You might be sitting on $200,000 worth of bitcoin, but you still can't comfortably buy a new laptop without doing mental gymnastics about taxes and timing.

Selling bitcoin feels wrong for multiple reasons. First, there's the tax hit. Depending on where you live, you could lose 20-30% to capital gains taxes. Then there's the timing anxiety. What if bitcoin pumps right after you sell? You've seen it happen to other people, and the regret stories are painful.

But not selling creates its own problems. You're asset-rich and cash-poor. Your bitcoin portfolio shows impressive numbers, but your checking account shows reality. You need actual dollars for actual things like rent, car repairs, or that business opportunity you've been considering.

Traditional banks aren't much help. Try explaining to a loan officer that you want to borrow money against your bitcoin holdings. You'll get blank stares and requests for documentation of an asset they don't understand or trust. The whole process takes weeks and usually ends with rejection anyway.

Credit cards work for small expenses, but they come with terrible interest rates. Personal loans require good credit and stable income documentation. Home equity loans require owning a home. Most bitcoin holders fall into an odd category where they have substantial wealth but don't fit traditional lending criteria.

This creates a strange situation where you're simultaneously wealthy and cash-constrained. You believe in bitcoin's long-term potential, so selling feels like giving up future gains. But holding means living below your means while sitting on an appreciating asset you can't actually use.

The solution seems obvious right? borrow against your bitcoin like you would borrow against any other valuable asset. Keep your bitcoin, get the cash you need, pay back the loan when convenient. Simple concept, but until recently there weren't many reliable ways to do this without significant platform risk or terrible terms.

That's where bitcoin-backed lending platforms like Ledn come in. They treat bitcoin as legitimate collateral and offer loans with reasonable terms and transparent processes.

What is Ledn?

Ledn is a crypto lending platform that lets you borrow real money against your bitcoin holdings. Think of it as using your bitcoin like collateral for a traditional loan, except everything happens online and settles within hours instead of weeks.

Learn more about Ledn's loan products at ledn.io

The platform focuses specifically on bitcoin-backed loans, having moved away from supporting Ethereum to become what they call "Bitcoin-only."

Ledn genuinely believes bitcoin represents the most reliable collateral in crypto, and they've structured their entire business around that thesis.

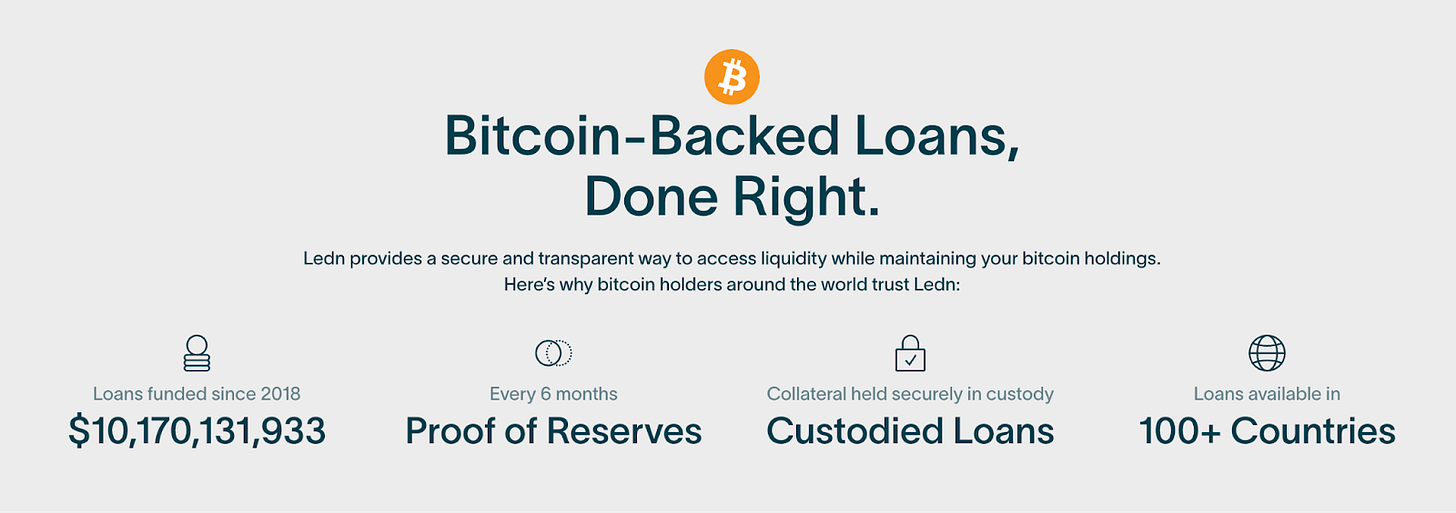

Founded in 2018 by CEO Adam Reeds and CSO Mauricio Di Bartolomeo, Ledn emerged from a personal experience with economic instability. Di Bartolomeo's experience protecting savings during Venezuela's economic crisis shaped the company's mission: giving people reliable ways to save and borrow using bitcoin.

The platform operates from the Cayman Islands under proper regulatory oversight, having received Virtual Asset Service Provider approval from the Cayman Islands Monetary Authority. This regulatory structure allows them to serve global markets while maintaining compliance standards that institutional clients require.

Why Ledn Is Relevant Now

Bitcoin-backed lending is hitting mainstream adoption at exactly the right moment. Several converging trends make 2025 a particularly relevant time for platforms like Ledn.

The Trump administration's crypto-friendly stance has accelerated regulatory acceptance of digital assets in traditional finance. The recent rescission of SAB 121 accounting guidance allows banks to offer crypto services without onerous balance sheet requirements. More significantly, the Federal Housing Finance Agency has ordered Fannie Mae and Freddie Mac to consider cryptocurrency as an asset for mortgage applications, fundamentally changing how traditional lenders view digital assets.

Senator Cynthia Lummis introduced the 21st Century Mortgage Act to codify these changes, specifically targeting young Americans who own crypto but struggle with homeownership. With homeownership rates for Americans under 35 sitting at just 36%, this legislation could unlock a massive market for crypto-backed lending solutions. Representative Nancy Mace's parallel American Homeowner Crypto Modernisation Act in the House shows bipartisan momentum for crypto-mortgage integration.

These policy changes create natural demand for platforms like Ledn. Rather than forcing crypto holders to sell their assets to qualify for traditional mortgages, they can now use crypto-backed loans for down payments while potentially having their remaining crypto holdings count toward their financial profile. This regulatory shift validates the core premise of bitcoin-backed lending.

Bitcoin's maturation as an asset class has attracted institutional investors and retail holders who view it as long-term wealth storage rather than speculative trading. These holders need liquidity solutions that don't force them to exit their positions. The launch of bitcoin ETFs created new pathways for institutional capital, and Ledn reported that institutional clients represented $969 million of their $1.16 billion in loan volume during the first half of 2024.

The crypto lending landscape consolidated significantly after 2022's market turmoil. Platforms like BlockFi, Celsius, and Voyager failed, leaving fewer options for bitcoin holders seeking lending services.

Ledn survived the 2022 crypto lending drawdown by maintaining strict risk management practices, conservative lending policies, and high transparency standards and refusing to lend to risky counterparties and regularly publishing detailed proof-of-reserves reports to reassure clients. Their prudent approach to credit underwriting and asset segregation protected client funds, helping them remain resilient while many competitors collapsed.

Ledn survived this consolidation and now processes what they estimate might be more than 50% of retail bitcoin-backed loan originations. This market concentration creates opportunities for surviving platforms with strong risk management.

Rising bitcoin adoption among high-net-worth individuals creates demand for sophisticated financial services. Many early bitcoin adopters now hold substantial positions but lack traditional wealth management infrastructure. Bitcoin-backed lending bridges this gap by enabling portfolio diversification and liquidity management without forced asset sales.

What Products Does Ledn Offer?

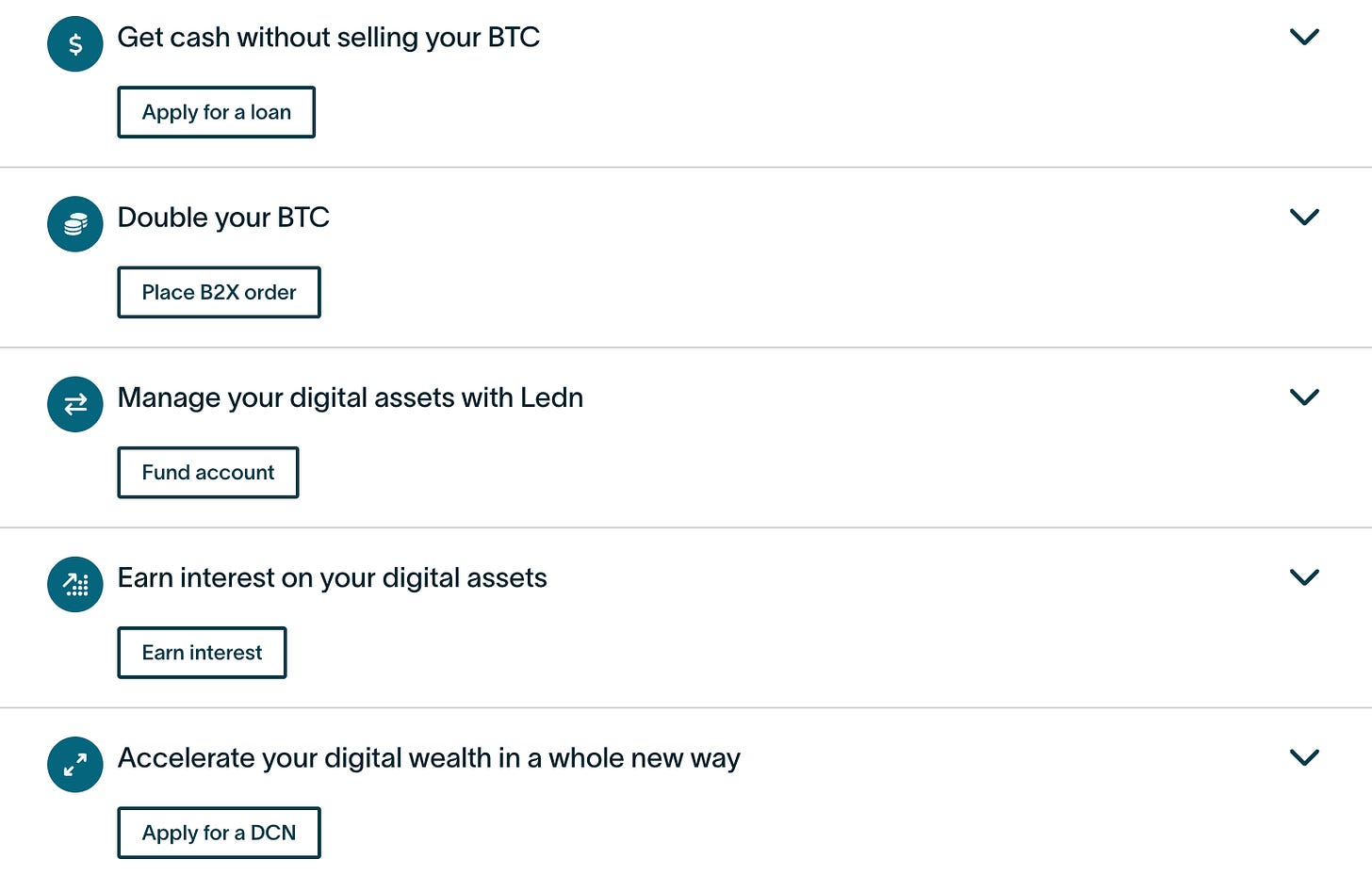

Ledn has structured its offerings around five integrated products that work together to help bitcoin holders manage their finances.

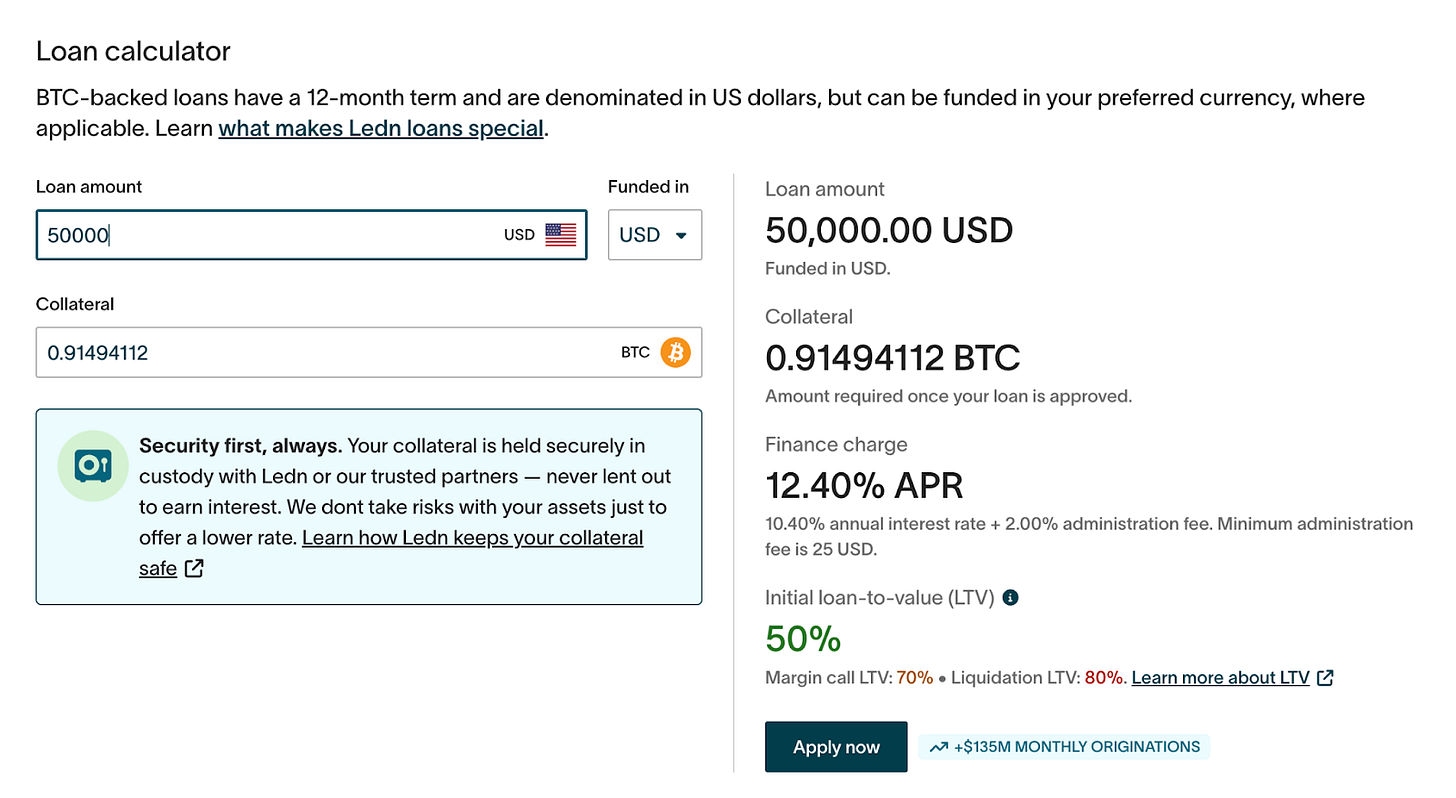

Bitcoin-backed loans represent Ledn's primary offering and the foundation of their business model. You deposit bitcoin as collateral and receive traditional currency loans in return. The mechanics are straightforward: you can borrow up to 50% of your bitcoin's current market value, with a minimum collateral requirement of $1,000 worth of bitcoin.

The loan terms offer flexibility that traditional lending rarely matches. You receive loan proceeds in USD, USDC, or various local currencies depending on your location. The current interest rates sit around 10.4% annually, translating to approximately 12.4% APR when fees are included. Loans run for up to 12 months, but there are no mandatory monthly payments and no penalties for early repayment. Interest accrues over time, and you can repay whenever convenient rather than following a fixed payment schedule.

Ledn offers two distinct approaches to handling your bitcoin collateral. The custodied model keeps your bitcoin entirely secure and untouched throughout the loan period, but carries higher interest rates around 13.9% APR. The standard model offers lower rates at 12.4% APR but allows Ledn to potentially lend your bitcoin to institutional borrowers while maintaining full collateral backing. This choice lets you prioritise either maximum security or lower borrowing costs based on your preferences.

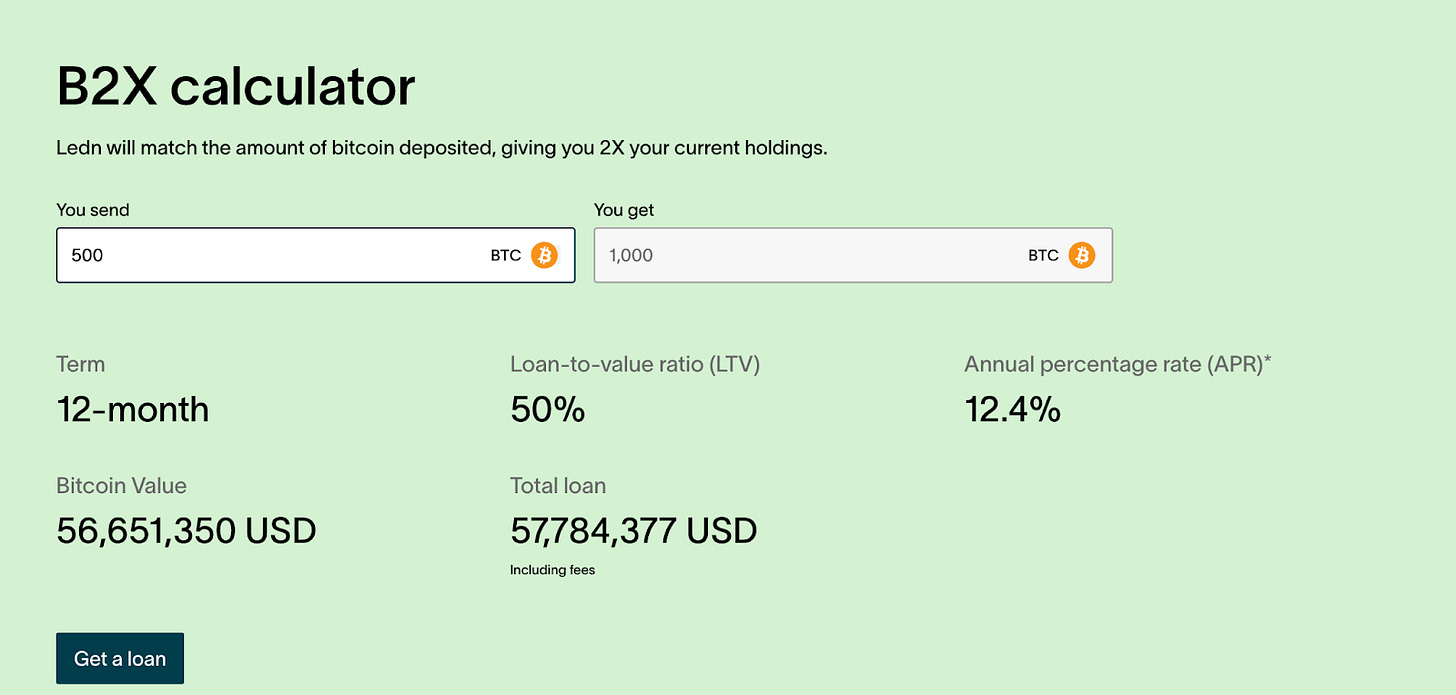

B2X amplifies bitcoin exposure through a clever combination of borrowing and purchasing. Instead of just getting a loan against your bitcoin, B2X automatically uses those loan proceeds to purchase additional bitcoin, effectively doubling your bitcoin holdings. If you start with 1 bitcoin, B2X gives you a loan to buy another 1 bitcoin, leaving you holding 2 bitcoin while owing the dollar equivalent of the loan.

The financial mechanics create leveraged exposure without requiring additional cash investment. Your original bitcoin serves as collateral while the loan funds purchase more bitcoin at current market prices. When you repay the loan, you keep both the original bitcoin and the purchased bitcoin, capturing any price appreciation on the full 2 bitcoin position. If bitcoin's price increases 50% during your loan term, you benefit from that gain on twice your original holdings.

B2X carries the same loan terms as regular bitcoin-backed loans, including the 50% loan-to-value ratio, 12-month maximum term, and current interest rates around 12.4% APR. The key difference is that you're making a leveraged bet on bitcoin's price movement rather than accessing cash for other purposes. This product appeals specifically to users who want to increase their bitcoin exposure without deploying additional capital.

USDC Growth accounts serve users looking to earn yield on stablecoin holdings rather than borrowing against bitcoin. These accounts function like high-yield savings accounts, offering up to 8.5% annual percentage yield on USDC deposits. The accounts have no minimum balance requirements, no lock-up periods, and no fees for deposits or withdrawals.

The yield generation comes from lending to Ledn's bitcoin-backed loan customers. When someone takes a bitcoin-backed loan, they're essentially borrowing from the USDC Growth account pool. This creates a direct connection between the two product lines and ensures that Growth account yields are backed by overcollateralised bitcoin loans rather than speculative trading or high-risk investments.

Ledn emphasises that Growth account funds are ring-fenced, meaning they're kept separate from company operational funds and other business activities. This segregation protects Growth account holders from platform-level risks and ensures their funds are only exposed to the specific lending activities that generate their yield. The 2:1 collateralisation ratio on bitcoin loans provides additional protection, as borrowers post twice the value in bitcoin collateral compared to the loan amount.

Digital asset management provides the foundational account infrastructure for all other services. This includes secure wallet functionality, instant transfers between other Ledn users, and basic account management tools. You can deposit Bitcoin, USDC, or USDT and move funds between different account types based on whether you want to earn interest or keep them readily accessible for trading or withdrawals.

The platform handles all the technical complexity of managing digital assets, including secure storage, transaction processing, and integration with traditional banking systems for fiat withdrawals. This foundational service makes the more sophisticated lending and investment products possible.

Dual Cryptocurrency Notes (DCNs) offer a sophisticated approach to yield generation combined with price targeting. DCNs let you earn higher yields while setting specific prices where you'd be willing to buy or sell bitcoin. You choose a strike price and time horizon, then earn interest while waiting to see if bitcoin hits your target.

The product works in two directions. "Buy Low" DCNs let you earn interest on USD while setting a target price to purchase bitcoin. If bitcoin drops to your strike price, you automatically buy bitcoin at that level plus keep the interest earned. "Sell High" DCNs work in reverse, letting you earn interest on bitcoin while setting a target selling price. If bitcoin rises to your strike price, you automatically sell at that level plus keep the interest earned. You can also think of this as selling out of the money puts and calls. Basically your bet is that the asset will be rangebound, and while it is in a range, you keep earning interest.

DCNs appeal to users who have strong opinions about bitcoin's future price movements and want to earn yield while positioning for those outcomes. Rather than just holding bitcoin or cash and hoping for the best, DCNs let you get paid to wait for the price levels you actually want to trade at.

The five products work together to serve different aspects of bitcoin-focused financial management.

bitcoin-backed loans provide liquidity without selling, B2X amplifies exposure for bullish positioning, digital asset management handles the operational foundation, Growth accounts offer yield on stablecoins, and DCNs provide sophisticated yield strategies with price targeting. This integrated approach allows users to manage multiple financial objectives through a single platform while maintaining focus on bitcoin as the primary asset.

How Ledn Works?

Getting a bitcoin-backed loan through Ledn follows a straightforward process designed to minimise complexity while maintaining security.

Account setup requires creating an account and completing identity verification. Ledn requires full KYC documentation, including government ID and proof of address. This process typically takes a few minutes and happens entirely online through automated verification systems.

Once verified, you deposit bitcoin to your Ledn wallet. The platform requires at least $1,000 worth of bitcoin as minimum collateral. Your bitcoin goes into secure custody arrangements with qualified institutional custodians, not just held on the platform's own systems.

For the loan application, you specify how much you want to borrow up to 50% of your bitcoin's current value and choose your loan structure. Ledn offers two options: a custodied model where your bitcoin stays entirely secure but carries higher interest rates, or a standard model with lower rates where your bitcoin might be lent to institutional borrowers.

Once approved, Ledn transfers the loan amount to your designated bank account in USD, USDC, or your local currency. Loans carry current rates around 10.4% annually with 12.4% APR and run for up to 12 months. There are no monthly payment requirements, and you can repay early without penalties.

Throughout the loan term, you can monitor your loan-to-value ratio through Ledn's dashboard. If bitcoin's price falls and your LTV approaches 70%, Ledn will request additional collateral. If it hits 80%, they begin liquidating bitcoin to protect against further losses.

When you're ready to repay, you simply transfer the loan principal plus any accrued interest back to Ledn. Your bitcoin collateral gets released immediately, and you regain full control over your holdings.

How Ledn Compares to Competitors

The crypto lending landscape includes several different approaches, each with distinct tradeoffs that affect user experience and security.

Centralised Competitors (Nexo, SALT)

Platforms like Nexo offer broader asset support, accepting dozens of different cryptocurrencies as collateral and providing additional features like crypto debit cards and staking rewards. However, this complexity can create additional risks and makes it harder to understand exactly how your assets are being used.

During the 2022 lending crisis, Nexo actively positioned itself as a potential rescuer, reaching out to Voyager and Celsius with offers to acquire distressed assets as both platforms faced insolvency. Although the buyouts weren’t completed, Nexo’s swift and public approach reinforced its reputation for financial strength while other lenders faltered.

SALT focuses specifically on bitcoin lending like Ledn but offers multiple LTV options (30%, 50%, or 70%) and accepts several cryptocurrencies as collateral. They also provide a stabilisation feature that can help during market downturns.

Ledn differentiates itself through simplicity and transparency. By focusing solely on bitcoin, they can optimise their risk management and offer clearer terms. Their regular Proof of Reserves reports provide verification that many competitors don't offer.

Decentralised Alternatives (Aave, Compound)

DeFi protocols like Aave allow borrowing against crypto collateral through smart contracts rather than centralised platforms. These protocols offer non-custodial lending where you maintain control of your private keys throughout the process.

However, DeFi protocols typically have variable interest rates that can change rapidly, require users to manage complex smart contract interactions, and offer limited customer support if issues arise. They also primarily work with Ethereum-based assets rather than bitcoin.

Ledn trades some of DeFi's trustlessness for predictable rates, customer service, and the ability to receive traditional fiat currencies rather than just stablecoins.

Traditional Finance

Some traditional financial institutions now offer crypto-backed loans, but these typically require significant minimum investments, lengthy approval processes, and extensive documentation. They also often impose strict requirements about how funds can be used.

Ledn provides institutional-quality service with consumer-friendly minimums and approval times, making bitcoin-backed borrowing accessible to regular holders rather than just high-net-worth individuals.

The Security Model

Given the history of crypto lending platform failures, understanding Ledn's security approach is crucial for potential users.

Ledn doesn't hold bitcoin collateral on its own systems. Instead, they work with qualified institutional custodians like BitGo Trust Company, which provides insured custody services. This separation means your bitcoin isn't mixed with company operational funds or exposed to platform-specific risks.

Every six months, Ledn publishes independently audited Proof of Reserves reports that verify they actually hold the bitcoin and other assets they claim. Users receive hashed IDs that let them verify their specific holdings are included in these reports without revealing personal information.

For their USDC Growth accounts, Ledn maintains ring-fenced asset segregation, meaning funds in these accounts aren't exposed to other platform activities or general business risks. The yield comes specifically from lending to bitcoin-backed loan customers, not from trading or other higher-risk activities.

In their custodied loan model, Ledn commits to not re-lending your bitcoin collateral to generate additional yield. Your bitcoin stays securely held throughout the loan term rather than being used for other business purposes.

Considerations and Risks

While bitcoin-backed loans solve real problems, they also introduce specific risks that users should understand clearly.

Liquidation Risk: If bitcoin's price falls significantly, you might need to provide additional collateral or face liquidation of your bitcoin holdings. Ledn begins liquidation procedures when LTV ratios hit 80%, which could happen during severe market downturns.

Interest Rate Risk: Current rates around 12-13% APR means your bitcoin needs to appreciate by more than that annually for the leverage to be profitable. If bitcoin remains flat or declines, you'll pay interest without corresponding gains.

Regulatory Changes: Crypto lending regulations continue evolving globally. Changes in tax treatment, lending regulations, or custody requirements could affect loan terms or platform operations.

Platform Risk: Despite security measures, centralised platforms still present counterparty risk. While Ledn has maintained operations through previous crypto market stress periods, no platform is entirely risk-free.

Looking Forward

Ledn's recent strategic decisions suggest a platform betting heavily on bitcoin's continued adoption as digital collateral. Their move to bitcoin-only lending and full-custody models reflects confidence that bitcoin will increasingly function like digital real estate or gold in portfolios.

The platform reported processing over $300 million in retail loans during Q1 2025, suggesting growing mainstream acceptance of bitcoin-backed borrowing. As traditional finance becomes more comfortable with bitcoin and regulatory frameworks mature, products like Ledn's might become standard financial tools rather than crypto-specific innovations.

For bitcoin holders, platforms like Ledn represent a maturation of crypto toward practical utility rather than just speculative trading. The ability to access bitcoin's value without selling creates new possibilities for financial planning and portfolio management.

If bitcoin becomes less volatile and more widely accepted as collateral, products like Ledn's could bridge crypto and traditional finance in meaningful ways.

For now, Ledn offers bitcoin holders a practical solution to an old problem: how to benefit from your bitcoin's value while keeping your bitcoin.

Whether that's worth the costs and risks depends on your specific situation, risk tolerance, and confidence in bitcoin's future trajectory.

I’ll see you next week with another cool product.

Until then …stay curious.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

BTC-backed loans and hybrid CeDeFi models are testing the foundational boundaries of decentralized finance. My latest protocol review covers both technical risk vectors and regulatory strategies shaping the sector’s institutional pivot. Where do you see the greatest need for clarity or innovation: compliance layers, oracle design, or market structure?