LATAM loves crypto? 🩵

North might be cold on crypto, while LATAM's heating things up. US debt just took a huge leap; Bitcoin be like, "hold my beer." Kanani logs out from Polygon. MoMA's postcards and Adidas' at it again.

Hello, y'all. What song are you FEELING right now? Oh yes, you can know that. Check out 👉 ImFeeling

What are we feelin?👇

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

North Vs. South.

Who does crypto better?

While the global north might be experiencing a little crypto winter chill, Latin America and the Caribbean (let's just call it LAC for short) are keeping the crypto scenes alive and kicking.

A recent study by the University of Cambridge and the Inter-American Development Bank shows that the crypto in LAC has doubled since 2016.

What's driving the hype?

Previously, it was all about trying to score big and ride the price wave (who doesn’t love a bit of speculation?), but the game's changed.

Lately, folks are diving into crypto as a hedge against inflation and the sinking value of their currencies.

Plus, with the benefit of making cross-border payments and sending remittances, it's a no-brainer why many are hopping on.

Who's leading the pack?

Brazil, Argentina, and Mexico are the big players in LAC's crypto scene, with Brazil dominating the trifecta of exchanges, digital payments, and crypto custody.

The report highlights:

Between 2020 and mid-2022, the average crypto company saw its user base double in 2020 and then grew by about 50% each year after that.

More users mean more jobs. The crypto boom has led to a bunch of new employment opportunities in the region.

Crypto companies aren’t just sitting pretty either. They're morphing into these all-in-one fintech hotspots, becoming a one-stop solution for folks looking to buy, sell, stash, and even learn about crypto.

Regulators in LAC seem to be warming up to crypto. About 36% of public sector peeps said they're feeling more positive about crypto than they did five years ago.

Bryan Zhang, Executive Director and Co-founder, CCAF

“The rapid pace of change in the crypto asset ecosystem has increased the urgency for greater understanding and cooperation among public and private stakeholders to ensure that the industry’s development is sustainable, consumer protection is robust and policymaking is evidence-based. We hope this study’s findings will provide insights into the development of LAC’s crypto asset ecosystem and inform evidence-based decision-making and regulation.”

What else is happening in LATAM?

Brazil IDs itself on the blockchain 🇧🇷🔗

Brazil's gone techie, rolling out a blockchain-based National Identity Card.

Where’s it happening: Starting with a few trendsetters—Goias, Parana, and Rio de Janeiro—but soon to be nationwide by November 6.

Why it matters: Identity theft's got a new foe in Brazil. Each card flaunts a QR code to verify the card's authenticity. Alexandre Amorim of Serpro (the genius devs behind this) highlights how blockchain is a game-changer for personal data protection.

Bonus bit: Rogério Mascarenhas from the Ministry of Management and Innovation in Public Services chipped in, promising the card would bring consistency, traceability, and security across states.

Venezuelan crypto watchdog hits snooze on restructuring 🇻🇪⏳

Sunacrip, the country's crypto referee, has just earned a time extension on its restructuring.

How long?: Six more months with the same team directing the show.

Backstory: President Nicolas Maduro started the restructuring after Sunacrip's former head honcho, Joselit Ramirez, found himself in hot water over alleged corruption ties.

Miner mayhem: Registered Bitcoin miners are feeling the heat—they're unplugged from the grid and awaiting a green light to power back up.

Buenos Aires: Say hi to blockchain ID 🇦🇷🔐

Buenos Aires has unveiled Quarkid, a digital wallet where citizens can store ID documents, all on the blockchain.

The tech: Powered by Ethereum’s Layer 2 Zksync Era, Quarkid ensures privacy is top-tier.

What’s inside?: Birth and marriage certificates for starters, with income proofs and academic records coming in November. And they're not stopping there—a more expansive roadmap's in the works. Starting in October, Argentine citizens in Buenos Aires will be able to download a self-sovereign QuarkID wallet to claim the certificates.

Global dreams: Quarkid's eyes are on the prize—they're looking to expand across Argentina and maybe, just maybe, help other countries leap onto the blockchain ID bandwagon.

TTD Numbers🔢

$275 billion

The US government's debt swelled by $275 billion within just 24 hours.

This number surpasses half of Bitcoin's entire market cap, which currently stands at $535 billion.

The new debt translates to an increase of $1,300 per American in a single day.

The US's total national debt is now a staggering $33 trillion.

Comparison to Bitcoin: Bitcoin pioneer, Samson Mow, highlighted the drastic rise in debt, pointing out that the increment was over half of Bitcoin's market cap, around $267 billion. Mow emphasised the significance by stating that this value equates to about 10 million BTC, leading him to question skeptics who doubt Bitcoin's current valuation.

Arthur Hayes, co-founder of BitMEX says in a good thread👇

Philip Swift, creator of statistics resource LookIntoBitcoin says 👇

Macro analyst Lyn Alden drew attention to a fact that such public debt levels haven't been observed since the 1940s.

She explained that despite the spiralling debt, falling interest rates over the past few decades have kept public interest expenses under control, suggesting the presence of a late-stage debt bubble.

The US's rising debt has been a source of political friction, leading to intense congressional debates. Policymakers have been battling the threat of a potential government shutdown and a historic debt default.

However, the silver lining amid the dark cloud of debt might be Bitcoin. Alden expressed optimism about Bitcoin's prospects over the coming years, linking its price with global liquidity.

Alden anticipates an upswing in global liquidity by 2024 or 2025, which could further propel Bitcoin's price upwards.

TTD Who’s Out?👋🏻

Jaynti Kanani, one of the brains behind Ethereum's Layer 2 solution, Polygon, is packing up to leave.

Kanani announced his decision to step down.

But, like all good showbiz exits, he's doing it with a bit of flair.

Kanani made this announcement on X (previously known as Twitter) and mentioned his intent to focus on new ventures, though he will still support and contribute to Polygon in an informal capacity.

Polygon was founded in 2017 by Jaynti Kanani, Sandeep Nailwal, and Anurag Arjun.

In his post, Kanani expressed that he had been contemplating this move for about six months and is now ready to take a break "from the day-to-day grind" of the network.

Responding to Kanani's announcement, co-founder Sandeep Nailwal expressed his sentiments saying, "I wish we could've done more for longer together in this crazy journey that is Polygon. But hey, you got to do what you got to do."

This isn't the first change-up for the Polygon crew. Just a couple of months ago in July, there was a bit of a chair shuffle at Polygon Labs. Marc Boiron got the big promotion to CEO while Ryan Wyatt thought it’d be cooler to give advice than run the show, so he shifted to an advisory role.

Where’s ETF?🚨

The launch of the ether futures products may lead to optimism that spot bitcoin products will be approved👇🏻

TTD NFTs 🐝

MoMA's postcard 🎴

New York’s iconic Museum of Modern Art (MoMA) introducing its community to the magic of blockchain art - With a new initiative called "MoMA Postcard."

"MoMA Postcard" is all about interactive digital chain letters. Each chain letter features 15 blank "stamps" sent across the blockchain. As these letters pass from one participant to another, each adds their artistic touch, gradually building a collaborative art piece around a certain theme.

The museum, known for embracing innovation, is minting these NFTs on Tezos.

As a grand curtain-raiser, MoMA has brought together 15 digital artists for the "First 15" series. They're the pioneers of the postcards, setting the stage for the digital renaissance.

Artists have come up with prompts ranging from counting broken hearts to creating pixel geese. With contributors like Dmitri Cherniak, whose artwork staggeringly fetched $6.2 million at Sotheby’s, this NFT initiative promises to be monumental.

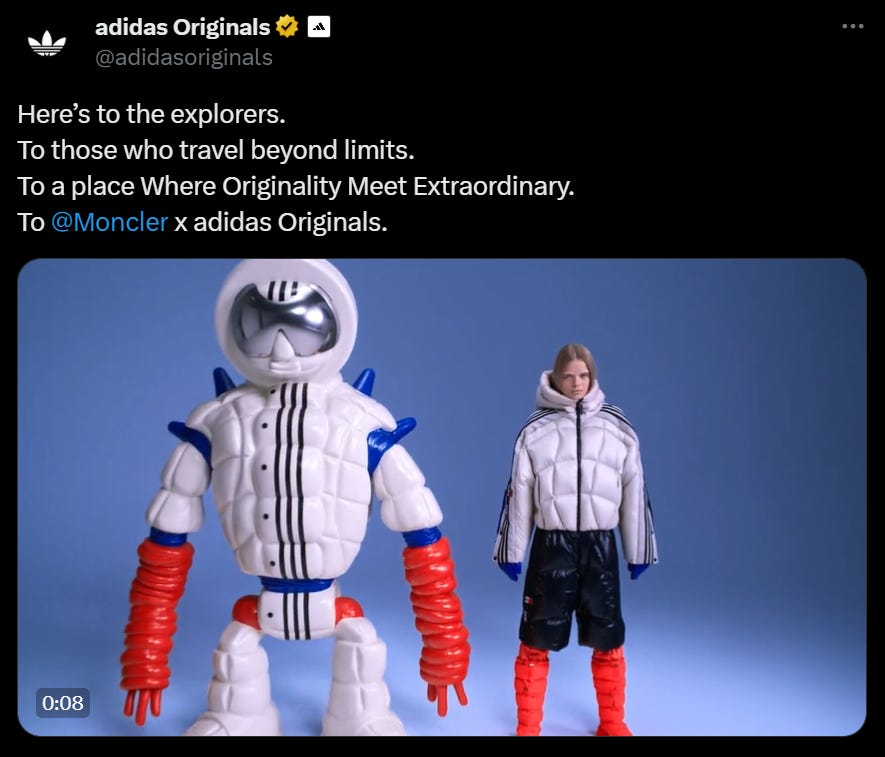

Adidas again👟

Adidas and Moncler have collaborated on a campaign called "The Art of Explorers," featuring AI-generated adventurers and NFT collectibles. The campaign showcases sculptures of explorers created by multidisciplinary artists, alongside human models wearing looks from the collaborative collection.

The images were shot by photographer Hanna Moon, and the sculptures were designed to reflect a distorted mirror version of the Moncler look. The campaign aims to create avatars inspired by the collection, using transparent plastic vacuum formed masks, airbrushed colours, and reflective materials. The immersive digital experience can be accessed on the Moncler website.

Costa Rica brews up NFTs 🇨🇷

Costa Rica is using NFTs to fund coffee research and conservation efforts. The Tropical Agricultural Research and Higher Education Centre (CATIE) and the Specialty Coffee Association of Costa Rica (SCACR) have partnered to launch an NFT collection inspired by CATIE's coffee varietals.

The auction will be organised through BIOCENFT, with proceeds going towards promoting CATIE's International Coffee Collection.

The NFTs feature unique designs representing each coffee variety and range in price from $20 to $12,000.

The funds will be used for research and development of disease-resistant coffee strains and to enhance Costa Rican coffee standards.

TTD BTC 🟡

3 Miners

Three Bitcoin mining giants—Marathon Digital, Riot Platforms, and CleanSpark—have reported a substantial surge in their Bitcoin production for September, which led to a slight increase in their stock prices on October 4th.

Marathon Digital - Leading the Marathon

Produced 1,242 BTC in September, which is 16% more than August, and an astonishing 245% rise compared to September 2022.

Their increased output can be attributed to a 508% rise in their installed hashrate—from 3.8 EH/s (exahashes per second) last year to 23.1 EH/s this year.

CEO Fred Thiel announced that the company has successfully achieved its target of 23 exahashes. They're now scouting for new mining locations powered by affordable renewable energy.

With 8,610 BTC produced in 2023, the firm's assets include 13,726 BTC and $101 million in unrestricted cash, summing up to $471.2 million.

Marathon's stock price saw a growth of 3.29%, settling at $7.54 on October 4th.

Riot Platforms - Strategic Curtailment

Riot Platforms recorded a 9% month-on-month growth by mining 362 BTC in September, all while strategically reducing their mining operations.

The company's approach to power curtailment credits, through a unique contract, has allowed them to earn more from credits than from their Bitcoin sales in the past two months.

CEO Jason Les revealed that the company's self-mining hash rate capacity is at 12.5 EH/s, aiming to push that to 20.1 EH/s by mid-2024.

Riot's share price rose by 3.25% to $9.06 on October 4th.

CleanSpark - Peak Performance

CleanSpark produced 643 BTC in September and a total of 6,903 BTC in the fiscal year 2022-2023, marking their best performance till date.

CEO Zach Bradford attributed this success to operational efficiency, reduced energy costs, and running their facilities at full capacity.

Their stock price witnessed a growth of 4.61%, reaching $3.63 on October 4th.

3 Banks

A coalition of three pivotal financial entities has put forth a prototype system, Project Atlas, intended for tracking international Bitcoin transactions. This effort is in line with the increasing recognition of the significance and economic implications of cryptocurrency flows.

The Bank of International Settlements alongside the central banks of Germany and the Netherlands have initiated the development of Project Atlas.

This venture seeks to offer tailored data regarding cross-border flows specifically for central banks and fiscal regulators.

The prototype amasses data from cryptocurrency exchanges and public blockchains, aggregated through nodes.

Its objective is to trace the flow of crypto assets between diverse locations. The tracking method employs transactions on the Bitcoin network associated with crypto exchanges, with these exchanges' geographical locations serving as indicators for cross-border capital transitions.

However, the model has its limitations. Due to the anonymous nature of cryptocurrency wallets—which don't necessarily require the disclosure of a user's location—data inaccuracies might arise.

TTD Surfer 🏄

The social app Stars Arena, a rival to FriendTech, has caused a surge in transactions on the Avalanche C-chain network.

CMCC Global, a blockchain-focused venture capital firm, has raised $100 million for a new fund called the Titan Fund.

Sam Bankman-Fried, the founder of FTX, now has a jury to decide his fate in a fraud and conspiracy case.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋