As an Indian, whenever I’ve looked at my parents’ investments, real estate returns have always stood out. In India, especially, people have traditionally invested heavily in precious metals like gold and silver or in Real Estate.

While sources vary, most suggest that more than 50% of household investment in India flows into real estate.

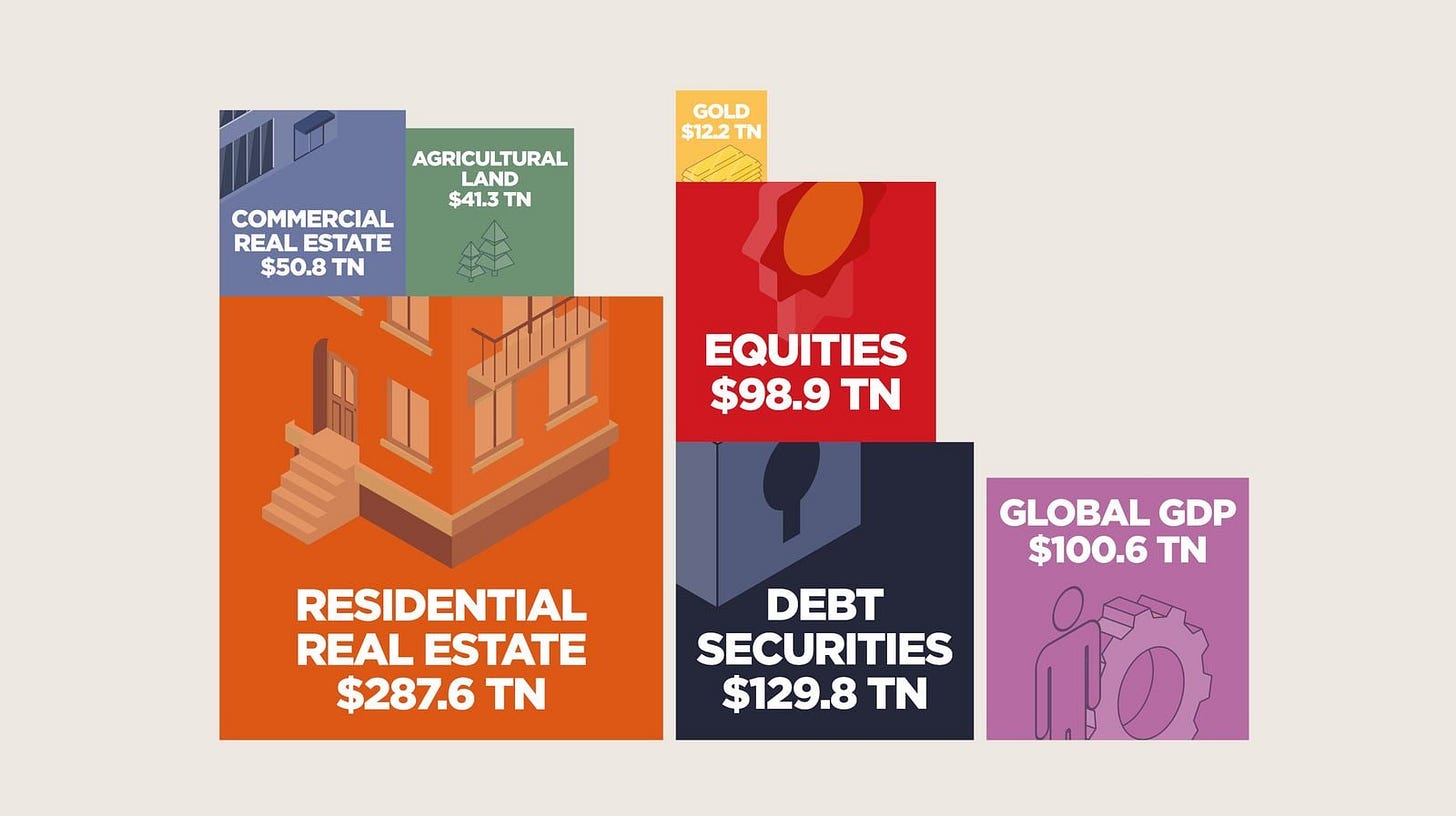

The story isn’t as different in the rest of the world. The real estate market cap today stands at $370 trillion, while the equity market is much smaller.

Why am I telling you this?

Because the real estate market is highly illiquid. Selling a property can take weeks or months, and prices continue to rise, making it increasingly unaffordable. Young investors who want exposure to this asset class often have to save for years before they can even think of diversifying into land or flats.

This raises the question: can tokenisation fix this? In theory, yes.

Tokenisation of real estate promises three major benefits: First, fractional ownership— allowing investors to gain exposure with as little as $50. Second. Global liquidity— making properties tradable across borders. Third, digital settlement—so people can invest in buildings on the other side of the world without ever visiting them.

Today, let’s look at where this market stands and how it might evolve.

According to rwa.xyz, tokenised real estate, in its last five years or less has reached about $356 million in value, with most assets spread across USA and the UAE. For context, the Real Estate Investment Trusts (REITs) - fund managed real estate portfolios that trade on the stock exchange - in the USA it took 10 years after their launch in the 1960s for them to reach their first billion in Market Cap.

The global REIT market has grown much higher since then and is now approximately $2.5 trillion with U.S. REITs alone holding $1.4 trillion in market cap. Which means, multi trillion dollar capital looking for real estate exposure all without underlying asset ownership.

These assets listed on rwa.xyz are spread across platforms that are more focused towards accredited investors, such as Hedge Funds, Private equity firms or Insurance Companies, and have almost no retail marketplaces.

Among them is Ctrl Alt, which accounts for roughly $125 million in UAE tokenised real estate. The firm operates as a B2B tokenisation platform and works with Dubai’s Land Department on a government-backed project that aims to tokenise AED 60 billion in assets by 2033. On the other side, we also have Red Swan which is tokenising the USA real estate market with a license from the SEC.

Let’s Bring Retail

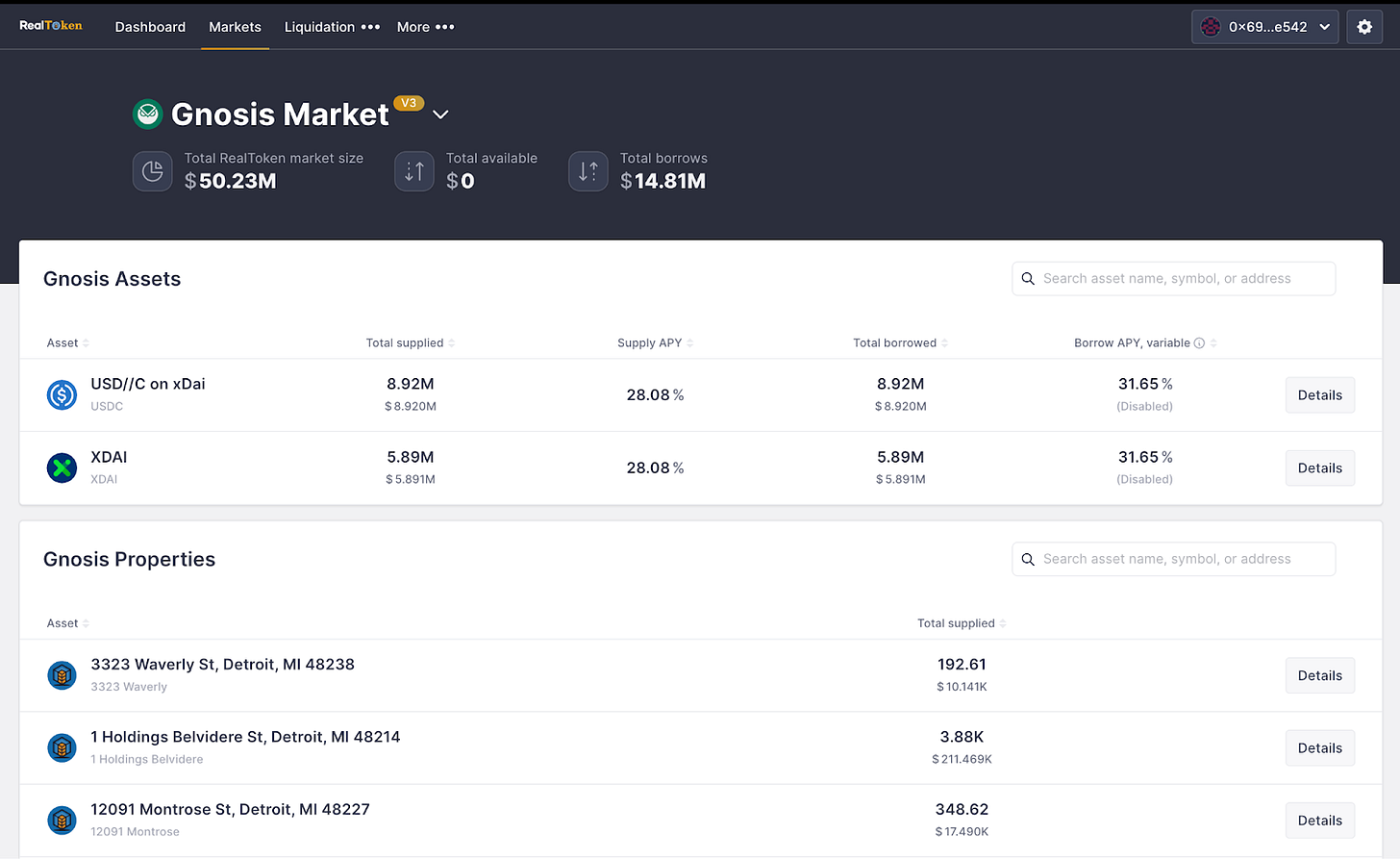

While these assets are meant for accredited investors, but there are also platforms like RealT and Lofty that are completely focused on the retail audience and let you buy specific properties instead of getting exposure to a portfolio.

RealT has tokenized over 200 properties across the United States worth more than $45 million, while Lofty has 148 properties tokenized on Algorand with around $3 million distributed in rental income to date.

Here’s what buying RealT typically looks like:

You set up a MetaMask wallet, complete identity verification, and browse available properties. Each listing shows the property address, projected rental yield (typically 6-16% annually), current occupancy, and property management details. You buy tokens with USDC or via credit card, and receive RealTokens representing fractional ownership. The property rent gets distributed weekly in stablecoins directly to your wallet.

Lofty works similarly but on Algorand, with tokens starting at as low as $50 and rent paid daily instead of weekly. Both platforms offer secondary markets where you can sell your tokens before the property itself gets sold.

The catch is that here, the blockchain only tracks the token ownership. Everything else - property deeds, rent collection, maintenance, insurance, legal compliance - runs through traditional structures. Each RealT property is owned by a specific LLC. When you buy tokens, you become a member of that LLC. A property management company collects rent from tenants, deducts expenses, and RealT distributes the net income to token holders.

You’re trusting several layers: that the LLC actually owns the property as claimed, that the property manager is collecting rent accurately, that RealT is calculating distributions correctly, and that the legal structure will hold if something goes wrong. The tokens give you exposure to real estate cash flows, but the custody and operations remain fundamentally off-chain.

What to Solve?

Real Estate Investment Trust (REITs) - the traditional real estate investment vehicles - have SEC oversight, quarterly financial disclosures, independent audits, and legal frameworks built over decades. Tokenized real estate platforms, on the other hand, have platform-specific terms and conditions.

However, they are fundamentally different from tokenised assets.

An investor putting money in a REIT is leaving the job of portfolio management to the fund itself, and has no hand whatsoever in deciding where the investments go. REITs can particularly be dangerous during any real estate market crash like ion 2008, users would have no choice but to cash out their capital from the fund. Whereas for tokenised assets, a trader can diversify to other countries.

Additionally, all REITs are geographically constrained, while onchain applications can offer both a villa in Bali and a commercial property in UAE by design, REITs can’t.

Long-term data (1998-2022) shows REITs have provided average annual returns of 9.7%, while we don’t have much historical data on that for tokenised assets, the returns for Tokenised assets are highly dependent on the purchased property shares, and thus more flexible and user choice dependent.

The trust issue still stands though, and mirrors the early days of stablecoins.

Early stablecoins operated on “trust us, we have dollars in a bank account.” Then Tether faced credibility questions. It’s when Circle responded by publishing monthly attestation reports from independent accounting firms, showing exact reserve compositions, and eventually, Tether followed.

Real estate tokenization platforms have not crossed the trust line yet.

When RealT reports a property generated $X in rent minus $Y in expenses, it lies on the user to trust the platform. While county deed records exist, tracking property ownership across different registries and verifying platform claims requires manual work that most token holders don’t do.

The Stablecoin Playbook

Real estate platforms can learn a few things from how stablecoins built credibility and handled distribution to get to a mammoth ~$300 billion market cap today.

First, regular independent attestations. Circle publishes monthly reserve reports verified by Grant Thornton. Real estate platforms should publish monthly or quarterly reports showing property valuations from independent appraisers, rent rolls verified by accountants, detailed expense breakdowns, vacancy rates, and maintenance costs. Make property ownership verifiable through cryptographic proofs linked to county registries.

These markets need to establish powerful distribution channels that can help establish their moats. Establish partnerships that help them reach where the users are - for Circle that included two strong factors such as the CCTP native bridge launch which allowed seamless interoperability between the chain it supports, and the partnership with Coinbase which even today accounts for approximately a quarter of USDC’s supply source.

For tokenised real estate, the distribution channels need to be both on the supply side of bringing quality rental properties onchain and tapping into the userbase looking for real estate exposure. For supply side the partnerships can be with builders like Ctrl Alt did with the UAE government.

On the demand side, the more composable the underlying asset is within DeFi, the easier it would be to reduce a user’s opportunity cost and attract larger pool of capital that might otherwise look for other yield sources. The sell can’t be “passive income” - that’s what REITs already provide with better liquidity and regulation. The killer app is leveraged yield strategies that only work in DeFi.

DeFi protocols should be able to create secondary DeFi primitives on top of the underlying real estate representations.

Such as building a rental income streams into fixed-rate bonds (buy a token that pays 7% annually regardless of individual property performance), enable derivative trading on property appreciation (long Detroit real estate without buying specific tokens), or build automated reinvestment strategies (rent received in USDC automatically swaps to highest-yielding property tokens).

Projects like Pendle split yield-bearing tokens into principal and yield components, which would do wonders for a real estate asset. Someone receiving $100 monthly rent could sell future rent streams for upfront capital while retaining property appreciation exposure.

Similarly, Yearn Finance has $300M TVL. If Yearn launches a “Real Estate Yield Vault” that automatically allocates deposits to highest-yielding property tokens and auto-compounds rental income, Yearn’s existing users get real estate exposure without ever visiting RealT directly.

Where This Goes

The tokenised real estate market stands at roughly $350-400 million, depending on which assets you count. Projections range from $1.4 trillion to $3 trillion by 2030.

For now, buying tokenised real estate means trusting that LLCs, property managers, and platform operators are doing what they claim. I would still wait for the platforms to evolve further from here before I buy tokenised villas in Bali or get rental yield exposure from UAE markets.

Until then, perhaps precious metals will remain our generation’s default hedge.

Talk to you next Saturday,

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.