Hello,

For the longest time, crypto functioned much like tribes, built around chain maximalism. You picked one, learned its tools and apps, mingled with its community, followed its conference circuit, and rarely ventured far outside of that bubble.

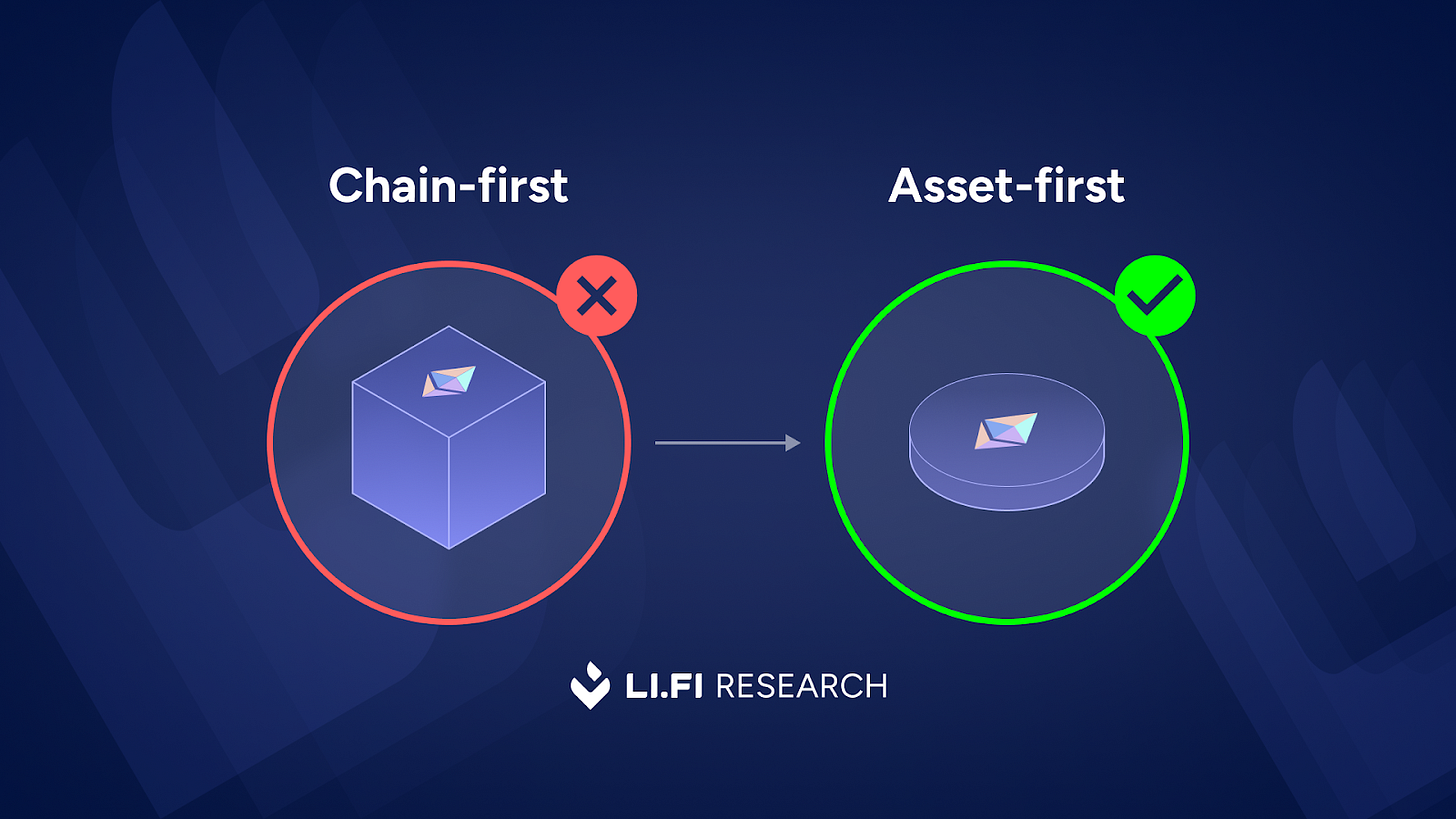

That initial choice was shaped by whatever pulled you into crypto in the first place. Since the early decentralised finance (DeFi) grew on Ethereum, many early adopters ended up there. Later, the NFT hype and memecoin cycles drew new users into a different ecosystem, Solana. The result was a chain-first onboarding model: once you landed on a chain, you typically stayed there.

For most users, crypto felt like a collection of separate worlds, and you only interacted with one at a time. That mental model is now breaking down.

Today, crypto is increasingly experienced as a single market, not as a collection of chains. Activity is spread across many thriving ecosystems at once. Capital moves to where yields are highest, and assets are purchased where liquidity is deepest. Users no longer choose chains. They choose actions, and they care about results. They want to swap, earn, send, or pay, and they care about what those actions produce: profit, yield, or a transfer of money.

As a result, the dominant user model has shifted. Crypto is no longer chain-first. It’s asset-first. And wherever the asset is, users now expect to be able to go.

This new asset-first economy only works because interoperability (often shortened to interop) enables value to move freely across chains.

What is interoperability?

Interoperability connects the entire crypto ecosystem and makes it feel usable as a whole. Without it, every blockchain would be its own walled garden.

As defined in the State of Interop (2026):

“Interoperability is the ability for value, state, and intent to move seamlessly across independent blockchains. It is what allows composability to operate at scale in crypto, enabling coordination across otherwise separate ecosystems. For users, interoperability compresses a multi-chain ecosystem into a single, interconnected mental model of using crypto as a whole.”

A helpful way to think about this is to treat each chain as its own financial backend. They don’t naturally talk to one another. Assets, liquidity, and applications live in separate environments, each with different rules, costs, and trade-offs.

Interoperability is the layer that connects these backends.

If that sounds abstract, traditional finance offers a familiar parallel. Banks don’t natively interoperate either. What makes the global financial system usable isn’t the existence of one giant bank; rather, it’s the shared rails like Visa, SWIFT, and ACH that sit on top and move money between them. When you send money, you don’t think about which banks’ systems are involved. You just expect it to work.

Crypto is undergoing the same transition. Interoperability enables chains to feel less like isolated networks and more like a single financial system. It’s what lets users swap assets, chase yield, or move capital across chains without having to start from scratch each time.

For a long time, this was mostly theoretical. The tools existed, but the users weren’t ready. That has changed.

Users are already living multi-chain

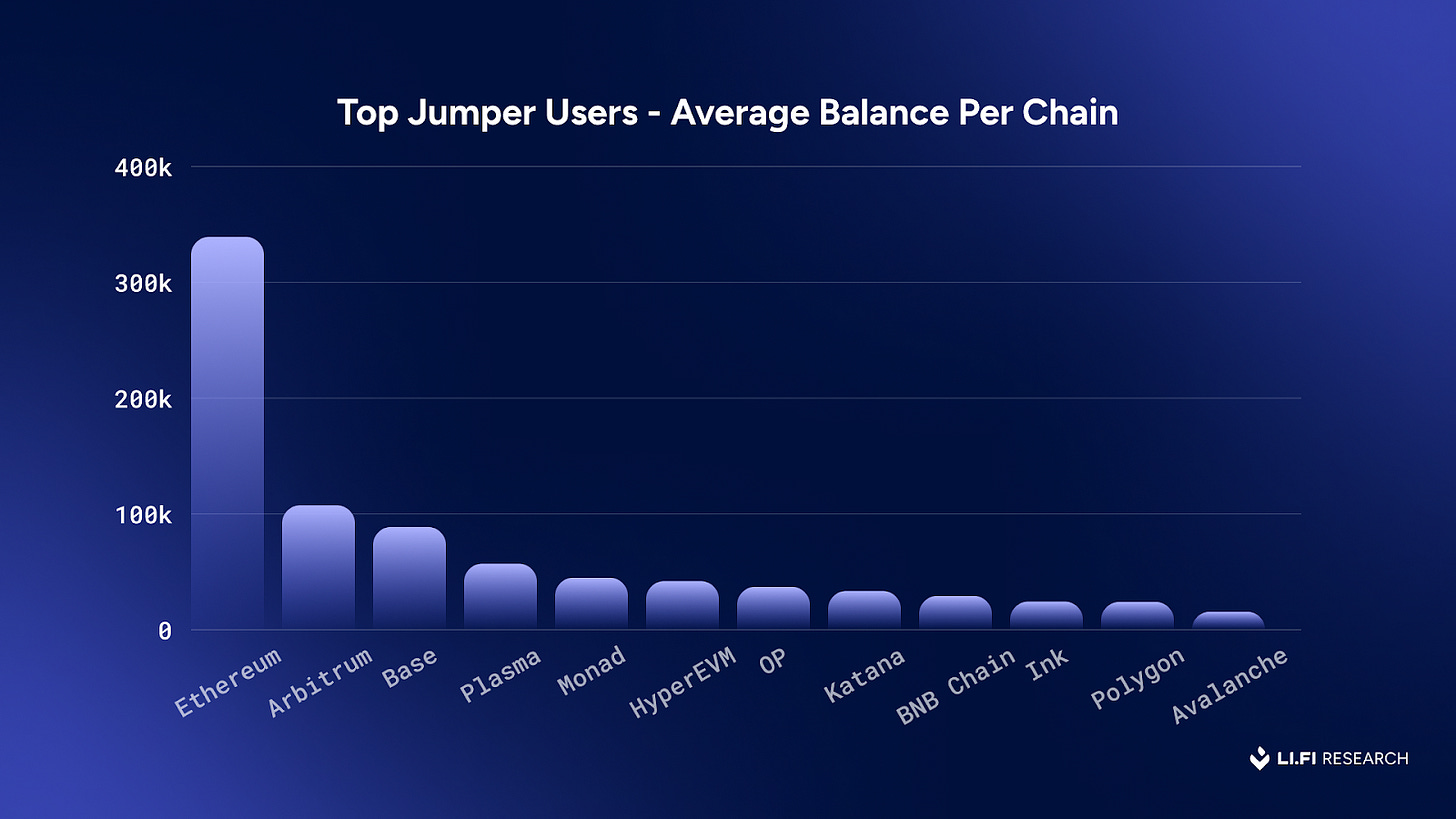

Today, active crypto users routinely hold assets across multiple chains. While many still have a “home” chain (often Ethereum, especially among high-net-worth users), their on-chain behaviour shows that they are natively multi-chain. Capital moves based on risk, cost, and opportunity, not loyalty to a single chain.

Data from high-activity cross-chain users of Jumper, a multi-chain swapping and bridging exchange, illustrates this shift. Most users distribute their funds across several chains. They tend to park the majority of their capital on one or two primary networks, then move smaller amounts elsewhere when the market presents an opportunity.

This reflects how crypto is actually used today.

Users keep their capital where they feel most comfortable. When a new opportunity emerges, like a better yield, a new app, or a fresh narrative to speculate on, they use interoperability rails like bridges to move funds to wherever that activity is happening.

As a result, the act of ‘bridging’ funds, i.e., moving capital from one chain to another, has become a routine part of participating in crypto, and cross-chain volume is up 100x since 2022. Bridges tend to see their highest activity during these surges, as users move funds to whichever chain is the latest hotbed of speculation and attention.

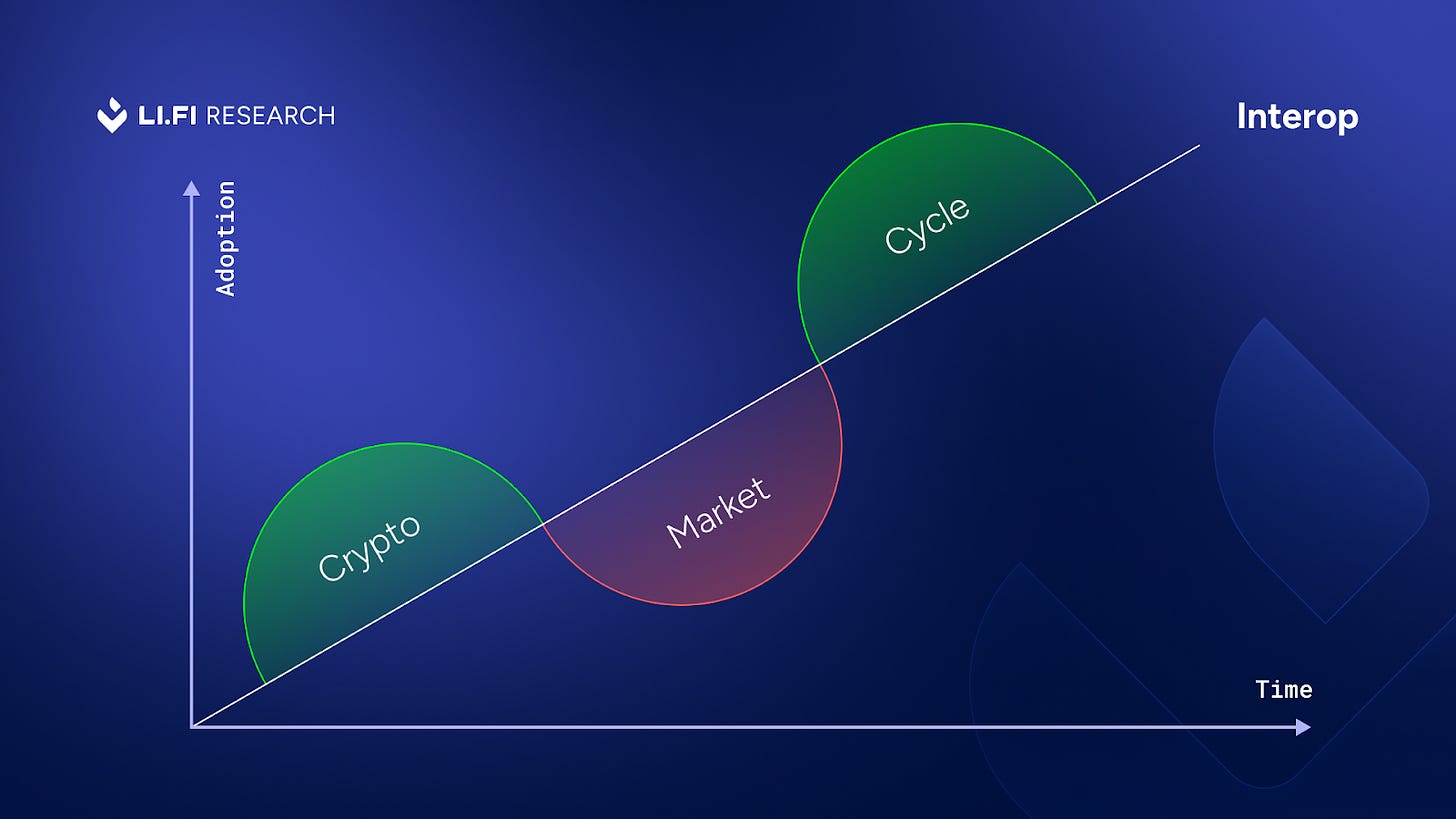

Three things happening at once are amplifying the importance of interoperability:

First, users are accepting the multi-chain reality of crypto. Liquidity can never be confined to one corner of a global market. It will go where it gets the most bang for its buck, and the average user no longer expects everything to happen on one chain.

Second, chains are being launched at an unprecedented rate. 2025 saw one of the broadest waves of chain launches in the industry’s history. This includes crypto native ecosystems and chains run by fintech companies like Stripe. The surface area of crypto has expanded dramatically.

Lastly, tokenisation is accelerating rapidly. From equities and treasuries to private credit and real-world assets, everything is coming on-chain. At the same time, regulatory clarity, most notably through the GENIUS bill, has unlocked a wave of stablecoin issuance.

This is the reality of crypto today, and interoperability sits at the centre of all three shifts.

For users, interoperability is how crypto is used. Bridges are the primary way users move, trade, and express intent across chains.

For chains, interoperability is economic infrastructure. Without bridge connectivity, chains cannot attract external capital or onboard users at scale. A chain without interoperability (interop) is like a country without trade routes - isolated, constrained, and irrelevant in a global market.

For asset issuers, interoperability is a distribution requirement. Issuers no longer want to launch assets on a single chain; they want assets to be everywhere. That means availability across markets, chains, and liquidity venues. Doing so efficiently and at scale is only possible via interoperable rails.

Taken together, these indicate that interop is the layer through which crypto now expands. As users, chains, and assets multiply, interop becomes the mechanism that keeps the market liquid. Interop is crypto. Interop is inevitable.

State of Interop in 2026

Now that we’ve established that interoperability matters, what does the interop market actually look like?

It’s entering the phase that every infrastructure category eventually reaches: consolidation.

You see this pattern everywhere in finance and technology. In the early days of a category, value is spread thin. Many players coexist. Differentiation is weak. Growth comes less from being the best and more from being early.

Think back to the early days of fintech. Before Stripe emerged as the default payments layer, there were dozens of payment gateways. Before Plaid, every bank integration was custom. Before Bloomberg consolidated financial data, traders stitched information together from multiple terminals and feeds.

Interoperability followed the same arc. As blockchains proliferated, barely any interop protocol saw traction. That phase is now over.

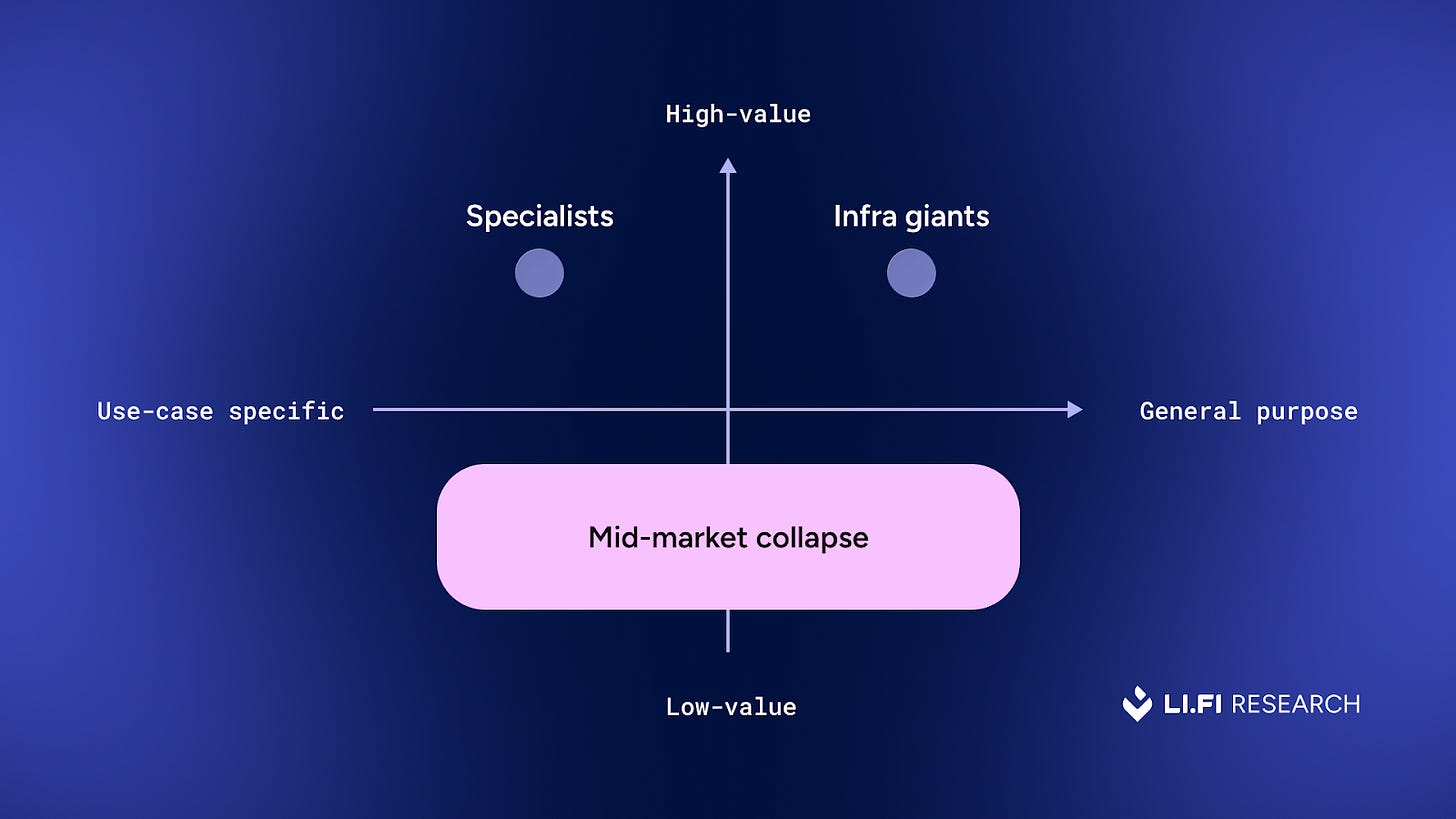

As categories mature, value stops accumulating in the middle. It concentrates on the edges. You either become exceptional at one specific job or you operate at a scale that makes you unavoidable. Everything in between gets squeezed.

In practical terms, this means two things:

Users gravitate toward the best possible solution for a specific job.

Developers default to infrastructure that’s proven, reliable, and widely adopted.

Interop today is a textbook example of this dynamic.

On one end are the specialists. These teams focus obsessively on a single outcome and optimise everything around it. They don’t try to be platforms. They aim to win one job.

Think Stripe, which started with payments APIs; Wise which focuses narrowly on cross-border FX or Robinhood, which makes trading simple and cheap. In interop, intent-based bridges fall into this category. Teams like Relay and Gas.zip realised most users just want fast, cheap cross-chain swaps, so they built for speed and low cost, and nothing else.

At the other end are the infrastructure giants. These are generalised platforms with real distribution, deep integrations, and network effects.

Think SWIFT in banking, Visa in payments, or AWS in cloud computing. In interop, large platforms that power many apps, wallets, and chains sit here. This includes the likes of LI.FI, LayerZero, and Wormhole.

Once a team proves it can operate reliably at scale, the market gives it permission to expand into adjacent products. This is happening in interop, with teams expanding into new product offerings like swaps and yield aggregation.

What struggles is the middle.

Projects that are neither sharply focused nor widely adopted end up in a dangerous no-man’s land. They’re too generic to dominate a niche but too small to be foundational infrastructure. They move slower than specialists and lack the distribution of platforms.

This is where consolidation happens. Some teams pivot. Some shut down. Others are acquired for talent or technology, like Circle’s acquisition of Interop Labs’ team and IP.

Interop in 2026 is no longer about being “good enough.” As with every mature market, specialisation and scale are where value now accrues.

Where We’re Headed

If you step back, the shift is obvious.

Crypto now asks you what you want to achieve, irrespective of where you are.

Users don’t need to be conscious of which chain they are on. They act: swap, earn yield, send money, and get exposure to an asset, irrespective of the chain they reside on.

And increasingly, those actions just happen, even when they span multiple chains underneath.

This is the new reality of crypto. Chains still exist, but mostly as infrastructure. To the user, crypto is starting to feel like a single, global system of markets and money.

However, this still requires the users to know which interoperability tools to use and how to use them.

This is where the next step comes in: everything will soon be embedded in app buttons, and things will just work.

Today, interoperability helps you move between chains. Soon, it will help you act across them - automatically, atomically, and in one seamless flow. Swapping, lending, rebalancing, paying, issuing assets, coordinating agents, all with a single click, even if ten different chains are involved.

This is what an asset-first, action-first crypto experience looks like.

For the reader, the implication is that on-chain capabilities are increasing rapidly. Things that once required planning, bridging, and manual coordination are collapsing into single decisions and single clicks.

All to say:

The chain-first era is behind us.

The action-first era is arriving.

And interoperability is what makes it inevitable.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: The author, Arjun Chand, is the head of narrative at LI.FI, a bridging and DEX aggregation protocol. The views expressed in this article belong to the author and not Token Dispatch.