Inscriptions Gold Rush 🎉🥳

Where's the Inscriptions taking us? ARK sells more, a profit-taking spree. Brian Armstrong vs anti-crypto army. More ETF ads rolling in. Would you want future president to be a tech whiz?

Hello, y'all. If you think you know your music, then this is for you frens👇

If you think you can boss it, a $500 Apple gift card is for you to win frens 🎁

A complete go. Check out 👉 Asset - Music Nerd.

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Crypto's latest sensation: inscriptions.

These experimental data files were supposed to be a fleeting fancy when they first surfaced with the Ordinals protocol in early 2023.

But today, they're writing a thrilling tale of their own.

It's a big rush out there.

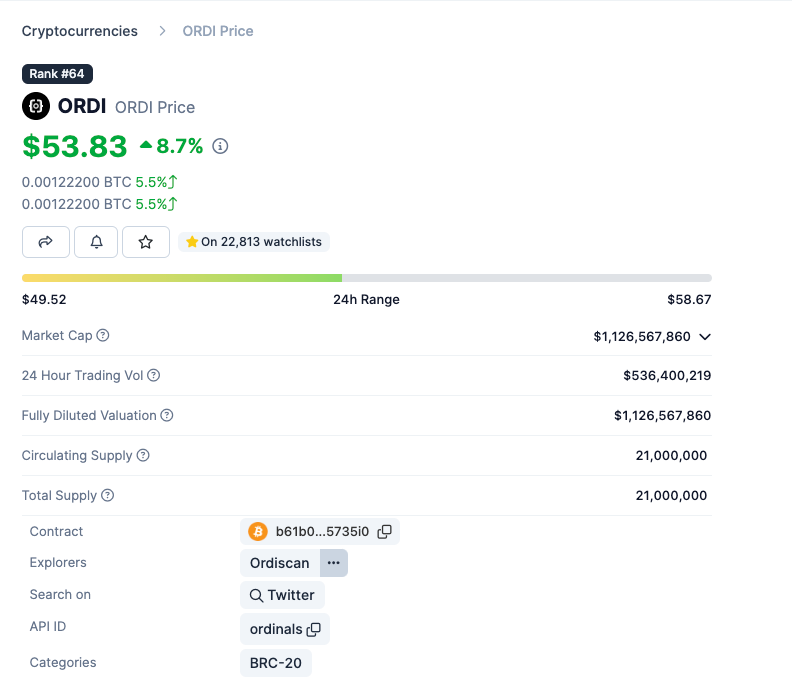

The total market size for Bitcoin inscription tokens now stands at a staggering $1.1 billion, with ORDI leading the pack as one of the top meme coins in the crypto universe.

But what are these inscriptions, anyway?

They allow users to mimic Ethereum's smart contract capabilities on the Bitcoin blockchain.

In simpler terms, it's akin to giving a bicycle the powers of a rocket ship.

It lets users embed data, like images and audio files, to create NFTs and meme coins on Bitcoin, which was once deemed impossible.

Beyond Bitcoin: Inscriptions have expanded to other blockchains due to their cost-effectiveness.

Developers Tool: Use inscriptions on Ethereum, BNB Smart Chain, Avalanche, Polygon, Arbitrum, and more.

Inscriptions are driving up the market value of early Bitcoin Ordinals like ORDI, which saw its value shoot up 17-fold in just four months.

Major exchanges like Binance have listed inscription tokens and added fuel to the fire.

The EVM Inscriptions

While Bitcoin Ordinals paved the way, Ethereum and other Ethereum Virtual Machine (EVM)-based chains have also embraced inscriptions.

EVM inscriptions enable users to send token mint and transfer transactions to themselves with call data because these operations are relatively cheap.

Many of these transactions involve BRC-20-type tokens, inspired by various collections and novel token tickers.

EVM inscriptions offer retail investors a way to access low-cap crypto assets, bypassing restrictions on initial coin offerings (ICOs) = anyone can create specific tokens from the ground up without needing venture capital or accredited investor status.

Read this thread👇

The Blockchain Blackout

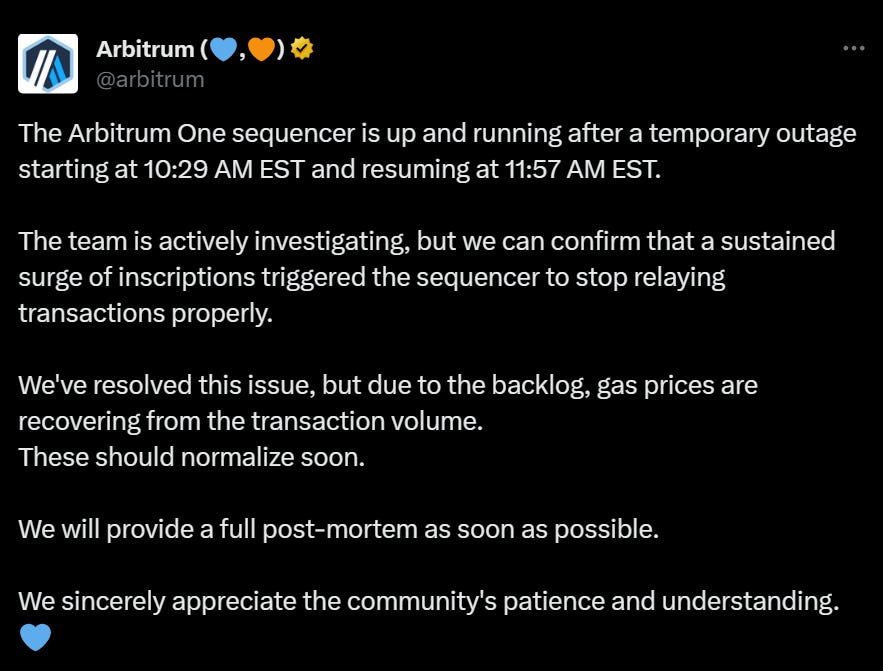

Over the past week, the inscriptions frenzy has caused partial or full outages on multiple blockchain networks: Arbitrum, Avalanche, Cronos, zkSync, The Open Network, and even the data availability network Celestia.

Arbitrum One has also felt the impact, with inscription transactions comprising 30% of all network traffic.

Activity on the Arbitrum One blockchain to grind to a halt for the first time in months.

While some crypto aficionados celebrate inscriptions, others see them as nothing more than spam or just a new hot thing.

The Gas-Spending Spree

Gas expenditures on inscriptions have skyrocketed in recent days.

Dune Analytics says more than $6 million was spent on gas on inscriptions on Dec. 18, and a record $8.3 million on them on Dec 16.

And mints migrate to chains such as Polygon with more favourable gas fees.

TTD Numbers 🔢

$181 million

ARK Invest, the asset management firm led by Cathie Wood, has been on a profit-taking spree.

Over the past month they have sold

$181 million worth of Coinbase (COIN) shares.

$64 million worth of Grayscale Bitcoin Trust (GBTC) shares.

ARK Invest holds shares of Coinbase and Grayscale Bitcoin Trust in three of its ETFs: ARK Fintech Innovation ETF (ARKF), Ark Innovation ETF (ARKK), and ARK Next Generation Internet ETF (ARKW).

The decision to sell these holdings aligns with ARK's strategy of buying during market downturns and selling during periods of price appreciation.

Bullish on Bitcoin

Despite being bullish on Bitcoin, with Cathie Wood consistently praising the cryptocurrency's performance, ARK Invest decided to capitalise on Bitcoin's impressive rally - 161% since the start of the year.

This rally has been fuelled by growing anticipation for the approval of a spot Bitcoin ETF.

ARK Invest, along with 21Shares, is among the companies vying to register a spot Bitcoin ETF.

TTD Blockquote 🎙️

Coinbase CEO Brian Armstrong.

Being anti-crypto is ‘really bad political strategy’

Brian Armstrong recently shared some insights on crypto and politics.

5 Reasons

Cryptocurrency Ownership: 52 million U.S. citizens are already part of the crypto community. That's a significant chunk of voters who have a vested interest in the crypto space.

Youth Appeal: Approximately 38% of young people believe that crypto can open up new economic opportunities.

Market Growth: Crypto prices have surged by 90% year-to-date. In contrast, only a mere 9% of Americans express satisfaction with the current financial system.

Supportive Allies: Armstrong highlights the Stand With Crypto Alliance, a nonprofit actively advocating for the crypto industry among elected officials.

Read this: The lobbying war ⚔️

While Armstrong didn't provide specific sources for these numbers, they seem to align with a Coinbase report from October 2023, which was based on surveys conducted primarily by Morning Consult's polling firm during the summer and fall of 2023.

TTD Grayscale 🏦

Grayscale Investments commissioned a survey, and the results?

We want our future president to be a tech whiz.

73% of respondents believe U.S. presidential candidates should understand innovative tech like AI and crypto.

A total of 2,090 adults chimed in.

They "strongly agree" or "somewhat agree" that a future U.S. president should have their tech radar up and running.

What else?

26% see inflation as the top issue, and 40% of those familiar with crypto are more interested in Bitcoin due to inflation and economic concerns.

40% of investors plan to include cryptocurrency in their future investment portfolios.

Younger voters, such as Gen Z and Millennials, own more cryptocurrency than traditional equities, and a majority of them believe that "crypto and blockchain technology are the future of finance."

However, 46% of the surveyed voters are waiting for "additional policies" before entering the cryptocurrency market.

Where's Grayscale ETF?

SEC and Grayscale have held another meeting to discuss a potential spot Bitcoin ETF. The meeting comes as the January 10th deadline for a decision approaches.

Also: BlackRock and Nasdaq recently met with the SEC to discuss BlackRock's proposal for a spot Bitcoin ETF.

Meanwhile Grayscale CEO Michael Sonnenshein thinks ETF could bring in $30 trillion into the market.

TTD Ads 🎥

Bitcoin exchange-traded fund (ETF) issuers have recently gone all out in a marketing frenzy.

Three attention-grabbing ads yet.

Bitwise started the show on December 18 with a Bitcoin ETF ad featuring the "Most Interesting Man in the World" himself, Jonathan Goldsmith.

On December 20, Hashdex entered the ring with a cheeky ad. They used a dumper truck to make the point that stocks, fixed income, and precious metals aren't crypto.

Bitwise quickly responded with another ad featuring Jonathan Goldsmith. He coolly delivered the line, "Satoshi sends his regards."

The SEC has 13 pending spot Bitcoin ETFs, with a high chance of approval by January 10.

What everyone thinks about ETFs?

Read here: As the Spot Bitcoin ETF Anticipation Grows: What people say?

TTD Surfer 🏄

Ripple has received approval from the Central Bank of Ireland to be listed on its Virtual Asset Service Providers Register.

A US appeals court has finalised the mandate for the forfeiture of 69,370 crypto connected to the Silk Road dark web market.

A judge has denied a request from lawyers representing Sam Bankman-Fried, former CEO of FTX, to delay his sentencing.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋