Hello!

Monad, an Ethereum-compatible L1 is aiming to solve one old puzzle - making the EVM faster without breaking compatibility or turning into a modular maze.

Check out our Saturday edition to know more.

Perpetual futures eat crypto trading alive. 70% of daily volume flows through these derivatives contracts. Professional traders live on them. Regular people can't touch them. The platforms make it impossible. They either treat users like children with basic spot trading or assume everyone wants to become a quant.

In 2024, the top 10 centralised perpetual exchanges alone recorded $58.5 trillion in trading volume, doubling from $28 trillion the previous year. Add decentralised perpetual exchanges, which hit $1.5 trillion in volume, and the total market represents tens of trillions in annual activity.

Those who do face platforms that either oversimplify to uselessness or overwhelm with complexity. Mobile trading apps have failed completely. They fall into two categories: dumbed-down versions offering only spot trading, or desktop ports that assume users have multiple monitors and unlimited patience.

Neither serves people who understand memecoins and Robinhood but have never touched derivatives. In today’s issue - I look at a team taking an alternative approach. Enter Lootbase.

Bold & Direct. Trade Everything. Everywhere. Always On.

Lootbase is building the mobile exchange for a generation that demands more. Trade stocks, crypto, memes, real estate—all from your phone, 24/7.

Built by traders, for traders, with profits shared fairly.

Simplification Without Sacrificing Functionality

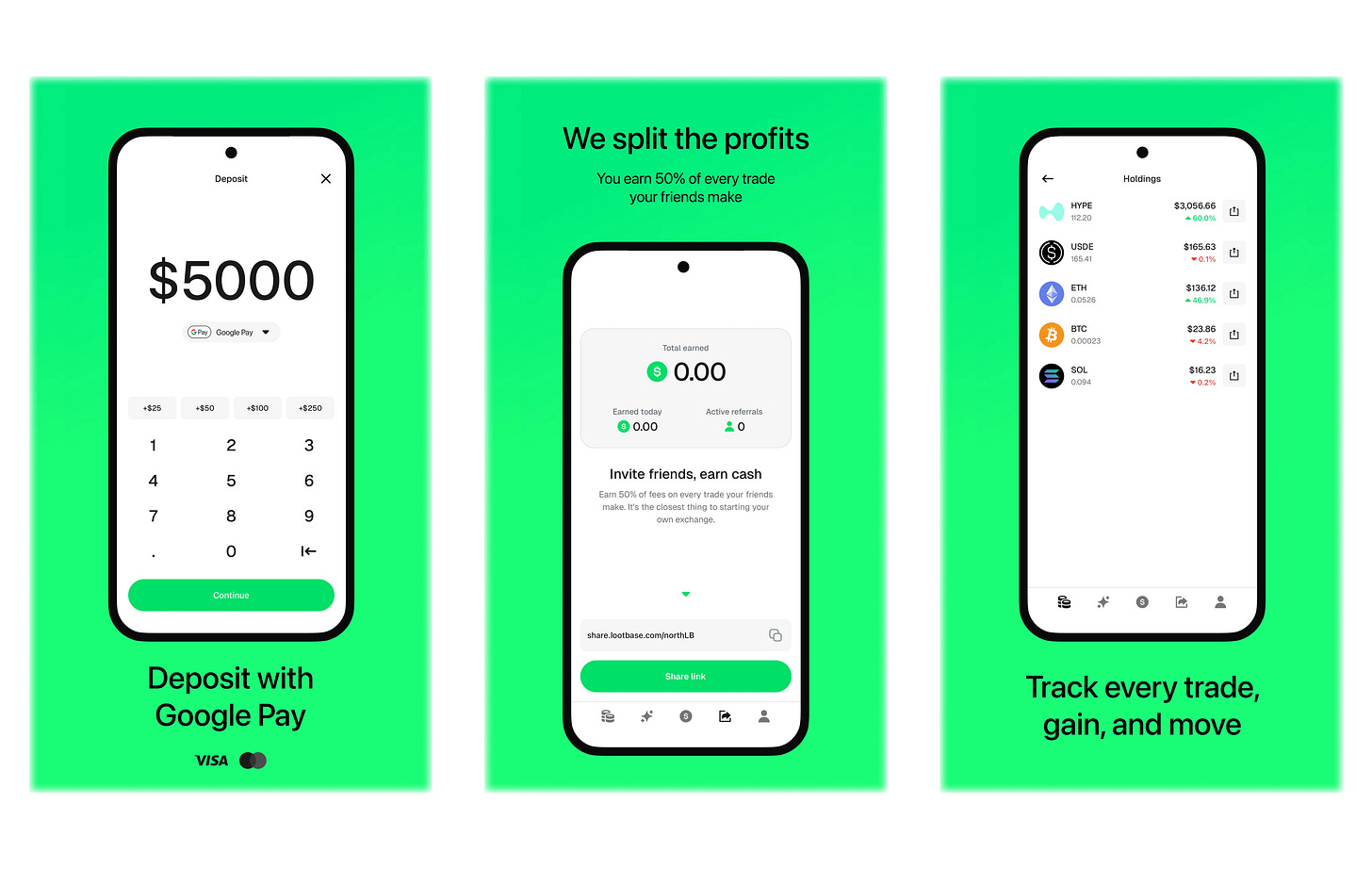

To understand what Lootbase is trying to solve, I downloaded the app myself.

Within minutes, I was browsing leveraged positions on various tokens, all without reading a single tutorial or setting up a traditional crypto wallet.

The experience was simple.

The app showed me featured assets with clear performance indicators, demonstrated potential returns from hypothetical trades, and presented two buttons: Short or Long. That's it. No order books, no complex charts, just a question: which direction do you think these go?

I did not have to go through the typical crypto onboarding experience of seed phrases and gas fees.It felt more like using a mainstream fintech app than managing a self-custodial wallet.

The team recognised two primary ways people engage with crypto: earning through time and activity (airdrops, farming, tasks) or earning through market creation and trading.

Nobody had created a way for users who aren't deeply technical to understand perpetual futures quickly. Existing platforms copied each other's approaches without questioning whether those approaches served their target users.

The Lootbase team decided to start from scratch.

Their approach centres on radical simplification without sacrificing functionality.

"We took every screen and framed it around a question that a user may ask themselves while opening a position. Which way do you think the price is going to go up or down? How much capital do you want to risk? What leverage do you want?" explains the team in a conversation with Token Dispatch.

This reduction to three screens eliminates the complexity that intimidates new users. No candlestick charts that require technical analysis knowledge.

No complex order types that confuse casual traders. Just line charts, large numbers, and plenty of white space following familiar mobile design principles.

The platform even includes a dice button that randomly selects leverage levels. Sometimes traders want to let chance decide their risk parameters, and Lootbase accommodates that impulse rather than forcing users into overly analytical decision-making processes.

The Technology Stack

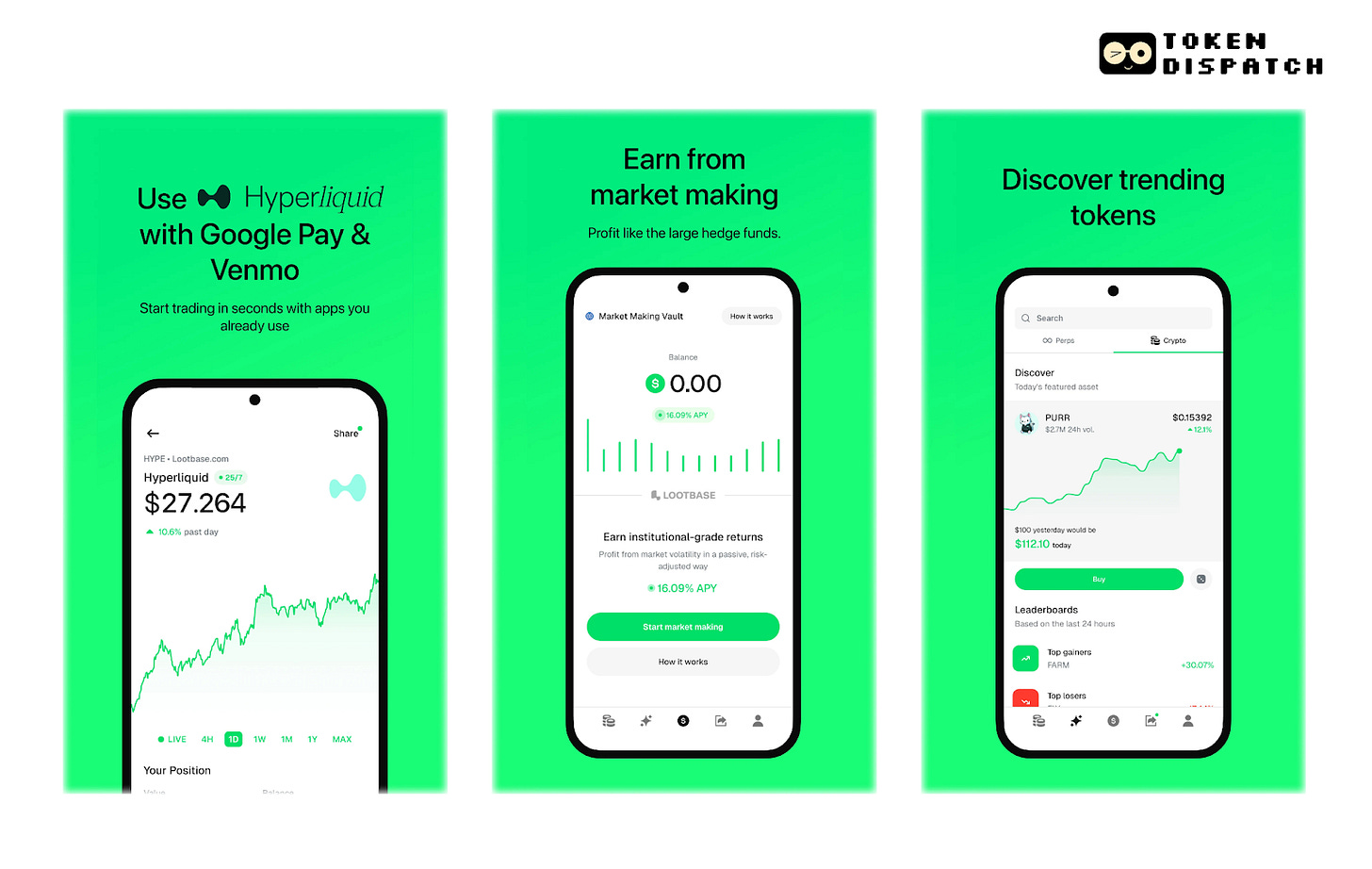

Lootbase built on top of Hyperliquid. This lets them skip the hard parts of building an exchange and focus entirely on user experience.

For onboarding, they integrated Privy for email authentication and MoonPay for payments. Users can deposit through credit cards, debit cards, Venmo, or PayPal, payment methods people actually use.

The platform supports Bitcoin, Ethereum, and Solana, with conversion to HYPE happening under a minute.

The non-custodial approach solves several problems at once. Users control their assets while the platform avoids the regulatory headaches of holding customer funds.

Users sign in with email. No seed phrases. No gas fee calculations. The technical complexity gets handled behind the scenes while users interact with familiar interfaces.

This assumes the underlying providers maintain high security standards, but it solves the convenience versus control trade-off that has limited crypto adoption.

Business Model Innovation

The economics of not holding customer funds create significant advantages.

Traditional exchanges generate revenue by investing customer deposits in treasury bills and other instruments. They need extensive compliance teams, risk management systems, and regulatory infrastructure to operate safely. Lootbase skips this entire category of operational complexity.

"Since we're not custodying anything, we can list more assets much faster. We can keep the team small and massively increase the margins," the team notes.

They can experiment with features and respond to user feedback rapidly. Most importantly, they can operate profitably with minimal overhead, which enables more aggressive pricing and user incentives.

Their fee-sharing model represents a departure from traditional exchange economics. Rather than extracting maximum value from users, they split trading fee revenue with users who refer others to the platform. The current thinking involves a 50/50 split, though they continue experimenting with different formulas.

This creates a referral system where users become advocates because they profit from the platform's growth. Customer acquisition becomes community building rather than traditional marketing spend. Users feel ownership in the platform's success because they literally own a piece of it.

User Acquisition Strategy

With 1,400 current users who are mostly crypto-native, Lootbase is taking a deliberate approach to scaling. Rather than rushing to market with traditional advertising, they're building what the team calls a "cabal" — a network of engaged users and supporters who can help drive organic growth.

The distribution strategy focuses on Web2 channels that traditional crypto platforms avoid: TikTok, streaming platforms, and the broader creator economy.

These channels reach audiences that Coinbase and Robinhood typically don't target, either because the platforms don't fit their corporate narratives or because they lack expertise in these newer marketing approaches.

The team plans to experiment with user acquisition techniques that haven't been tried in crypto, including free deposit bonuses and margin incentives. These approaches mirror successful strategies from traditional fintech companies but adapted for the crypto context and non-custodial infrastructure.

They understand the importance of daily engagement.

"The biggest things that we did really well was we gave people a reason to open the app every single day. If you can get people to open the app every day, you can get them to do anything on the app," the team explains.

Integration with Hyperliquid

The decision to build on Hyperliquid rather than creating proprietary infrastructure affects several aspects of the platform. Currently, Lootbase functions as an interface layer, which means they don't have proprietary protocols for API integration or automated trading systems. Market makers aren't necessary because Hyperliquid provides sufficient liquidity.

This architecture choice eliminates entire categories of operational complexity. They don't need to manage order books, handle settlement, or maintain trading infrastructure. The focus remains entirely on user experience and community building.

However, this dependency also creates limitations. Advanced features that require custom protocols would need to be developed separately, and the platform's capabilities are bounded by Hyperliquid's feature set. The team has indicated willingness to explore proprietary development if user needs justify the additional complexity.

Future Expansion Plans

Lootbase wants to own speculation.

Crypto derivatives are just the start. The real vision: condition users to open the app whenever they have any financial opinion. Election outcomes. Pre-IPO valuations. Sports results. Celebrity drama. If people can bet on it, Lootbase wants to host it.

Crypto infrastructure makes this possible. Traditional platforms need regulatory approval for each new instrument. Lootbase can launch new markets rapidly without bureaucratic delays. The frequency insight drives everything. Most trading apps sit unused because traditional brokerages offer limited engagement. Check your portfolio. Maybe place a trade. Close the app for weeks.

Lootbase aims for daily opens. Multiple speculation categories create multiple reasons to engage. The technology becomes invisible infrastructure, not the selling point.

The team wants Lootbase mentioned alongside Binance, Venmo, Coinbase, and Robinhood. Not as another exchange, but as the platform that democratised sophisticated trading instruments. Traditional financial intermediation extracts value. Crypto technology efficiency redistributes it. The goal: sustainable business through better economics, not better marketing.

The shared economics approach reflects deeper philosophy about platform ownership. Instead of concentrating value in operators, distribute it to users who drive success through referrals, trading activity, and community building.

Everyone wins when everyone owns a piece.

Token Dispatch View 🔍

Lootbase succeeds by prioritising practical solutions over crypto ideology. The embedded wallet approach acknowledges that most people don't want to become blockchain experts, they want blockchain benefits without complexity. This represents maturation in crypto application design, where user experience takes precedence over technical purity.

The three-screen trading flow demonstrates how thoughtful design can make sophisticated financial instruments accessible without sacrificing functionality. The reduction in interface complexity doesn't reflect dumbing down the produc, it reflects understanding what information users actually need to make trading decisions.

The fee-sharing model creates proper incentive alignment between platform and users. When user success directly impacts platform revenue, customer acquisition becomes community building. This approach could influence how other platforms structure their economics, moving away from extractive models toward collaborative ones.

The "everything becomes a market" vision raises questions about financialising all aspects of life, but it also recognises existing human tendencies to speculate and express opinions through betting. Whether this expansion creates positive outcomes depends partly on implementation details and risk management approaches.

Questions remain, though. Can the team really scale to millions of users without compromising the experience that makes Lootbase special? Will the simplified interface prove sufficient as users become more sophisticated, or will they migrate to platforms offering more advanced features?

Most critically, does gamifying derivatives trading through dice buttons and mobile-first design create responsible financial behavior or encourage reckless speculation? The team's vision of daily engagement through multiple betting markets might sound appealing to traders, but regulators and consumer advocates may see it differently.

Whether Lootbase represents the future of accessible finance or simply another way to separate retail investors from their money remains to be seen.

See ya, next Sunday.

Until then … stay curious,

Thejaswini

Week That Was 📆

Saturday: Blockchains’ Long Quest for Speed ⚡️

Thursday: Credit's Rise Beyond Collateral 🪪

Wednesday: Circle's Wild Ride 🎢

Tuesday: ETH's Treasury Turnaround 🏛️

Monday: Trump vs Musk Feud ✊🏽

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains sponsored content and affiliate links. All sponsored content is clearly marked. Opinions expressed by sponsors or in sponsored content are their own and do not necessarily reflect the views of this newsletter or its authors. We may receive compensation from featured products/services. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.