to $107,000. The quick rebound back above $111,000 has pulled some of them back into profit, but the cohort remains on edge. Unless BTC can reclaim and hold above $114,000–116,000, a large share of short-term supply will stay underwater, leaving the market vulnerable to another flush.

For now, $112,500–$113,650 is the ceiling that matters. A decisive close above that zone would confirm a bullish break of structure and open up targets at $116,000. Until then, the risk of another sweep toward $105,000, and even the psychological $100,000, cannot be ruled out.

Surfer 🏄🏾♂️

U.S. Bank, the fifth-largest bank in the US, has restarted its Bitcoin custody services for institutional clients after a years-long pause. The move comes after US President Donald Trump’s administration rescinded the Securities and Exchange Commission Staff Accounting Bulletin (SAB) No. 121 bill that prevented banks from custodying digital assets.

The Trump brothers’ American Bitcoin stock soared over 80% in its Nasdaq debut before sharply dropping, triggered by intense price volatility and trading halts. Formed by merging with Hut 8 and Gryphon Digital Mining, the firm aims to be both a mining operation and Bitcoin treasury.

A dormant Bitcoin whale moved over $52 million in BTC after 13 years of inactivity, transferring more than 80 BTC to new addresses. This high-profile transaction follows a trend of major holders possibly adding selling pressure to Bitcoin as it trades around $110,000.

Treasuries Trim BTC Appetite

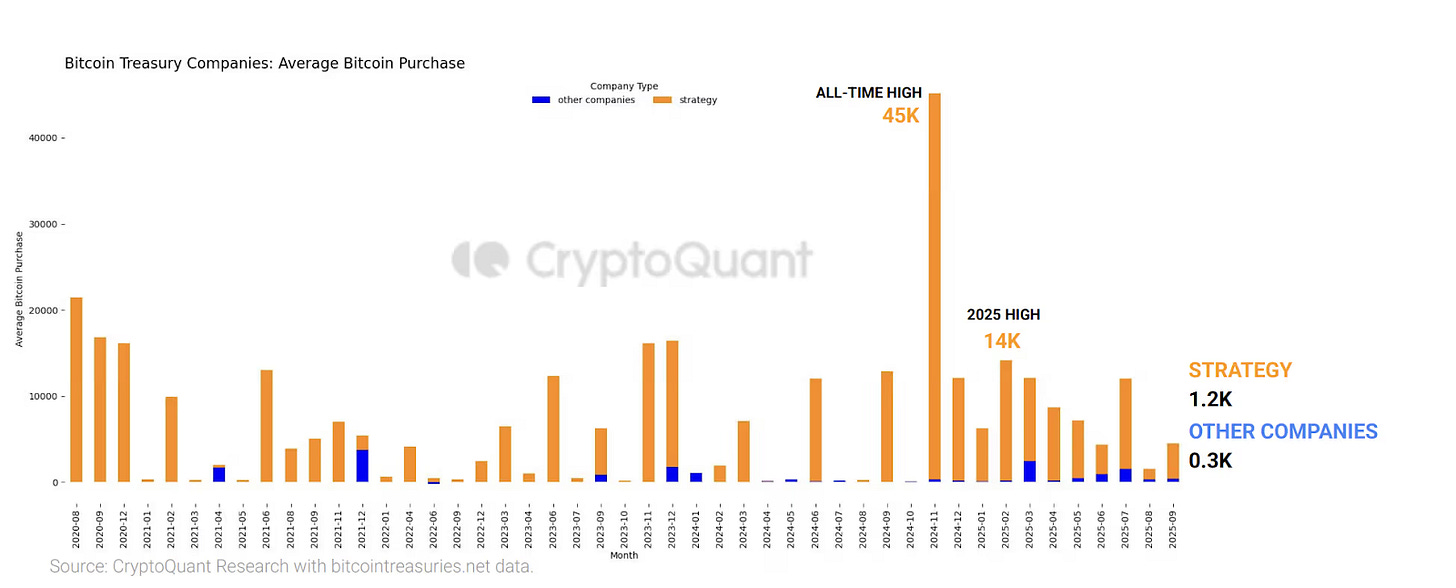

Treasuries are buying more Bitcoin than ever, just in smaller bites. On-chain data shows corporate coffers now hold a record 840,000 BTC, with Strategy alone sitting on 637,000 coins. But the average purchase size has collapsed by 86% since early 2025.

Strategy’s August buys averaged just 1,200 BTC per deal, while other firms barely crossed 343 BTC, down from six-figure hauls last year.

This is in stark contrast to Bitcoin’s Q2 rally, which was powered by treasuries scooping up supply at a 6:1 imbalance versus daily miner output. If that demand weakens, the price floor looks less sturdy.

Still, it’s not all gloom. In July and August alone, 28 new treasury firms emerged, adding 140,000 BTC to the pile. And Asia is stepping up, with Taiwan’s Sora Ventures recently launching a $1 billion fund to seed regional treasuries, out of which $200 million has already been committed.

That’s it for this week’s macro and news analysis.

I’ll see you next week.

Until then … stay sharp,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

Enjoyed your breakdown of on-chain signals. It’s incredible how narratives shape price action behind closed doors. I’d value your feedback on my dive into the big institutional maneuvers going unreported: https://beyondthecoin.substack.com/p/the-16-trillion-secret-wall-street

Thank you for sharing! Great work as always! ♥️💯🌊