Jeff Yan has a chameleon obsession.

Though not the changing-colours-to-blend-in kind of obsession. He means the actual animal. His Twitter handle is @chameleon_jeff, and in a recent podcast, he explained his fascination: chameleons can independently move their eyes in different directions, have "two claws forward and three claws back, which shows a very interesting evolutionary trajectory," and wield a powerful tongue mechanism. "They're kind of like aliens on Earth," he said.

It's a weird detail to lead with, but it tells you so much about the guy who recently built one of the world's largest trading platforms with just ten people and zero venture capital.

Over the past twelve months, Hyperliquid has processed $1.8 trillion in trading volume. The platform captures over 10% of global perpetual futures trading and processes over 70% of DEX perpetual volume. Its total value has grown to nearly $2 billion. Over 200,000 active users trade on the platform daily, generating hundreds of millions in revenue.

Jeff Yan didn't set out to build one of the world's largest decentralised exchanges. Yet in less than two years, that's exactly what he's done. Jeff saw problems that others missed and fixed them.

Cross-Chain isn’t a Feature. It’s the Future.

But most cross-chain experiences today are broken—full of sketchy bridges, hacks, and half-baked wrappers.

t3rn fixes that with a completely new approach: atomic, reversible, and trustless execution across chains.

That means:

You can call a smart contract on Ethereum that settles on Polkadot.

You can build apps that operate across multiple chains natively.

And if any part of the process fails, the entire transaction rolls back—automatically.

No more bridging tokens. No more piecing together flows. Just clean, composable interoperability built into your contracts.

This isn’t a workaround. It’s how cross-chain was supposed to work from the start.

The Making of a Systems Thinker

Jeff Yan's path to crypto began in Palo Alto, California, where he grew up in the heart of Silicon Valley. Unlike many of his peers, who gravitated towards building consumer internet companies, Jeff was drawn to the intersection of mathematics, physics, and complex systems.

Back in 2013, while most high schoolers were busy figuring out prom dates, Jeff was representing the US at the International Physics Olympiad and bringing home gold medals. This is something that gets you into any university you want and likely lands you a few job offers before graduating.

So naturally, he went to Harvard for math and computer science, then immediately joined Hudson River Trading, one of those ultra-secretive high-frequency trading firms where people make millions by simply being a few microseconds faster than everyone else.

"I learned a lot about markets and thinking about them rigorously," Jeff says. At HRT, Jeff worked on complex problems that blended engineering and mathematics. He learned how to build low-latency systems that could execute thousands of trades per second. He understood how market makers provide liquidity and how different types of trading flows could either make or break market efficiency.

After a few years at HRT, he left to explore crypto because he sensed an opportunity.

In 2018, he'd tried building a Layer 2 prediction market platform, even raised some funding, moved to San Francisco, and assembled a team. That venture didn't work out; regulatory uncertainties and lack of user adoption killed it. But it gave Jeff valuable lessons about what crypto users actually wanted.

Between 2018 and 2022, after Jeff Yan's prediction market platform didn't work out, he shifted his focus back to trading. He started by trading crypto as a side project and quickly noticed major inefficiencies in the market. Recognising the opportunity, he scaled up his activities and by early 2020, founded Chameleon Trading, a crypto market-making firm. Chameleon Trading rapidly grew to become one of the largest market makers on centralised crypto exchanges during the bull run, operating throughout this period and cementing Jeff's reputation in quantitative trading.

Then FTX happened.

When Sam Bankman-Fried's empire collapsed in November 2022, it marked the collapse of an exchange once seen as the future of crypto. Remember the FTX arena deal worth $135 million? They had celebrity endorsements like Tom Brady, Larry David, and more.

"We saw the problems with FTX firsthand," Jeff remembers. "People realised that crypto is all fun and games until something bad happens."

Jeff watched billions of dollars disappear overnight because users had trusted a centralised platform with their money. Most people would have taken this as a warning to stay away from crypto. Jeff saw it as a challenge.

Building a Rocket Ship in a Garage

The obvious solution was to build a decentralised exchange that could compete with its big centralised counterparts. Simple idea. Almost impossible to execute.

Every blockchain Jeff looked at had problems. Ethereum was too slow. Layer 2 solutions added latency. Solana was relatively faster, but still not fast enough for serious trading. Every option required compromises that would make the exchange worse than what it was.

So Jeff did what any reasonable person would do. Out of the necessity of what the user experience demanded, he decided to build his own blockchain from scratch.

The result was Hyperliquid—a blockchain specifically designed for trading, capable of processing 200,000 transactions per second with near-instant finality. Users could leverage up to 125x on over 145 different markets while keeping their money in their wallets.

This is where most startup stories pivot to raising $50 million from top-tier VCs and scaling up with hundreds of engineers. Jeff's approach, though, was different. He funded developments through profits from his trading firm and kept the team lean, with just ten people.

"We [were] bootstrapped," he says. "We didn't need to raise, so the decision was easy."

Jeff believed that having venture capitalists own a large stake in a decentralised network would be "a scar on the network" and compromise its long-term development.

This bootstrap approach allowed Jeff to focus entirely on building a product that users loved rather than pandering to investor expectations. It also enabled one of Hyperliquid's most innovative features: when the platform launched its HYPE token in November 2024, 31% of the supply went directly to users based on their trading activity. This was one of the largest user-focused distributions in crypto. The remaining tokens were allocated to future community rewards (38.88%), core contributors (23.8%), the Hyper Foundation (6%), community grants (0.3%), and a small allocation for a protocol upgrade (0.012%)

This approach to token distribution was only possible because Jeff hadn't sold equity to venture capitalists who would have demanded their own allocation before anything else. By staying independent, he could prioritise community ownership over investor returns.

When Hyperliquid launched in 2023, there were no press releases, no influencer partnerships and no billboards in Times Square. Jeff just opened the doors and waited to see what would happen.

What happened was explosive growth that caught everyone off guard. Within 100 days, daily trading volume hit $1 billion. By mid-2025, monthly volume reached $2.48 trillion, putting Hyperliquid in the same league as Binance and Coinbase.

Hyperliquid went from zero to over 545,000 users in just two years.

"We have zero marketing department," Jeff admits. "I think that community does an amazing job—better than the marketing departments of all these centralised exchanges."

This wasn't luck. Jeff designed the entire platform around aligning incentives with users instead of extracting value from them.

Read: Hyper Liquid

It was such a radical approach that other exchanges probably couldn't copy it even if they wanted to. When you've already raised hundreds of millions from VCs, you can't exactly give away most of your tokens to users.

The Ecosystem

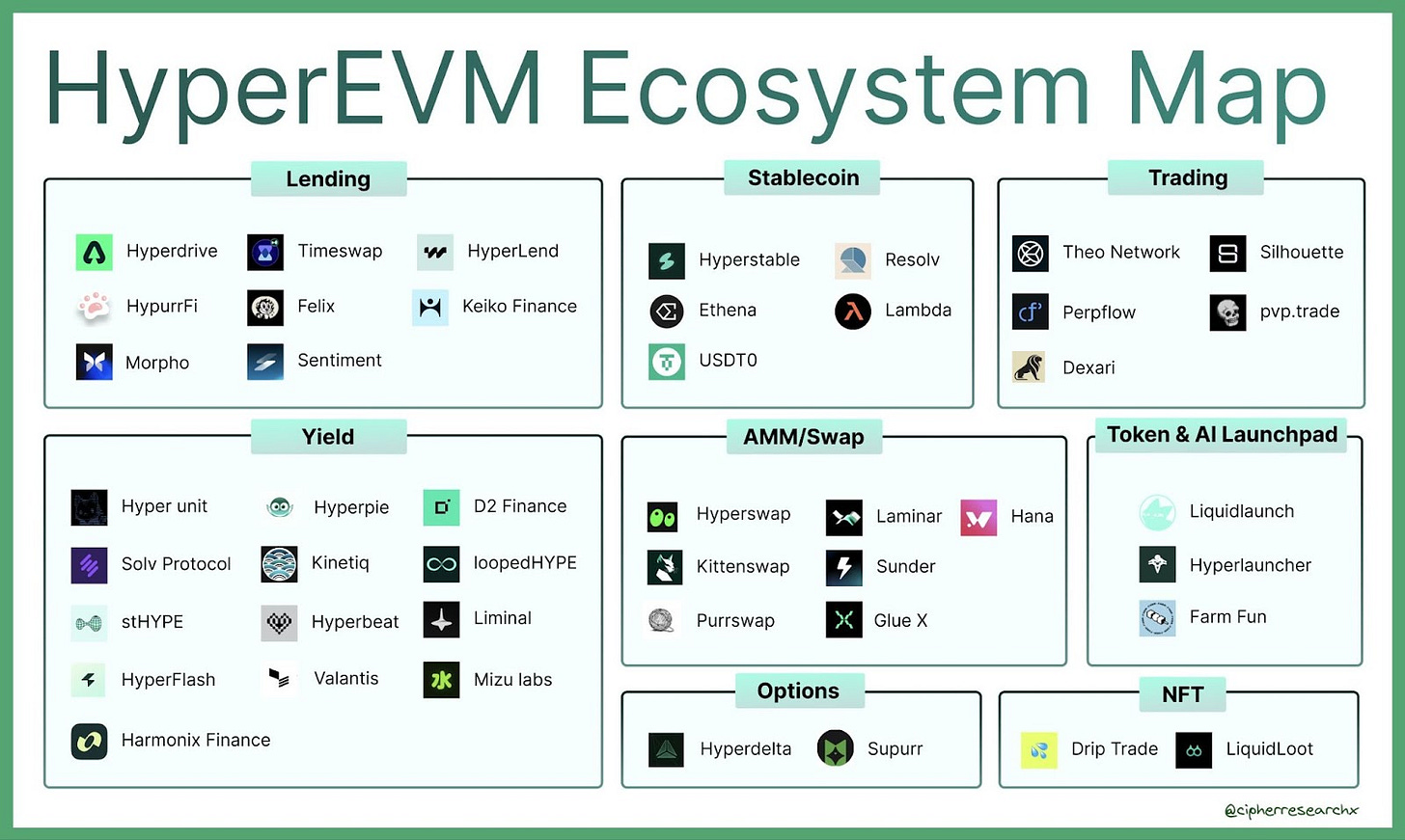

While Hyperliquid began as a perpetual futures exchange, Jeff's vision always extended beyond simple trading. In early 2025, the platform launched HyperEVM, an Ethereum-compatible virtual machine that allows developers to build financial applications directly on Hyperliquid's blockchain.

The ecosystem growth has been rapid. Felix, a collateralised debt position protocol, now manages over $400 million in assets. HyperLend, a lending protocol, handles another $380 million. According to Jeff, the ultimate vision is for all of finance to take place on a single platform.

The problem Jeff identified is common across all crypto exchanges: sophisticated high-frequency traders use bots to quickly buy or sell right after market makers post their prices, and before they can update their quotes when prices move. As a result, market makers are forced to widen their spreads to protect themselves, and regular traders end up paying more.

Hyperliquid solves this by deprioritising fast "taker" orders that pick off stale quotes. Instead, the platform offers market makers a fair chance to update their prices, which means tighter spreads and better prices for everyone else.

The platform's order-matching engine uses a price-time priority mechanism with added rules that smooth out execution. Special orders like cancels and post-only orders can outrank regular orders under certain conditions, meaning market makers can respond to new information and modify their offers before getting picked off by fast traders.

This subtle change encourages market makers to quote tighter spreads since they're less likely to lose money to latency arbitrage. The result is better pricing and more liquidity for everyone trading on the platform. All of this happens on-chain, so the process is transparent and users see fairer, more consistent outcomes.

This level of technical sophistication is probably why professional traders—the people most sensitive to execution quality— choose to use Hyperliquid despite having access to every centralised exchange in the world.

What Happens Next

Jeff faces an interesting problem, though: how do you scale a 10-person company that's processing trillions in trading volume?

His solution is characteristically counterintuitive. Instead of hiring more people, he's building tools that let other people build on Hyperliquid.

"If something can be built by someone else, it should be built by someone else," Jeff says. "We just don't have the capacity to do almost anything. And I think that's actually a blessing in disguise."

The platform recently launched permissionless market creation, allowing anyone to create new trading markets by staking HYPE tokens — though the requirement of 1 million HYPE tokens (worth tens of millions of dollars) means this isn't exactly accessible to everyone. For those who can meet the threshold, developers can keep up to 100% of the fees from the markets they create, terms that no traditional exchange would ever offer.

Jeff is also talking to sovereign wealth funds about building financial infrastructure, though he won't say where exactly. The goal is to prove that decentralised systems can handle the scale and complexity of national financial systems.

In July 2025, Nasdaq-listed biotech company Sonnet BioTherapeutics announced it was pivoting to crypto, forming an $888 million entity focused on holding HYPE tokens. The deal would make the newly renamed Hyperliquid Strategies Inc. the largest US-listed public company with HYPE on its balance sheet.

In an industry full of grand promises to revolutionise everything, Jeff built something that simply… works. No lofty claims about banking the unbanked. No grand visions of Web3 changing the world. Just a platform that traders actually prefer to use.

"We're focused on building something that users love," Jeff explains. "Everything else is secondary."

That approach seems to be working. Hyperliquid now handles over 10% of global crypto derivatives, operating with just a ten-person team and no marketing budget. For Jeff, it’s simply another engineering problem that needs solving.

See ya next Tuesday with another genius profile.

Until then …stay curious,

Thejaswini

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.