Inside FBI's NexFundAI 🚨

When law enforcement creates its own token to catch the bad guys, you know crypto has entered a new era. FBI's NexFundAI sting operation reveals sophisticated market manipulation tactics.

Hello, y'all. Winding up the last Sunday of Uptober? What’s that. October didn’t play out as expected. Happy Sunday anyway.

FOMO about missing out on Coldplay live? Play Muzify quiz to score the concert ticket👇

The Federal Bureau of Investigation (FBI) releasing a crypto token was never our 2024 bingo card.

We're in an era where the FBI is deploying tokens to catch criminals.

And not just any token - a fully functioning, seemingly legitimate crypto project that managed to expose an entire network of market manipulators.

Welcome to NexFundAI, the trap token that changed the game.

Instead of trying to chase down crypto fraudsters after the fact, they built what amounted to a digital honeypot: a token so tempting that market manipulators couldn't resist showing their hand.

The Birth of a Trap Token In May 2024, the FBI quietly launched an Ethereum-based token called NexFundAI.

NexFundAI looked perfect on paper

Professional website with detailed whitepaper

Clear tokenomics and development roadmap

Active GitHub repository

Engaging social media presence

"Doxxed" team (all FBI agents in disguise)

Integration of AI and blockchain (the holy grail)

But there was one catch - it was all a setup.

Part of Operation Token Mirrors, this was the FBI's most sophisticated crypto sting yet.

The goal? Catch the puppet masters behind pump-and-dump schemes.

And they took the bait. Hook, line, and sinker.

Inside the Operation By July 2024

Arrests

18 individuals across multiple countries

Key executives from major market-making firms

Several prominent crypto influencers

Companies implicated

Gotbit Consulting

ZM Quant Investment

CLS Global

MyTrade MM

Damage

Over $25 million in assets seized

Evidence of manipulation across 60+ tokens

Multiple bank accounts frozen

Servers confiscated in three countries

Not bad for a "fake" token, eh? Acting United States Attorney Joshua Levy explains.

“This investigation, the first of its kind, identified numerous fraudsters in the cryptocurrency industry. Wash trading has long been outlawed in the financial markets, and cryptocurrency is no exception.

These are cases where an innovative technology – cryptocurrency – met a century old scheme – the pump and dump.

The message today is, if you make false statements to trick investors, that’s fraud. Period. Our Office will aggressively pursue fraud, including in the cryptocurrency industry.

These charges are also a stark reminder of how vigilant online investors must be and that doing your homework before diving into the digital frontier is critical.

People considering making investments in the cryptocurrency industry should understand how these scams work so that they can protect themselves.”

How did NexFundAI work?

How do you catch a wash trader? Simple. You let them wash trade.

NexFundAI was designed as the perfect bait. It looked legitimate enough to attract serious players but was new enough that manipulators thought they could control its market.

The FBI essentially created a playground for fraudsters, complete with monitoring equipment.

What they discovered was sobering.

Coordinated wash trading to create false impressions of liquidity

Deliberate price manipulation through timed trades

Complex networks of shell companies and fake accounts

Market makers offering "guaranteed" price pumps

One particularly interesting catch?

A wallet that had previously manipulated SAITAMA token.

Initial investment: $7,300

Sold for: $8.85 million

Total profit: $11 million

Same wallet later interacted with NexFundAI.

The Home for All the Music Lovers

Muzify - With close to 2 million plays, is more than just a platform.

It's a journey into the world of music.

It provides an interactive experience through quizzes and exploration tools. For artists it’s a powerful tool for artists to connect with their fans.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to fans, fostering a sense of connection that goes beyond mere listening.

The Evolution of Crypto Stings

The FBI has come a long way from its Silk Road days.

2013: Silk Road Takedown

Overview: Silk Road was a major dark web marketplace using Bitcoin for illegal transactions.

FBI Actions: In October 2013, the FBI shut down Silk Road, arresting founder Ross Ulbricht and seizing over 144,000 bitcoins.

Techniques: The FBI utilised basic blockchain monitoring to trace Bitcoin transactions, while physical surveillance remained crucial.

2017: Operation Bayonet

Objective: Targeted AlphaBay, another significant dark web marketplace.

Collaboration: The FBI worked with international law enforcement to dismantle AlphaBay, resulting in substantial seizures and arrests.

2018: Operation Cryptosweep

Multi-agency Effort: Involved over 40 jurisdictions in the U.S. and Canada.

Scope: Investigated over 200 fraudulent ICOs, leading to 35 enforcement actions.

Recovery: Successfully recovered millions in stolen funds, raising awareness of ICO risks.

2020: Operation Disruption

Focus: Disrupted various darknet markets through coordinated international efforts.

Results: Led to numerous arrests and significant seizures of illegal goods.

2024: Operation Token Mirrors

Innovative Tactics: Introduced trap tokens to catch fraudsters in real-time.

Advanced Monitoring: Employed real-time blockchain surveillance and AI for pattern detection.

Global Coordination: Enhanced cross-border collaboration for more effective investigations.

Think about it - law enforcement is now using the very tools of crypto criminals against them.

Meanwhile the US Treasury has been taking the help of AI

Recovered $4 billion in fraud and improper payments in the 2024 fiscal year using AI technology.

NexFundAI's timing couldn't have been better.

2024: The year of the hack?

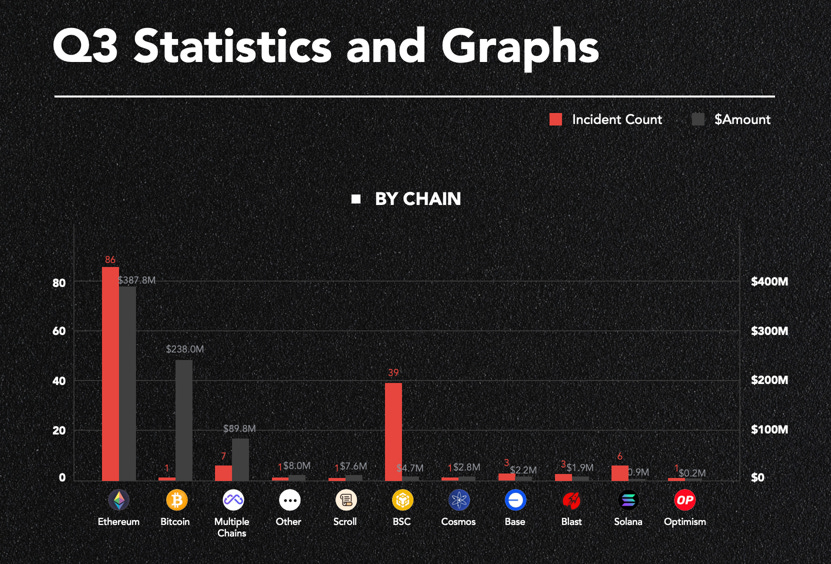

Q3 2024 Stats (CertiK)

Total Losses: $753 million

Incidents: 155 confirmed cases

Network Breakdown

Ethereum: 86 hacks ($387M)

BNB Chain: 42 hacks

Other chains: 27 hacks

Major Q3 Incidents

Bitcoin Whale Hack: 4,064 BTC ($238M)

WazirX Exchange Breach: $235M

Multiple DeFi protocol exploits

Total 2024 losses so far? Nearly $2 billion.

Cyvers reports an even grimmer picture

Yearly totals (Cyvers report)

Total 2024 Losses: $2.1B

CeFi Attacks: Up 984% YoY

DeFi Losses: Down 25% YoY but still vulnerable

Attack types

Phishing: $343M (65 incidents)

Private Key Compromises: $324M (10 incidents)

Smart Contract Exploits: $380.4M (79 incidents)

The FBI's strategy was brilliant in its simplicity

Create perfect bait

Use trendy AI narrative

Show promising early growth

Demonstrate "organic" trading

Monitor everything

Track every wallet interaction

Record all communications

Document manipulation attempts

Build evidence

Collect real-time proof

Track money flows

Map connection networks

Spring the trap

Coordinate international arrests

Seize assets simultaneously

Preserve digital evidence

How to spot a trap token

Whether it's FBI or fraudsters, here's what to watch for.

🚩 Sudden price spikes without reason

🚩 Low liquidity + high volumes

🚩 Suspicious trading patterns

🚩 Hidden team members

🚩 Unrealistic promises

The 100 years old mantra: If it looks too good to be true, it probably is.

Token Dispatch view

NexFundAI marks a watershed moment in crypto enforcement.

This sets a new precedent for law enforcement tactics in crypto

Market manipulators will think twice before their next scheme

We'll likely see more sophisticated sting operations

The line between legitimate and trap tokens gets blurrier

Investors need better tools to verify token legitimacy

The FBI creating its own token might seem wild, but in a space where scammers keep innovating, maybe it's exactly what we needed.

Just remember - the next hot token you're eyeing might be another trap.

And not all of them will be run by the good guys.

Week That Was 📆

Friday: Solana Going Brrr ... 🚀

Thursday: Self-custody Wins 😋

Wednesday: Can Polls Trigger Crypto Regulations? 🤔

Tuesday: If Trump Wins ...🗳️

Monday: Stable and Stronger💪🏽

If you want to make a splash with us, check out partnership opportunities 🤟

Our sponsorship storefront on Passionfroot 🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

Crypto stings have evolved from simple undercover buys to creating whole fake ecosystems. This proves the FBI can adapt, but it also underscores the need for regulation and verification standards across the industry. Imagine a verification badge system for crypto projects, similar to social media—might help cut down on these scams.

Impressive work from the FBI, honestly. But it raises questions too. If law enforcement can create convincing 'fake' tokens, what happens when bad actors do the same, but with no consequences? Now, more than ever, due diligence is crucial for investors who want to avoid getting caught up in the next trap token.