Today’s edition is brought to you by Fuse Energy.

They are building a modern energy company from the ground up — using blockchain infrastructure to make electricity cheaper, more transparent, and more efficient.

Instead of bloated utilities, hidden fees, and zero accountability, Fuse Energy brings:

Lower-cost energy through smarter infrastructure

Transparent billing powered by on-chain systems

Faster settlements and real-time data

A path toward cleaner, decentralised energy markets

This isn’t “crypto for crypto’s sake.” It is blockchain doing real-world work, starting with energy.

If you care about where Web3 actually touches reality, Fuse Energy is worth paying attention to.

Hello

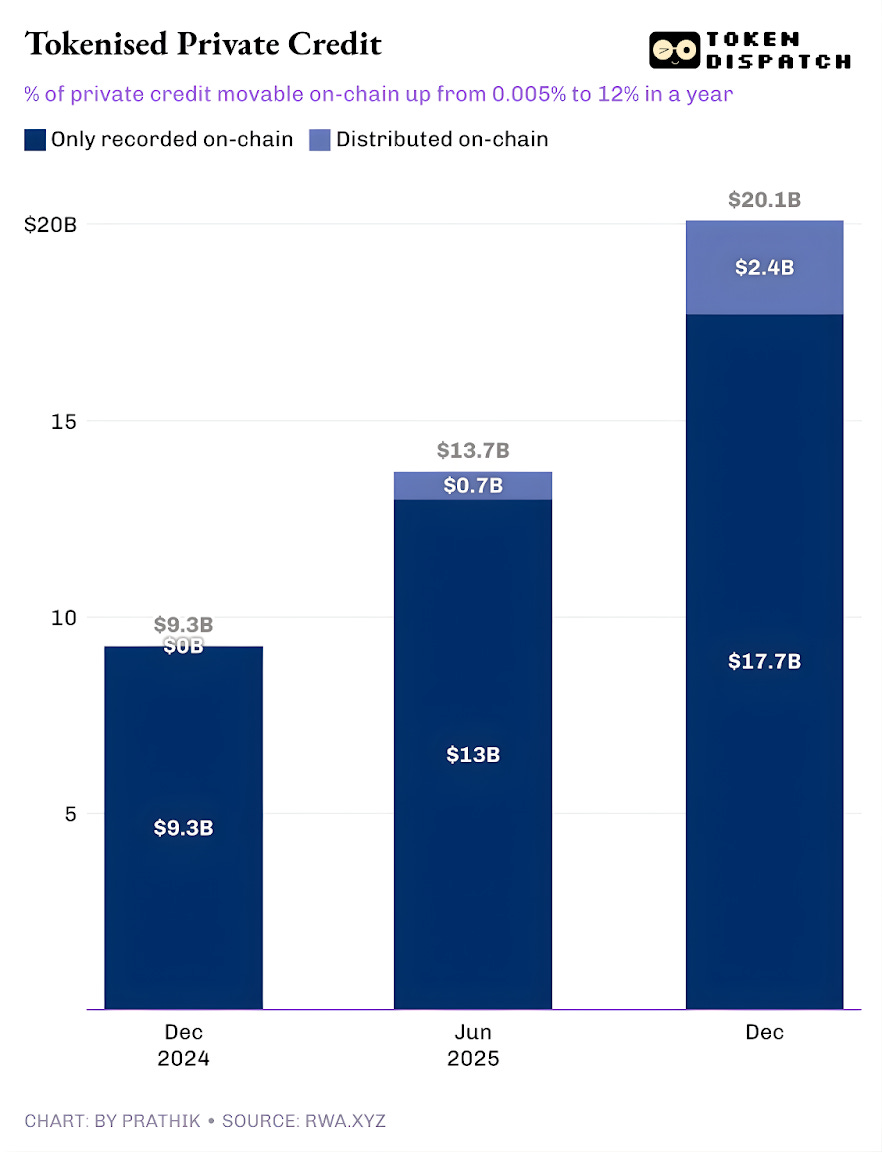

Private credit is having a moment on tokenised real-world assets (RWA) dashboards. Tokenised private credit was the fastest-growing category over the past year, jumping from under $50,000 to approximately $2.4 billion.

If you exclude stablecoins, which offer payment rails that span all on-chain activities, tokenised private credit ranks second only to on-chain commodities. Top tokenised commodities include Tether’s and Paxos’ gold-backed currencies, and Justoken’s cotton, soybean oil, and corn-backed tokens. It appears to be a serious category with real borrowers, cash flows, underwriting, and yields that are less reliant on market cycles than commodities.

But the story gets complicated only when you dig deeper.

That $2.4 billion outstanding tokenised private credit is a fraction of the total loan amount outstanding. It tells us how only a portion of the overall asset can actually be held and moved across on-chain via tokens.

In today’s quantitative analysis, I will examine the reality behind the numbers on tokenised Private Credit and what they mean for the category’s future.

Let’s jump to the story,

The active loans value on RWA.xyz is a little over $19.3 billion. Yet, only about 12% of these assets can be held and moved around in tokenised form. This shows the two sides of tokenised private credit.

One is “represented” tokenised private credit, where blockchain merely provides an operational upgrade by enabling an on-chain registry of the outstanding loans that originated in the traditional private credit market. The other is a distributional upgrade, where a blockchain-powered market emerges alongside the conventional (or off-chain) private credit market.

The former are recorded in the public ledger solely for recordkeeping and reconciliation. On the other hand, distributed assets are the ones that can be moved into a wallet and transferred.

Once we understand this taxonomy, you will no longer ask whether private credit is going on-chain. Instead, you will replace it with a sharper question: How much of private credit, the asset, is originating on the chain? The answer to this question is what offers some inspiration.

The trajectory of tokenised private credit is what inspires confidence.

Until last year, almost the entire tokenised private credit was just an operational upgrade. The loans existed, the borrowers repaid, and the platforms serviced, while the blockchain only recorded them. The entire tokenised private credit was merely recorded on-chain and not transferable as tokens. In a year, that on-chain transferable slice has climbed to 12% of the tracked private credit stack.

It shows the growth of tokenised private credit as a distributable on-chain product. This allows investors to hold fund units, pool tokens, notes, or structured exposures in token form.

If this distributed slice continues to expand, private credit will look less like a ledger of loans and more like an investable on-chain asset class. That shift changes what lenders receive from the deal. Beyond yield, lenders will receive an instrument with improved operational visibility, faster settlement, and more flexible custody. Borrowers will have access to capital that is not tied to a single distribution channel, which could prove helpful in a risk-off environment.

But who will drive the distributable private credit pile?

The Figure Effect

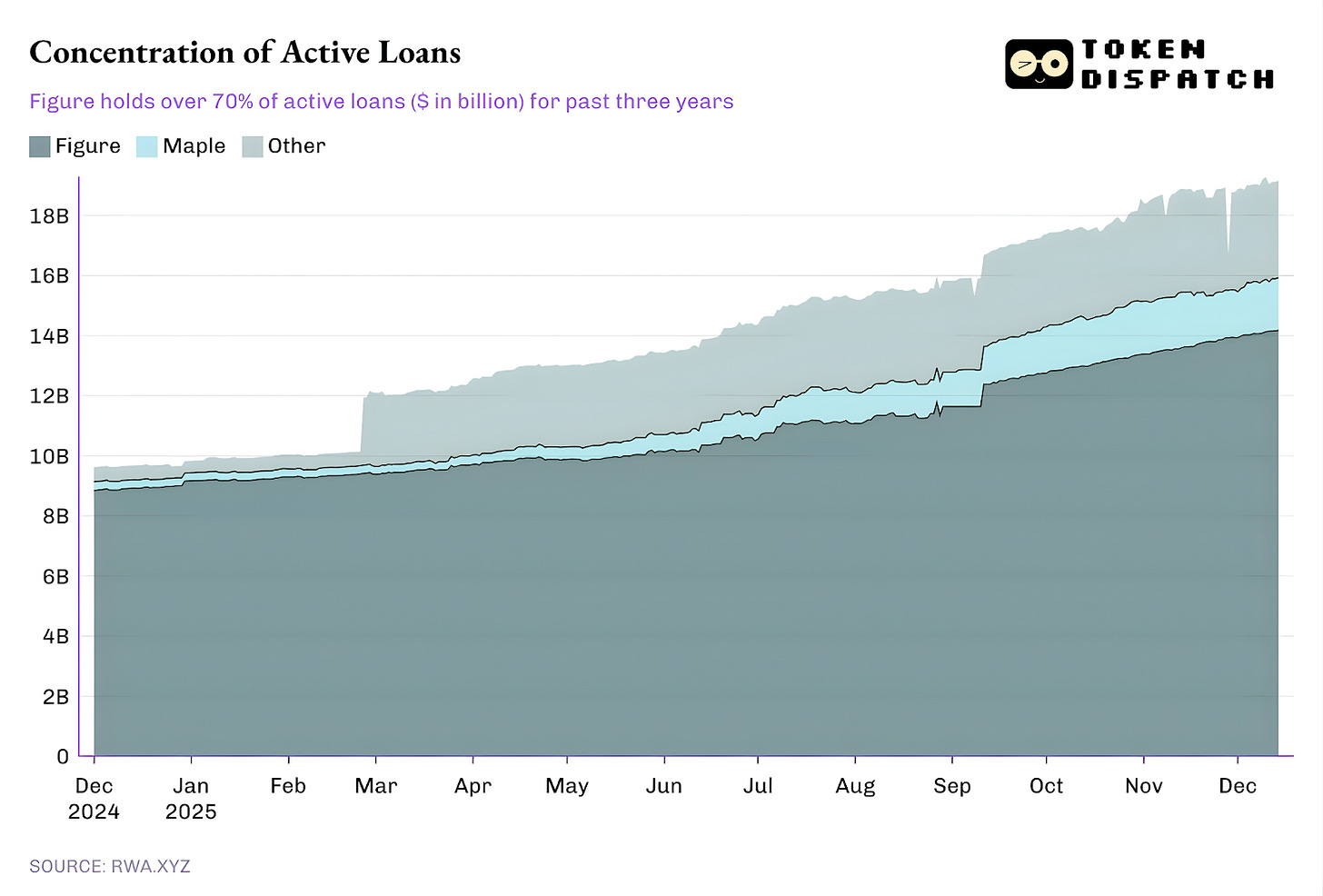

Right now, a disproportionate share of the outstanding loans comes from a single platform, while the rest of the ecosystem contributes to a long tail.

While Figure has held a monopoly in the tokenised private credit market since October 2022, its dominance has fallen from over 90% in February to 73% today.

But what’s more interesting here is Figure’s private credit model.

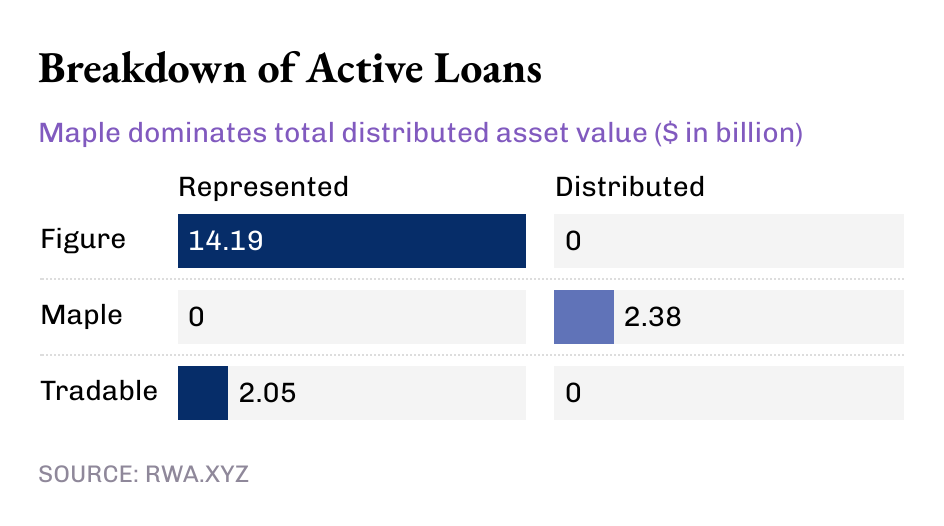

Despite accounting for over $14 billion in tokenised private credit today, the leader of the pack holds all that value in “represented” assets value and none in distributed value. This shows that Figure’s model is an operational pipeline which records loan originations and ownership trail on the Provenance blockchain.

Meanwhile, some smaller players are enabling distribution for tokenised private credit.

While Figure and Tradable hold all their tokenised private credit as represented value, Maple’s is distributed entirely via the blockchain.

When you zoom out, it is clear that a lion’s share of the $19 billion in active on-chain loans is currently recorded on the blockchain. But what cannot be refuted is the trend over the past few months: more private credit has been distributed via the blockchain. And this trend can only get stronger, given the scope of growth for tokenised private credit.

Even at $19 billion, RWAs currently account for less than 2% of the overall $1.6 trillion private credit market.

But why does “movable, and not just recorded” private credit matter?

Movable private credit offers more than merely liquidity. Exposure to private credit through a token outside one’s platform offers portability, standardisation, and faster distribution.

An asset acquired through a traditional private credit route gives the holder a position that is trapped inside the ecosystem of that specific platform. Such an ecosystem offers limited transfer windows and a paperwork-heavy process on the secondary markets. In secondary markets as well, negotiations are slow and dominated by specialists. This places more power in the market’s existing infrastructure rather than in the hands of the asset holder.

A distributed token can reduce these frictions by enabling faster settlement, clearer ownership changes, and simpler custody.

More importantly, “movable” is a prerequisite for standardising the distribution of private credit at scale, which it has historically lacked. In the traditional world, private credit came packaged as funds, Business Development Companies (BDCs) and Collateralised Loan Obligations (CLOs), each adding layers of intermediaries and opaque fees.

On-chain distribution offers a different path: a programmable wrapper enforces compliance (whitelists), cash flow rules, and disclosures at the instrument level rather than through manual processes.

That’s all for this week’s quantitative analysis. I will be back with the next one.

Until then, stay sharp,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

Imagine the level of coincidence and miracle that this article is published 12 hours before my Blockchain Technology Exam.

Thought that Substack is accessing my study PDFs now!!!

Brilliant breakdown of the represented vs distributed distinction. The 12% movable figure really undersocres how early we are in this shift. Back when I was looking at structured products, custody and transfer windows were such a pain point that deals would take weeks to close. If on-chain tokens can strip out those intermediaries and give real portability, that alone could justify the infrastrcture investment.