Institutional Crypto Moves Big Bucks 💸

Happy Tuesday, Bag Holders! Welcome to the inaugural edition of Money Bags.

Your weekly crypto cash flow tracker that cuts through the noise to show you where the real money is moving every Tuesday. We're tracking the raises, the deals, and the moves that actually matter in the wild world of crypto venture capital.

Let's dive into where the money flowed this week.

All the Web3 Funding Data You Need

Don’t raise funds in the dark — know who’s investing and who’s deploying in Web3. Get clarity with Decentralised.co’s all-in-one Funding Tracker.

Here’s a note on how to use the tracker.

If you are a founder, reach out to us at venture@decentralised.co

Bag Check: Raise of the Week 🧳

From gambling affiliate to Ethereum treasury pioneer in one week flat.

SharpLink Gaming secured $425 million through a private placement that sent $SBET shares from ~$4 to $124 (then back to $55, because crypto) — all in 10 days. The affiliate marketing company last week became the latest publicly traded firm to pivot hard into digital assets, positioning itself as the largest publicly traded holder of Ethereum.

Big news? Joseph Lubin, Ethereum co-founder and Consensys CEO, is now chairman of SharpLink's board.

Investors: Consensys led the round, joined by Galaxy Digital, Pantera Capital, Electric Capital, ParaFi Capital and other crypto heavyweights

Why this deal: SharpLink just proved that ETH is not forgotten in the race of corporates rushing to add Bitcoin to their balance sheets. The gambling affiliate plans to use the funds to add Ethereum to its treasury.

The catch: Float situation is the context. Martin Shkreli pointed out that only 2 million shares are actually tradable right now, despite 69 million new shares being issued. Most of them are locked up pending SEC registration. Massive demand chasing very few shares — explaining both the rally and the inevitable crash.

Possibly the reason for the dump post the pump in its share price?

SBET is still up more than 1,000% this month.

Whether this is genius or madness depends on where ETH goes next. What’s clear is that the fastest way to transform your public company in 2025 isn't innovative products; it's announcing you're buying crypto with the right co-founder backing you.

Got questions about a hot crypto topic that you want help understanding? Ask your question using the form and our crypto experts may answer it along with your name in the next Thursday’s News Rollups.

VC Corner 🧠

AI Vs Crypto: The GTM Reality

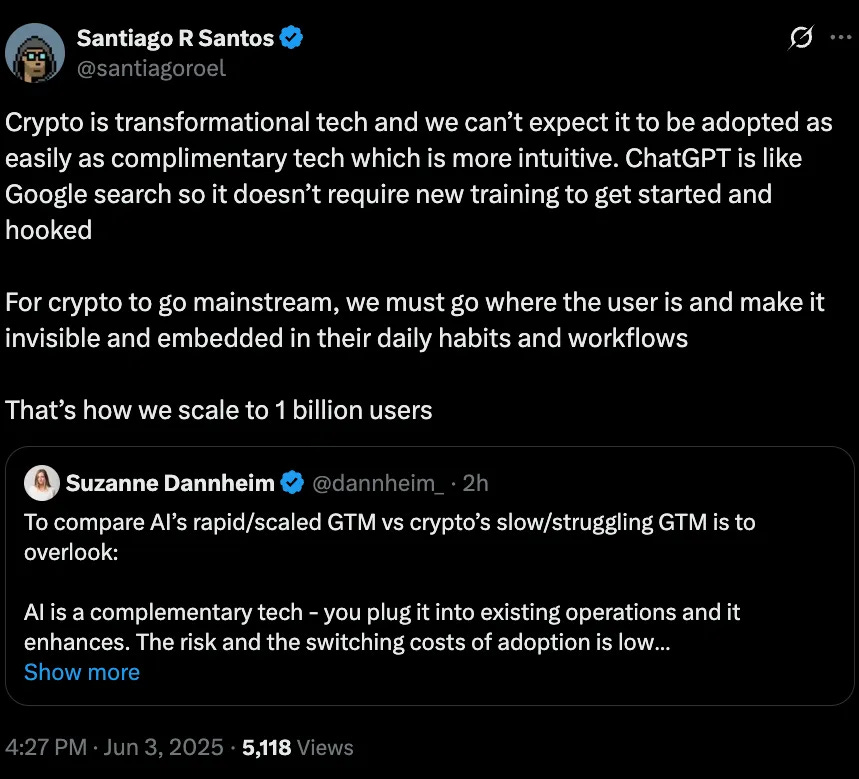

Why does it feel like the AI growth engine has shot up in no time while crypto still struggles for adoption? Suzanne Dannheim, Chief Operating Officer at Inversion Capital, has an answer.

AI plugs into existing operations, crypto requires ripping them out entirely.

No traditional CEO wants to bet their company on decentralised infrastructure without case studies. The switching costs are massive, the risks are real, and there's zero proof it works at scale. That's why the Stripe-Bridge acquisition matters so much: it could be the first real validation story.

Inversion founder Santiago Santos agrees: “We must go where the user is and make it invisible."

Stop trying to educate users about crypto's benefits and start embedding it seamlessly into existing workflows.

The funding thesis: VCs are backing the infrastructure that makes crypto disappear — payments rails (Conduit) and embedded wallets (Web3Auth).

The billion-user moment won't come from better UX alone, but from making blockchain so seamless users don't know they're using it.

Bag Breakdown 💰

Here are the other top deals of the week in the Web 3.0 ecosystem.

1. Conduit

$36 million – Series A

Investors: Co-led by Dragonfly and Altos Ventures, with Sound Ventures, Commerce Ventures, DCG, Circle Ventures, and existing backers Helios and Portage.

Purpose: Scaling stablecoin-powered cross-border payment infrastructure across Latin America, Africa, and Asia. The company hit $10 billion in annualised volume and plans to launch in five new Asian countries.

2. Donut Labs

$7 million – Pre-Seed

Investors: Led by Hongshan (formerly Sequoia CN), BITKRAFT, and HackVC, with participation from Solana and crypto ecosystem angels.

Purpose: Building the world's first "agentic" crypto browser on Solana. Donut envisions AI agents executing transactions, discovering tokens, and placing bets directly in your browser while you surf the decentralised web.

3. Rumi Labs

$4.7 million – Pre-Seed

Investors: Co-led by a16z crypto CSX and EV3 Ventures, with angels from Virtuals.io, ElizaOS, Solana, Monad, Polygon, and Omni Network.

Purpose: Transforming passive media consumption into AI-powered interactive experiences. Users earn while watching Netflix by running AI analytics on their devices; basically turning your binge sessions into a decentralised data goldmine.

Get 17% discount on our annual plans and access our weekly premium features (Mempool, Game On, News Rollups, HashedIn, Wormhole and Rabbit hole) and subscribers only posts. Also, show us some love on Twitter and Telegram.

In the Numbers 🔢

29.7%

That’s how much fund flow into ‘Web 3.0 Payments’ sector has grown in May 2025.

“Crypto VC’s have their eye peeled on - #Payments,” Pivot, a Web 3.0-focused global venture accelerator firm wrote in its recent report.

VCs’s bet reinforces the role of real-time payments, stablecoin rails, and tokenised assets in defining the future of how money moves globally.

Shopping Spree 🛍️

1. Robinhood

$200 million – Acquisition of Bitstamp

Why: The world's longest-running crypto exchange brings 50+ licenses, 5,000 institutional clients, and a footprint across Europe, UK, and Asia. Robinhood's crypto revenue hit $252M in Q1 alone—they're not slowing down.

2. Consensys

Undisclosed – Acquisition of Web3Auth

Why: MetaMask's 250 million users are about to get a UX upgrade. Web3Auth's social login tech eliminates seed phrase headaches (35% of users don't back theirs up anyway). Plus faster Bitcoin and Solana support coming Q3.

3. FalconX

Undisclosed – Majority stake in Monarq Asset Management

Why: The $1.5 trillion trading volume prime broker is hunting institutional clients beyond hedge funds. Monarq (formerly FTX's LedgerPrime) comes with quantitative models and a team ready to scale - minus the bankruptcy baggage.

Surfer Deals 🏄🏽♂️

BlockSpaces, a Bitcoin-native infrastructure company, raised $2 million from Axiom, Leadout Capital, Sand Harbor Capital, Lisa Hough, and Bob Burnett. The funding will support the launch of its ARCC platform for institutional Bitcoin collateral and risk management.

Oncade, a platform empowering game studios with community-driven distribution, raised $4 million from a16z Crypto and CSX. The funding will help Oncade boost sales and engagement for game creators.

Naoris Protocol, a quantum-resistant blockchain and cybersecurity mesh company, raised $3 million from Mason Labs, Frekaz Group, Level One Robotics, and Tradecraft Capital. The funding will help secure blockchain infrastructure against quantum threats.

Alph.AI, a decentralised meme coin trading platform, raised $2 million from Bitrue. The funding will support its AI-powered analytics and secure MPC wallet tools for retail traders.

Neutral Trade, a quant strategies platform for traders, raised $2 million from investors including Ergonia Trading. The funding will accelerate development of on-chain hedge fund-grade strategies and structured DeFi products.

Token Dispatch View 🔎

Institutional crypto is having its moment as the money is flowing in ways that would have seemed impossible just a year ago.

SharpLink's $425 million Ethereum treasury raise is more than a corporate pivot; it's institutional validation that ETH deserves a seat at the treasury table alongside Bitcoin (and Solana).

When Ethereum's co-founder becomes chairman of a publicly traded company specifically to build an ETH treasury, that speaks of conviction from the powers that be.

Meanwhile, the merger & acquisition (M&A) spree reflects how crypto firms are approaching the buy-vs-build dilemma.

Robinhood dropping $200 million on Bitstamp for global reach; Consensys acquiring Web3Auth to fix MetaMask's biggest UX problem; FalconX buying Monarq to expand beyond hedge funds — this shows institutions buying their way into crypto infrastructure rather than waiting for organic adoption.

The VC conversations give us a hint of the strategy being discussed in their board rooms: stop trying to educate traditional finance about crypto's benefits and start embedding crypto so seamlessly into existing workflows that institutions use it without thinking about it.

Conduit's cross-border payments, embedded wallet solutions, and invisible blockchain experiences are all precisely looking to achieve this: make crypto institutional-grade by making it invisible.

The biggest signal is that institutional crypto is evolving quickly, and in ways few expected it to.

📬 Tell Us What You’re Building

Raised funds? Got a spicy deck? Want to collaborate on telling the story of what you’ve been building? 📝 Drop it at: team@thetokendispatch.com

That's it for this week's Money Bags.

See ya, next Tuesday.

Until then … stay curious.

Don't forget to whitelist thetokendispatch+money-bags@substack.com to ensure you’ve got me each week in your primary inbox.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.